TradingKey - How is cryptocurrency "created out of thin air"? Besides purchasing cryptocurrencies, what other investment avenues are available?

This brings us to the concept of "mining."

Just like miners in the real world dig for gold underground, cryptocurrency "miners" actually use computers to "mine" coins in the digital realm. This concept originated with Bitcoin, and as one of the earliest cryptocurrencies, Bitcoin's mining mechanism laid the foundation for the entire cryptocurrency space.

(Source: Freepik)

How Does the Mining Mechanism Work?

Taking Bitcoin's Proof of Work (PoW) mechanism as a case study.

This mechanism requires miners to use computer power to solve complex mathematical puzzles.

The first person to succeed gains the right to add a new block to the blockchain and receives a certain amount of Bitcoin as a reward, along with transaction fees contained in that block.

During this process, miners must continuously try different random numbers (Nonces) and combine them with transaction data from the block, timestamps, and the hash of the previous block. Miners generate a new hash by employing the SHA-256 algorithm.

Only when this hash value is lower than the target difficulty set by the network does a miner succeed in finding a "solution," thus qualifying them to create a new block and add it to the blockchain.

How Has the History of Mining Evolved?

The historical evolution of mining can be understood through the types of mining hardware used.

CPU Mining (2009-2010)

In the early days of Bitcoin, ordinary computer CPUs could participate in mining, allowing individual miners to easily earn rewards (as Satoshi Nakamoto mined the first block using a CPU).

GPU Mining (2010-2013)

The parallel computing capabilities of graphics processing units (GPUs) far exceeded those of CPUs, prompting miners to shift to using graphics cards (such as AMD GPUs).

This significantly increased hashing power and marked the beginning of professionalization in mining.

ASIC Miner Era (2013-Present)

Application-specific integrated circuit (ASIC) miners were optimized for hashing algorithms and could achieve hashing power thousands of times greater than that of GPUs (for instance, Bitcoin miner hashing power has now reached levels measured in EH/s).

This significantly raised the barriers to entry for individual miners and gradually led to the formation of an industrial supply chain consisting of "miner manufacturers → mining farms → mining pools."

(Source: Freepik)

What Are the Different Methods of Profit Distribution in Mining Pools?

As mining difficulty continues to rise, the chances of individual miners successfully mining a block with their computing power decrease.

To increase their odds of success and stabilize earnings, miners have begun to join mining pools for collaborative mining.

A mining pool functions as a collective setup that unites the computational abilities of various miners. By aggregating this distributed power, a pool can significantly enhance the likelihood of successfully mining a block.

Within a mining pool, many miners collaborate, which raises questions about how profits are distributed.

There are various methods for profit distribution in mining pools, such as PPS and FPPS, each with its advantages and disadvantages. The choice largely depends on miners' preferred balance between risk and reward.

Pay Per Share (PPS)

Earnings are relatively stable.

Regardless of whether a block is mined or not, payments are made on schedule at the end of the month.

The pool estimates a "virtual reward" based on your share of computational power and pays you that agreed amount, even if no block was mined that day.

This sounds quite stable, doesn't it? However, the trade-off is that the mining pool assumes all risk, leading to fees as high as around 7.5%.

Full Pay Per Share (FPPS)

FPPS can be viewed as a "PLUS" version of PPS: in addition to fixed income from computational power, when the pool successfully mines a block, it distributes all transaction fees to you.

For example, if one day the pool earns 10 BTC in rewards and 0.5 BTC comes from fees, under FPPS mode, you not only receive the fixed 0.001 BTC but also an additional 1% of those fees (0.005 BTC).

However, this method carries greater risk for pool operators as well; therefore, fees tend to be higher.

Pay Per Last N Shares (PPLNS)

This method offers more unstable earnings compared to the previous two options.

If no blocks are mined by the pool during your participation period, you won’t earn anything at all.

Once a block is mined, rewards (including transaction fees) are distributed based on your most recent contribution of computational power.

Earnings for miners depend on luck regarding when blocks are mined; extended periods without blocks may result in no revenue, while hitting one could yield substantial profits.

The pool fees under this model tend to be lower, around 3%.

Which Method is Right for You: Mining or Buying Cryptocurrency?

After learning what mining is, do you find it cumbersome? It might be much more convenient to just buy cryptocurrency instead.

You only need to open your phone, and within a few minutes, you can complete the entire process from registration to purchasing coins.

There’s no need to worry about computational power, electricity costs, or outsmarting hackers; buying cryptocurrency is generally more suitable for most ordinary investors compared to mining.

(Source: Freepik)

Investors can purchase cryptocurrencies through various trading platforms. These trading platforms are similar to stock exchanges and provide a market for buying and selling cryptocurrencies.

Common trading platforms include Coinbase, Binance, and Kraken, among others.

On these platforms, you simply need to complete steps like registration and identity verification before using fiat currency or other cryptocurrencies you already hold to purchase your target cryptocurrency.

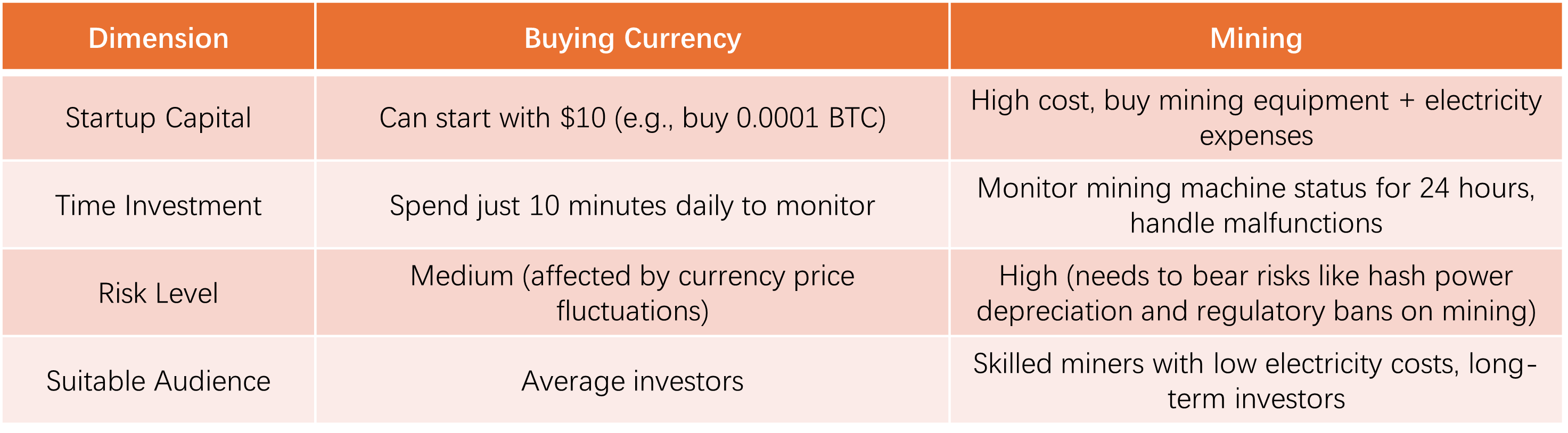

Here’s a summary comparison between buying coins and mining; you can take a look: