Congressional Stock Trades: Unlock the Wealth Code of U.S. Politicians on Capitol Hill

Introduction

TradingKey - In the U.S. capital markets, beyond the savvy strategists at major institutions like Goldman Sachs, Morgan Stanley, and JPMorgan, a group of U.S. Congress members has investors’ attention with their market acumen and performance — earning them the nickname "Congressional Stock Gods."

When the term "Congressional Stocks Gods" is mentioned, few names come to mind as quickly as former House Speaker Nancy Pelosi. Often dubbed the “stock goddess,” Pelosi has made impressive gains by betting on tech giants like AI leader Nvidia and Broadcom. Her market acumen is so well-recognized that some institutions have launched an ETF named after her—NANC—underscoring the financial world’s acknowledgement of her investment prowess.

Unlike many countries, the U.S. has the STOCK Act, designed to restrict members of Congress from trading on non-public information. However, concerns about insider trading continue to persist, fueling public skepticism and ongoing debate.

Both the Biden and Trump administrations have attempted to implement a full ban on congressional stock trading, but these efforts have seen little success. For investors, disclosures of stock holdings by these so-called "Stock Gods" often highlight potentially lucrative — though typically short-term — investment opportunities.

Performance of U.S. Politicians

The STOCK Act, passed in 2012, stipulates that Congress members are prohibited from trading stocks based on non-public information acquired through their official duties for personal gain. It also requires them to disclose trading activity within 45 days.

From 2019 to 2021, nearly 100 U.S. lawmakers engaged in stock trading, achieving an annualized return of 14.3% — outperforming the S&P 500’s 10.4% return over the same period. In 2023, 183 of the 435 members of the House of Representatives held shares in U.S. stocks.

According to data from QuiverQuant, in 2024, Congressman Josh Gottheimer led all members in stock trading volume, with $75.59 million followed by Nancy Pelosi at $36.83 million.

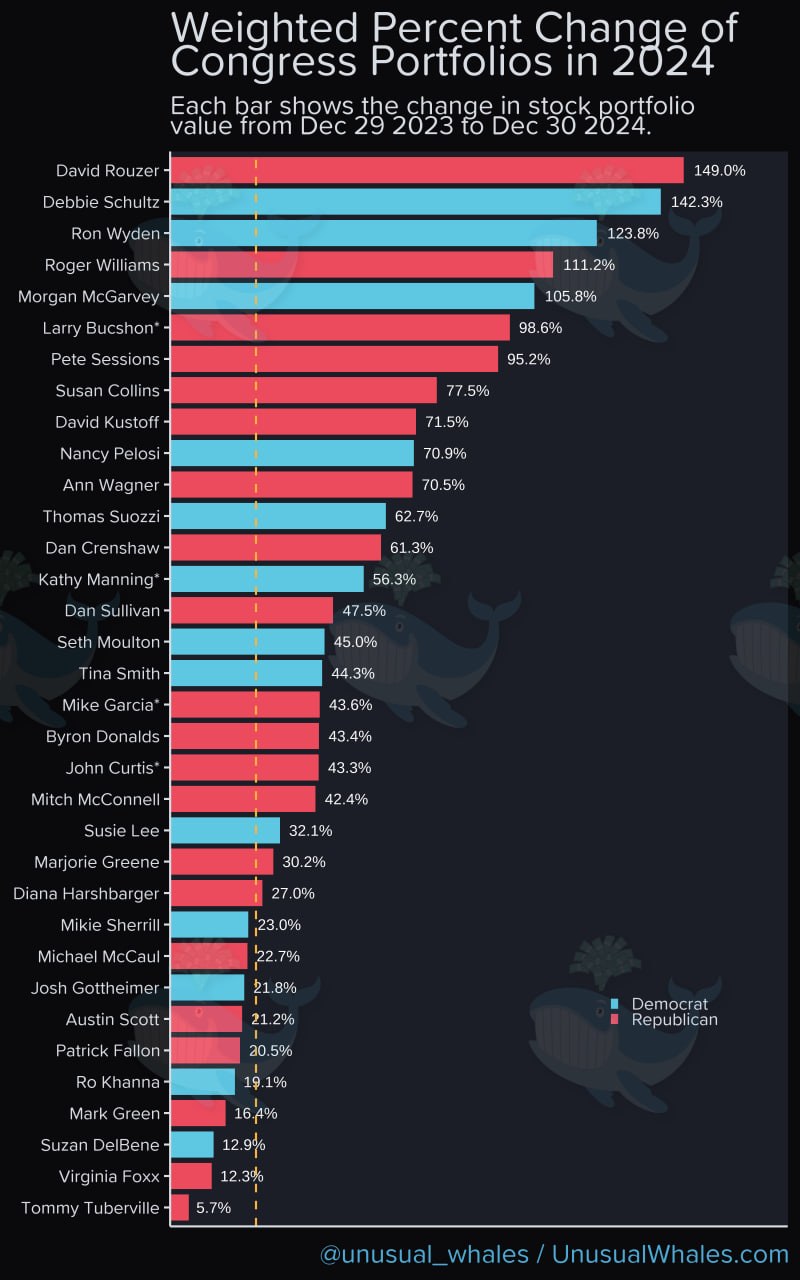

Research firm Unusual Whales reported that congressional stock trading achieved an annualized return as high as 149% in 2024. On average, Republican members gained 31%, while Democrats averaged 26% - both exceeding the S&P500’s 24.9% gain for the year.

[The Investment Return Ranking of US Congressmen in 2024, Source: Unusual Whales]

According to Capitol Trade, reported reported stock transactions by members of Congress in 2024 reached 9,942 trades, with Apple, Microsoft, and JPMorgan ranking as the three most frequently traded stocks. The top three favored sectors were software, semiconductors, and banking.

The so-called "Stock Gods on Capitol Hill" have developed a reputation for accurately timing market entry and exit points — achieving notable profits while minimizing losses. Notable examples from 2024 include:

- Best Buying Opportunities: Senator Tommy Tuberville earned a 179% return on trades involving Fannie Mae, Senator Markwayne Mullin realized 178% gains on Nvidia, and Congressman Michael McCaul secured a 152% return on GE Vernova.

- Best Loss Minimization: Congressman Michael McCaul sold his Intel shares before a major drop, Congressman Josh Gottheimer exited Moderna before its decline, and Congressman Michael Burgess offloaded Volckling ahead of a sharp drop, avoiding losses of 58%, 58%, and 56% respectively.

The New York Times noted that roughly one-fifth of Congressional stock trades appear to be directly related to the lawmakers' official duties.

Among the most well-known figures is Pelosi, often dubbed one of the top "Stock Gods" due to her well-timed investments and the significant growth of her family's wealth. Most of her trades are executed by her husband, Paul Pelosi. Reports indicate her investment returns reached 84% in 2023 and 71% in 2024.

[The Net Asset Trend of Nancy Pelosi, Source: QuiverQuant]

Pelosi demonstrated remarkable skill in trading stocks like Tesla, Nvidia, Google, Microsoft, and several pharmaceutical companies— with many of her trades closely aligned with major policy developments:

- Tesla: In 2021, Pelosi purchased call options on Tesla before Biden's announcement new electric vehicle subsidies. Tesla’s stock rose 36% within a month.

- Nvidia: Pelosi acquired Nvidia stock ahead of the 2022 passage of the CHIPS and Science Act, which spurred a significant rise in the stock price.

- Google and Microsoft: She purchased call options in both companies just prior to U.S. antitrust actions, and quickly sold the positions afterward.

- Moderna and Tempus AI: She bought call options on Moderna before the approval of its COVID-19 vaccine, capitalizing on a sharp stock rally before closing her position. Her investment in the AI-driven medical firm Tempus AI saw a 150% return within a month.

Other notable cases of trading behavior aligned with policy actions include:

- Former Senate Intelligence Committee Chairman Richard Burr, who sold stocks after privately warning about COVID-19 in early 2020.

- In 2021, Congressman Brian Mast purchased shares in Raytheon shortly before the Defense Committee began discussions on arms procurement— a move that coincided with a 17% rise in the stock price.

Investment Preferences of U.S. Politicians

While members of both parties invest in individual stocks, Democratic and Republican lawmakers exhibit distinct investment styles, shaped in part by the interest groups behind them. Democrats tend to favour large-cap tech companies, whereas Republicans show a stronger preference for financial institutions, industrial manufacturers, and traditional energy firms.

Among stocks held by Democrats, more than 30% are concentrated in tech giants such as Apple, Microsoft, and Google, compared to just 10% for Republicans. Nancy Pelosi’s well-known "tech stock legend" underscores this pattern. Democrats also invest significantly more in green energy companies like Tesla and First Solar than their Republican colleagues.

In contrast, Republicans allocate nearly 20% of their portfolios to traditional energy stocks such as ExxonMobil and Chevron, while Democrats hold just 6% in that sector. Republican investments in defence contractors like Lockheed Martin and Raytheon also exceed Democrats by more than double.

Democrats and Republicans share similar levels of interest in pharmaceutical and financial stocks, though their choices within those sectors diverge. Democrats tend to favour biotech firms (e.g., Moderna) and investment banks/fintech companies (e.g., Goldman Sachs), whereas Republicans lean toward generic drug manufacturers (e.g., Mylan) and regional/insurance stocks (e.g., Wells Fargo).

Recent trading behaviour reveals further differences in strategy. Democrats are more likely to engage in high-frequency, short-term trades and event-driven transactions, while Republicans typically adopt a longer-term approach, aligning their portfolios with anticipated policy developments.

Legitimizing Politician Stock Trading

Although the STOCK Act imposes strict rules on insider trading and financial disclosure, many members of Congress have found ways to "legitimize" their stock investments through various legal and procedural loopholes:

1. Delayed Disclosure & Low Penalty Rates: Data shows that roughly 20% of congressional members either delayed or failed to disclose their trades in 2023. However, the enforcement rate remains alarmingly low — just 1%. Over the past decade, the SEC has not prosecuted a single lawmaker for stock trading violations.

2. Trading by Relatives: The STOCK act only restricts direct trading by members, leaving transactions conducted by spouses or children in a legal grey area with limited regulatory oversight.

3. Passive Investments: Many lawmakers assert that their assets are managed by third-party financial advisors, allowing them to distance themselves from investment decisions and avoid direct accountability.

Controversy Surrounding Politician Stock Trading

A growing majority of Americans have expressed dissatisfaction with politicians trading stocks, arguing that such activity undermines the integrity of the free market by enabling the exploitation of non-public information. A 2023 Gallup poll revealed that 83% of Americans support a complete ban on stock trading by members of Congress.

Opposition is also emerging from within the political establishment. A 2023 University of Maryland survey found that 86% of bipartisan congressional members, as well as, the president, vice president, and 87% of Supreme Court justices, support prohibiting lawmakers from engaging in stock trading. Over 90% of respondents agreed with the statement: "There are too many potential conflicts of interest."

Despite broad public and institutional support, legislative efforts to curb congressional stock trading have largely stalled. Proposals such as the Ban Congressional Stock Trading Act (2022), the Bipartisan Ban on Congressional Stock Ownership Act (2023), and the ETHICS Act (Ending Trading and Holdings in Congressional Stocks, 2024) have yet to be voted on, debated, or passed.

As key enforcers of American political and economic power, members of Congress participating in capital markets continue to erode both public trust and the foundations of a fair, transparent free market system.

- Distorted Resource Allocation: Legislative efforts may skew towards specific industries, as seen in the tax benefits and antitrust exemptions often enjoyed by tech giants — companies in which families like Pelosi’s hold substantial investments.

- Erosion of Public Trust: Surveys show that over 70% of Americans believe stock trading by members of Congress reflects a reality of government being influenced by the wealthy, further fueling the rise of populism.

- Increased Systemic Risk: The actions of several lawmakers who sold regional bank stocks shortly before the 2022 banking crisis contributed to heightened public concern and amplified market panic.

Stocks Associated with Congressional Stock Gods

According to Capitol Trades, in the year ending March 2025, financial assets traded by U.S. Congress members included U.S. Treasury securities worth $46.94 million, followed by trades in Microsoft, Google, Apple, and Nvidia, each totaling at least to $13 million.

In terms of the number of holdings, lawmakers consistently favored market heavyweights such as Microsoft, Nvidia, Google, Apple, Amazon, JPMorgan, Berkshire, Meta, Wells Fargo, and Starbucks over the past year.

Among active traders, Democrats, represented by Nancy Pelosi, and Republicans, represented by Ted Cruz, have seen the introduction of funds tracking their investments—NANC and KRUZ. In 2024, NANC gained 26.83% and KRUZ rose14.45% compared to a 25% increase in the S&P 500 index.

Top 10 Holdings | |

NANC | Nvidia, Microsoft, Amazon, Salesforce, Google, Apple, Costco, Philip Morris, American Express, Netflix |

KRUZ | JPMorgan, AT&T, Comfort Systems, Nvidia, Chevron, Accenture, The Allstate Corporation, IBIT (iShares Bitcoin Trust ETF), Intel, Tyson Foods |

[Source: Yahoo, TradingKey]