Wall Street Warns of U.S. Recession; Former NY Fed Chief Suggests Stagflation Could Be the Best Scenario

TradingKey - Donald Trump has made tariffs a cornerstone of his second term strategy, announcing reciprocal tariffs last week affecting all countries.

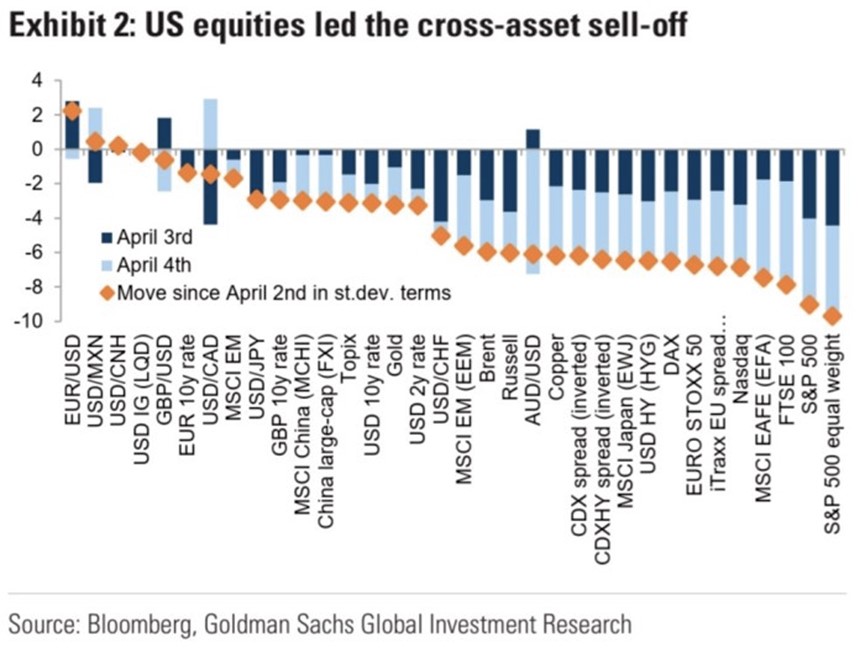

The announcement sparked a big market reaction, with the S&P 500 index falling 10.5% over Thursday and Friday. This was the fourth-largest two-day drop for the index since 1950. Notably, some of the biggest declines happened in March 2020 at the start of the COVID-19 pandemic, during the financial crisis in November 2008, and back on 'Black Monday' in 1987. Meanwhile, pessimism has seeped into nearly all asset classes.

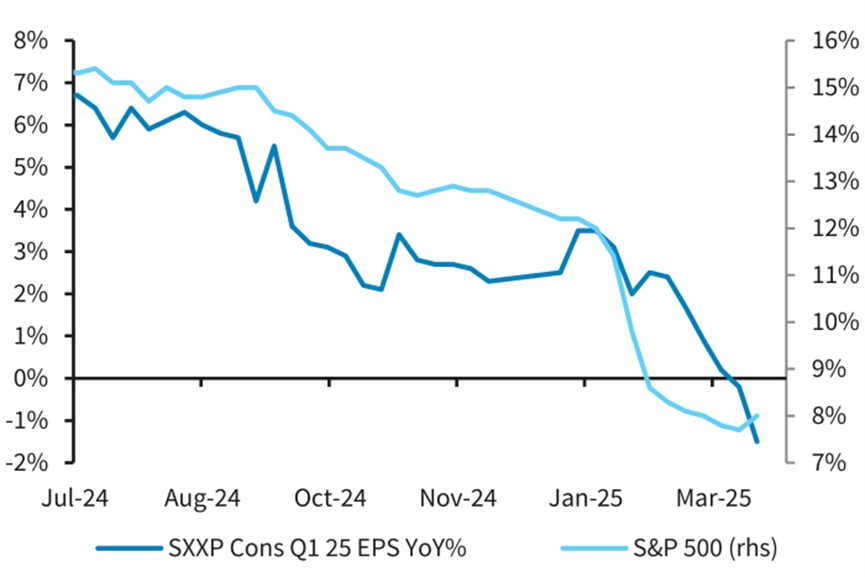

Source: GS

On Monday, the S&P 500 closed down just 0.2%, yet saw substantial volatility during the trading session.

How Does the US Economy Look Now?

A recession happens when there's less economic activity, usually marked by two straight quarters of economic contraction. By that definition, the U.S. isn't in a recession right now. The Atlanta Federal Reserve predicts a -2.8% growth rate for Q1 2025, but the Bureau of Economic Analysis is looking at a 2.4% growth for the last quarter of 2024.

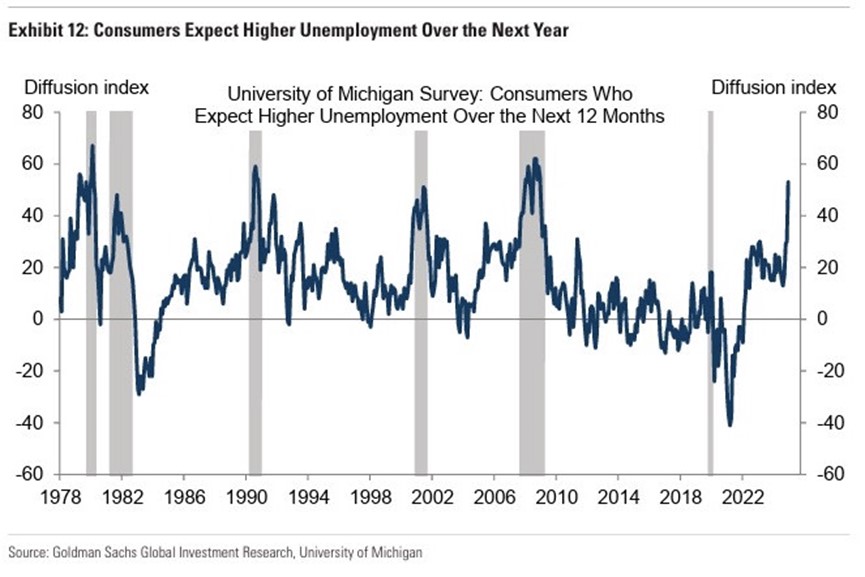

However, indicators are not pointing in a favorable direction. The unemployment rate has seen a slight increase compared to a year ago, with projections suggesting it will continue to rise over the next 12 months.

Source: GS

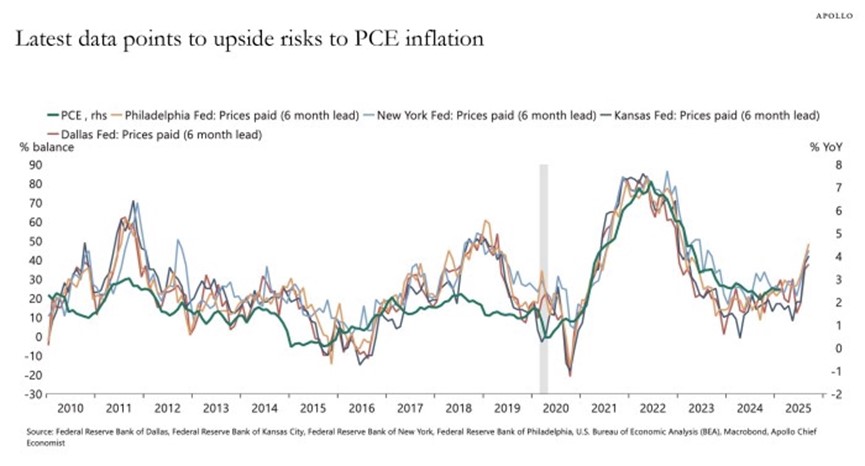

Latest PCE data—the Fed’s preferred inflation gauge—indicates an upside inflationary risk.

Source: Apollo

While these signals might seem small on their own, when you put them together with falling corporate confidence, lowered earnings expectations, and a sudden spike in business bankruptcies, they reveal some serious economic weaknesses, especially with uncertainties like tariffs hanging over us.

Source: Barclays

Notably, growth indicators for a fiscal quarter are typically only clear after the quarter has ended. So, it’s possible to not officially recognize a recession until it has already taken hold.

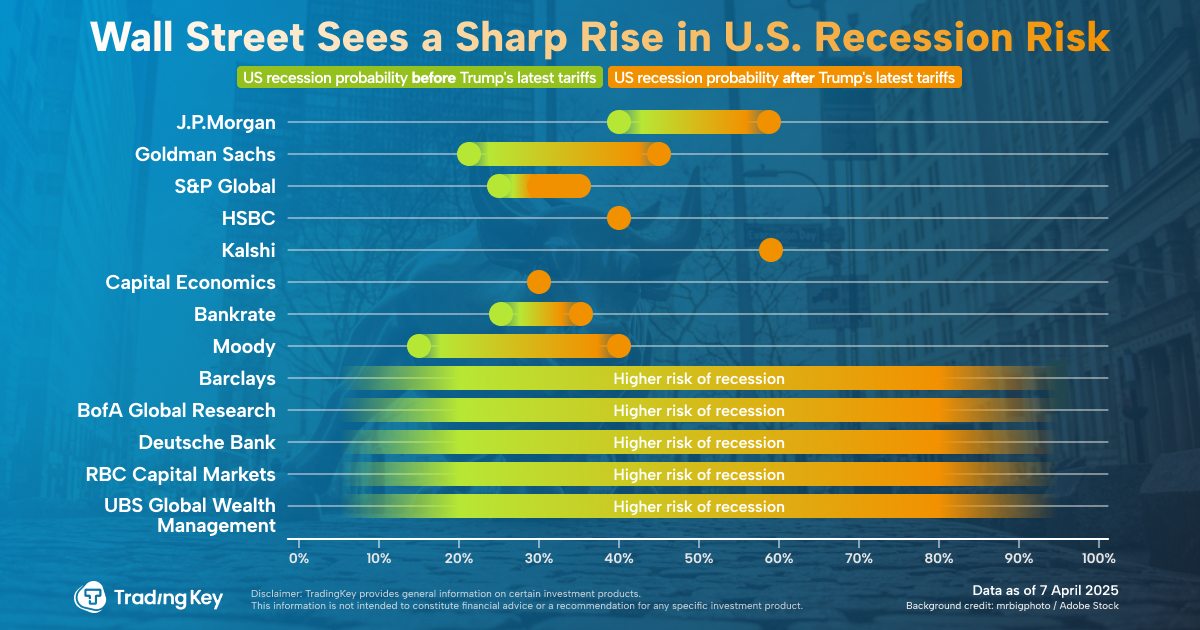

Wall Street Raises Recession Forecasts

JPMorgan currently predicts the highest likelihood of a U.S. recession among investment banks. CEO Jamie Dimon expressed in a recent investor letter that the recent tariffs could drive up inflation, leading many to believe that the odds of a recession have intensified. The bank’s research ominously stated, "There will be blood."

"Uncertainty could be exacerbated if 'maximum pressure' strategies extend into foreign policy (Iran and Ukraine-Russia) and fiscal policy (extension of U.S. tax cuts)," noted Solita Marcelli, Chief Investment Officer Americas at UBS Global Wealth Management, in a statement.

Marcelli suggests that concerns about tariffs could extend into other policy areas, escalating various uncertainties. While this approach might boost U.S. negotiating power in the short term, it could disrupt the global regulatory framework, leading to market inefficiencies in the medium to long term. If all three policies—tariffs, diplomatic pressure, and tax cuts—are implemented simultaneously, the likelihood of a U.S. recession could rise sharply.

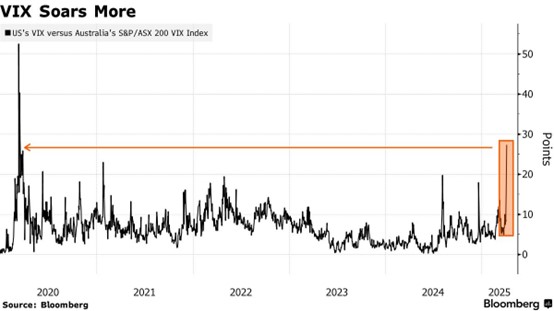

On April 6, Goldman Sachs released a report titled 'U.S. Economic: Countdown to Recession,' raising their recession probability to 45%, which they also attribute to tariffs averaging around 20%, higher than their earlier estimate of 15%. While their reasoning hasn't changed much, they’re now more worried about recession risks as market confidence has taken a hit. They pointed out that financial conditions have become more sensitive to even small increases in tariffs. After China announced a 34% retaliatory tariff against the U.S., the VIX index—often called Wall Street's "fear index"—jumped to its highest level since 2020, showing just how anxious investors have become.

Source: Bloomberg

Goldman Sachs further posited that ongoing "tightening of financial conditions" (i.e., stock sell-offs) and "foreign consumer backlash, alongside escalating policy uncertainty," could suppress capital expenditures more than previously anticipated.

Stagflation May Be the Best Outcome

Previously, the market detected signals of stagflation. Stagflation is often assessed through surveys of economic activity and inflation. The Michigan Consumer Confidence Index has shown a decline since January, with rising pessimism, although it remains to be seen whether this will translate into cautious consumer spending. On the flip side, inflation, as mentioned by Jerome Powell last month, "has begun to rise."

However, Bill Dudley, former President of the New York Fed, recently indicated in Bloomberg that stagflation is the optimistic scenario, with a full-fledged recession coupled with rising inflation being more likely.

Reports suggest that the Fed convened a closed-door meeting on Monday. What can the Fed do? Traditionally, combating inflation has involved raising interest rates, which could further exacerbate any recession. However, inflation rates have consistently surpassed the central bank's 2% target. If inflation remains above this target for a fifth consecutive year, with a risk of accelerating further, the potential for unanchored inflation expectations will be considerable. In this scenario, the Fed's options would be limited.

Moreover, shocks like U.S. tariffs can damage productivity, potentially impacting inflation and expectations more durably. Consider the two oil price shocks of the 1970s: despite experiencing two recessions, inflation remained persistent. It was only through inducing deeper recessions and pushing short-term interest rates to nearly 20% under then-Chairman Paul Volcker’s leadership that the situation was brought under control.

Expectations for More Rate Cuts

Trump's desire for rate cuts has become evident. Amid recession expectations, analysts widely believe the Fed will further reduce interest rates to provide more leeway for stimulating economic activity.

JPMorgan expects the outlook for additional rate cuts to "slightly alleviate" the impact of tariffs. Goldman Sachs predicts three rate cuts by the end of this year, up from an earlier expectation of two before Trump’s tariff announcement.

Nomura Securities and the Royal Bank of Canada foresee a single rate cut and three rate cuts, respectively, down from previous predictions of zero cuts.

UBS anticipates the Fed will lower rates by 75 to 100 basis points for the remainder of 2025. Citigroup reiterated its forecast for a 125 basis points cut starting in May, while JPMorgan maintained its expectation of two 25 basis points cuts.

According to data compiled by the London Stock Exchange, investors expect the rate to be cut by 100 basis points by 2025.