Is a Crisis of Confidence in the Dollar Coming?

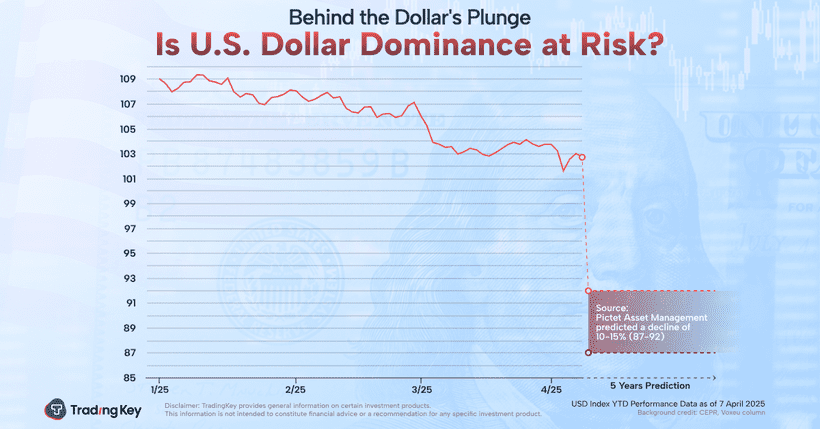

TradingKey - The U.S. dollar index has dropped by approximately 6% YTD, closing at 102. However, analysts on Wall Street are still bearish on the dollar, largely in light of uncertainty of President Trump's tariff policies.

This outlook is a sharp turnaround compared to earlier this year when Trump's tax cuts and tariffs were seen as potential boosters for the dollar. Back in February, U.S. Treasury Secretary Scott Bessent made it clear that “a strong dollar policy aligns perfectly with President Trump’s goals.”

Goldman Sachs previously believed that tariffs would bolster the dollar. However, the FX team at Goldman Sachs released a new outlook, forecasting that the U.S. dollar's weakness will “persist and deepen further.” Meanwhile, following Deutsche Bank's concerns about a potential "crisis of confidence in the dollar," Société Générale echoed this gloomy sentiment.

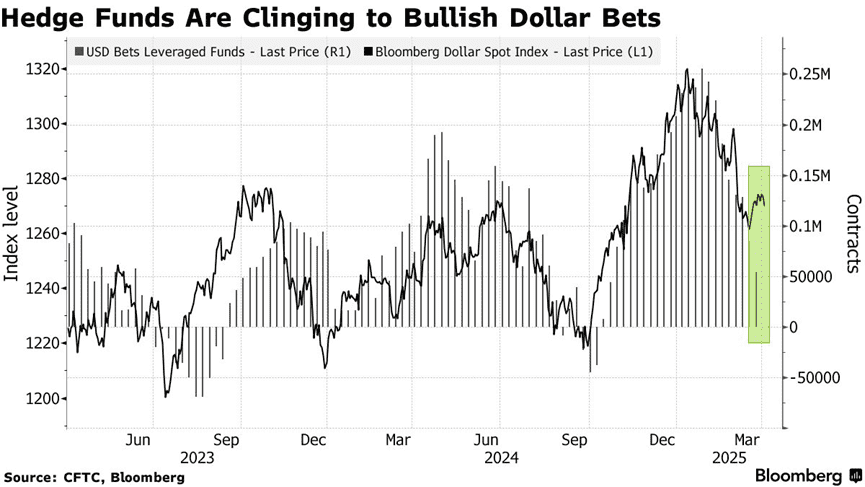

In the derivatives market, hedge funds have reduced their long positions on the dollar from a recent peak in January.

Source: Bloomberg

Why Tariffs Haven't Boosted the US Dollar as Expected?

For a long time, the U.S. has relied on trade deficits to push dollars into the global market, maintaining its grip on monetary power. But Trump's "reciprocal tariffs," which impose a hefty 34% tariff on $2.5 trillion of imported goods, are directly challenging this dynamic.

These current tariffs are strikingly similar to the Smoot-Hawley Tariff Act of 1930. Back then, global trade fell off a cliff, and the World Bank is now predicting a 12% decrease in global trade due to tariffs this year. Moreover, these tariffs could trigger a crisis in the dollar’s monetary system, reminiscent of the breakdown of the gold standard back in the day.

While Trump announced on April 9 that he would hold off on imposing tariffs on all but China, many investors have started to lose faith in the U.S.’s standing as the global economic leader.

Long-term Concerns for the U.S. Economy

Paul Mackel, global head of currency research at HSBC, suggests that the key to the dollar's strength lies in investor sentiment regarding the U.S. economic outlook. If the narrative of an economic slowdown continues, it could make the dollar less attractive as a safe-haven asset.

On Wednesday, Goldman Sachs raised the probability of a U.S. recession to 65%. Although they retracted this report following Trump's tariff deferral, they still consider an economic downturn as their baseline forecast. Meanwhile, a Bloomberg survey found that 92 out of 100 economists believe a recession is on the horizon.

Trump Commits to Deficit Cuts May Weaken Dollar

Trump has pledged to extend the tax cuts initiated in 2017, which were originally set to expire in 2025. If combined with new corporate tax reductions, the Congressional Budget Office (CBO) projects that the federal deficit will increase by 7.5 trillion over the next decade.

His tariff policy claims to 'cover the deficit with tariffs,' but the actual annual revenue is estimated to be only about $225 billion—far from sufficient to compensate for the fiscal shortfall caused by the tax cuts.

Deutsche Bank estimates that the U.S. would need to devalue the dollar by 40% to eliminate the trade deficit. If the Trump administration can’t achieve its tariff goals, it may have to accept a weaker dollar. Historically, the Plaza Accord of 1985 addressed trade imbalances through dollar depreciation, but today's U.S. debt of $36 trillion far exceeds past levels, which could lead to serious capital flight.

The Trend of Capital Flight

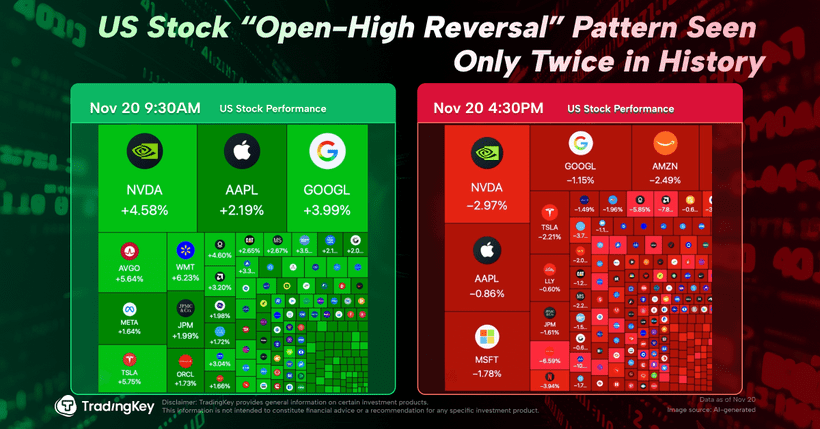

U.S. stock markets have been taking a beating. After the announcement of reciprocal tariffs, investors sold off stocks aggressively, causing the S&P 500 to decline consistently. By March 2025, it was already clear that international investors were reducing their stakes in U.S. equities and looking towards European and Asian markets. This sell-off has increased the supply of dollars, putting further pressure on its value.

According to WSJ data, over five-year periods, the differences in return on equity between U.S. and European stocks have shown a strong correlation—about 70%—to dollar-euro movements since 2001. This suggests that a significant amount of dollar strength comes from investments tied to economic productivity growth, largely driven by the tech sector in Silicon Valley.

Markets now seem to be bracing for another big shift. With renewed military spending, there’s hope for economic revival in Europe, while the U.S. growth narrative faces challenges from protectionism and increasing competition from Chinese tech.

This shift might lead U.S. investors to explore opportunities elsewhere. Compared to the uncertainty surrounding American financial markets, Europe presents a clearer picture. If the EU decides against retaliating to Washington's tariffs, while GDP growth might slow, inflation isn’t expected to spike like it is in the U.S. This makes the European Central Bank's job a bit easier, particularly as they still have room to cut rates, making European stocks and bonds more appealing.

We’ve seen a triad of declines earlier this week: U.S. stocks, bonds, and the dollar all falling together—something we hadn’t seen before. Deutsche Bank points out that ongoing dollar depreciation, alongside falling U.S. stock values and rising yields in U.S. Treasuries, signals a speeding up of capital outflows from the U.S.

Treasury Sell-Off Pressures the Dollar

Since last Thursday, yields on 10-year Treasuries have spiked, forcing hedge funds to reduce their leverage and triggering a "sell everything" trend. The risk premium on long-term U.S. bonds has shifted from negative to positive, indicating a rising demand for risk compensation.

Some analysts are pondering whether foreign entities might stop buying or even start dumping U.S. debt, given the intensity of this sell-off. Trump's goal is to balance trade, but countries that usually have big trade surpluses with the U.S. often use those surpluses to buy American bonds. Over the last decade, foreign holdings of U.S. debt have surged from 6.1trillion to 8.5 trillion, now accounting for 30% of the total. The largest holders include Japan (1.06 trillion), China (759 billion), Luxembourg (424billion, as a representative of European investment funds), and Canada(379 billion).

If these countries stop their current purchasing trends or begin selling off U.S. bonds, it could push yields higher and create significant hurdles for the U.S. economy, applying even more downward pressure on the dollar.

The Bottom Line: Liquidity Issues Are Key

At the core of this situation lies a broader issue of liquidity in the financial system. The widening gap between SOFR and Fed Funds rates is a classic early warning sign of liquidity stress, reminiscent of what we experienced in September 2019. The uneven distribution of reserves within the system, coupled with diverging reserve structures between large banks and regional banks, and the swift depletion of RRP balances alongside ongoing QT, all paint a picture of a liquidity crisis brewing.

This dollar liquidity crunch is prompting countries to diversify their foreign exchange reserves more aggressively. Usually, in a crisis, markets hoard dollar liquidity to ensure they can fund U.S. assets. However, the current dynamics are quite different.

“The market has lost faith in U.S. assets, so instead of closing the asset-liability mismatch by hoarding dollar liquidity, it is actively selling down U.S. assets themselves,” Deutsche Bank said. “We are now seeing this play out in real time at a faster pace than even we would have anticipated. It remains to be seen how orderly this process can remain. A credit event in the global financial system that threatens the provision of short-term dollar liquidity is the point of greatest vulnerability, which would turn dollar dynamics more positive,” the German bank added.