[IN-DEPTH ANALYSIS] Amazon: E-commerce Giant Hit Hard by Tariffs,Stock Plummet?

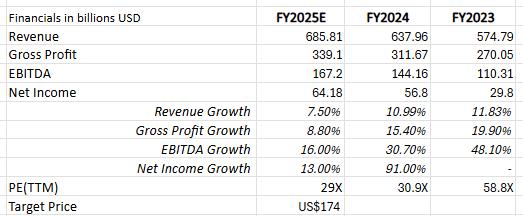

TradingKey - Recent market dynamics have been largely driven by sentiment, failing to fully reflect fundamental factors. The tariff policies implemented in 2025 have significantly impacted Amazon’s operations, particularly its e-commerce business. The broader effects of tariffs on the macroeconomic environment, supply chains, inflation, and consumer behavior are yet to be fully realized. This report focuses on analyzing the impact of tariffs on Amazon’s e-commerce segment. After accounting for these factors, we estimate Amazon’s fair value in 2025 to be $174 per share.

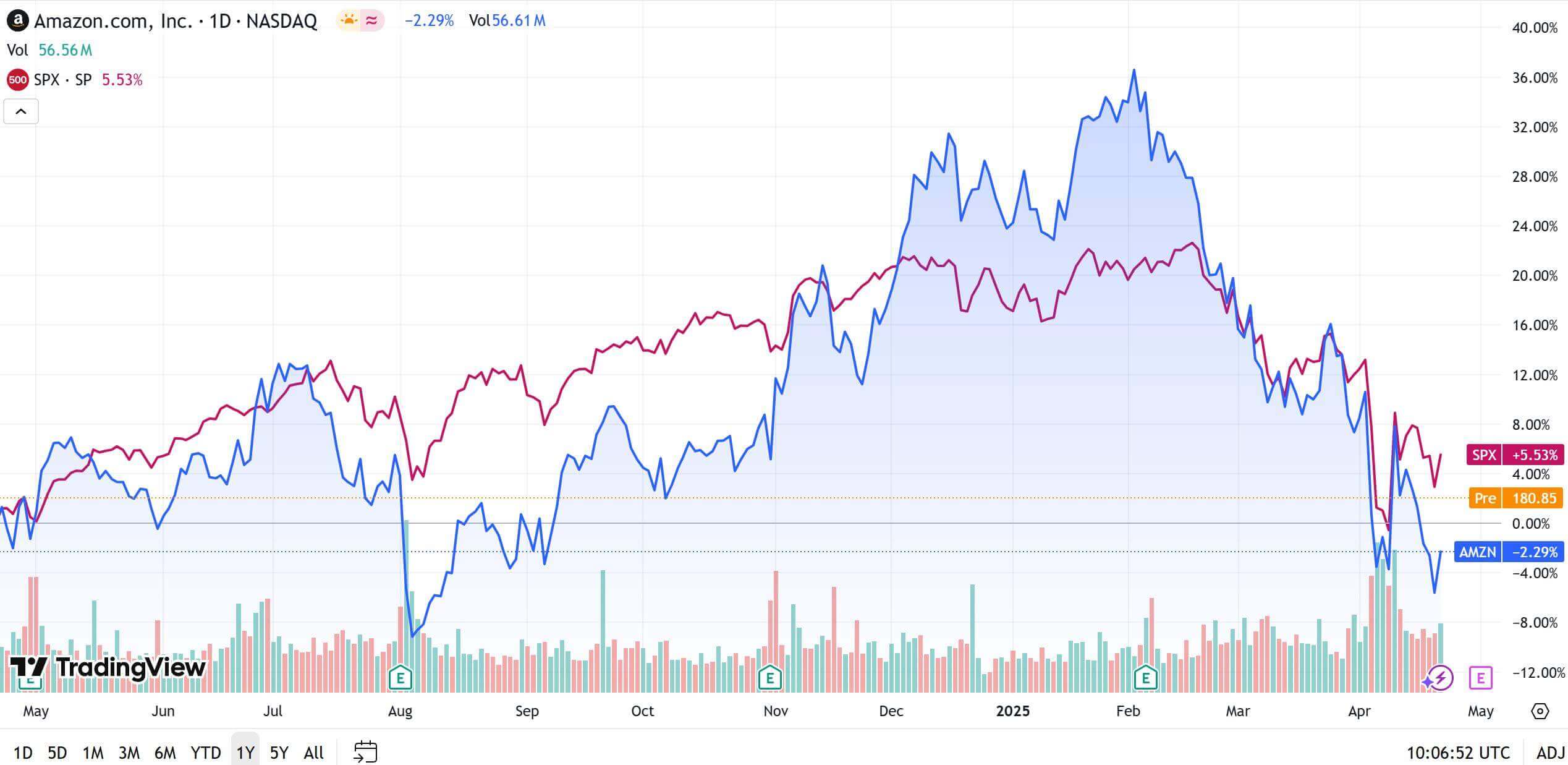

Source: TradingView

1. Tariff Shock to the E-commerce Industry

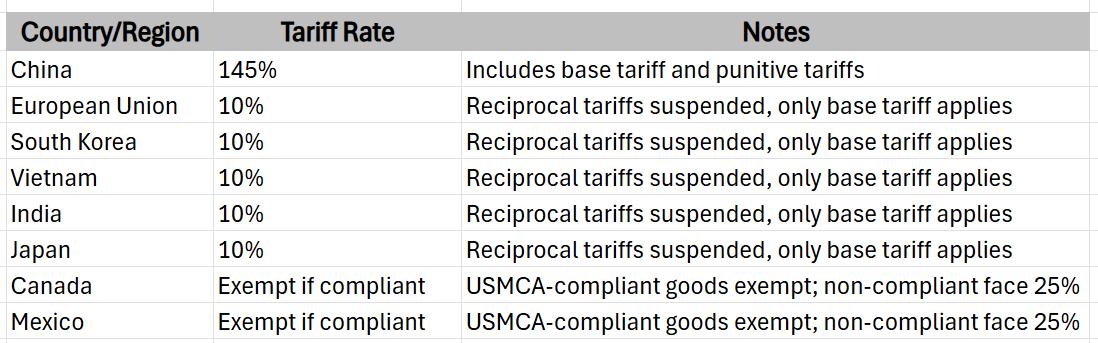

Source: TradingKey

In April 2025, the Trump administration announced a series of tariff measures, widely expected to be broader and more disruptive than the 2018 tariffs on China, posing a significant shock to global supply chains. So far, Trump has implemented a 10% global import tariff, with tariffs on Chinese goods reaching 145%. Steel, aluminum, autos, and auto parts face an additional 25% tariff. USMCA-compliant goods from Canada and Mexico are exempt, while non-compliant goods face a 25% tariff. Reciprocal tariffs, except for China, have been suspended for 90 days, with the policy being complex and far-reaching.

The e-commerce industry has been notably impacted, with the most immediate effect being a surge in import costs. Global E-commerce platforms like Amazon, Temu, and Shein, which rely heavily on Chinese supply chains, face profit compression, with product prices rising 15%-20% (e.g., clothing 12.5%-20.6%, toys 36.3%-55.8%). The elimination of the $800 De Minimis exemption further increases costs for small orders. To counter these challenges, these platforms are forced to adjust pricing strategies, optimize logistics, localize inventory, and tweak marketing strategies to mitigate the impact of declining consumer demand.

2. Have Tariffs Dealt a Heavy Blow to Amazon?

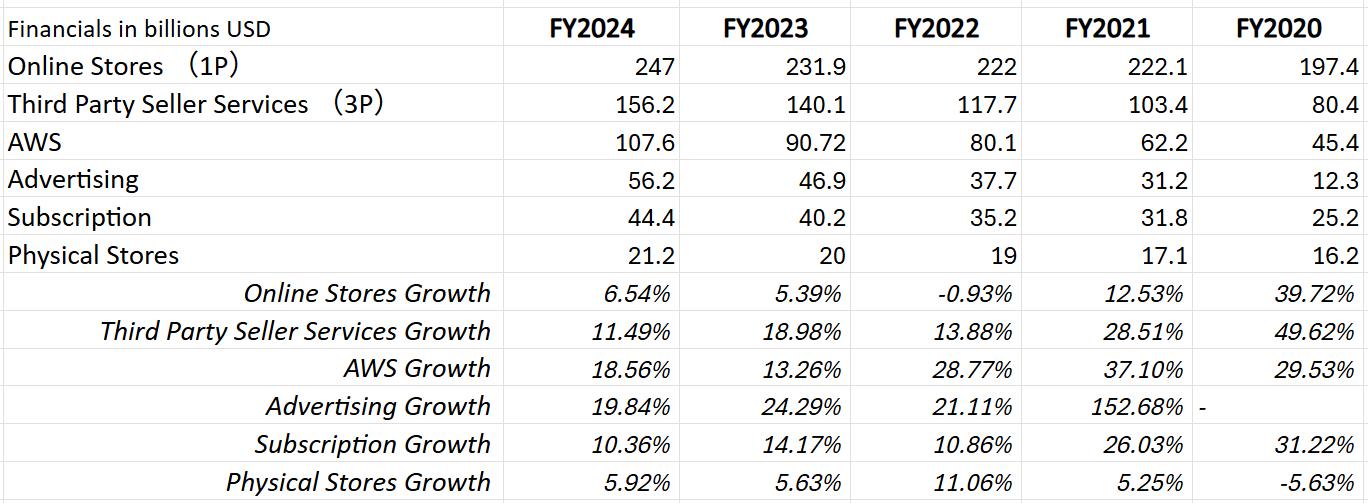

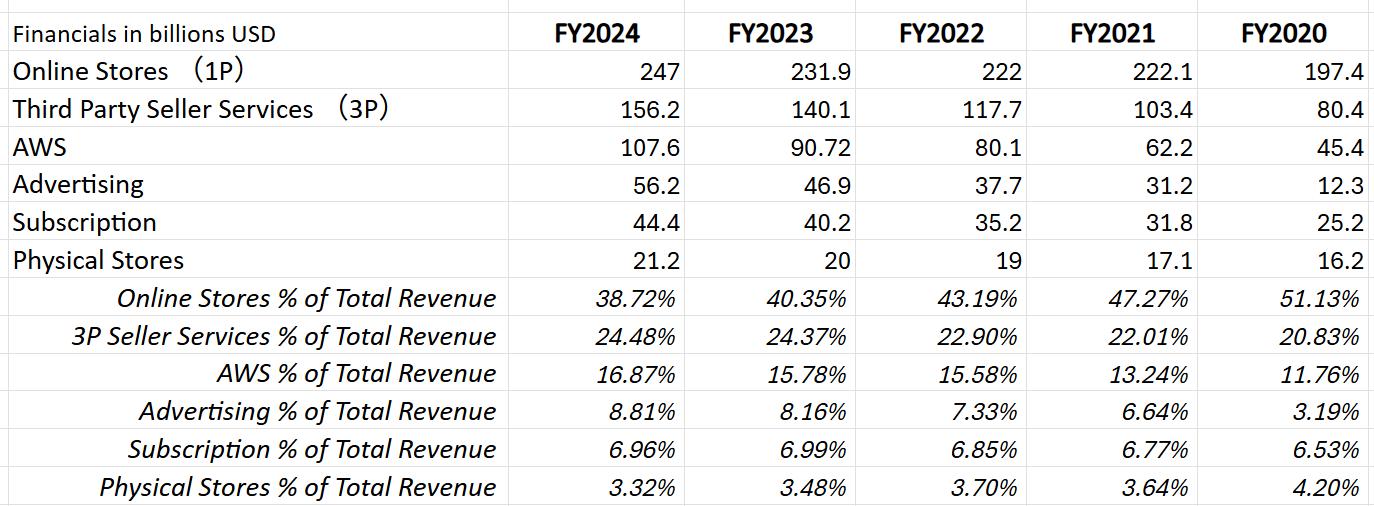

Amazon, as a global e-commerce giant, generated nearly $640 billion in total revenue in 2024, commanding a 40% share of the U.S. e-commerce market, far surpassing its competitors. However, the cost increases brought by tariffs have significantly impacted Amazon’s financial and market performance. Given that Amazon’s policy adjustments directly affect millions of sellers and consumers, its tariff response strategy is not only critical to its own development but also serves as an industry benchmark.

Over the past year, Amazon’s stock performance has been relatively stable. However, as the effects of tariff policies become evident, its stock price has started to decline significantly, even erasing all gains since Trump took office. This trend reflects market concerns over tariffs potentially weakening Amazon’s profitability.

For Amazon, the direct impact of tariffs centers on its supply chain, particularly businesses reliant on Chinese suppliers. Supply chain disruptions have led to reduced inventory availability and higher product costs, primarily affecting Amazon’s online store (1P) and third-party seller services (3P) businesses. This not only squeezes profit margins but also impacts related areas like advertising revenue. If tariff policies intensify and persist, Amazon’s e-commerce revenue growth is expected to slow, potentially turning negative.

In contrast, Amazon’s AWS cloud services, subscription services, and physical store businesses are less directly impacted by tariffs. However, if tariffs trigger a broader economic slowdown, companies may cut capital expenditures, and consumers may reduce spending, indirectly pressuring these segments’ revenue and casting uncertainty over their growth prospects.

Source: TradingKey, Amazon

3. Profits Under Pressure: Amazon’s 1P Business Faces Tariff Challenges

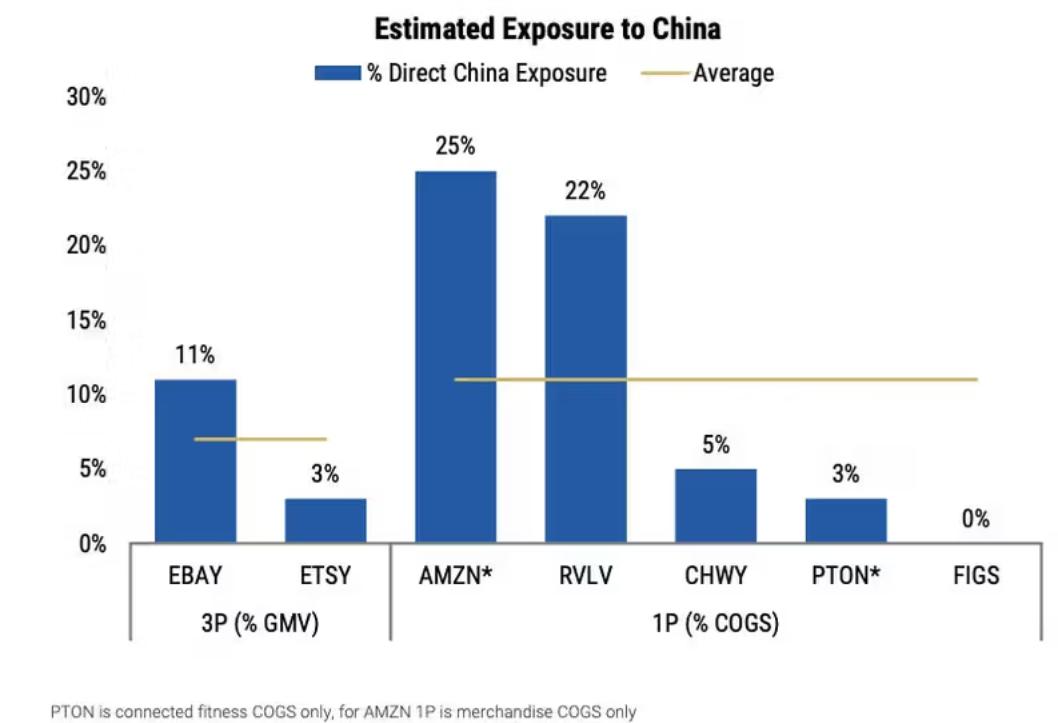

Amazon’s 1P business—where it procures goods directly from suppliers and sells them to consumers via its platform—is a key revenue pillar, accounting for roughly 40% of its total sales. This business model heavily relies on global supply chains, particularly Chinese suppliers, with about 25% of 1P inventory sourced from China. Due to this dependency, Amazon’s tariff exposure stands at 25%, far exceeding the industry average of 10%. Compared to other retailers, Amazon’s 1P business is more vulnerable to tariff policies.

According to Goldman Sachs analysis, the cost of goods in the 1P business accounts for about 74% of its revenue, with a gross margin of just 26%. The new tariff policies will significantly increase the cost of imported goods, especially those from China, with procurement costs expected to rise by 15-20%. However, Amazon cannot fully pass these additional costs onto consumers, which will directly compress its sales volume and profit margins.

Additionally, Amazon employs dynamic pricing algorithms, adjusting 1P product prices based on competitors’ pricing. If other retailers opt to absorb some tariff costs to maintain price competitiveness, Amazon will face even greater profit pressure. The dual challenge of market competition and rising costs further strains the profitability of the 1P business. While Amazon can adjust its procurement strategies or seek alternative suppliers, these changes are difficult to implement in the short term. Thus, the impact of tariff policy changes on the 1P business is particularly pronounced.

Source: Amazon, Morgan Stanley Research

4. Amazon’s 3P Business: A Dilemma

Amazon’s 3P business (third-party seller platform) involves independent sellers listing products on Amazon’s platform, with Amazon charging a commission based on sales. Unlike the 1P business (self-operated model), the 3P business does not directly bear inventory costs, so it appears less impacted by external factors like tariffs. However, the actual effects of tariffs create a complex dilemma for Amazon’s 3P business, balancing short-term gains with long-term risks.

Tariffs increase the operating costs of third-party sellers, forcing them to raise product prices to pass on some of the pressure. Since Amazon’s commissions are based on a percentage of sales, higher prices can boost commission revenue in the short term, easing profit pressure. However, consumers are price-sensitive, and if prices continue to rise, demand may decline, leading to a drop in total sales volume, which would be detrimental to Amazon.

Moreover, Amazon’s advertising business is a key source of diversified revenue. In 2024, advertising revenue reached $56.2 billion, up approximately 20% year-over-year, with its share of total revenue steadily increasing. 1P business ads primarily come from Amazon’s own platforms (e.g., Prime Video), while 3P business ads are dominated by third-party sellers’ Sponsored Ads. Statistics show that 3P sellers’ ad spending far exceeds that of 1P sellers, typically accounting for over 80% of ad revenue. If tariffs continue to squeeze sellers’ profits, they may cut ad spending due to declining gross margins, potentially dragging down overall ad revenue performance.

Overall, while higher prices under tariffs can boost commission revenue in the short term, if demand elasticity leads to a sales drop, the negative impact may outweigh the benefits of price increases. Amazon must strike a balance between pricing strategies and market demand to sustain long-term sales and ad revenue.

Source: TradingKey, Amazon

5. Amazon’s Competitive Edge in E-commerce Under Tariffs

Tariffs undoubtedly pose a negative impact on Amazon’s e-commerce business, but its unique strengths allow it to mitigate some of these challenges. Below are the key factors enabling Amazon to maintain a competitive edge in the tariff environment:

Supply Chain Diversification and Resilience: Amazon’s marketplace and sellers have already adapted to disruptions from tariffs imposed during Trump’s first term (2018), with many third-party sellers gradually diversifying their supply chains to reduce reliance on China. Although the 2025 tariffs are unprecedented in scale and risk, Amazon’s market flexibility and adaptability are expected to allow it to adjust its supply chain faster than other tier-1 retailers, mitigating tariff impacts.

Bargaining Power: As one of the world’s largest buyers, Amazon holds a significant advantage in negotiations with suppliers. This position enables it to secure lower prices and pass cost advantages on to consumers. By offering more competitive pricing, Amazon is poised to expand its market share, maintaining appeal even under tariff pressure.

Global Logistics Network: Amazon boasts one of the most extensive and sophisticated global logistics networks. As of 2024, its logistics investments have neared $100 billion. This scale of investment allows Amazon to shift inventory from Asia at a lower cost and faster pace than peers. Compared to smaller competitors reliant on third-party logistics, Amazon enjoys a clear edge in logistics cost control and efficiency, minimizing the additional burden of tariffs.

Source: TradingKey, Amazon

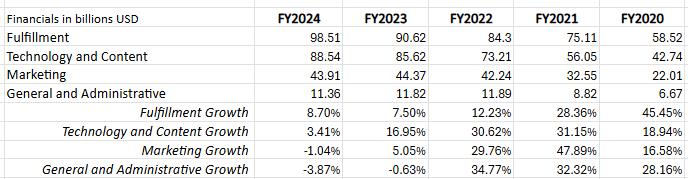

Operational Efficiency Gains: In recent years, Amazon has continuously optimized its cost structure, with operating expense growth slowing significantly. Through innovations like robotics, its e-commerce business has seen steady improvements in operating profit margins. Given the large scale of Amazon’s e-commerce operations, even small efficiency gains can turn into substantial profit improvements. This efficiency advantage bolsters its resilience against rising tariff costs.

Source: TradingKey, Amazon

Forex Buffer: About a quarter of Amazon’s revenue comes from international operations, which are not directly affected by U.S. tariff policies. Additionally, a weaker U.S. dollar helps mitigate recent headwinds, providing a buffer for its business model.

Source: TradingView

6. Valuation

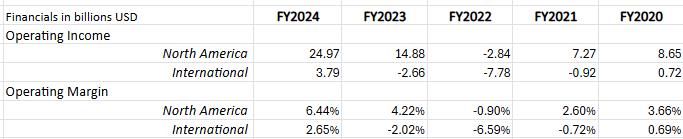

Tariffs have a significant impact on Amazon’s business, particularly in its 1P model. As a direct importer of goods, Amazon bears the additional costs brought by tariffs, directly compressing its profit margins. After comprehensive analysis, the tariff impact is expected to reduce Amazon’s annual operating profit by $5-10 billion. This cost pressure primarily affects the core of its e-commerce business, challenging overall profitability.

Considering the drag on e-commerce and advertising profitability due to tariffs, alongside the expected double-digit growth in AWS to partially offset the pressure, Amazon’s 2025 EPS is forecasted at $5.99. This figure is below the current market consensus of $6.25, indicating significant downside risk. Reflecting a cautious outlook on Amazon’s profitability and growth potential under the tariff regime, a 2025 PE ratio of 29x yields a reasonable target price of $174.

Source: TradingKey, Amazon