SPDR Portfolio S&P 1500 Composite Stock Market ETF: What Do You Get When You Buy "Everything"?

Warren Buffett's best advice for the average investor is to just buy "the market." He has singled out the S&P 500 index as a good choice for this approach, and an S&P 500 ETF wouldn't be a bad choice, but it also isn't "the market." A more comprehensive option would be the SPDR Portfolio S&P 1500 Composite Stock Market ETF (NYSEMKT: SPTM). Here's why.

What does the S&P 500 index do?

The S&P 500 index is fairly well structured. As its name implies, it owns around 500 stocks (although corporate events can change the number over the short term). Those stocks are selected by a committee so that they are broadly representative of the U.S. economy. The largest and most important companies in an industry tend to be the ones that get added to the S&P 500 index. The index constituents are weighted by market capitalization, so the largest companies in the index have the most impact on its performance.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Image source: Getty Images.

There are negative aspects about the structure of the S&P 500 index, too. For example, market cap weighting often leads to the index being heavily influenced by hot sectors. When sentiment turns negative that can lead to swift drawdowns. That's been on display recently with the market sell-off. However, the index weightings rebalance over time and new sectors rise to the top. All in, the S&P 500 index is a solid suggestion, which is why Warren Buffett guides investors toward this option.

That said, the S&P 500 index leaves out a lot of stocks because of its focus on large companies. Specifically, mid-cap and small-cap stocks aren't represented and there are a lot more of those companies than large caps.

Get all the caps with the S&P 1500 Composite

There are a couple of reasons you might want to add mid-cap and small-cap stocks to the mix. For starters, more stocks means more diversification. You'll also get exposure to companies that have potentially larger growth opportunities given their relatively small sizes. If you like the concept of the S&P 500 index, but want to have broader exposure to "the market," you should look at the SPDR Portfolio S&P 1500 Composite Stock Market ETF.

This ETF is actually three indexes in one. The portfolio includes all of the S&P 500 index stocks along with the stocks included in the S&P Midcap 400 index and the S&P Small Cap 600 index. That truly covers the broadest possible spectrum of the market, with a very modest expense ratio of just 0.03%.

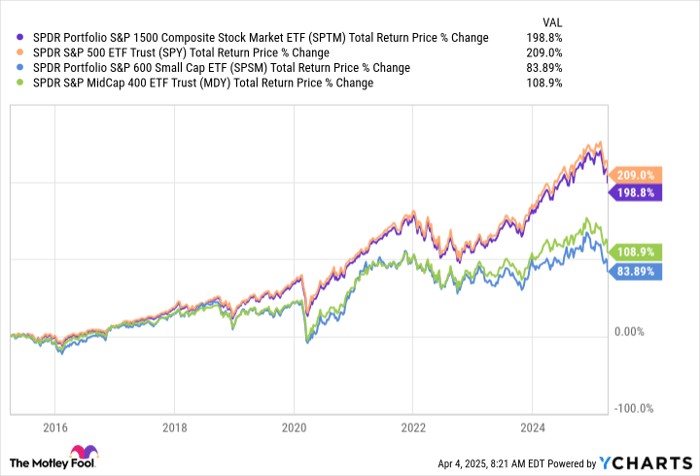

SPTM Total Return Price data by YCharts

What's most notable, however, is that the S&P Midcap 400 index and the S&P Small Cap 600 index are constructed in a similar manner to the S&P 500 index. Specifically, a committee oversees the companies that get added to the respective lists. If you like the idea of a little human intervention to weed out obviously troubled businesses, the SPDR Portfolio S&P 1500 Composite Stock Market ETF has you covered.

And since the index is market cap weighted, the stocks in the S&P 500 will still have the biggest impact on overall performance. All in, you increase diversification without losing much on the performance side of the equation.

If you want the biggest slice of "the market"

Owning the SPDR Portfolio S&P 1500 Composite Stock Market ETF has been a far better option than simply buying small-cap or mid-cap indexes. Yes, you could do better with just the S&P 500 index, but you give up very little performance with the larger S&P 1500 Composite and materially increase diversification.

All in, if you want to own "the market" as Warren Buffett has suggested, the SPDR Portfolio S&P 1500 Composite Stock Market ETF is one of the broadest options you have at your disposal. Notably, it comes with a healthy dose of human oversight for those who aren't comfortable leaving investing decisions to computers or blind fate.

Should you invest $1,000 in SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF right now?

Before you buy stock in SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $495,226!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $679,900!*

Now, it’s worth noting Stock Advisor’s total average return is 796% — a market-crushing outperformance compared to 155% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of April 10, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.