An Overview of DeepSeek: The Artificial Intelligence (AI) Industry Value Chain & the Best Exchange-Traded Funds (ETFs) to Watch

As major US tech giants compete to expand their capital expenditures (CapEx) to enhance AI infrastructure construction, the launch of China's large model DeepSeek R1, at the beginning of 2025, overturned the entire capital market and tech industry’s perception. DeepSeek flipped the narrative that AI computing power upgrades are solely about expanding capacity. The DeepSeek’s model proves that it can improve efficiency, hence, keeping the cost of AI computing power more affordable.

Before the birth of the DeepSeek, tech giants like Google, Microsoft, and Meta purchased a large number of semiconductor chips to train their own large AI models, and the notion that "building AI capabilities requires large amounts of money" was almost an ingrained perception in the AI industry.

The DeepSeek model became famous overnight due to its characteristics such as extremely low cost, low chip consumption, high performance, innovative algorithmic structure, and open-source nature, causing a sharp decline in the stock prices of chip stocks like NVIDIA.

The sudden change in the demand prospects of AI chips has led to a revaluation of the AI industry chain: The new understanding that less computing power is required, harmsthe basic computing power industry, while the democratization of AI is a positive for industries that are working on consumer application.

With that, we analyse the potential impact of DeepSeek on the AI industry chain and seek investment opportunities within it.

The Global Race of Large AI Models: ChatGPT vs Gemini vs Phi vs Llama vs Grok vs Nova vs Claude etc.

ChatGPT is the world's first human-level dialogue system, and its birth has spurred US tech giants to compete and develop their own large AI models, while investing huge amounts of resources.

Currently, the most well-known models include OpenAI’s ChatGPT, Google’s Gemini, Copilot or Phi from Microsoft, Meta’s Llama, Grok from xAI under Elon Musk, Amazon’s Nova, Anthropic’s Claude, French company Mistral’s Mistral Large, as well as the rapidly advancing DeepSeek and Alibaba's Qwen model, etc.

According to Chatbot Arena, as of the end of February 2025, the currently leading comprehensive large AI models include Grok 3 from xAI, Gemini 2.0 from Google, ChatGPT-4o, DeepSeek R1, Qwen 2.5 from Alibaba, Hunyuan Turbo S from Tencent, etc.

[AI Large Model Evaluation Ranking List, Source: Chatbot Arena]

Before the birth of the Deepseek, the scale of capital expenditure often represented the determination and strength to develop AI. In 2024, the total capital expenditure of Microsoft, Google, Amazon, and Meta reached $230 billion, and these four companies are expected to have a capital expenditure of $320 billion in 2025, with an annual growth rate of 40%.

Characteristics of the DeepSeek Model

On January 20, 2025, DeepSeek Company released the open-source inference large model DeepSeek R1, which achieved performance comparable to ChatGPT in multiple task tests such as mathematics, reasoning, and programming, but reduced the API call cost by more than 90%.

The core technologies of the DeepSeek model for reducing computing power costs are the Transformer architecture (a neural network architecture based on the self-attention mechanism) and the MoE architecture (Mixture of Experts).

- The Transformer architecture enables the model to process each element of the input sequence in parallel, improving computational efficiency;

- The MoE architecture splits the model into multiple expert sub-models, each responsible for different tasks, enhancing the model's generalization ability.

The single training costs of OpenAI GPT-4, Google Gemini, Meta Llama-3, and DeepSeek V3 models are $100 million to $200 million, $200 million, $30 million to $50 million, and $10 million to $50 million respectively.

The AI Industry Chain of DeepSeek

From a generalized basic framework perspective, the DeepSeek industry chain includes the basic layer, the technical layer, the application layer, and ecological cooperation.

1.Basic Layer (Computing Power and Data)

- Cloud Services: Amazon (AWS), Microsoft (Azure), Google (Cloud); Alibaba, Tencent, Huawei, etc.

- Chip Manufacturers: NVIDIA (GPU), AMD, Intel (CPU); Huawei (Ascend), Cambricon (Siyuan), etc.

- Server Manufacturers: Inspur Information, etc.

- Data Resources: Wikipedia (public dataset), Reddit (open-source corpus); Zhihu, Weibo, Haitian RaySound (data annotation), etc.

2.Technical Layer (Algorithms and Toolchain)

- Algorithm Development: Hugging Face, Github, Meta, OpenAI, etc.

- Model Training: NVIDIA, Deepmind; Huawei (MindSpore), Alibaba (PAI), etc.

3.Application Layer (Industry Solutions)

- Finance: Morgan Stanley; Ant Group, Ping An Technology, etc.

- Healthcare: IBM, Tempus AI; Yidu Cloud, etc.

- Education: Coursera; TAL Education Group, Zuoyebang, etc.

- General Entertainment: ByteDance, NetEase, etc.

4.Ecological Cooperation and Commercialization

- Developer Ecosystem: OpenAI, Anthropic, etc. (a relationship of competition and cooperation with complementary API services)

- Hardware Cooperation: Dell, HPE, etc.

- Terminal Devices: Apple; Xiaomi, OPPO, etc.

The chip manufacturers and application-side companies in the DeepSeek industry chain have received the most attention. Under the impact of the DeepSeek model, NVIDIA's stock price plummeted by 17% on January 27, with the largest market value evaporation in the history of US stocks, while companies such as Alibaba and Apple continued to rise subsequently.

The industry’s consensus is that the application and platform layers will benefit from model competition and lower computing power costs. The AI healthcare and AI advertising sectors received investors’ speculation shortly after the release of DeepSeek: The stock price of Hims & Hers Health (HIMS.US) doubled within half a month, and Applovin (APP.US) rose by more than 30% in a few days.

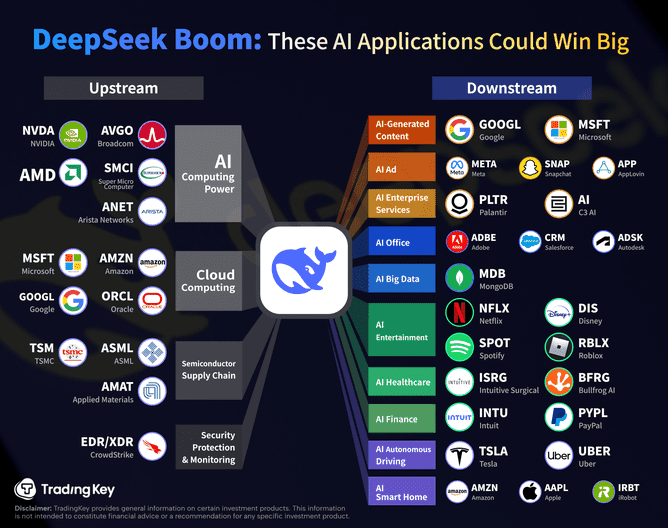

[Source: TradingKey]

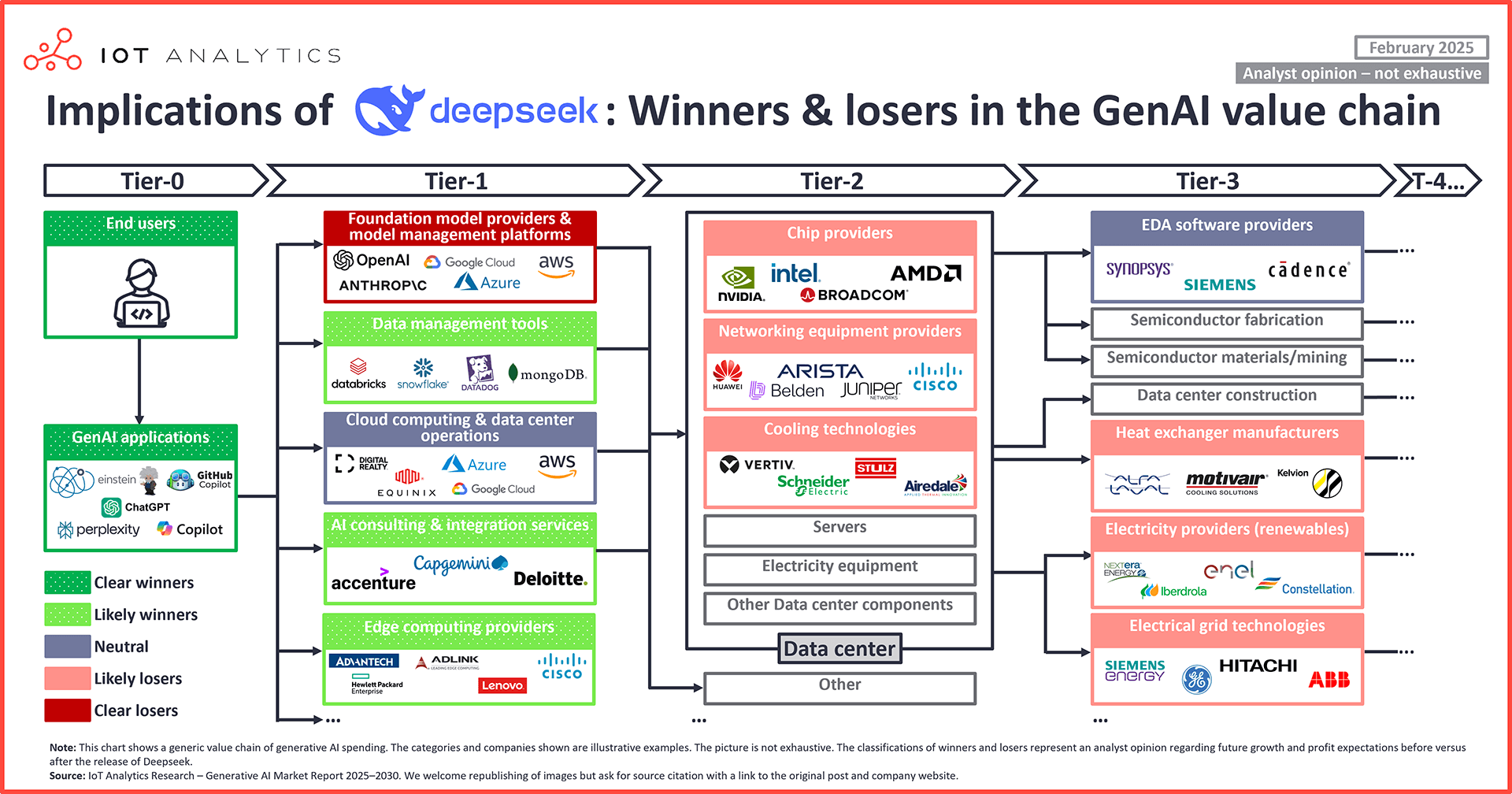

According to the research institution IOT Analytics, considering the short-term and potential long-term impacts of the DeepSeek model on the AI value chain, the winners may be end-users, GenAI APPs, edge computing providers, data providers, etc., while the losers may be AI chip manufacturers, large model manufacturers, etc.

[Winners and Losers in the DeepSeek Model's Industry Chain, Source: IOT Analytics]

How Does DeepSeek Impact Computing Power?

Research points out that in the face of the challenges of high-performance computing power resources, "expanding capacity" and "improving efficiency" are the two main approaches.

- Expanding Capacity: Expanding the scale of data centers and increasing the supply of computing power such as chips. Representatives: OpenAI, Google, Microsoft, etc.

- Improving Efficiency: Optimizing the computing power ecosystem, industrial clustering; carrying out algorithmic innovations such as knowledge distillation and efficient architectures, and optimizing data governance, etc. Representatives: Deepseek.

Shortly after the birth of the DeepSeek model, the sharp decline in the stock prices of chip manufacturers like NVIDIA reflected the market's expectation that the demand prospects for chips had turned bleak, and the sharp decline in the stock prices of giants like Microsoft reflected doubts about the rationality of huge capital expenditures.

However, since then, more and more analysts have begun to consider whether the impact of the DeepSeek model on the demand for chips and data centers is a cause for joy or concern.

Morgan Stanley pointed out that China's DeepSeek model and the US "Stargate" will jointly drive a new upsurge in the demand for the global AI chip industry chain: The DeepSeek model has led to a rapid increase in the demand for AI technology in the Chinese market; the Stargate project will stimulate the demand for AI hardware such as high-performance computing (HPC).

NVIDIA’s CEO, Jensen Huang said that the emergence of DeepSeek has ignited the enthusiasm of the global tech industry, and this inference model will be able to consume more computing power in the future.

Bank of America expects that cloud computing companies will still significantly increase their capital expenditures in 2025, reflecting strong AI demand and the limitations of existing production capacity; it is expected that the capital expenditures of hyperscale data center operators will increase by 34% in 2025 to $257 billion.

Recommended ETFs in the Tide of DeepSeek

The DeepSeek model has two main impacts on the capital market and industry perceptions:

- Sino-US Technological Strength: China's AI strength has been recognized, and major banks are optimistic about the revaluation of Chinese assets. One can pay attention to ETFs related to the Hang Seng Technology Index, etc.

- Hardware-Software Collaboration: The sharp reduction in computing power costs has shifted the focus of AI competition from training to inference, and the collaboration between software and hardware in the AI industry will be further enhanced in the future. In addition to chips, servers, and data centers, one can also pay attention to ETFs related to application terminals.

1. iShares Semiconductor ETF (SOXX): Bottom-Fishing AI Hardware

The iShares Semiconductor ETF (SOXX) was established in 2001. Broadcom, NVIDIA, Qualcomm, AMD, and Texas Instruments are the top five heavily weighted stocks. From 2023 to the end of February 2025, SOXX rose by 70%, and it fell by 8% in 2025.

[SOXX Price Trend, Source: TradingView]

The launch of DeepSeek has put pressure on SOXX, but the prospects of its constituent companies remain healthy. NVIDIA's revenue increased by 114% YoY and its profit increased by 145% YoY in the fiscal year 2025, and the gross profit margin is expected to exceed 70% in Q1 of the fiscal year 2026. Qualcomm's CEO said that the DeepSeek model is beneficial to Qualcomm because its chips can run the model efficiently locally instead of in the cloud.

2. Invesco QQQ Trust (QQQ): Bullish on the Technology Industry

The QQQ ETF, whose full name is Invesco QQQ Trust (QQQ), is a fund launched by Invesco to track the performance of the NASDAQ 100 Index. From 2023 to the end of February 2025, QQQ rose by 85%, and it fell by 3% in 2025.

[QQQ ETF Price Trend, Source: TradingView]

The top five heavily weighted stocks are Apple, NVIDIA, Microsoft, Amazon, and Broadcom. It also invests in the stocks of companies such as Tesla, AMD, Intel, Marvell, and Costco. The holdings of the QQQ ETF not only include AI software and hardware companies but also cover the consumer and healthcare sectors.

Fitch pointed out that if DeepSeek drives AI adopters to shift to a more sustainable spending model, some companies within the QQQ ETF will benefit: The diversification of the chip market will boost the prospects of AMD and Intel, and Broadcom and Marvell, which have diversified businesses, are not as vulnerable to significant pullbacks due to AI headlines as other competitors.

3. Invesco S&P 500 Equal Weight ETF (RSP): Diversified Investment

The Invesco S&P 500 Equal Weight ETF (RSP), that is, the Invesco S&P 500 Equal Weight ETF, holds the same weight (about 0.2%) for the 500 constituent companies of the S&P 500 Index, rather than being weighted by market capitalization. This ETF rose by 29% from 2023 to the end of February 2025 and rose by 1% in 2025.

[Invesco S&P 500 Equal Weight ETF Price Trend, Source: TradingView]

This ETF covers multiple industry sectors, such as industry accounting for 15.45%, finance 14.94%, information technology 13.72%, healthcare 12.63%, non-essential consumer goods 9.83%, etc.

If one remains bullish on the overall US stock market, the Invesco S&P 500 Equal Weight ETF is a good choice: it can diversify risks, offer opportunities in small and medium-sized stocks, and have a rebalancing effect. However, it should also be noted that when the major markets of tech giants are rising, the equal-weight ETF may lag behind the market-cap-weighted ETF.

4. CSOP Hang Seng Tech Index ETF (3033.HK): Revaluation of Chinese Tech Stocks

The CSOP Hang Seng Tech Index ETF (3033.HK) is the world's first ETF to track the Hang Seng Tech Index and also has the largest scale.

The CSOP Hang Seng Tech Index ETF fell by 33.25%, 27.42%, and 9.21% in 2021, 2022, and 2023 respectively. With the introduction of China's large-scale stimulus policies in 2024, the index rose by 18.64% in 2024. Driven by the DeepSeek model, from the beginning of 2025 to the end of February, the index rose by more than 23%.

[CSOP Hang Seng Tech Index ETF Price Trend, Source: TradingView]

This ETF tracks the performance of 30 top technological innovation companies listed in Hong Kong, including Xiaomi Group, JD.com, Alibaba, Tencent, Semiconductor Manufacturing International Corporation, Meituan, Li Auto, and XPeng Motors, etc.

Goldman Sachs said that DeepSeek has inspired investors to accelerate their purchases of Chinese stocks. Deutsche Bank stated that 2025 will be a crucial year for the global investment community to reunderstand China's international competitiveness.

.jpg)