Nvidia’s Upcoming Earnings: What’s Everyone in the Stock Market Watching?

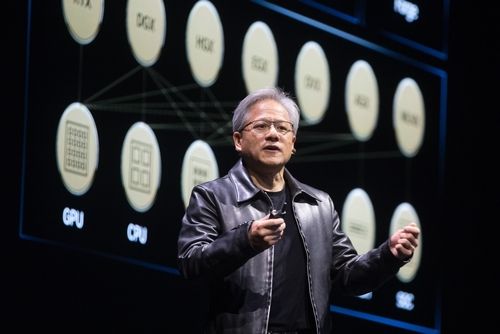

TradingKey - In the world of Artificial Intelligence (AI), no company is bigger right now than the semiconductor behemoth Nvidia Corp (NASDAQ: NVDA). The company has been a huge beneficiary of the advancement of generative AI and large language models (LLMs) that are required.

That’s mainly down the computing processing power that’s necessary to run the billions upon billions of algorithms that go into generative AI. Of course, Nvidia designs the most efficient and powerful chips that are up to this task, mainly its cutting-edge Graphics Processing Units (GPUs).

This incredible success story in AI has seen Nvidia take around 80% market share in the chips required for AI and a big part of this has also been based off Nvidia’s proprietary software system, CUDA. Nvidia today is worth over US$3.4 trillion, making it one of the most valuable companies in the world alongside Apple Inc (NASDAQ: AAPL).

The company is also set to report its much-anticipated Q3 FY2025 earnings – for the three months ending 27 October 2024 – on Wednesday (20 November) after the market closes in the US. Given how important Nvidia is to the market now, this could have a significant impact on broader investor sentiment.

So, here’s what investors should be watching when Nvidia reports results on Wednesday.

Can revenue growth keep pace?

Revenue growth, as with all growth stocks like Nvidia, is the go-to metric investors will be looking at first and foremost. Over the previous five quarters, Nvidia’s revenue growth has grown in the triple-digit percentage range, on a year-on-year basis.

Its latest Q2 FY2025 results in late August saw the company clock revenue of US$30 billion, up 122% year-on-year. Unsurprisingly, that was driven by its monster data centre business, that houses its array of AI-focused chips, with the division posting revenue of US$26.3 billion – up 154% year-on-year.

The big question for investors is whether Nvidia can surprise the market by keeping up this triple-digit growth. The expectation from the market suggests not given the consensus forecast is for Q3 FY2025 sales to have risen 83% year-on-year to US$33.1 billion.

Given the market’s sky-high expectations going into the earnings, any underperformance or disappointment on the top line growth number could see Nvidia’s stock price get hit.

Focus on Blackwell chip revenue

Further down the line items, investors will be laser-focused on Nvidia’s latest next-generation Blackwell chip. The Blackwell GPU has been designed primarily for AI and high-performance computing that Nvidia says will start generating revenue in the current quarter (for the three months ending 31 January 2025).

As a result, investors will want to hear more from management on what kind of revenue it expects from the new product. Nvidia’s stock price fell earlier this week after reports came out that the Blackwell processors have overheating issues when installed in high-capacity server racks.

That sparked concerns that there could be delays to installing the new AI data centre technology for its clients. However, estimates for the revenue that Blackwell could generate this quarter range from as low as US$5 billion all the way up to US$13 billion.

Any management commentary on how Blackwell is faring and whether demand is being able to be met will be watched closely and could impact the share price. In July, Nvidia’s contract chip supplier, Taiwan Semiconductor Manufacturing Co Ltd (NYSE: TSM), said that the production of AI chips going into early 2025 will be “very tight”.

Watch out for share price move

Of course, given Nvidia’s dominance in the AI story, these earnings are going to be closely watched by investors. Any initial moves in Nvidia’s stock is likely to be spurred by both top-line growth as well as commentary surrounding Blackwell.

Indeed, this will no doubt feed into the company’s outlook for the next quarter and how it foresees its business performing on the back of its next-gen Blackwell offering to clients. With the fast-paced world of AI never standing still, it’s an opportunity for investors to peek more into Nvidia’s underlying business fundamentals.

So far in 2024, Nvidia shares are up 191% versus the S&P 500 Index’s 24.3% gain over the same period.