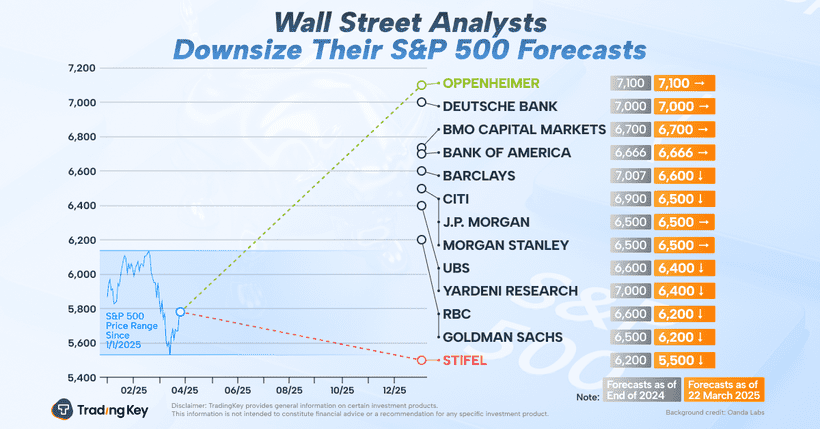

Goldman & BofA Raise Gold Price Targets: Persistent Macro Risks Drive Surge in Gold ETF Buying

TradingKey – Despite gold prices surging 15% in 2025 to reach record highs, Wall Street is once again raising its gold price targets amid growing uncertainty fueled by U.S. tariff policies and geopolitical tensions.

On Wednesday, March 26th, Bank of America raised its average gold price forecasts for both 2025 and 2026. The projection for 2025 was increased from $2,750 to $3,063 per ounce, while the 2026 forecast was lifted from $2,625 to $3,350 per ounce.

BofA noted that ongoing uncertainties surrounding U.S. trade policies will likely continue to support gold prices in the short term.

As of March 27, the price of gold (XAUUSD) stood at $3,030 per ounce. Year-to-date, gold has gained approximately 15%, including a 6% increase since the beginning of March.

[2025 Gold Price Chart, Source: TradingView]

Just one month after adjusting its gold price target for the end of 2025 to $3,100 per ounce, Goldman Sachs has once again turned bullish on gold. The bank now expects gold to rise to $3,300 per ounce by the end of this year, citing stronger-than-expected central bank demand and solid inflows into gold-backed ETFs.

Goldman noted that official sector gold demand could average 70 tons per month in 2025, up from a previous estimate of 50 tons.

The bank emphasized that since the U.S. froze Russia’s reserves in 2022, central bank gold purchases have nearly quintupled, with China likely to continue its aggressive gold buying over the next three years.

While ETF flows are often linked to changes in Federal Reserve policy rates, Goldman pointed out that during extended periods of macroeconomic uncertainty, such as during the COVID-19 pandemic, ETF inflows can significantly overshoot expectations.

In the most optimistic scenario, if hedging demand accelerates and pushes ETF holdings back to the pandemic-era peak of 2020, gold prices could soar to $3,680 per ounce by year-end.