TradingKey - As an ordinary retail investor, are you still sticking to the basic investment logic of buying when stock prices drop and selling when prices rise?

Why is it that some people can profit from short selling during market downturns, while you may be facing losses?

Once traders learn common trading strategies in stock investing, they should consider advanced stock investment strategies that allow them to find investment opportunities even in different trading environments.

What is Short Selling?

In the conventional understanding of the stock market, investors typically buy stocks first and then sell them after the price rises, realizing a profit through a "buy low, sell high" approach.

Short selling challenges the conventional approach; it serves as a counter-strategy. When investors believe that a particular stock's price is too high and will decline in the future, they can engage in short selling.

It's like borrowing an umbrella from a friend. On a rainy day, you sell it at a high price and wait for the rain to stop, when the umbrella's price drops, before buy it back to return to your friend.

The difference between the selling price and the buying price becomes your profit.

How Does Short Selling Work?

To illustrate with a simple example, let’s say you have your eye on a stock currently priced at $100, and you believe it is overpriced and will eventually drop. You can:

Borrow the Stock from a Broker: Just like borrowing a book, you borrow 100 shares of this stock from a broker.

Sell at Market Price: You immediately sell the borrowed shares for 100 each, receiving 10,000 in cash.

Wait for the Stock Price to Drop: After a while, when the stock price decreases to 80, you buy back 100 shares for 8,000.

Return Shares to the Broker: You give back the purchased shares to the broker and gain a profit from the $2,000 difference.

(Source: Freepik)

What Risks Does Short Selling Involve?

Although short selling allows investors to profit when stock prices fall, it also carries significant risks.

First, unlimited loss risk.

While regular stock investing limits losses to the initial capital, short sellers can end up losing more than they invested.

For example, if you short a stock at $100 and it rises to $200, you have to buy it back at $200, losing $10,000 on 100 shares.

If the stock climbs to $500, your loss balloons to $40,000. Since there's no upper limit to how high a stock price can go, your potential loss is unlimited.

Second, borrowing costs.

Brokers don’t lend stocks for free — they charge daily "borrowing interest."

If the annual borrowing rate is 10%, and you short sell $100,000 worth of stock, you’ll pay $2,500 in interest over three months.

If the stock rises instead of falling, you lose money on both the price difference and the interest, like a "double kill."

Third, forced buy-in risk.

Brokers may suddenly ask you to return borrowed shares — for example, if the original owner wants to reclaim them or if regulatory rules change.

At that point, even if the stock price has skyrocketed, you still have to buy it back at the current high price to cover your position.

Case Study: The GameStop (GME) Short Squeeze

In late 2020, GameStop (GME), a traditional video game retailer, was labeled by many institutional investors as a “dying business” in a sunset industry.

Its stock price fluctuated between $10 and $20 for a long time. If you believed its price was overvalued, you might have considered short selling:

Borrow and Sell: You borrow 100 shares of GME from a broker, sell them at the market price of $15 per share, and receive $1,500 in cash.

Wait for the Drop: You expect the stock to fall to $5 per share. Once it does, you buy back 100 shares for $500 and return them to the broker, pocketing a $1,000 profit (before borrowing fees).

But starting in January 2021, things went wildly off track: retail investors banded together on social media platforms to rally behind GME. In just ten days, the stock soared to $483 per share.

Now your position looks like this:

Unlimited Loss Risk: You must now buy back the shares at $483 each to return them. Instead of gaining $1,000, you face a loss of ($483 – $15) × 100 = $46,800 — many times more than your initial investment.

Forced Buy-In Risk: Brokers, seeing the sharp price rise, may demand immediate repayment of borrowed shares. You’d be forced to cover your shorts at a high price, with no chance to wait for a price drop.

Skyrocketing Borrowing Cost: At that time, the stock lending fee for GME jumped from the usual 1% to over 100%. If you held the short position beyond a few days, the borrowing cost alone could wipe out your entire capital.

What is Options Trading?

Have you ever thought about making money in the stock market without actually buying shares? Or using just a small amount — like the cost of a milk tea — to generate massive returns?

Options trading acts like a magic tool in the financial world, allowing you to engage in the market in an entirely new way.

Let’s start with the basics:

An option gives an investor the right — but not the obligation — to buy or sell an underlying asset (such as a stock, index, or futures contract) at a specific price within a set period.

For example, you pay $5 for an option that allows you to buy a stock at $100 per share in the future. If the stock increases to 120, you achieve significant profits.

If it drops to $80, the most you lose is the $5 premium paid for the option.

That’s the core of options: you're paying for the right to choose, not being locked into an obligation.

(Source: Freepik)

What Are the Types of Options Trading?

Based on exercise direction, options are divided into call options (bullish) and put options (bearish).

Call Option

If you believe a stock price will rise, you can pay a premium to buy a call option. Once the stock price exceeds the strike price, you can buy low and sell high.

Put Option

The opposite strategy! If you expect a stock price to fall, you can buy a put option. When the price drops, you can sell high and buy back low.

Options can be classified into American-style and European-style based on exercise timing.

American-style options: The holder can exercise the option at any time before expiration, offering greater flexibility.

European-style options: Can only be exercised on the expiration date itself.

What Are Common Options Trading Strategies?

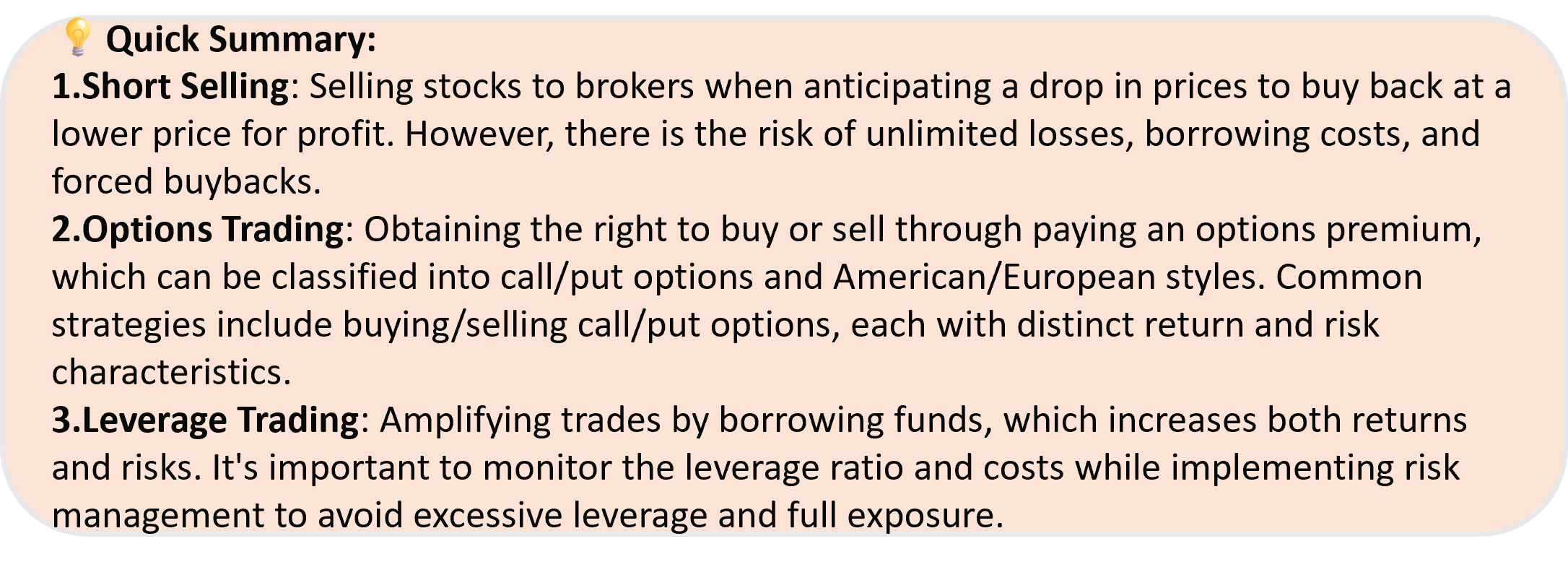

- Long Call

When an investor strongly believes the stock price will rise significantly, buying a call option is a common strategy.

For example: You're confident that a tech stock will surge. Its current price is 100 yuan. You pay a 5-yuan premium for a call option with a strike price of 105 yuan.

If the stock rises to 120 yuan, you exercise the option to buy and then sell, making a net profit of 10 yuan after deducting the premium (120 - 105 - 5 = 10).

This strategy features unlimited profit potential and limited downside risk.

(Source: Wikipedia)

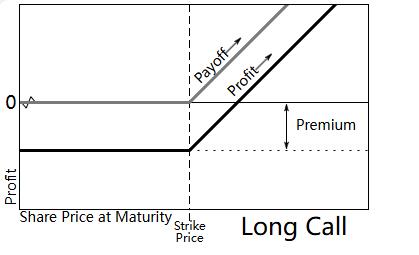

- Long Put

Opposite of a long call, this strategy is suitable when expecting a stock price decline.

Example: A stock is trading at 80 yuan. You expect it to fall, so you pay 3 yuan for a put option with a strike price of 75 yuan.

When the stock drops to 70 yuan, you exercise the option to sell and then repurchase at a lower price, making a net profit of 2 yuan (75 - 70 - 3 = 2).

Profit potential increases as the stock price falls further.

If the stock rises instead, the investor loses the premium paid.

(Source: Wikipedia)

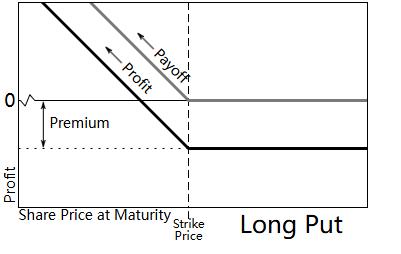

- Short Call

When an investor believes the stock price will not rise significantly — or may fall or remain stable — they may choose to sell a call option.

However, the risk is substantial. If the stock surges and the buyer exercises the option, you have to buy the stock at a high price and sell it at the strike price, meaning potential unlimited losses.

(Source: Wikipedia)

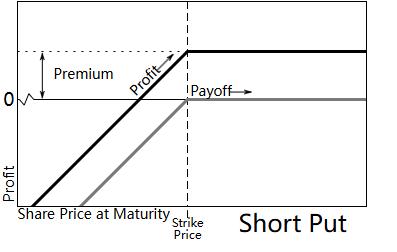

- Short Put

You are bullish on a stock and decide to sell a put option to collect the premium. If the stock price increases instead of decreasing, you keep the premium as pure profit.

However, if the stock plummets, you may be forced to buy the stock at a high price.

(Source: Wikipedia)

What is Leverage Trading?

Leverage in stock trading is a strategy that allows traders to control a larger market position than their initial capital would normally permit.

How Does Leverage Work?

Suppose you have $1,000 in capital, and your broker offers you 10:1 leverage. This means:

You can borrow $9,000, combining it with your own $1,000 to control a $10,000 stock position.

If the stock rises by 10%, you gain $1,000 (10,000 × 10%), effectively doubling your capital.

However, if the stock drops by 10%, you lose $1,000 — your entire capital is wiped out. This is why leverage is often described as a "double-edged sword."

Margin Call Warning: When losses approach your available capital, brokers issue a margin call. For example, under 10:1 leverage, if the stock drops by 5%, your capital shrinks to $500. The broker may then require an additional $500 deposit to maintain the position, or else your position will be forcibly liquidated.

(Source: Shutterstock)

What Should You Pay Attention to in Leverage Trading?

How to Choose the Right Leverage Ratio?

Investors ought to evaluate their risk tolerance and investment objectives when choosing a leverage ratio.

Investors who are risk-averse and seek stable returns may prefer lower leverage ratios, such as 1:2 or 1:3, to better manage losses caused by market volatility.

Investors with high risk tolerance, aiming for high returns and confident in their market outlook, may choose higher leverage ratios like 1:5 or 1:10, but must be prepared to bear greater risks.

Cost Control

Using leverage isn't free — interest and other fees apply.

Before trading, investors should understand how brokers calculate interest charges and transaction fees, as these can vary significantly across platforms. Choosing a broker with reasonable costs helps reduce overall expenses.

For example, if you use 10:1 leverage to buy $100,000 worth of Tesla (TSLA) shares (assuming a share price of $100):

Your broker charges a daily interest rate of 0.05% on the $90,000 loan — that’s $45 per day.

If the stock stays flat for 30 days, you’ll pay $1,350 in interest, equivalent to buying a Starbucks coffee every day.

If the stock rises just 1% ($101) after 30 days, you make $1,000 in profit, but after deducting interest, you’re actually at a $350 loss.

Risk Management

When using leverage, the losses aren’t limited to your principal alone — excessive leverage significantly increases risk. Therefore, risk management must be handled with great care.

Avoid investing your full capital in a single leveraged trade.

Always set stop-loss levels to limit potential losses.