Alphabet Stock Plunges 8% After Earnings: Is AI Enough to Keep It Growing?

TradingKey - For tech investors, this week is set to as big as last week given the amount of Big Tech firms reporting their latest earnings.

For those interested in search and broader Artificial Intelligence, the leading search firm Alphabet Inc (NASDAQ: GOOGL) just reported its Q4 2024 earnings after the market closed on Tuesday (4 February).

But Wall Street wasn’t buying it – literally. Despite reporting 12% year-on-year revenue growth and a 30% growth rate for Google Cloud, shares of the tech giant plunged nearly 8% in after-hours trading.

Why the cold shoulder from investors? The market’s reaction signals that investors expected even more from one of the “Mag 7” members, especially with AI-fuelled optimism running high.

While Alphabet continues to dominate search and digital advertising, its slight revenue miss and China’s new antitrust probe on Google cast a shadow over its results. Here’s more on what investors need to know about Alphabet’s latest numbers.

Deeper look at Alphabet’s key metrics

Alphabet’s latest earnings report delivered plenty of good news, but it wasn’t enough to keep investors happy. While revenue came in at US$96.5 billion, up 12% year-on-year, it missed expectations by over US$100 million.

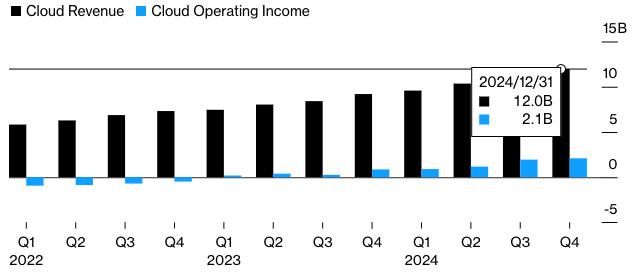

However, it was Google Cloud revenue that really impacted sentiment. IOnvestors were looking for higher growth from the cloud segment but it delivered just 30% year-on-year revenue growth, posting sales of US$12 billion for the period.

On the YouTube Ad revenue front, sales of US$10.5 billion were up 14% year-on-year but relatively muted versus expectations.

As for the bottom line, net income came in at US$26.5 billion, rising 28% year-on-year, while earnings per share (EPS) of US$2.15 marginally beat expectations.

While those numbers were arguably strong, they weren’t strong enough – especially in an environment where AI-driven companies like Palantir Technologies Inc (NASDAQ: PLTR) and Nvidia Corporation (NASDAQ: NVDA) are posting blowout growth.

Positive on AI and cloud growth

Alphabet is doubling down on AI and cloud computing, two areas that CEO Sundar Pichai believes will fuel the company’s next phase of growth.

In the broader picture, Google Cloud revenue actually hit a US$110 billion annual revenue run rate, pointing to the fact that businesses are increasingly turning to its AI-driven infrastructure.

Google Cloud revenue + operating income (US$ billions)

Source: Bloomberg, company filings

Meanwhile, Alphabet’s AI is deeply integrated into Search, YouTube, and Google Workspace, with Gemini (Alphabet’s advanced AI model) now available in over 200 million Android devices. Its other AI-powered tools – like Deep Research and Project Mariner – are gaining traction, hinting at Alphabet’s ambitions to create more AI-powered search and productivity tools.

CEO Pichai was optimistic about the AI opportunity, noting that Google’s Gemini models are already used by 4.4 million developers, double the number from six months ago. The big bet? AI will increase user engagement across Google’s ecosystem and drive monetisation through search, ads, and cloud services.

What spooked investors?

Despite Alphabet’s strong AI push, a few red flags stood out in the report and this coalesced around Google Cloud. While the 30% growth was impressive, it’s slower than previous quarters and lags behind Microsoft Azure’s stronger AI-driven demand.

Alphabet admitted that demand outpaced available capacity, meaning it could have grown faster if it had more infrastructure in place.

Even as AI and Cloud expanded, Alphabet remains heavily dependent on advertising, which makes up 82% of total revenue. YouTube ad revenue advanced 14% but concerns remain about whether AI search innovations will cannibalise traditional ad-driven search queries.

Finally, the fact that China launched a new antitrust investigation into Google caused some jitters. The Chinese government has accused Alphabet of violating competition laws. This move, along with China’s renewed scrutiny of Nvidia and Intel Corporation (NASDAQ: INTC), could spell trouble for Alphabet’s business in the region.

What’s Next for Alphabet?

Alphabet is navigating a tricky period where AI hype is high, but expectations are even higher. The company is pouring money into AI infrastructure – planning US$75 billion in capital expenditure for 2025 according to management – but investors want to see faster returns from those investments.

Short-term, Alphabet’s stock may stay under pressure as Wall Street digests its slight revenue miss and geopolitical risks. But long-term, AI-powered growth in search, cloud, and YouTube could make it a winner for patient investors.

If Alphabet can execute on AI and scale its cloud business, this post-earnings dip may be a buying opportunity for long-term believers.