Broadcom (AVGO): ASIC vs GPU: Broadcom and NVIDIA’s Battle for AI Dominance

Source: TradingView

Key Points

- Broadcom pursued a "buy-integrate-optimize-rebuy" strategy to build a "semiconductors + software" dual engine, driving 22% annual free cash flow growth.

- Broadcom dominates AI inference with custom ASICs, which is driven by demand of edge computing and data centers.

- AI revenue surged yet tariff impacts may slow growth rate. Even after Blackwell goes public, AVGO share could rebound 15% to $200 despite competitive pressures.

Overview

Founded in 1961 and headquartered in San Jose, California, Broadcom Inc. (AVGO)is a global leader in semiconductor design and enterprise software solutions. The predecessor of Broadcom was Avago Technologies Limited. In 2016, Avago Technologies Limited acquired Broadcom Limited. Subsequently, in 2018, the company moved its headquarters from Singapore to the United States and officially changed its name to Broadcom Inc. Through its "mergers and acquisitions (M&A) + integration" strategy, Broadcom has built a full-stack solution portfolio spanning semiconductors, cybersecurity, cloud computing, and virtualization technologies. The company serves global hyperscale enterprises (such as tech giants Google, Meta) and industrial clients, with its AI chip revenue ranking second only to NVIDIA.

Broadcom's technology roadmap spans chip design-packaging-cloud services-security tools. Its customized AI ASICs lead globally, designed exclusively for hyperscale clients like Google, Meta, and ByteDance, achieving an energy efficiency 10x higher than general-purpose GPUs. As the world’s first manufacturer of 2nm 3D-packaged XPUs, Broadcom’s chips deliver 10 petaflops of computing power and are scheduled for mass production in 2026. This technology reduces latency and boosts energy efficiency by 30% through vertical stacking of chip layers.

The company’s Tomahawk series chips (1.6T bandwidth) capture 40% of the AI networking market, while its leadership in Wi-Fi 7 solutions and RF front-end modules supply high-end smartphone chips to clients like Apple. Broadcom also supports private AI solutions via VMware and provides end-to- end hybrid cloud security through Symantec’s cybersecurity portfolio.

Revenue Sources

1) Semiconductor Solutions

The semiconductor business holds a core position in Broadcom's business landscape, accounting for 59% of revenue. The AI-related products have become the core driving force. In the fiscal year 2024, the AI revenue reached $12.2 billion, surging by 220% year-on-year. This revenue mainly comes from customized ASIC chips (such as Meta's MTIA 3 and Google's TPU v6) and data center network equipment.

2) Infrastructure Software

Here we saw an explosive growth in revenue in 2024Q3, which was mainly attributed to the acquisition of VMware(virtualization and cloud computing company) completed in November 2023. VMware contributed 65% to the software division. Through the bundled subscription model (such as VMware Cloud Foundation), customer stickiness has been enhanced, and the dependence on the semiconductor cycle has been significantly reduced, forming a "hardware + software" synergistic effect.

Quarter Ending | 30-Sep-24 | 30-Jun-24 | 31-Mar-24 | 31-Dec-23 | 30-Sep-23 | 30-Jun-23 | 31-Mar-23 |

Semiconductor Solutions | 8.23B | 7.27B | 7.20B | 7.39B | 7.33B | 6.94B | 6.81B |

Semiconductor Solutions Growth | 12.34% | 4.80% | 5.79% | 3.98% | 3.30% | 4.79% | 9.30% |

Infrastructure Software | 5.82B | 5.80B | 5.29B | 4.57B | 1.97B | 1.94B | 1.93B |

Infrastructure Software Growth | 195.78% | 199.64% | 174.55% | 152.82% | 7.13% | 5.16% | 2.72% |

Source: TradingKey, SEC Filings

M&A Mania Drove Growth

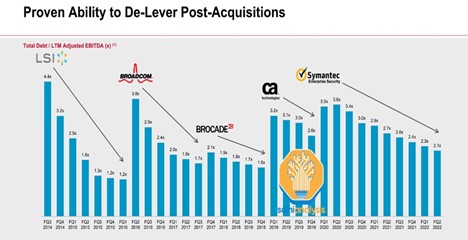

After being spun off from Hewlett-Packard in 2005, Avago, the predecessor of Broadcom, embarked on a path of mergers and acquisitions under the leadership of PE firms KKR and Silver Lake. In the early days, by acquiring LSI Corporation and Emulex Corporation, it quickly entered the storage and network chip markets.

In 2015, Avago acquired the original Broadcom Corporation in a reverse takeover worth $37 billion, inheriting its brand and technological legacy, and soaring to become the world's fifth-largest semiconductor company.

Starting in 2018, it shifted its focus to the enterprise software sector, acquiring CA Technologies for $18.9 billion and the enterprise security division of Symantec for $10.7 billion. Eventually, it made a huge acquisition of VMware, a cloud computing giant, for $61 billion, achieving a dual-driven model of "semiconductors + software."

.jpg)

Source: Company Data

Broadcom's acquisitions follow a cycle of "buy-integration-optimization-repurchase." It targets mature enterprises with high technological barriers and stable cash flows. For example, VMware's virtualization technology has been integrated into subscription services, and the profit margin has increased from that of traditional software to 90%. Through highly leveraged acquisitions and rapid debt repayment (by divesting assets to recover funds), Broadcom has maintained an average annual free cash flow growth of 22%, and its dividends have also increased for over 10 years, attracting long-term value investors.

Source: Semianalysis,Broadcom, Refinitiv

Broadcom vs. Nvidia: The Battle for AI Chip Supremacy

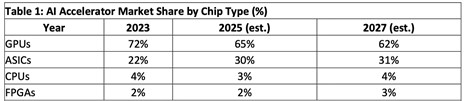

Broadcom and NVIDIA have significant differences in their business models and technological approaches. Broadcom focuses on customized AI processors and network solutions, while NVIDIA leads with its powerful GPUs and comprehensive AI infrastructure. Broadcom's ASIC chips are tailored for specific AI tasks, offering extremely high efficiency and energy efficiency ratios for those particular tasks. However, ASICs have relatively low flexibility; once designed, it is difficult to adjust their functions. Currently, NVIDIA holds an absolute dominant position in the AI accelerator market. GPUs, on the other hand, provide the flexibility required to handle diverse and complex operations and are also crucial for training large language models and other AI applications.

AI training and inference play distinct roles in the development and deployment of artificial intelligence. Training is the initial stage where an AI model learns to recognize patterns by analyzing large amounts of data. This process demands substantial computing power, which is precisely where NVIDIA's GPUs excel. On the other hand, inference involves applying a trained AI model to new, unseen data to make predictions. This stage requires efficient, real-time processing, and ASICs from companies like Broadcom and Marvell are optimized for this area. Both types of chips are essential in the AI ecosystem. ASICs are typically used for specialized functions, while GPUs are utilized for broader and more dynamic tasks.

Source:The Information Networt

In the next few years, the demand for AI chips will experience rapid growth with a continuously diverging structure. GPUs will remain dominant but stabilize, while ASICs will rise rapidly and focus on niche scenarios. As AI applications penetrate fields such as edge computing and smart hardware, ASICs, with their highly customized nature and low power consumption, will play a more significant role in the inference side and in specific scenarios (such as consumer electronics and automotive electronics). Although their overall market share will still be lower than that of GPUs, the demand in their areas of strength will continue to be released.

Broadcom vs Marvell: The Dual Faces of ASIC Dominance

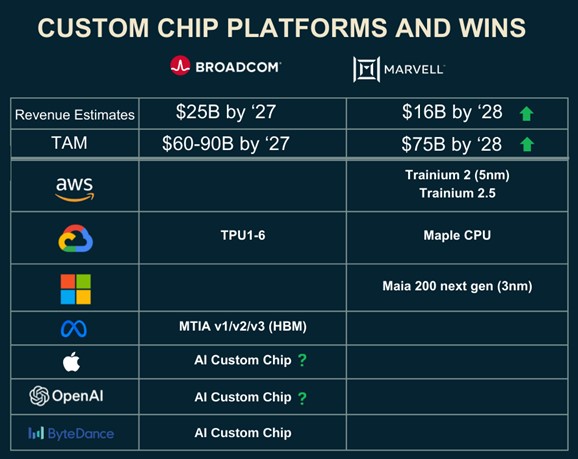

Both Broadcom and Marvell are major players in the ASIC chip sector, yet they have adopted strikingly different technical approaches and market strategies, presenting a differentiated competitive landscape.

Broadcom offers stable R&D investment and technical integration capabilities as its core competitiveness. It has long held a leading position in the fields of network interconnection and ASIC design and has reinvented its competitive edge through 3.5D packaging technologies and a 2-nm manufacturing process.

Marvell, through acquisitions of companies like Cavium, Avera, and Innovium, has rapidly built up its core competencies in ASICs and data centers, focusing on ASIC solutions for AI server demands. Although it lags slightly behind Broadcom in optoelectronic products and Ethernet switch chips, Marvell holds a significant market share in the optical module DSP market.

Source:Spear-Invest

In terms of market share, Broadcom, with a market share of 55% - 60%, firmly ranks first in the high-end custom ASIC market. Its customers include industry giants such as Google, Meta, Apple, and Cisco. Marvell currently ranks second with a market share of 13% - 15%, still lagging but growing faster. Broadcom has a relatively rich customer base, which provides stability for its performance and growth. In contrast, Marvell still faces the risk of losing orders from major customers (such as Amazon). Broadcom is expected to continue to hold the top position in the ASIC market.

In terms of business strategies, Broadcom reaps the high-end market with its closed- loop ecosystem (for example, holding a 90% share of TPU), achieving high operating profit margins and stable cash flow. Its software business has a gross profit margin of over 90%. In contrast, Marvell mainly penetrates long-tail demands with cost- effectiveness and an open ecosystem, maintaining relatively low operating profit margins (30%) but higher revenue growth rates.

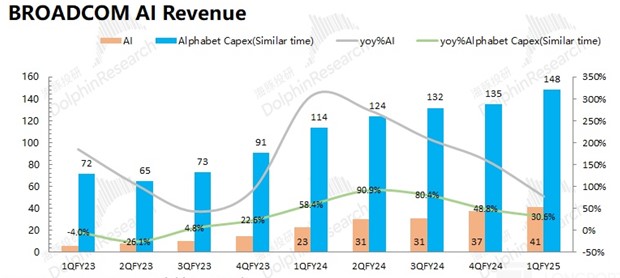

Factually, Broadcom's AI revenue is highly synchronized with the growth of Google's Capex (with over 80% of it directed towards AI). If Google maintains a 30% Capex this year and the proportion of TPU-related expenditures would rise to 65%, thus we foresee Broadcom's AI revenue growth rate will correspondingly exceed 50%. However, since Google is currently in a product transition period, shifting from 5nm TPU inference chips to 3nm TPU v6 training chips, the growth rate of AI revenue has likely slowed down since the second half of last year. Once the product transition is completed, Broadcom's AI revenue is expected to experience more robust growth starting from 2025 Q3.

Source:Company Reports, Dolphin Research

Financials and Valuation

Judging from the performance in the latest financial report for FY2025, the AI revenue has surged by 77% year-on-year, mainly driven by the XPU accelerators customized for customers such as Google and Meta, as well as the data center connectivity solutions. The management's guidance only shows moderate growth. However, CEO Hock Tan believes that the demand from hyperscale customers for XPU chips, VMware, and optical interconnection solutions will continue to rise. He also plans to deploy million-scale XPU clusters for 3 or more customers by 2027.

Considering the scenario where the United States imposes a 25% tariff on imported semiconductors, Broadcom, which relies on foundries such as TSMC and Samsung to produce chips, will face an increase in procurement costs. Chinese customers (accounting for 18% of its revenue) may turn to domestic alternative solutions, leading to a decline in demand. Moreover, the disruption of material imports will also have an impact. As a result, its revenue growth rate would decline to 50%. Since the cost accounts for a relatively small proportion, the gross profit margin will remain around 68%. The main impact lies in the valuation compression caused by the downward adjustment of the growth rate expectations.

After the launch of NVIDIA's Blackwell product, Broadcom's market share would have been squeezed due to competition, its profit growth is unlikely to beat Wall Street expectations again. AVGO’s high valuation implies that the CAGR of revenue needs to be maintained at 15% over the next five years. However, high gross margin and strong profitability are driven by operational resilience, we believe in 2025 the AVGO stock price would likely recover to above $200, indicating that there is still a 15-20% recovery margin compared to the current price of $170.

Ticker | AVGO | TSM | QCOM | TXN | AMD | ARM | Median |

Company Name | Broadcom Inc. | Taiwan Semiconductor Manufacturing Company | QUALCOMM Incorporated | Texas Instruments Incorporated | Advanced Micro Devices, Inc. | Arm Holdings plc | —— |

Industry | Semiconductors | ||||||

P/E | 29.13 | 20.08 | 11.47 | 28.46 | 23.56 | 59.19 | 28.65 |

Price/Sales | 13.36 | 7.25 | 3.41 | 8.51 | 4.91 | 24.27 | 10.29 |

EV/Sales | 12.66 | 5.37 | 3.17 | 8.16 | 3.9 | 22.01 | 9.21 |

EV/EBITDA | 19.13 | 7.9 | 8.17 | 17.27 | 15.52 | 43.94 | 18.66 |

Price to Book | 10.51 | 4.9 | 5.13 | 7.87 | 2.2 | 14.09 | 7.45 |

Revenue Growth (YoY) | 40.30% | 33.89% | 12.13% | -10.72% | 13.69% | 25.73% | 19.17% |

Source: TradingKey, Refinitiv