TradingKey - Today's stock investing is no longer limited to domestic markets; investors can now focus on international opportunities.

So, how can you invest in overseas markets?

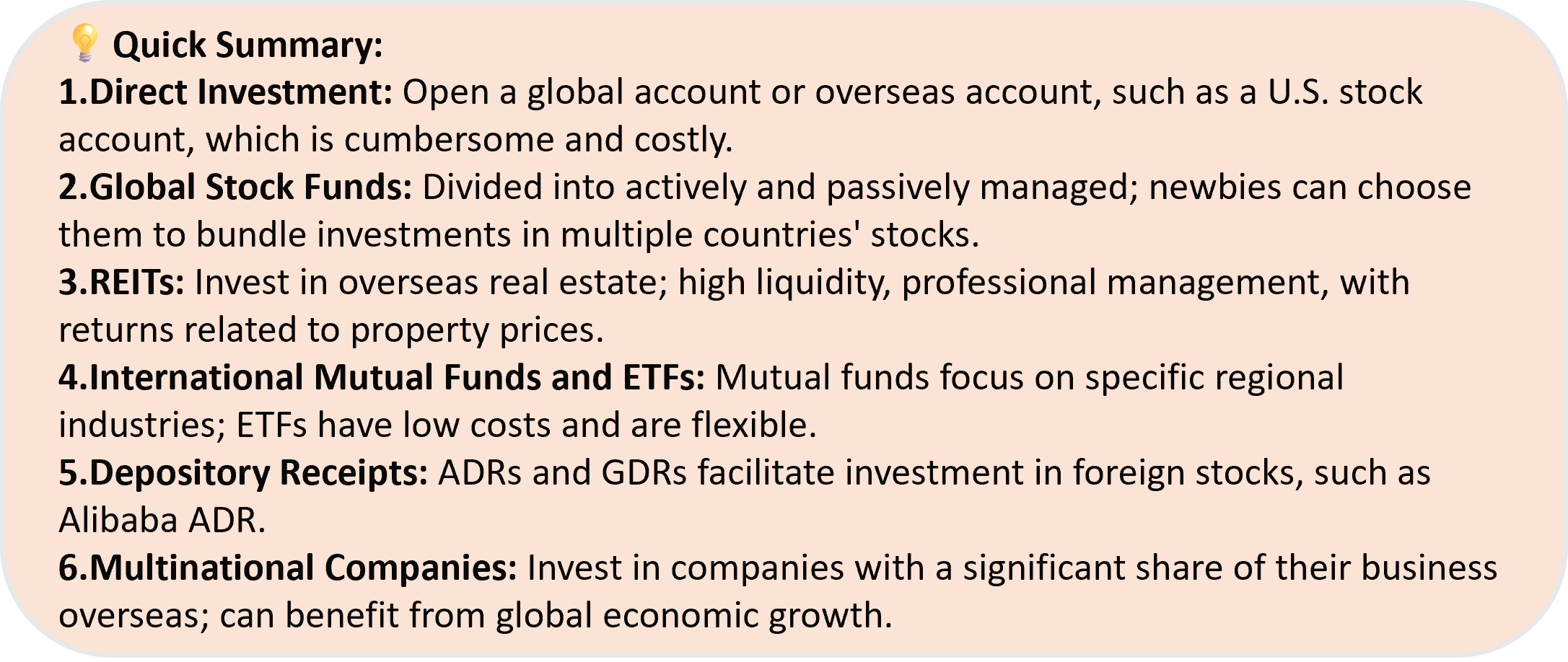

Below are several methods for investing in global stock markets.

What are the Ways to Invest in Overseas Stock Markets?

1. Direct Investment

One way is to open a global account with a domestic brokerage.

Another option is to open an overseas securities account.

Taking the U.S. securities account as an example, you should choose a reputable brokerage and prepare the necessary documents, such as proof of identity and address, before applying for an account.

After opening the account, you can wire funds to start trading. However, this method has high requirements, a complex account opening process, and necessitates an understanding of various laws and regulations in different countries, along with potentially high trading fees.

2. Global Stock Funds

If you are a novice investor or prefer not to spend too much time researching individual stocks, global stock funds might be your best choice.

There are actively managed and passively managed options available.

The former involves fund managers selecting stocks based on extensive market analysis, while the latter directly replicates global indices—such as tracking the MSCI World Index—essentially allowing you to buy shares in quality companies from over 100 countries packaged together.

3. Real Estate Investment Trusts (REITs)

If you find directly purchasing overseas property too cumbersome, consider trying REITs instead.

The advantage of REITs is that they offer more liquidity than direct real estate purchases and provide professional management services.

REIT returns are linked to rental income and property values; thus, if property prices decline, REIT earnings may also drop.

(Source: Freepik)

4. International Mutual Funds and ETFs

- Mutual funds can be managed either actively or passively and may concentrate on particular regions, sectors, or investment approaches.

For instance, if you're optimistic about renewable energy in Europe, you might consider purchasing a "European Clean Energy Fund," where fund managers will select wind and solar companies in Europe for you.

- ETFs offer a more cost-effective and flexible option, allowing you to buy and sell stocks throughout the trading day while tracking various indices.

5. Depositary Receipts

Depositary receipts consist of American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs).

- ADRs are suitable for foreign company stocks traded on U.S. exchanges, making it convenient for investors who wish to hold foreign stocks without directly investing in international markets.

For example, Alibaba's (BABA) ADR traded in the U.S. means that when you buy 1 share of the ADR on the U.S. stock market, it's equivalent to owning 1 share of Alibaba's stock.

- GDRs have a comparable function but can be acquired in various markets, usually outside the U.S.

6. Multinational Corporations (MNCs)

If you prefer not to invest directly in foreign stocks, investing in multinational corporations may be a viable option.

Companies like Apple and Microsoft from the U.S., as well as China's Huawei and BYD, have increasingly significant overseas operations.

This strategy allows investors to benefit from global economic growth while maintaining a portfolio primarily focused on domestic markets.

.jpg)

(Source: Freepik)

What Are the Major Stock Exchanges Worldwide?

Americas Region

New York Stock Exchange (NYSE) – USA

NASDAQ Stock Market (NASDAQ) – USA

Europe Region

London Stock Exchange (LSE) – UK

Frankfurt Stock Exchange (FWB) – Germany

Asia Region

Tokyo Stock Exchange (TSE) – Japan

Shanghai Stock Exchange (SSE) – China

Hong Kong Exchanges and Clearing Limited (HKEX) – Hong Kong, China

Bombay Stock Exchange (BSE) – India

Oceania Region

Australian Securities Exchange (ASX) – Australia

Africa Region

Johannesburg Stock Exchange (JSE) – South Africa

What Factors Affect the Global Stock Markets?

1. Economic Indicators

GDP growth rate, unemployment rate, inflation rate, and other economic data are direct reflections of economic performance and serve as important indicators for the stock market.

For example, GDP growth rates reflect the overall economic growth of a country or region. A higher GDP growth rate indicates economic expansion, leading to increased sales and profits for businesses, which often results in a rising stock market.

Conversely, if the GDP growth rate declines, it signals potential recession risks, causing adjustments in the stock market. Additionally, central bank communications—including statements from key officials—are closely monitored by investors as they often contain hints about future monetary policy directions.

2. Political Activities

Political events, policy changes, and tensions in international relations can significantly influence global stock markets.

For instance, election outcomes can shift government policy directions that affect specific industries. If a party advocating for increased infrastructure investment comes to power, related industry stocks may gain favor.

.jpg)

(Source: Freepik)

Policy changes directly impact corporate costs and profitability; for example, an increase in tobacco tax could lead to a decline in tobacco companies' stock prices, while policies encouraging renewable energy development might boost stocks of related companies.

During U.S.-China trade tensions, multinational companies like Apple (AAPL) and Intel (INTC) experienced frequent stock price fluctuations since tariffs directly affected their profits.

More severely, trade wars can generate market concerns over global economic stability.

3. Unexpected Events

Natural disasters and pandemics can disrupt production and cause supply chain issues that severely impact stock markets.

Natural disasters like earthquakes and floods can harm production facilities and infrastructure, resulting in disruptions to production.

Public crises like the COVID-19 pandemic have wreaked havoc on the global economy and caused significant volatility in the stock market.

Travel restrictions limited movement and consumption, resulting in severe impacts on sectors such as tourism and aviation; airline stocks plummeted during this period.

4. Currency Volatility

When purchasing overseas stocks, exchange rates represent an invisible cost that must be closely monitored.

For instance, if you buy a Hong Kong stock for 100 HKD when 1 USD is equal to 7 HKD but later the USD appreciates to 1:8— even though the stock price remains at 100 HKD—you would only receive 12.5 USD when converting back to dollars after selling your shares; resulting in a loss of 87.5%.

Additionally, strong domestic currencies may reduce export competitiveness, affecting profits for companies reliant on international sales, while weak currencies can enhance export competitiveness but lead to inflation due to rising import costs.

When the Japanese yen depreciates slightly against other currencies, Japanese exporters like Toyota (TM) or Sony (SONY) become more profitable because they will earn more yen when selling products overseas. However, Japanese importers face challenges since they must spend more yen on necessities like oil or natural gas.