Nvidia Stock’s Q4 FY2025 Earnings: AI Boom Powers Another Record Quarter – What’s Next Though?

TradingKey - The market has been watching the Artificial Intelligence (AI) theme closely over the past few weeks as technology stocks have been hit hard.

The big event his week was earnings from Nvidia Corporation (NASDAQ: NVDA). The company just reported another strong quarter by releasing its Q4 FY2025 earnings (for the three months ending 26 January 2025) on Wednesday (26 February) after the market closed.

Fuelled by relentless AI demand, revenue soared 78% year-on-year to US$39.33 billion, exceeding the US$38.05 billion consensus estimate.

But here’s the catch – growth is decelerating. Last year, Nvidia was posting triple-digit revenue increases, but this quarter’s 78% gain marks a slowdown.

Even Nvidia’s Q1 FY2026 guidance, which calls for US$43 billion in revenue (up 65% year-on-year), suggests the meteoric rise is starting to level off.

So, is this just a natural maturation of an AI powerhouse, or is there more to the story?

AI is everything and Nvidia owns the market

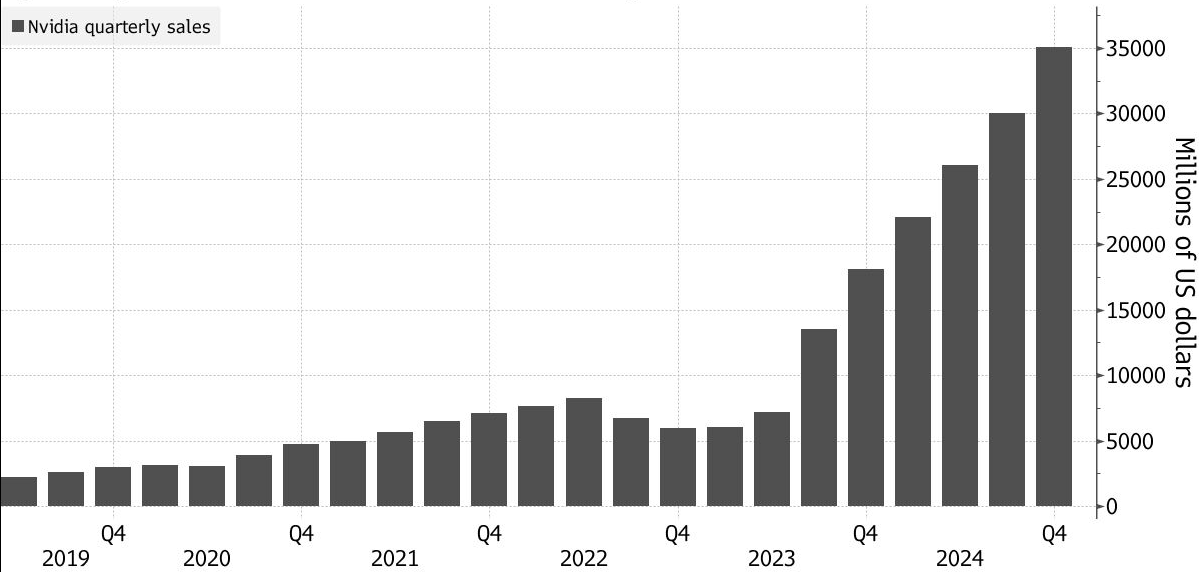

Nvidia’s data centre business is an absolute juggernaut, generating US$35.6 billion in revenue for the quarter – a 93% jump from a year ago. To put this in perspective, just two years ago, data centre revenue for Nvidia stood at just US$3.2 billion.

Driving this growth is Blackwell, Nvidia’s next-gen AI chip, which is already breaking records. CEO Jensen Huang described Blackwell’s demand as “amazing,” with Q4 FY2025 sales reaching US$11 billion, and it’s only the beginning.

Nvidia’s data centre sales: Powered by AI demand

Source: Bloomberg

But AI is shifting. Initially, Nvidia’s chips were used primarily to train AI models – think OpenAI’s ChatGPT. Now, the focus is shifting toward “reasoning AI,” where models process and deliver AI-generated results on the fly. Nvidia believes this shift could require 100 times more computing power, which translates into more Nvidia GPUs.

This is why Nvidia’s dominance is hard to disrupt. Sure, Amazon, Google, and Microsoft are all developing their own AI chips. But Huang isn’t worried, saying during the earnings call: “Just because the chip is designed doesn’t mean it gets deployed.”

Translation? Making a chip is one thing but building a full software ecosystem to support it is a whole different ballgame. And Nvidia remains miles ahead on that front.

Gaming slows but AI is picking up the slack

While AI is booming, Nvidia’s gaming segment took a hit, with revenue declining 11% year-on-year to US$2.5 billion, missing Wall Street’s US$3 billion estimate. Gamers are upgrading at a slower pace, and supply constraints didn’t help.

That said, Nvidia is still pushing innovation in gaming. The company recently launched Blackwell-powered GeForce RTX 50 Series GPUs, which use AI to dramatically boost frame rates. If these catch on, gaming revenue could see a rebound later this year.

Meanwhile, automotive revenue surged 103% year-on-year to US$570 million, though it remains a small portion of Nvidia’s overall business.

What’s next for Nvidia and shareholders?

Nvidia remains the AI stock to own, but investors should monitor a few key factors. One critical aspect is Blackwell adoption: can Nvidia maintain its record-breaking growth as competition intensifies?

Additionally, the demand for enterprise AI is expanding but the key question is whether companies will continue choosing Nvidia over emerging alternatives.

Another concern is profitability. If costs continue to rise, Nvidia’s margins could come under pressure, potentially slowing profit growth. Meanwhile, the launch of Blackwell Ultra later this year will be closely watched to determine whether it will be another game-changing product for the company.

Overall, Nvidia remains the undisputed leader in AI chips but with growth starting to moderate, investors need to adjust their expectations. This is no longer a "buy at any price" stock, but as long as AI continues to transform industries, Nvidia will remain one of the best long-term bets in the tech space.

Should you buy Nvidia shares?

If you believe in the future of AI, then owning Nvidia shares seems like a no-brainer. The company dominates the AI chip market, boasts the strongest software ecosystem, and continues to grow rapidly.

That said, valuation matters. Nvidia now boasts a market cap exceeding US$3 trillion and trades at a forward price-to-earnings (PE) ratio of 42x – that’s a steep price tag. If you’re a long-term investor, waiting for a pullback could be a smart move.

For now, the AI story remains intact but expectations need to be realistic. Nvidia can’t sustain 100%+ revenue growth rates forever, but if AI continues to reshape the world, it will keep winning big. Final verdict? Nvidia is still a strong buy over the long term but don’t expect triple-digit growth every year.