First Quarter 2025 Banking Industry Earnings Comments

Key Takeaways: Q1 2025 Major U.S. Banks

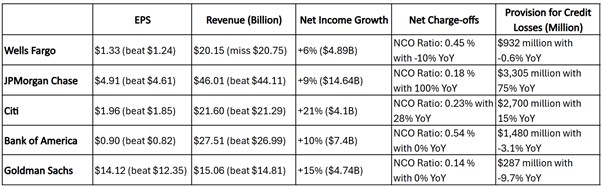

- Robust Earnings: All banks beat EPS forecasts, with Goldman Sachs ($14.12) and JPMorgan ($4.91) leading, despite economic headwinds.

- Revenue Mixed: JPMorgan ($46.01B) and Bank of America ($27.51B) exceeded expectations; Wells Fargo ($20.15B) missed due to commercial real estate pressures.

- Credit Quality: Goldman Sachs (0.14%) and Bank of America (0.54%) stable; Wells Fargo improved (0.45%); JPMorgan (0.18%) and Citi (0.23%) rose.

- Provisions Vary: Bank of America ($140M) and Goldman Sachs ($287M) cut provisions; JPMorgan ($3.3B) and Citi ($2.7B) increased cautiously.

- Outlook: Banks cautiously optimistic, with diversified firms like JPMorgan and Bank of America better equipped for trade and inflation challenges.

Overall Performance Evaluation

The five major U.S. banks delivered strong business performance in Q1 2025, particularly in investment banking, wealth management, and market trading segments. Based on earnings reports and conference call insights, the banks expressed cautious optimism about future markets. They unanimously acknowledged challenges such as economic volatility, geopolitical uncertainties, and trade policy changes but remain confident in their ability to navigate these effectively, leveraging their strategic positioning, financial strength, and client support capabilities.

1.Wells Fargo

Financial Performance:

- Earnings Per Share (EPS): Wells Fargo reported an EPS of $1.33, surpassing market expectations of $1.24, indicating robust profitability.

- Revenue: Revenue reached $20.15 billion, slightly below expectations of $20.75 billion, reflecting pressure on revenue growth, possibly due to significant commercial real estate exposure and macroeconomic challenges.

- Net Income Growth: Net income grew 6% to $4.89 billion, the lowest among the five major banks, suggesting modest profit growth.

- Net Charge-Off Ratio (NCO Ratio): The NCO ratio dropped to 0.45%, down 10% year-over-year, signaling improved credit quality due to optimized loan portfolios.

- Provision for Credit Losses: Provisions fell to $932 million, down 0.6% year-over-year and below expectations, reflecting optimism about future credit risks.

Business Segment Performance:

In Q1 2025, Wells Fargo’s Consumer Banking and Lending segment saw revenue decline 2% to $8.913 billion and net income drop 1% to $1.689 billion, primarily due to rising deposit costs, though increased deposit balances partially offset this. Credit card revenue grew 2%, while auto revenue fell 21%. Credit loss provisions decreased 6% to $739 million, indicating improved credit quality. The Corporate and Investment Banking segment reported a 2% revenue increase to $5.064 billion and a 23% net income rise to $1.941 billion, driven by commercial real estate gains and investment banking revenue, though noninterest expenses rose 6% to $2.476 billion, reflecting higher operating costs. The Wealth and Investment Management segment saw growth in average loans and deposits, reflecting client asset expansion. Overall, Wells Fargo’s transformation efforts drove fee-based revenue growth and better credit outcomes, but net interest income fell 6% to $11.5 billion, impacted by declining rates and deposit mix shifts.

2.JPMorgan Chase

Financial Performance:

- Earnings Per Share (EPS): JPMorgan’s EPS reached $4.91, exceeding expectations of $4.61, showcasing strong profitability.

- Revenue: Revenue totaled $46.01 billion, above expectations of $44.11 billion, reflecting significant growth driven by exceptional performance in investment banking and retail banking.

- Net Income Growth: Net income rose 9% to $14.64 billion, a healthy performance, though trailing Citi and Goldman Sachs.

- Net Charge-Off Ratio (NCO Ratio): The NCO ratio increased to 0.18%, up 100% year-over-year, driven by growth in credit card and auto loan balances, but remains low overall.

- Provision for Credit Losses: Provisions rose to $3.3 billion, up 75% year-over-year, reflecting management’s cautious approach to potential credit risks.

Business Segment Performance:

In Q1 2025, JPMorgan Chase’s Commercial and Investment Banking segment performed strongly, with net income of $6.9 billion and revenue of $19.7 billion, up 12% year-over-year, driven by a 19% increase in markets and securities services revenue, including a 48% surge in equity markets revenue, reflecting favorable market volatility. Banking and payments revenue grew 4%, despite deposit margin compression challenges. The Asset and Wealth Management segment reported net income of $1.6 billion and revenue of $5.7 billion, up 12%, fueled by higher management fees and increased brokerage activity, with assets under management reaching $4.1 trillion, up 15%, signaling strong client asset inflows and market growth. In contrast, the Consumer and Community Banking segment saw net income decline 8% to $4.4 billion, despite 4% revenue growth to $18.3 billion, due to higher noninterest expenses and a $2.6 billion increase in credit loss provisions, impacted by elevated costs and shifting economic outlooks. The Corporate segment’s net income surged 150% to $1.7 billion, primarily due to gains from the First Republic acquisition and lower expenses. Overall, JPMorgan Chase’s diversified business model and fee-based revenue strategy drove exceptional performance across multiple segments.

3.Citi

Financial Performance:

- Earnings Per Share (EPS): Citi’s EPS was $1.96, surpassing expectations of $1.85, reflecting strong profitability driven by diversified revenue streams and efficient cost management.

- Revenue: Revenue reached $21.6 billion, slightly above expectations of $21.29 billion, indicating solid business performance.

- Net Income Growth: Net income grew 21% to $4.1 billion, the highest among the five banks, signaling significant profitability improvements, likely due to global business expansion and cost control.

- Net Charge-Off Ratio (NCO Ratio): The NCO ratio rose to 0.23%, up 28% year-over-year, indicating a slight decline in credit quality but remaining at a low level.

- Provision for Credit Losses: Provisions increased to $2.7 billion, up 15% year-over-year, reflecting attention to potential credit risks, though the moderate increase suggests a balanced risk management approach.

Business Segment Performance:

In Q1 2025, Citigroup’s Services segment led with revenue of $4.9 billion, up 3%, driven by growth in treasury and trade solutions, with net income rising 7% to $1.6 billion. The Markets segment reported revenue of $6 billion, up 12%, with fixed income markets up 8% and equity markets up 23%, driven by equity derivatives and prime services, boosting net income 27% to $1.8 billion. The Banking segment’s revenue grew 12% to $1.9 billion, primarily from investment banking, though net income rose only 4% to $543 million due to higher costs. The Wealth segment’s revenue surged 24% to $2.1 billion, with net income up 62% to $284 million, driven by client investment asset growth. U.S. Personal Banking revenue grew 2% to $5.2 billion, with net income soaring 115% to $745 million, aided by lower credit costs. However, the All Other segment’s net loss worsened to $870 million, with revenue down 39%, reflecting divestitures and currency devaluation challenges. Overall, Citigroup’s diversified operations and focus on operational efficiency provided resilience.

4.Bank of America

Financial Performance:

- Earnings Per Share (EPS): Bank of America’s Q1 EPS was $0.90, exceeding expectations of $0.82, reflecting solid profitability.

- Revenue: Revenue reached $27.51 billion, slightly above expectations of $26.99 billion, indicating stable growth.

- Net Income Growth: Net income grew 10% to $7.4 billion, on par with JPMorgan, demonstrating healthy profitability.

- Net Charge-Off Ratio (NCO Ratio): The NCO ratio remained steady at 0.54%, at historical lows, indicating stable credit quality.

- Provision for Credit Losses: Provisions fell to $140 million, down 3.1% year-over-year, reflecting optimism about credit risks, likely due to the bank’s stable business structure and improved loan portfolio quality.

Business Segment Performance:

Bank of America’s Q1 2025 performance highlighted the effectiveness of its diversified business strategy. The Consumer Banking segment reported net income of $2.5 billion and revenue of $10.5 billion, up 3%, driven by growth in net interest income, service fees, and credit card revenue, reflecting resilient consumer spending. However, credit loss provisions rose 12% to $1.3 billion, signaling caution about potential credit risks, though asset quality remained stable. The Global Wealth and Investment Management segment saw net income of $1 billion and revenue of $6 billion, up 8%, driven by a 15% increase in asset management fees, fueled by asset inflows and higher market valuations, though noninterest expenses rose 9%, reflecting investments in personnel and technology. The Global Banking segment’s net income was $1.9 billion with flat revenue of $6 billion, as gains in leveraged finance and treasury services were offset by lower net interest income, though credit quality improved, particularly in commercial real estate. The Global Markets segment reported net income of $1.9 billion and revenue of $6.6 billion, up 12%, driven by strong fixed income and equity trading, reflecting increased market volatility and client activity, though noninterest expenses rose 9%, reflecting business growth investments. Overall, Bank of America’s digital transformation and client engagement strategies provided a buffer in a complex macroeconomic environment.

5.Goldman Sachs

Financial Performance:

- Earnings Per Share (EPS): Goldman Sachs’ EPS was $14.12, significantly exceeding expectations of $12.35, the largest EPS beat among the five banks, indicating exceptional profitability, likely driven by strong investment banking and trading performance.

- Revenue: Revenue reached $15.06 billion, above expectations of $14.81 billion, reflecting robust growth.

- Net Income Growth: Net income grew 15% to $4.74 billion, second only to Citi.

- Net Charge-Off Ratio (NCO Ratio): The NCO ratio remained steady at 0.14%, the lowest among the banks, indicating stable credit quality, likely due to its focus on institutional clients with lower credit risk.

- Provision for Credit Losses: Provisions fell to $287 million, down 9.7% year-over-year, reflecting confidence in its credit portfolio.

Business Segment Performance:

In Q1 2025, Goldman Sachs’ Global Banking and Markets segment excelled, with revenue of $10.71 billion, up 10%, driven by a 27% increase in equity revenue to $4.19 billion, fueled by strong derivatives and portfolio financing performance. Fixed Income, Currency, and Commodities (FICC) revenue grew 2% to $4.4 billion, benefiting from mortgage and structured lending gains, though investment banking fees fell 8% to $1.91 billion, primarily due to a 22% drop in advisory revenue, despite an 8% rise in debt underwriting. The Asset and Wealth Management segment reported revenue of $3.68 billion, down 3%, impacted by weaker equity and debt investment performance, but management fees rose 10% to $2.7 billion, with assets under management reaching a record $317 billion, reflecting strong client demand. Platform Solutions revenue fell 3% to $676 million, primarily due to a 19% drop in transaction banking revenue, reflecting lower deposit balances. Overall, Goldman Sachs’ success stemmed from its market leadership in mergers, equity, and debt underwriting, as well as its ability to support clients in uncertain economic conditions.

Future Outlook

The Trump administration’s tariff policies may exacerbate trade tensions, raising import costs and indirectly fueling inflation pressures. This uncertainty could slow global economic growth and even heighten recession risks. Rising inflation expectations may delay monetary policy easing (e.g., rate cuts), presenting both opportunities and challenges for the banking sector. On one hand, higher interest rates could enhance bank profitability; on the other, economic slowdowns may increase credit risks. Additionally, market uncertainty could lead companies to delay IPOs or reduce merger activity while stimulating market volatility, impacting various banking businesses differently.

Among them, investment banking-focused banks like Goldman Sachs and JPMorgan Chase may face pressure on their investment banking operations due to IPO stagnation and reduced mergers, but their trading businesses could benefit from market volatility. Diversified banks like JPMorgan Chase and Bank of America, with broad business structures, can capitalize on rising rates while mitigating some risks through wealth management, though they must remain vigilant about economic slowdowns affecting credit quality. Consumer and commercial banks like Wells Fargo, with significant exposure to commercial real estate and consumer loans, may face heightened risks, though higher rates could bolster net interest income. Highly international banks like Citigroup may see their services segments strained by global trade tensions, but their wealth management businesses could demonstrate resilience amid market adjustments.