The Future of AI Runs on NVIDIA

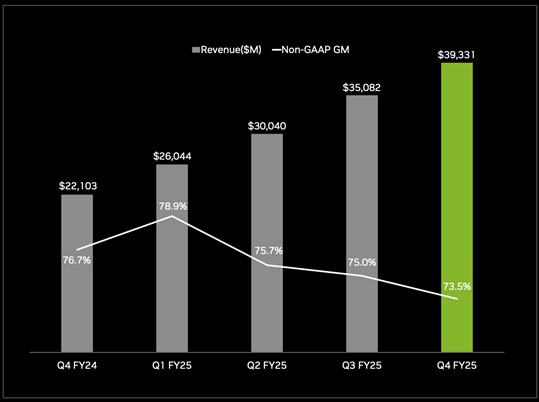

- Explosive Growth in AI Computing: NVIDIA’s Q4 FY25 revenue surged 78% YoY to $39.3 billion, with data center sales up 93% to $35.6 billion, driven by hyperscaler AI adoption.

- AI Inference Driving Future Demand: The shift from AI training to inference is fueling sustained demand for NVIDIA’s high-performance GPUs, reinforcing its market leadership and pricing power.

- New AI Hardware Expanding Market Reach: NVIDIA introduced GB10 and Project DIGITS, bringing AI computing beyond cloud data centers to enterprise desktops and independent developers, diversifying revenue.

- Valuation Concerns Amid Rising Competition: NVIDIA trades at an EV/revenue multiple over 30x, well above AMD (10x) and Intel (3x), raising questions on sustainability.

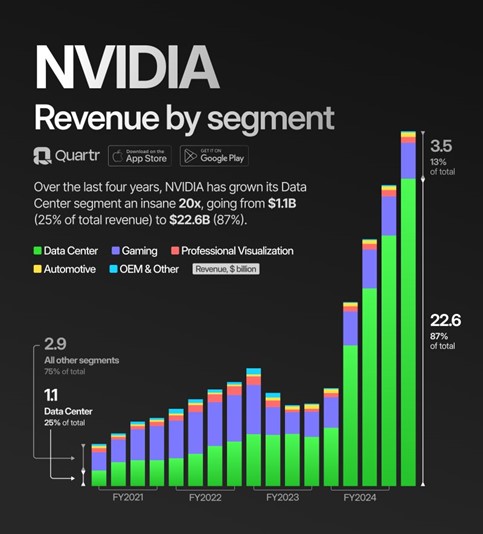

NVIDIA (NVDA) is a leader in AI computation, data center solutions, gaming, professional visualization, and auto industry AI. Its business is centered on high-performance GPUs, first used in games, now the backbone of AI model training, inference, and cloud computing. NVIDIA's business is organized into four large revenue segments:

- Data Center,

- Gaming,

- Professional Visualization, and

- Automotive.

Its Data Center business, over 90% of revenue currently, reported $35.6 billion in Q4 FY25, growing 93% year over year on hyperscale AI adoption. It is comprised of Hopper and Blackwell AI GPUs, NVLink networking, and AI-optimized software stacks including CUDA, TensorRT, and NVIDIA AI Enterprise. NVIDIA's software stack creates very high switching costs, which reinforces its dominance.

The Gaming segment continues to be robust at $2.5 billion for Q4, down 11% year on year as AI overtakes gaming demand. NVIDIA continues to roll out GeForce RTX GPUs like the RTX 50 series with AI-powered DLSS tech.

Professional Visualization contributes about $511 million in quarterly revenue, supporting AI-driven design and engineering solutions, and Automotive AI products, including NVIDIA DRIVE in autonomous vehicles, 103% year-to-year growth to $570 million. They bring diversification, but AI-driven data centers represent NVIDIA's largest revenue growth driver.

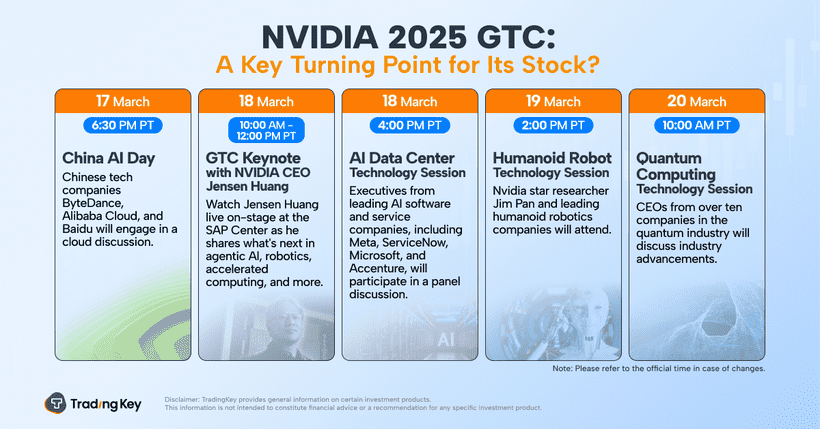

NVIDIA GTC 2025: AI Domination, Robotics Revolution, and the Future of Computing

NVIDIA's 2025 GTC conference was a grand showcase of the company's technological ambitions, further establishing it as the leader in AI, computing, and robotics. Its opening speech by its CEO Jensen Huang outlined NVIDIA's future AI breakthroughs, unveiling large-scale new hardware, software, and AI-driven solutions that will set the course of computation in the coming decade.

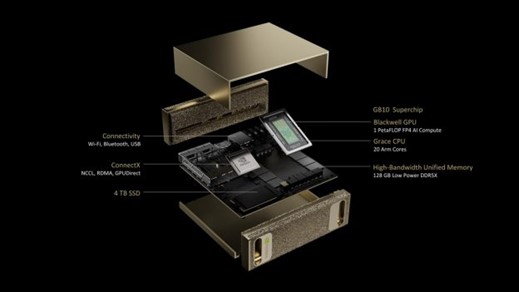

One of the highlights of the event was the announcement of the GB10 AI chip, a power-efficient and smaller version of NVIDIA's flagship GB200 platform. Whereas its larger sibling fuses two Blackwell GPUs with a Grace CPU, the GB10 fuses one Blackwell GPU with a Grace CPU, offering a less scalable but lower-cost alternative for AI workloads. The GB10 should see widespread adoption by large cloud incumbents Amazon (AMZN), Google (GOOG), Meta (META), Microsoft (MSFT), and Tesla (TSLA), all of which are already utilizing NVIDIA's AI accelerators at scale.

One of the key applications of the GB10 chip is Project DIGITS, NVIDIA's new AI workstation that will bring high-compute AI to single developers, researchers, and enterprise customers. The desktop workstation comes with 128GB unified memory and 4TB storage, positioning it as a very capable AI workstation on a user's desktop rather than in a large data center.

Huang highlighted that Project DIGITS is already shipping and in full production by the month of May, with the ability to unlock new markets in AI creation independent of cloud computation. The strategic choice highlights NVIDIA's aspiration to democratize AI hardware so that small companies and solo developers can access cutting-edge AI capabilities without having to rely on massive cloud infrastructure.

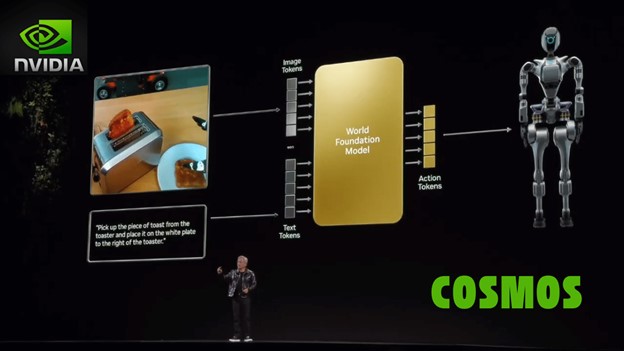

In addition, one of the growth markets on the rise is autonomous systems and robotics, where NVIDIA's Cosmos platform and Isaac GROOT Blueprint software deliver AI-driven simulation tools. Cosmos is a breakthrough platform that utilizes world foundation models (WFMs) to build AI-driven robots and autonomous vehicle systems. Using Cosmos, companies can test real conditions in simulated environments, greatly reducing the cost and risk of training AI-driven machines.

This translates into not having to deploy costly physical robots or test autonomous vehicles in dynamic environments, but instead being able to refine their systems virtually before transitioning to actual uses. Companies such as Toyota, Continental, and Aurora have already signed up to leverage NVIDIA's autonomous vehicle technology, further demonstrating its widespread use in the auto industry.

Another key announcement was the Isaac GROOT Blueprint software that allows developers to train humanoid robots on Apple's Vision Pro headset. The software provides an augmented reality training ground in which the robots learn to move through complicated spaces, manipulate objects, and learn to perform tasks in a way that resembles humans in a wide range of industries.

Huang's aspirations for AI-powered robotics extend well beyond manufacturing or warehouse automation—he sees the creation of a new multi-trillion-dollar industry arising from the development of general-purpose humanoid robots, much like the AI revolution is reshaping data centers.

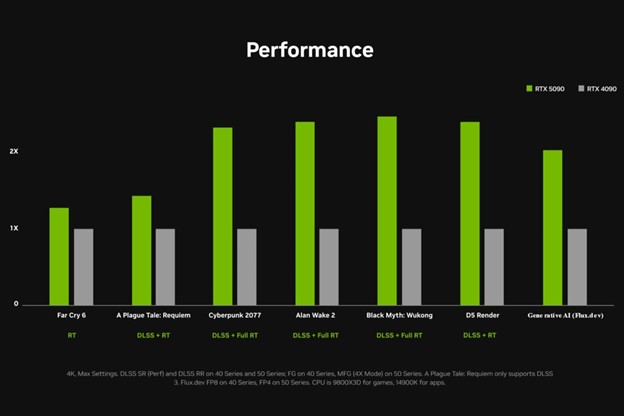

Apart from AI computing, NVIDIA continues to prioritize gaming with the launch of the latest GeForce RTX 50 series graphics cards. Its top-of-the-line RTX 5090 provides double the performance of the previous generation, and the more affordable RTX 5070 now matches the RTX 4090’s performance thanks to AI-powered DLSS enhancements. This move cements NVIDIA’s continued dominance in the gaming sector while leveraging AI-powered technology to remain ahead.

Competitive Landscape: Defending Market Share Against Emerging Challengers

While NVIDIA remains the undisputed leader in AI computing, it is coming under increasing pressure. AMD has aggressively expanded its AI product set with the MI300X AI GPU, offering a cheaper alternative to NVIDIA's AI accelerators.

While AMD hardware is promising, it lacks the software ecosystem of NVIDIA's CUDA platform, so it has been adopted at a slower pace by enterprise AI developers. Intel is also a player with its Gaudi AI chips, targeting the data center. But it remains well behind on performance and ecosystem integration, so it is a secondary threat in the near future.

A greater threat to NVIDIA is the shift by hyperscalers to custom AI chips. Amazon (Trainium), Google (TPUs), and Microsoft (Athena AI chips) are investing heavily in reducing their reliance on NVIDIA GPUs for AI processing. If these in-house solutions catch on, they will gradually erode NVIDIA's data center dominance. The issue with these players, however, is scalability and ecosystem support. NVIDIA's CUDA, NVLink, and high-speed network solutions deliver end-to-end integration, which makes it difficult for enterprises to shift to other AI hardware.

Even in the presence of competitive pressures, NVIDIA's deepest software moat remains its strongest defense. The company's end-to-end AI platform, integrating AI models, inference engines, and enterprise-class software, is something that is not replicable by competitors in terms of efficiency. NVIDIA is also continuously expanding its AI capabilities, with Cosmos and Isaac GROOT Blueprint expanding into new markets in robotics and autonomous systems. Unless and until competitors build a comparable software ecosystem, NVIDIA's dominance is not going to be meaningfully disrupted in the near future.

Strategic & Financial Deep Dive

NVIDIA is still the leader in AI computing, supported by innovative hardware, a well-entrenched software ecosystem, and incursions into robotics and autonomous systems. Recent Q4 FY25 results affirm its position, with total revenue up 78% year over year to $39.3 billion and data center revenue up 93% to $35.6 billion. One of the growth drivers is the shift from AI training to inference, which is fueling demand for high-performance AI inference GPUs, where NVIDIA has a commanding position based on its custom hardware optimizations and proprietary software stack (CUDA, TensorRT).

One of the key financial drivers heading into 2025 is the transition from AI training to AI inference, where actual AI workloads require constant processing power rather than initial training. This trend supports persistent demand for inference-optimized GPUs, enabling persistent revenue growth. NVIDIA enjoys a unique competitive advantage in AI inference, with its custom hardware (Tensor Cores, Hopper/Blackwell architecture) and proprietary software stack (CUDA, TensorRT) enabling high-margin adoption by cloud hyperscalers and enterprises. This differentiation will be key to preserving its price premium as competitors ramp up plays.

In the future, NVIDIA's prospects for growth up to 2025 remain strong, but higher expenses and geopolitical challenges pose headwinds. R&D expenses exceeded $16 billion annually as the business spends heavily on next-generation AI chip development, including GB10 and Rubin platforms. During GTC 2025, NVIDIA announced Project DIGITS, a desktop AI computing product that targets small businesses, which has the potential to diversify revenue streams away from hyperscaler cloud demand. However, despite this incursion into desktop-based AI, profitability at large outside of data centers will require strong enterprise adoption.

Valuation and Investment Case: Is the Market Pricing in Too Much Optimism?

NVIDIA shares have beaten all major indexes, but valuations are becoming extreme. It is trading on an EV-to-revenue ratio of over 22x, compared to the 11x of AMD or 3x of Intel. While NVIDIA's growth is worth a premium, investors should consider the potential for multiple compression in the event of a slowdown in AI adoption or competitive price pressures.

A valuation assessment suggests NVIDIA's fair value depends on sustaining AI-driven demand and expanding into new high-margin software markets. However, any sign of slowing AI demand or more intense competitive pricing can trigger a stock price correction.

For longer-term investors, however, NVIDIA remains one of the strongest AI plays in the space, with unchallenged leverage to the AI revolution. That being said, with its rich valuation, conservative positioning could be appropriate for shorter-term traders. The future performance of the stock will depend on AI adoption persisting, execution on its newer product lines, and NVIDIA's ability to hold on to its pricing power amidst growing competition.

Concluding Thoughts

NVIDIA is still the leader in AI innovation, and its latest announcements on GTC and CES 2025 further solidify its position. The unveiling of GB10, Project DIGITS, and Cosmos demonstrates that it is capable of propelling AI adoption beyond the traditional data center, opening up new markets. But as its rivals ramp up AI efforts and hyperscalers develop custom AI chips, NVIDIA needs to keep its dominance going by continuously delivering hardware and software breakthroughs.

For long-term investors, NVIDIA remains a fundamental AI investment, but short-term traders need to be wary of the possibility of overvaluation and future corrections. While the AI revolution is ongoing, hopes invested in NVIDIA's stock are highly optimistic. Investors must weigh the potential future growth of the company against the possibility of slowing momentum and increased competition in the AI space.