CoreWeave Is Reshaping AI Economics

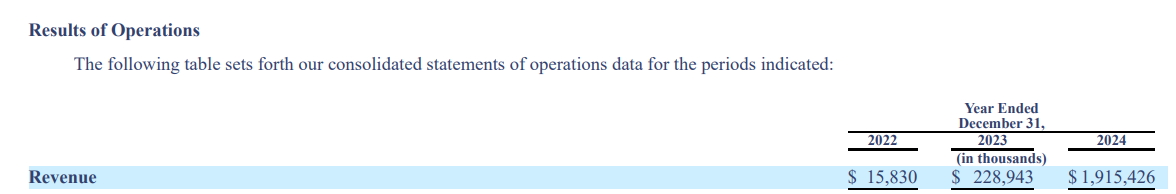

- Revenue soared from $15.8M in 2022 to $1.92B in 2024, with a staggering 80% CAGR projected through 2026.

- Adjusted EBITDA hit $1.22B in 2024, achieving a 64% margin—unmatched in AI infrastructure.

- Deployed 250K+ Nvidia GPUs using structured financing, with payback in under 2.5 years.

- Unlike hyperscalers, CoreWeave’s orchestration optimizes GPU economics, reducing AI costs while boosting performance.

The Unseen Power Grid Behind the AI Explosion

TradingKey - Whereas money has flowed to foundation models, edge inference chips, and shiny AI applications, few investors have taken the time to learn about the infrastructure scaffolding behind the AI explosion. CoreWeave (CRWV) may not be on the lips of every investor, but it is one of the most crucial enablers of high-performance AI computing in the United States. Born from a niche GPU mining business, it has rearchitected itself as a hyperscale-grade infrastructure company architected from the ground up to support AI workloads. In doing so, CoreWeave is upending the entrenched economics of the cloud, creating an all-new operating model around capital efficiency, GPU composability, and elastic performance at scale. At an era when latency is killing performance and cost per token matters more than computing hours, CoreWeave is more and more the grid behind AI's next trillion-dollar wave.

It is not CoreWeave's hardware that distinguishes it, but its orchestration. It reengineered the economics of the cloud on GPUs, dematerializing complexity by software and unbundling infrastructure ownership from deployment. With its developer-first mentality and purpose-built financing structure, it is able to offer performance guarantees and agility that even the largest hyperscalers cannot. With revenues of $1.92 billion as of 2024, and adjusted EBITDA margins greater than 60%, CoreWeave is not scaling, it is reshaping how AI infrastructure is delivered, monetized, and funded. While valuation is elastic, the company’s platform-like behavior and embedded customer contracts make it one of the most misunderstood opportunities in public markets.

Source: SEC Prospectus

Architecture of CoreWeave: Elastic by Nature, Efficient by Default

CoreWeave's business is focused on orchestration-based GPU infrastructure. It does not operate and own a cloud, but provides access to composable, container-based GPU clusters provisioned dynamically by workload sensitivity, latency requirements, and computational needs. The central product is elastic GPU infrastructure installed in over 14 geographically distributed U.S. data centers. They are tied together by proprietary ultra-low-latency networking, enabling customers to route and scale AI workloads within milliseconds. Relying on neither static provisioning or overprovisioning of resources, CoreWeave utilizes job-level scheduling and containerization on Kubernetes to optimize the use of GPUs. The system supports high-throughput training workloads and low-latency inference at scale, enabling customers to train and deploy on one stack.

Financially, CoreWeave is moving beyond just compute. CoreWeave offers managed APIs, model hosting, developers' SDKs, and integration software that allow AI developers to decouple infrastructure without compromising performance. Complementary to its developer-centric orientation is long-term infrastructure deals with several of the world's most computationally demanding AI businesses, including Runway, Inflection AI, and Mistral.

One of the most important areas of difference is its capital strategy. CoreWeave avoids up-front high CapEx by utilizing sale-leaseback and term loans over time to fund GPU acquisition and data center buildout. In 2024, it deployed over 250,000 Nvidia GPUs while having property and equipment on its balance sheet of under $10 million. This balance-sheet-light strategy enabled over $8.7 billion of infrastructure rollout without sacrificing liquidity or resorting to excessive dilution.

What is unique about CoreWeave is that it turns infrastructure into a software platform. When developers can talk to infrastructure through programmable interfaces, infrastructure is no longer a service provider, it is part of the toolchain of software development. This is the behavior that is critical to building long-term pricing power and lock-in. When inference workloads are more distributed and latency-sensitive, elastically scheduling jobs between geographies is a platform feature, not an optimization of performance.

Source: SEC Prospectus

Mapping the Competitive Landscape: Scale, Detail, and Platform DNA

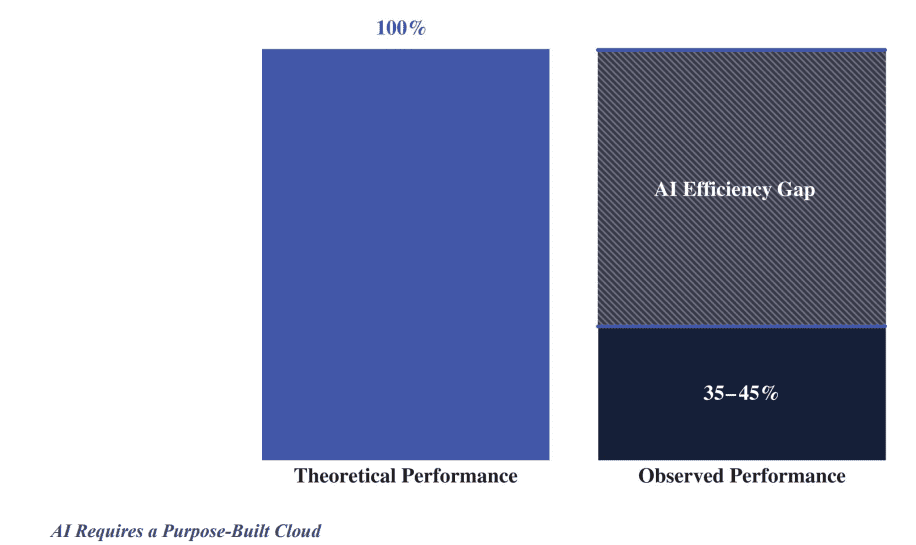

CoreWeave is operating in an environment where incumbents and upstarts are all fighting to define the future of AI infrastructure. At the high end of the market are AWS, Microsoft Azure, and Google Cloud, who together command the majority of all global cloud workloads. They are huge, but their GPU orchestration is not yet mature. Hyperscalers package together computation and storage, APIs, and analytics capabilities, but cannot optimize GPU clusters for AI-throughput. Their systems are designed to provision resources generally, leading to underutilization and cost for AI developers who need job-specific determinism.

CoreWeave, by contrast, does one thing. It does not inherit any legacy cloud baggage and can thus optimize power distribution and scheduling software to fully leverage GPU economics. This gives it a true performance gain when it comes to latency-sensitive workloads and cost savings when it comes to big training. It is more transparent and flexible than usage-based, region-tiered pricing schemes of bigger clouds. Customers can reserve capacity per job and achieve assured throughput.

Start-ups including Lambda Labs, Together AI, and Crusoe offer competing alternatives, particularly in the training cluster market. They all, however, lack CoreWeave’s depth of orchestration, developer environment, and capital structure. They are primarily GPU leasers or cloud wrappers without an infrastructure programmable layer. CoreWeave’s ability to offer software-defined infrastructure, including embedded APIs and SDKs, places it on the way to platform-level monetization.

One of the key peers is Nebius, operating a sovereign GPU cloud business. Nebius is good at GPU sourcing and localization but is structurally and geographically constrained on extensibility of the platform. It has much higher valuation multiples than CoreWeave despite lower revenues and thinner commercial presence.

It is CoreWeave's distinction from competitors most of all that it is not positioned as a provider of compute, but as an operating layer. It is integrated into client development workflows. This makes switching costs high, churn costs low, and leverage on margins sustainable. In an environment where availability of GPUs is commoditizing, this type of platform behavior may be the most defendable of all.

.png)

Source: SEC Prospectus

Strategic and financial growth along the infrastructure stack

CoreWeave growth lies in the shift from research on AI to production deployment. With the market shifting from experimentation to monetization, infrastructure needs are more complex and long-term. Inference workloads are not bursty, they are continuous, latency-sensitive, and distributed geographically. This maps exactly to CoreWeave’s value proposition. Its multi-region orchestration, low-latency routing, and burstable computing infrastructure are tailor-made for large-scale inference and rollout to production.

Between 2022 and 2024, CoreWeave's financial situation changed from being a scrappy start-up to an infrastructure leader at scale. In 2022, it generated $15.8 million of revenue and reported a net loss of $31.1 million. Cost of revenue was 77% of sales and G&A was 38%. Gross margins were negative and adjusted EBITDA was negative $9.9 million. These numbers were representative of an early-stage business developing infrastructure.

Revenue reached $228.9 million by 2023, up over 1,300% from the previous year. Gross margin expanded to 32.1%, and adjusted EBITDA turned positive at $103.9 million. Adjusted net loss had declined to $44.6 million, while GAAP net loss had expanded to $593.7 million due to derivative revaluation. Perhaps most notably, over 93% of revenue was from long-term contracts.

Transformation was completed by 2024. Revenue reached $1.92 billion, and adjusted EBITDA reached $1.22 billion, or 64% of the margin. Cost of revenue fell to 26%, G&A fell to 6%, and adjusted net loss fell to $64.9 million. The company's remaining performance obligations reached $15.1 billion, 96% of which are to be recognized within six years. This level of visibility, along with software-like margins, is an uncommon financial picture for infrastructure.

Its own capital efficiency is also noteworthy. Having expanded to more than $14.5 billion of total infrastructure value, CoreWeave had little CapEx by applying structured financing. Its payback on average GPU clusters is less than 2.5 years, and the majority of workloads are breakeven within 12 months. Such payback economics are more akin to SaaS than to cloud infrastructure.

.png)

Source: SEC Prospectus

Valuing In Context: Platform Power Disguised as Infrastructure

At 20.6x Trailing EV to Sales and 6.98x Price to Sales, CoreWeave is pricey versus infrastructure peers but considerably undervalued versus platform peers. Snowflake is trading at over 13.44x EV to Sales with lower growth and lower adjusted margins. Nebius is trading at over 28.53x EV to Sales and 49x Price to Sales, though its total revenue is barely one-tenth of CoreWeave’s.

CoreWeave's operating conversion efficiency is high as shown by its 7.33 Price to Cash Flow. Adjusted EBITDA margins are above 60%, and growth remains in the triple digits. With 93% of revenue contracted and long-term price visibility, CoreWeave is less exposed to spot demand volatility than pay-as-you-go-priced peers.

An 80% top-line CAGR to 2026, declining to 25% by 2029, and 25% to 28% terminal EBITDA margins implies a value range of between $18 billion and $22 billion. This is 9 to 11 times forward EV to Sales fully justified by a high cash flow-generating, contract-durable, infrastructure-exposed productized platform.

More upside lies ahead as CoreWeave monetizes more layers of the stack. Once inference APIs, orchestration engines, and SDKs are standalone drivers of revenue, the company may begin trading as hybrid of Cloudflare and Databricks rather than as a leaser of GPUs. That re-rating would be worth billions of dollars of equity value.

.png)

Source: SEC Prospectus

Risks: Outstanding Performance Concealing Underlying Structure

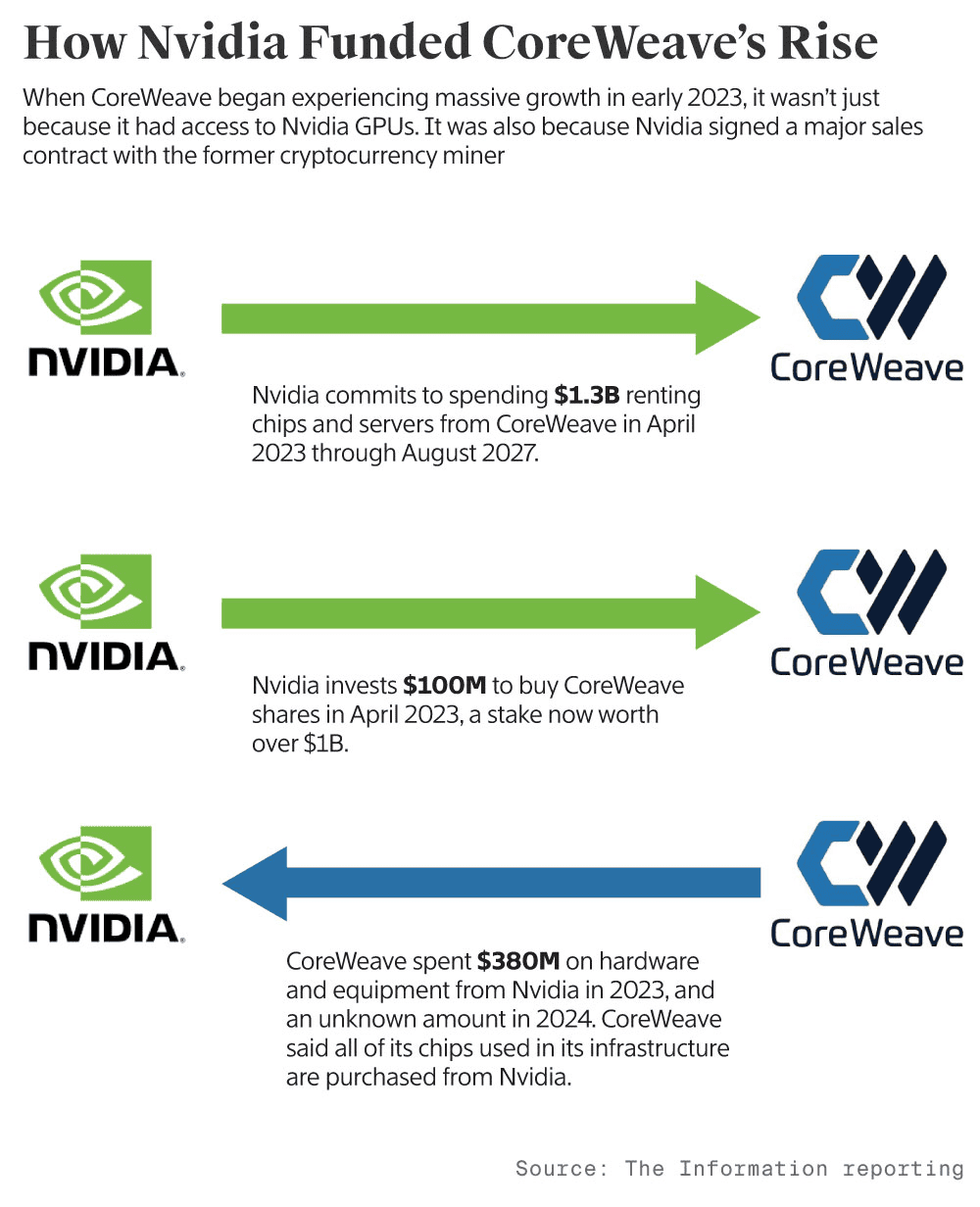

It does have momentum, but CoreWeave also involves material risks. There is extreme customer concentration. In 2023, over 70% of revenue came from three customers. These are long-term contracts, but a sudden decrease in demand or financing from one of these participants would compress utilization and delay the realization of margins. The company is expanding its base, but it remains top-heavy.

Hardware dependency is also a structural risk. CoreWeave is highly reliant on Nvidia for supply, pricing, and availability. Relations are good and long-term arrangements are in place, but any material disruption to the availability of GPUs would hinder cluster deployment. Greater competition from cloud-native vendors and sovereign GPU vendors would also put downward pressure on price. Lastly, regulatory and geopolitical risk cannot be ignored. When governments begin to regulate AI workloads, export controls, and compute density, CoreWeave and other vendors might be taken aback by the requirements of compliance. The very infrastructure that enables true-time AI may become subject to carbon scrutiny or concerns of national security.

CoreWeave has become one of the most strategically important companies in AI infrastructure without much ado. Their orchestration-based platform, their capital-light deployment, and their developer-first strategy are the recipe for infrastructure monetization in the AI era. With hypergrowth, increasing margins, and platform potential, CoreWeave is not just scaling, it is setting the standard for what's next.

Source: theinformation.com