TradingKey - On March 3, 2025, U.S. President Trump announced that XRP, Solana (SOL), and Cardano (ADA) would be included in the U.S. cryptocurrency reserves, leading to significant fluctuations in the cryptocurrency market.

The price of SOL surged dramatically due to Trump's comments, exceeding $160 per coin; however, it had previously experienced a decline of 27.7% over the past 30 days. The high volatility and uncertainty in the market have caused many investors to hesitate.

This situation demands that cryptocurrency investors master effective trading strategies and techniques.

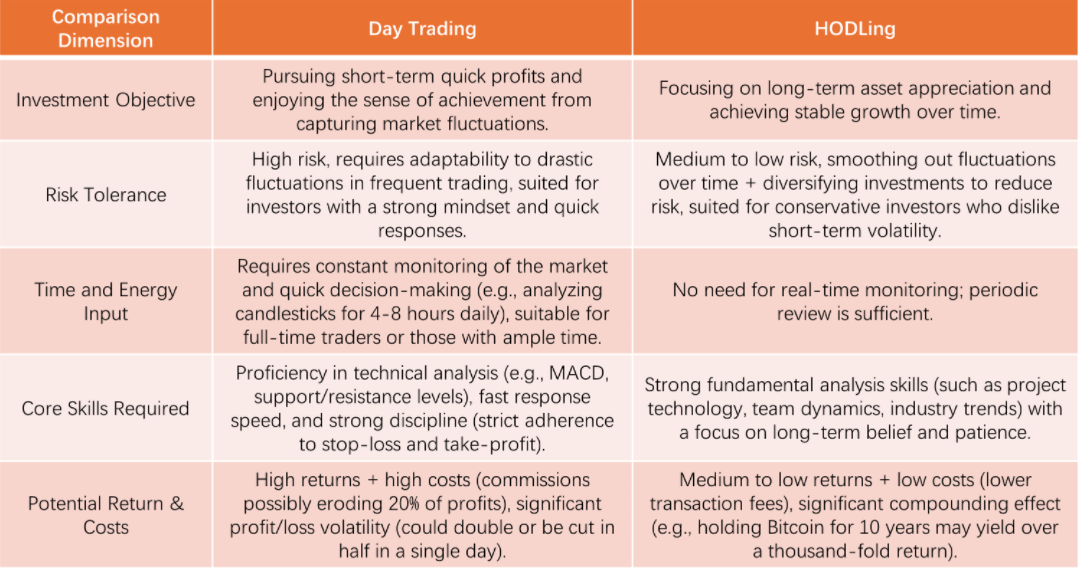

Next, let's explore two common strategies: Day Trading and HODLing.

What is Day Trading?

Day trading allows traders to profit from short-term price fluctuations in the market.

Traders buy and sell on the same day, without holding positions overnight.

(Source: Freepik)

It commonly takes three forms:

Scalping

The name may sound intimidating.

The term "scalping" has its roots in a historical practice among Native Americans—warriors would swiftly remove the scalps of their foes on the battlefield as a sign of triumph.

For example, if two Bitcoin platforms are out of sync by 2 seconds, a trader can buy at the latest price on the faster platform and then immediately sell once the slower platform's price updates—this back-and-forth is akin to using a sharp blade to precisely “shave” off-price differences in the market.

Each profit might only be a few dollars, but success lies in speed and decisiveness, akin to quickly peeling away small profits from above.

This strategy is like a fighter jet within ultra-short-term trading; trades are completed in seconds or minutes, each capturing a tiny difference of 1%-3%, accumulating gains through high-frequency trading.

Arbitrage Strategy

Arbitrage strategies are frequently discussed.

These involve profiting from price differences between different markets or various products within the same market.

For instance, if ETH is selling for 1,800 on Binance and1,810 on OKX, you can buy it on Binance and immediately transfer it to OKX for sale, pocketing a $10 profit.

Range Trading

Range trading involves making buying and selling decisions between support and resistance levels.

Buy when prices drop to support levels and sell when they rise to resistance levels; importantly, it’s essential to confirm that these ranges are valid.

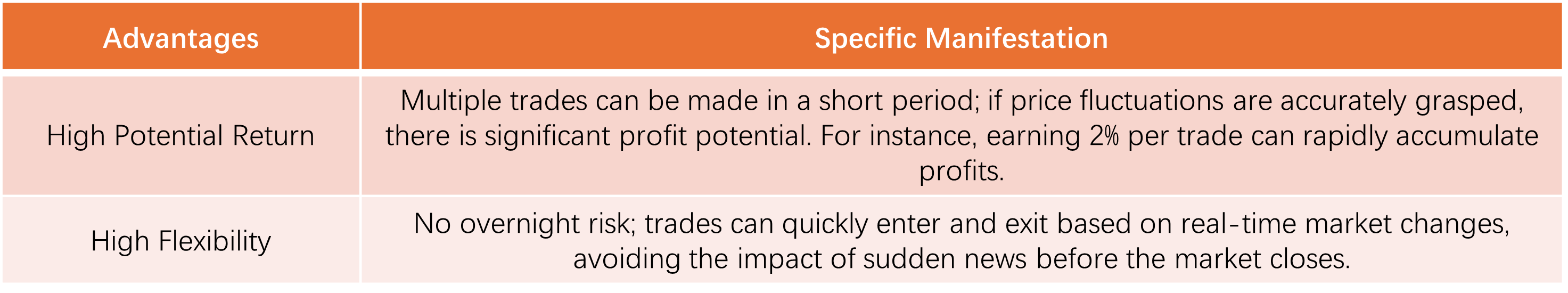

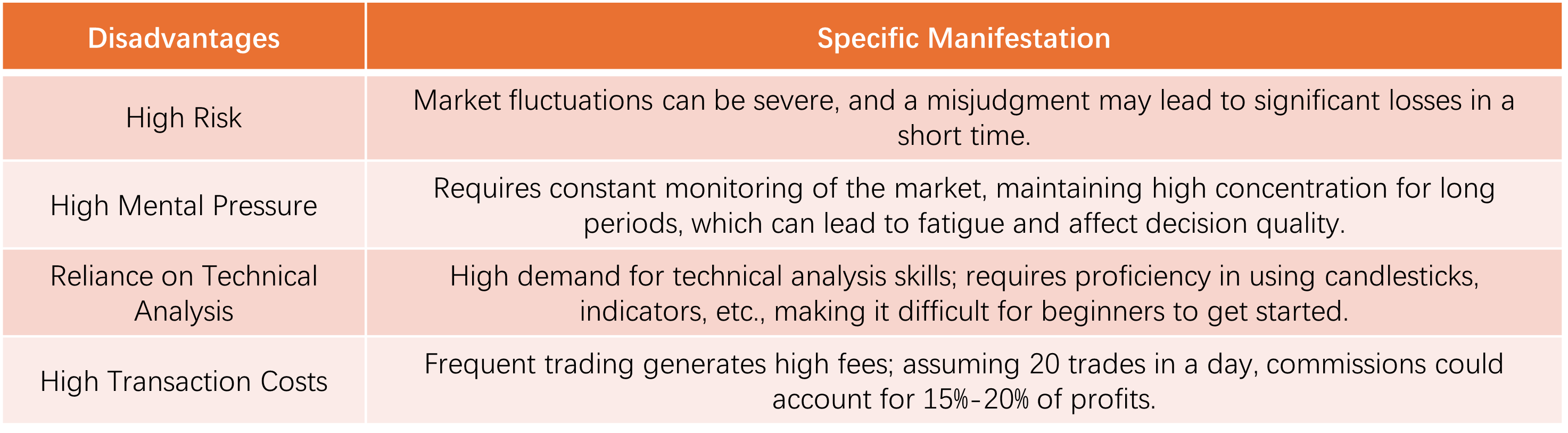

What Are the Benefits and Drawbacks of Engaging in Day Trading?

Day trading offers several advantages.

However, it also has numerous drawbacks.

What is HODLing?

HODLing is like the tortoise in the story of the Tortoise and the Hare—it's about not chasing after price spikes and not being disturbed by short-term fluctuations, but rather focusing on the finish line and moving forward slowly.

Does that sound a bit zen?

It represents a long-term commitment. If you believe that a particular cryptocurrency has long-term value, like "digital gold" (for example, Bitcoin or Ethereum), then you shouldn’t be affected by daily price changes.

When the market drops by 30%, short-term traders may panic and sell off their holdings. Can you be like a wise person sitting in a rocking chair, even pulling out your wallet to buy more at lower prices?

(Source: Freepik)

The concept of HODLing originated from a Bitcoin forum where a user mistakenly misspelled "holding" as "HODL," which gradually evolved into a widely circulated investment strategy in the cryptocurrency market.

Within long-term holding strategies, Dollar-Cost Averaging (DCA) is a common and effective approach.

It means investing a fixed amount of money in specific cryptocurrencies at regular intervals, such as weekly or monthly.

What are the advantages of HODLing?

It reduces trading costs; for example, if you trade once every month, your annual fees would only amount to several dozen dollars.

But if you're engaged in frequent trading, those fees can add up quickly.

Although HODLing is not without risks—such as market volatility and missing out on short-term gains or choosing the wrong assets that result in nothing—it is often seen as a more suitable method for those willing to commit to a long-term investment strategy within an unpredictable cryptocurrency environment.

Day Trading vs. HODLing: How to Choose?

Summarizing Day Trading and Long-Term Holding, How to Choose: