USD/CHF languishes near its lowest level since March, holds above mid-0.8700s

- USD/CHF drifts lower for the third straight day amid the post-FOMC USD selling bias.

- Geopolitical risks further benefit the safe-haven CHF and contribute to the downfall.

- A positive risk tone holds back bearish traders from placing fresh and helps limit losses.

The USD/CHF pair remains under some selling pressure for the third successive day on Thursday and drops to its lowest level since March 13, around the 0.8760 region during the Asian session. The downfall validates the overnight breakdown through the 0.8800 round figure and is sponsored by the post-FOMC US Dollar (USD) selling bias.

The Federal Reserve (Fed) decided to hold its benchmark interest rate steady in the 5.25%-5.50% range while acknowledging the recent progress on inflation and cooling in the labor market. Furthermore, Fed Chair Jerome Powell, speaking at the post-meeting press conference, signaled the likelihood of an early rate cut if inflation stays in line with expectations. This, in turn, drags the US Treasury bond yields to a multi-month low, which keeps the USD bulls on the defensive near a three-week low and turns out to be a key factor exerting pressure on the USD/CHF pair.

The Swiss Franc (CHF), on the other hand, attracts some haven flows in the wake of the risk of a further escalation of geopolitical risks in the Middle East. Meanwhile, the prospects for an imminent start of the Fed's policy-easing cycle trigger a fresh leg up in the equity markets. This might keep a lid on any meaningful appreciating move for the CHF and help limit the downside for the USD/CHF pair. Nevertheless, the aforementioned fundamental backdrop favors bearish traders and suggests that the path of least resistance for spot prices is to the downside.

That said, investors are likely to wait for the release of the closely-watched US monthly employment details – popularly known as the Nonfarm Payrolls (NFP) report on Friday – before placing fresh bets. In the meantime, the USD/CHF pair remains at the mercy of the USD price dynamics and the broader risk sentiment in the absence of any relevant market-moving economic data from the US on Thursday.

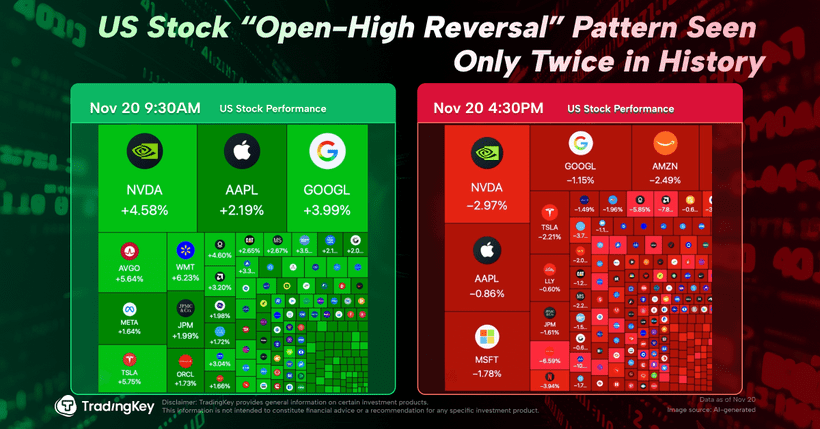

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF |

|---|---|---|---|---|---|---|---|---|

USD |

| -0.00% | 0.04% | -0.19% | -0.00% | 0.19% | -0.04% | -0.12% |

EUR | 0.00% |

| 0.04% | -0.21% | -0.01% | 0.21% | -0.03% | -0.12% |

GBP | -0.04% | -0.04% |

| -0.25% | -0.03% | 0.16% | -0.07% | -0.16% |

JPY | 0.19% | 0.21% | 0.25% |

| 0.20% | 0.41% | 0.12% | 0.05% |

CAD | 0.00% | 0.01% | 0.03% | -0.20% |

| 0.21% | -0.03% | -0.12% |

AUD | -0.19% | -0.21% | -0.16% | -0.41% | -0.21% |

| -0.23% | -0.33% |

NZD | 0.04% | 0.03% | 0.07% | -0.12% | 0.03% | 0.23% |

| -0.09% |

CHF | 0.12% | 0.12% | 0.16% | -0.05% | 0.12% | 0.33% | 0.09% |

|

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).