US stock market extends crash after S&P 500′s worst week since September

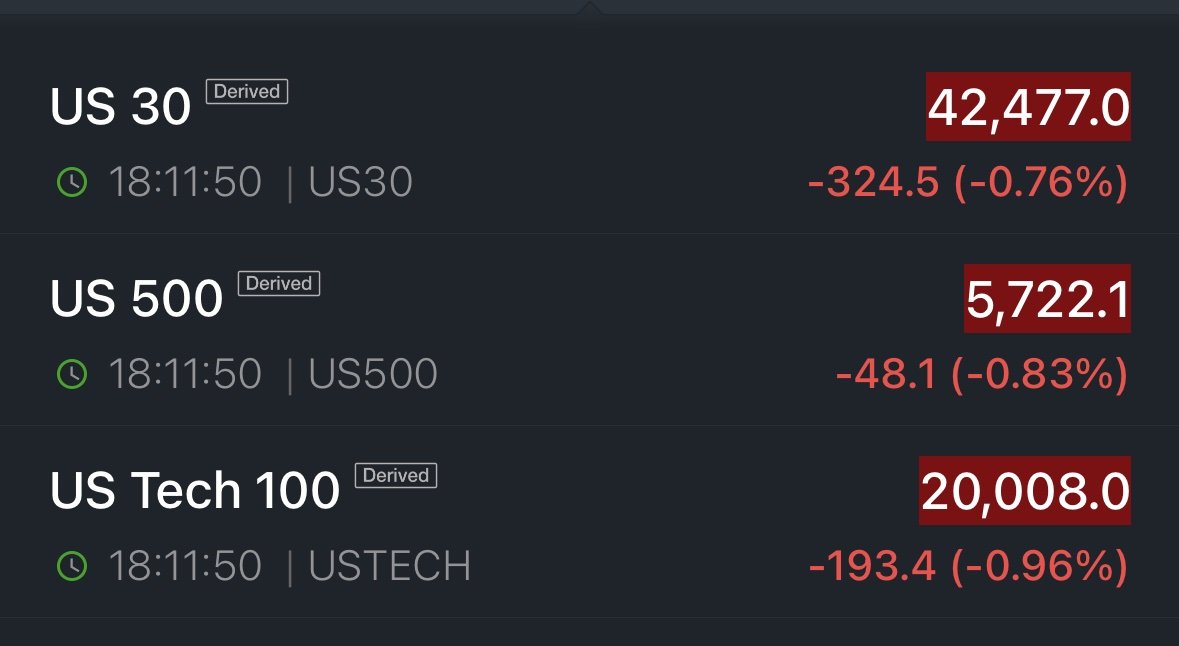

Stock futures fell hard Sunday night, setting up another rough week on Wall Street after major indexes took a beating in early March. S&P 500 futures dropped 0.8%, Nasdaq 100 futures slid nearly 1%, and Dow Jones futures sank 268 points (0.6%), per data from CNBC.

This comes after last week’s brutal selloff, where the S&P 500 plunged 3.10%, the Dow lost 2.37%, and the Nasdaq Composite tumbled 3.45%—its worst performance since September.

The selloff was also fueled by Washington’s economic policies and tariff negotiations with Mexico and Canada, creating uncertainty that sent investors running for cover.

Throughout the week, a flood of economic reports will be released and they likely would add to the chaos. The New York Fed’s consumer expectations survey is set for release Monday, but the real concern is inflation—something the Federal Reserve and investors are watching closely.

So we got the Consumer Price Index (CPI) for February will be released Wednesday, followed by the Producer Price Index (PPI) on Thursday, and then the University of Michigan’s consumer sentiment index comes on Friday.

Bill Adams, chief economist at Comerica Bank, said, “The total and core CPI likely rose at a more moderate pace in February after sharp increases in the prior month.” Bill also explained that tariffs and trade uncertainties continue to push producer prices higher.

On Friday, Fed Chair Jerome Powell addressed the uncertainty, saying the central bank is “focused on separating the signal from the noise.” He pointed out that his team isn’t in a hurry to adjust interest rates, adding that the Fed will wait for “greater clarity” before making changes.

The Biden administration’s economic policies also remain a factor. President Donald Trump’s Treasury Secretary Scott Bessent admitted on Friday, “The economy is starting to roll a bit.”

Investors are watching to see whether Washington will step in with any measures to stabilize the markets, but let’s face it, with Trump saying “I’m not even looking at the stock market,” last week, they probably won’t.

Bitcoin sinks as US creates strategic reserve

The market bloodbath wasn’t limited to stocks, the crypto market took a hit too. Early Monday, Bitcoin fell more than 5%, trading at $80,622, according to data from CoinGecko. Ethereum and XRP weren’t spared either, both dropping by 6% and 7.5% respectively.

The plunge came after Trump signed an executive order to establish a US strategic bitcoin reserve. The reserve will be funded with bitcoins seized from criminal and civil forfeiture cases, and there are no plans for the government to buy more.

That announcement disappointed investors, many of whom expected massive and aggressive federal purchases of Bitcoin. Matt Hougan, chief investment officer at Bitwise Asset Management, wasn’t convinced the market’s reaction made sense.

Bitcoin price chart. Source: Jai Hamid/TradingView

“I absolutely think the market has this wrong,” Matt said on CNBC’s Squawk Box Asia. “The market is short-term disappointed” that the US didn’t announce a 100,000 or 200,000 bitcoin purchase.

David Sacks, White House Crypto and AI Czar, promised that the US could acquire more bitcoin in the future using “budget-neutral strategies” that wouldn’t cost taxpayers anything.

The idea of a strategic bitcoin reserve has long-term implications, and Matt believes it’s the key to Bitcoin becoming a key geopolitical asset, so now we’re all watching to see if other governments follow suit and start stockpiling crypto.

Bitcoin Magazine’s David Bailey told Bloomberg TV last week that Middle Eastern countries and even China are secretly making plans to jump into crypto too.

Wall Street faces uncertainty as investor panic grows

Jim Cramer, speaking on CNBC, didn’t hold back in his assessment of the situation. “Our president, Donald Trump, tells us that ‘what we are doing is big,’ so there might be economic consequences to come that we don’t like,” said Jimmy.

Commerce Secretary Howard Lutnick hasn’t helped the situation, giving conflicting signals about tariffs. “Howard tells us to worry about tariffs, then not to worry, and then to worry again,” Jim said. “What was the last worry or not worry turn? I forget. Is he freelancing?”

With $36 trillion in national debt, tariffs alone won’t fix the economy. Jimmy pointed out that tariffs worked when Alexander Hamilton was building a manufacturing base, but today’s situation is completely different.

With 4% unemployment and a worker shortage in manufacturing, he questioned how effective they can be. “Just target those countries dumping on us or hitting us with high tariffs,” Jimmy suggested.

“Take the history books we studied that proved over and over again that tariffs helped cause the Great Depression. They weren’t lies. They weren’t propaganda. They were just empirical observations.”

The instability has investors running. “It’s like the whole point of the exercise post-inauguration is to get you to sell all of the stocks you own and certainly not to put any money to work,” said Jimmy.

“The major stock benchmarks are barely down. But look at this endless rotation out of anything with earnings risk, anything with exposure to data centers, personal computers, semiconductors, and enterprise software—about 50% of the market is now radioactive.”

What’s next for the markets?

Wall Street is watching for signs of stabilization, but it’s hard to see through the uncertainty. “Pass me the binoculars; I don’t see one yet because the dust storm the White House keeps kicking up is obscuring everything,” Jimmy bantered.

For investors, the biggest question is whether the market collapse is sustainable. Trump’s presidency was expected to be bullish for stocks, but the opposite has happened. “Everything you thought would be good for the stock market under Trump hasn’t happened, and everything you knew would be horrendous for the stock market has happened times ten,” Jim pointed out.

Still, he doesn’t think the downturn is permanent. “I think Trump is going to try to figure out something good for the markets,” he said. “But not when the Dow Jones falls 10% from here. He cares that our markets will soon be the worst in the world, and no one with pride can ignore that.”

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now