Stocks Themes that can Make Big Moves at The Consumer Electronics Show (CES) 2025

Investor Takeaways

- Historically, CES was mainly for tech enthusiasts. However, recently it has been attracting a lot of attention from investors wanting to see how consumer electronic firms will be able to navigate the AI wave to boost their sales

- As Nvidia is the centerpiece of the event and Jansen Huang being a keynote speaker, investors would be able to grasp the current progress on the newly launched Blackwell product and get an idea about the timeline for the release of the company’s future products and how this can affect the revenue growth in the coming years

- Nvidia suppliers, such as the memory chip stocks, will be able to demonstrate the prowess of the high broadband memory (HBM) technology

- Consumers will be able to understand better the value proposition and the benefits of AI in their personal devices, potentially fueling the next spending cycle in consumer electronics

Background

The Consumer Electronics Show (CES) is an annual trade show organized by the Consumer Technology Association (CTA). The main goal of the event is to showcase to the public the latest trends and products within the consumer electronics sector. The event itself has a long tradition as it first started in 1967 - more than half a century ago. Throughout the decade, CES established itself by attracting the biggest tech enthusiasts and the largest consumer electronic companies from across the world.

In recent years, CES became a subject of increased attention from the investment community, mainly because of the active participation of some of the largest tech firms such as Nvidia, but also due to the growing impact of AI in our daily lives.

The big themes for this year’s show have already been mentioned in the media but there will still be plenty of information and surprises that can affect the markets. Here are some stocks and investment themes that investors should closely observe as CES 2025 unfolds:

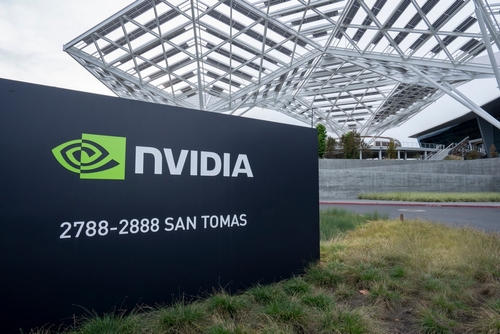

Nvidia (NVDA)

Without any doubt, Nvidia will be the center of attention during the week. They plan to launch GeForce RTX 5080 and 5080 graphic cards. From a stock investing perspective, these graphic cards may trigger a large-scale renewal of gaming PCs which can serve as a much-expected tailwind to the recently sluggish PC market. Nvidia is also expected to bring more clarity about Blackwell, its newest product and the development of its Rubin chip (expected to be released in 2026). This can help investors understand the sales pipeline of the company better and see whether the launch of Blackwell is going smoothly. Last but not least, Jensen Huang will probably mention some of its suppliers during his talk and this can boost their price.

Memory Chip Stocks – SK Hynix, Samsung, Micron (MU)

Important partners of Nvidia are the memory chip stocks. The memory chip stocks have recently been putting significant effort into the growing high broadband memory (HBM) segment. SK Hynix can be considered the leader in this market, and they will present a new HBM product at the show. This will be a great opportunity for the Korean company to showcase their strong business relationship with Nvidia. We also believe that Micron (MU) can benefit from this, as well, as they are the second strongest player in HBM at the moment.

Companies engaged in the consumer electronics sector - Qualcomm (QCOM)

As mentioned before, the consumer electronics sector has been sluggish and this is something normal considering it has always been cyclical, depending on the overall consumer spending. A focal point of the revival of consumer electronics is AI and the applicability of AI in our phones and personal computers. Currently, the investment thesis of a lot of consumer electronics stocks relies on how they will adapt AI to their devices, as investors are in “wait and see” mode.

Consumers of electronic products are also not very clear on how AI will improve their user experience and productivity. It won’t be an exaggeration to say that users at this point spend more time trying to understand and get used to the AI features.

The CES 2025 show will be a great field for companies to bring more clarity to users and investors on how AI can transform their devices and improve their productivity. If this happens, this can be the start of a PC/mobile device renewal wave, and it will definitely benefit the stocks related to consumer electronics.

.jpg)