The impact of the US election on major asset classes

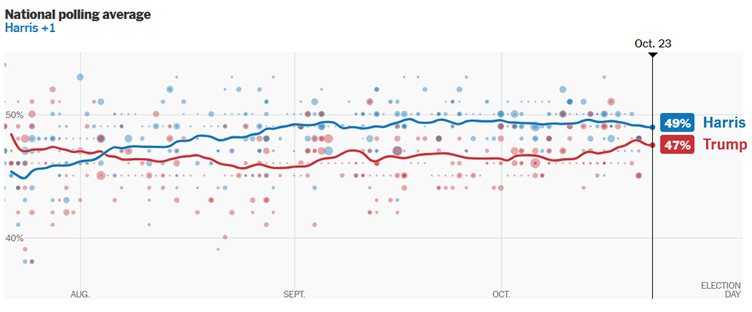

It is difficult to predict the result given the current election situation. As of 23 October 2024, Harris slightly led Trump in the general election poll (Figure 1). However, according to data from Polymarket, which is more sensitive to the market, the possibility of Trump winning the election was much higher (Figure 2). The US elections are always in a situation of "whoever wins the swing states wins the election". Trump has a slight advantage in the seven major swing states. While the competition is intense in Pennsylvania, Trump's support rate has surpassed Harris and remained an advantage in the state. Therefore, we expect Trump to win the 2024 general election.

Figure 1: US general election poll

Source: The New York Times

Figure 2: Polymarket’s 2024 election forecast

Source: Polymarket

Economic outlooks and related policies

Due to the different policy propositions of the Republican and Democrat parties, the elected party will dominate the economic prospects. On the economic growth front, Trump's tax cuts and other related policies to encourage the return of manufacturing will boost growth, while Harris's proposition may have the opposite economic effect. On the inflation front, Harris focuses on fighting inflation through stricter supervision and an increase in aggregate supply. On the other hand, Trump's tax cuts are likely to lead to an increase in domestic demand. This, together with tightening immigration policies and increasing tariffs, may push up inflation. On the fiscal policy front, Harris generally advocates tax increases. In contrast, Trump advocates substantial tax cuts, and the fiscal deficit is planned to be filled in by increasing tariffs. On the monetary policy front, if Trump is elected, under his combined effects of high growth, high inflation and loose fiscal policy, the Fed's monetary policy easing space may be compressed.

The impact of election results on the outlooks of asset prices

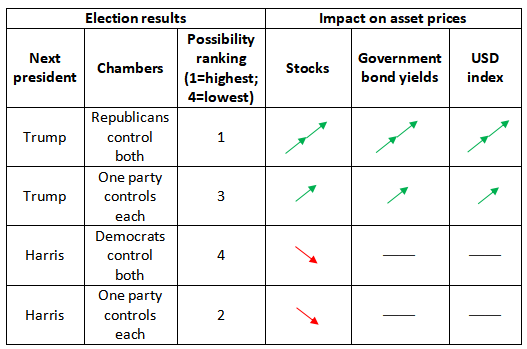

Who can be elected as the next president, whether his/her policies can be smoothly promoted and implemented, as well as whether he/she can get the support of Congress are important facts to the US economy and asset prices. Therefore, this paper analyses different election results and their impacts on the financial markets.

President Trump + Republicans control both chambers

Over the past ten elections, six months before the elections, the probability of rising stocks was high. This may be because of the ruling party's political demands. A good performance of stocks is conducive for the government to seek re-election. One month before the elections, stocks were more likely to fall due to risk aversion returning to the market. Three months after the elections, stocks increased in most of the cases, rising eight times out of ten, as the election-related uncertainties faded (Figure 3). In addition, stock prices went up by 7.6% three months after Trump got the presidency in 2016 (Figures 3 and 4). After the election this year, if Trump becomes the president again and the Republicans successfully control both chambers, the smooth implementation of the tax reduction policies may benefit US stocks, though raising tariffs will have both positive and negative impacts on the market over the longer term.

Figure 3: US stock performance before and after elections

| 6 months before election | 1 month before election | 3 months after election |

1984 | 6.0% | 3.6% | 7.1% |

1988 | 6.4% | -1.5% | 9.4% |

1992 | 2.5% | 3.0% | 4.7% |

1996 | 10.1% | 0.8% | 11.7% |

2000 | 0.0% | 1.6% | -5.6% |

2004 | 2.1% | -0.1% | 5.2% |

2008 | -31.7% | -12.1% | -13.2% |

2012 | 3.5% | -3.0% | 6.6% |

2016 | 3.6% | -1.0% | 7.6% |

2020 | 16.9% | -1.1% | 15.6% |

Probability of increase | 8/10 | 4/10 | 8/10 |

Source: iFinD, Tradingkey.com

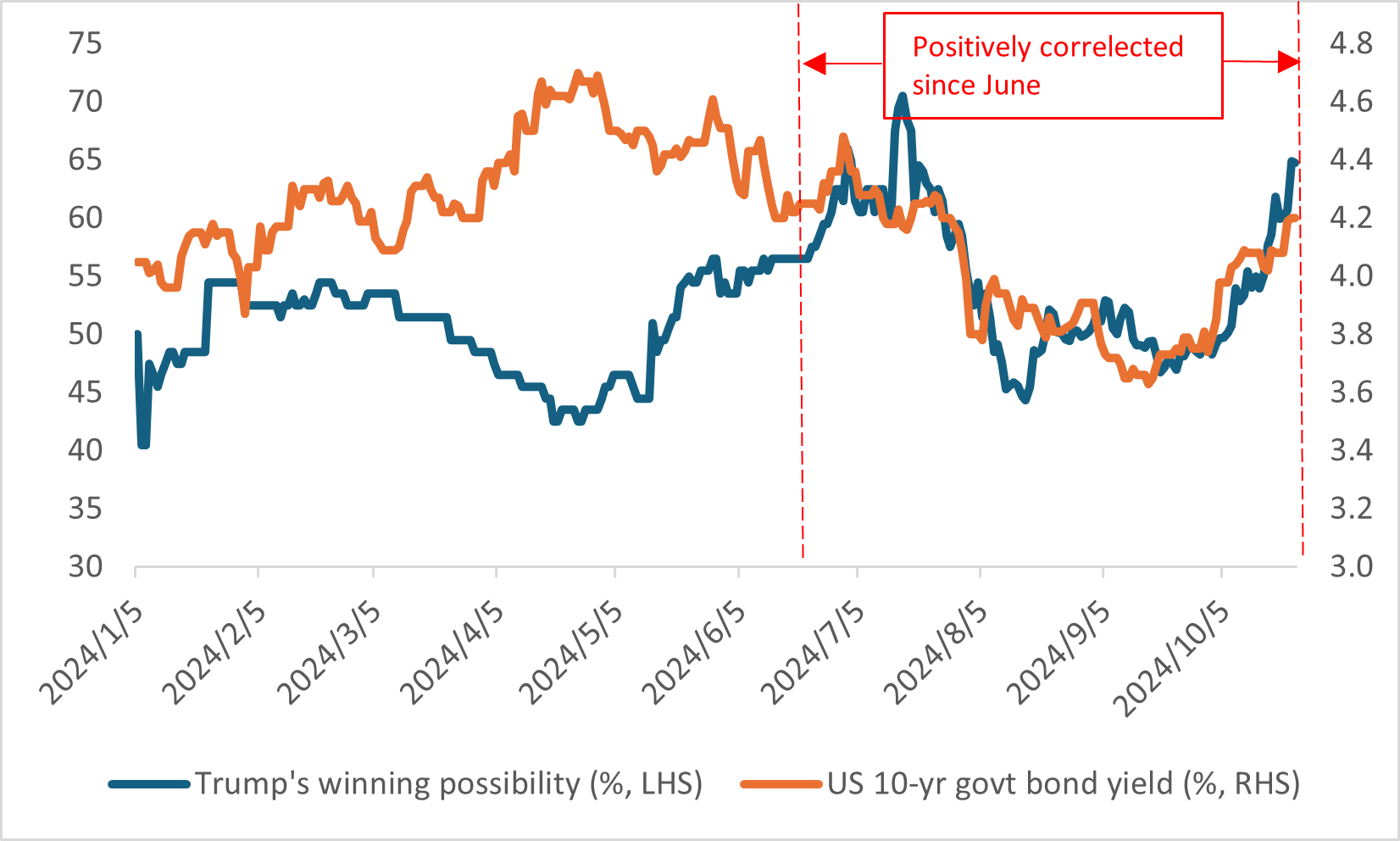

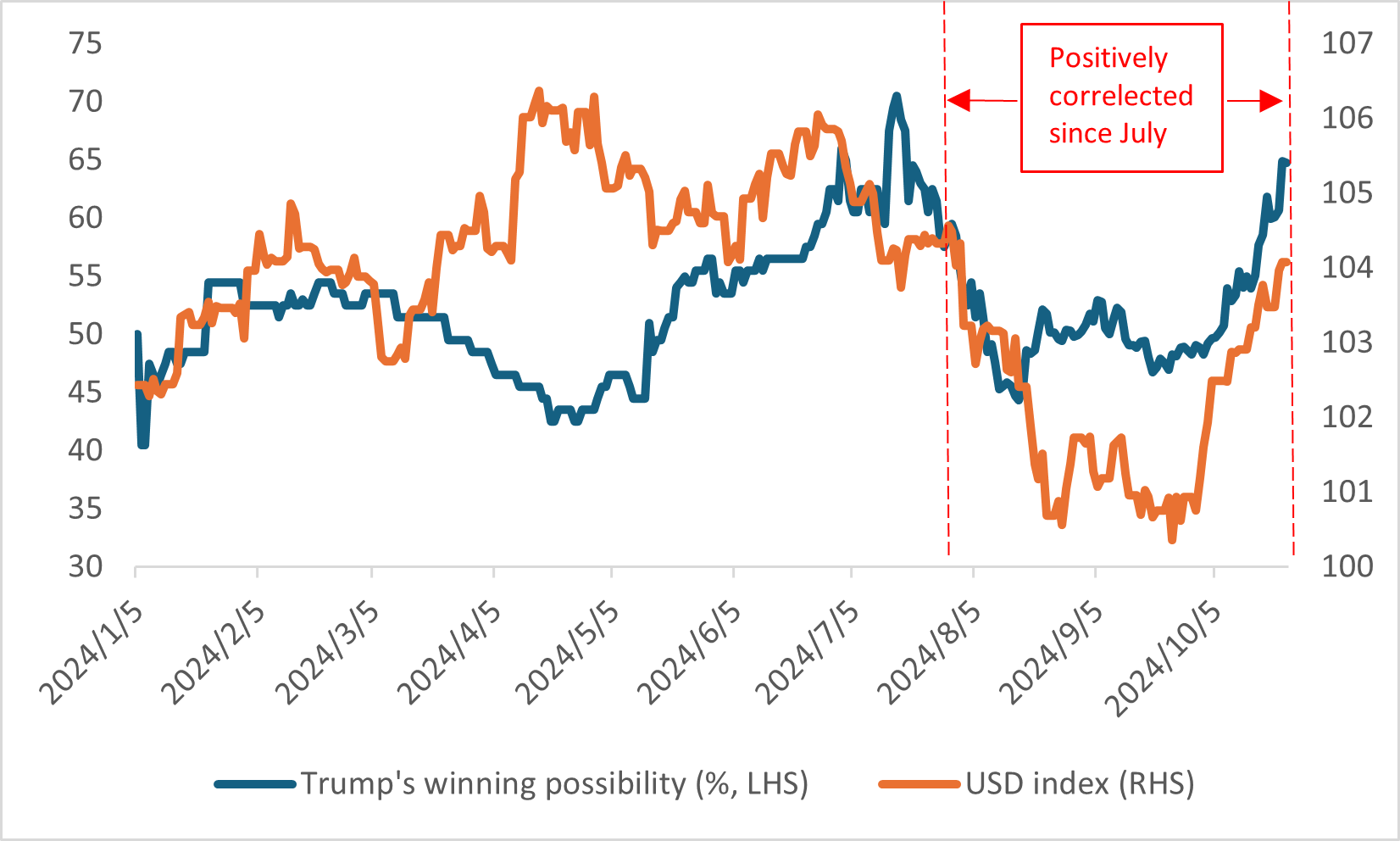

In terms of the fixed income and currency markets, treasury yields and the US dollar went up three months after Trump’s 2016 election (Figure 4). Since the second half of this year, the "Trump Trading" strategy has been rife again, making Trump's winning probability positively correlate with yields and the dollar (Figures 5 and 6). Looking forward, under the scenario of “President Trump + Republicans control both chambers”, US government bond yields may rise as the fiscal deficit expands and the issuance of treasury bonds increases. The impact on the US dollar is more complicated. On the one hand, loose fiscal policy and tight monetary policy will support the dollar to remain strong in the short term. On the other hand, the higher deficit level caused by tax cuts may weaken the US dollar in the long term.

Figure 4: Markets reaction three months after Trump’s 2016 election

.png)

Source: iFinD, Tradingkey.com

Figure 5: Trump's winning possibility vs. US 10-yr government bond yield

Source: iFinD, Tradingkey.com

Figure 6: Trump's winning possibility vs. USD index

Source: iFinD, Tradingkey.com

President Trump + One party controls each chamber

From the historical lessons of "Republican president + One party controls each chamber", the performance of US stocks diverged. Splitting the control of the chambers increased the uncertainty of fiscal spending, especially in the year when the debt ceiling was triggered, which increased the risk of an economic downturn. In the 2024 elections, while the probability of “Trump elected + One party controls each chamber” is relatively smaller, if this happens, Trump will lose the controlling power to the House of Representatives, which holds the "fiscal decision power". This means the extension of the domestic tax cut bill is likely to face obstacles, and the possibility of further tax cuts for enterprises is lower. Meanwhile, it is more difficult to implement foreign tariff policies. As a result, US stocks may only rise moderately, and the increase in US bond yields and the US dollar will also be relatively smaller.

President Harris

If Harris wins the election, the overall policies may continue the current route. The 2017 tax cut bill is unlikely to be extended. In addition, unlike the Senate, the House of Representatives is likely to be controlled by the Democrats, who in turn control government spending. This is conducive to the implementation of Harris' fiscal policies. An increase in corporate tax will reduce the earnings of US-listed companies, and a tax increase on the rich will decrease risk appetite. Both will put downward pressure on US stocks. However, as Harris' fiscal policies are not radical, it will be unlikely to see a large-scale debt increase. This means the upward pressure on US bond yields will be less than if Trump is elected.

Conclusion

This paper analyses different election results and predicts the asset price moves for each specific result. We expect the probability of the "President Trump + Republicans control both chambers" scenario to be the highest (Possibility Ranking=1 in Figure 7). This means the markets (US stocks, government bond yields and the dollar) are likely to rise within the three months after the election. Therefore, in terms of asset allocation, we overweigh US stocks and the US dollar as well as underweight US government bonds.

Figure 7: Impact of different election scenarios on asset prices

Source: Tradingkey.com