Dollar mauled by Trump trade war; German 'bazooka' blasts bonds

- Euro up, bonds in epic selloff after German debt reform

- Beijing retains growth target of 5%, lines up more stimulus

- Oil sinks as Trump trade war escalates

- Global growth worries trigger losses for oil, Wall Street

TOKYO/LONDON, March 5 (Reuters) - The dollar hit three-month lows on Wednesday as the U.S.' trade war with its partners escalated, while a major overhaul to German government borrowing triggered the biggest sell-off in the country's debt since the late 1990s.

In addition to the cocktail of tariffs and a seismic shift in German fiscal policy, investors also parsed through the start of China's annual sessions of its parliament, the National People's Congress (NPC), at which Beijing retained a goal of roughly 5% economic growth for 2025.

The euro EUR=EBS hit its highest in four months, while European stocks surged .STOXX. The biggest casualties were longer-dated German government bonds, caught up in their worst one-day selloff in more than 25 years as yields ripped higher.

Overnight, German political parties agreed to a 500 billion-euro ($534.75 billion) infrastructure fund and, crucially, an overhaul in borrowing limits that economists billed as "a really big bazooka".

"Last night Germany announced plans for one of the largest fiscal regime shifts in post-war history, perhaps with reunification 35 years ago being the only rival," Deutsche Bank strategist Jim Reid said.

"Everything you thought you knew about Germany's economic prospects three months ago, or even three weeks ago, should be ripped up and you should start your analysis from fresh," he said.

German 30-year yields - the rate the government pays to borrow over the very long term - rose by almost a quarter of a percentage point in early trading, which would have marked their largest rise since October 1998.

The 30-year bond was last up 15 basis points to yield 2.978%.

Longer-dated yields elsewhere rose too, with French 30-year rates FR30YT=RR up 11 basis points at 3.963% and even U.S. Treasury bond yields US30YT=RR up 3.5 bps at 4.55%.

Europe's STOXX 600 jumped by more than 1% to record highs. The prospect of a meaningful increase in European spending on security has sent the region's defence stocks soaring this month.

TRADE WAR INCOMING

U.S. tariffs on imports from Canada, Mexico and China went into effect on Tuesday, when President Donald Trump also delivered his State of the Union address, in which he touted his successes since taking office six weeks ago.

Canada and China retaliated immediately, while Mexican President Claudia Sheinbaum vowed to respond likewise, without giving details.

With a full-on trade war underway, crude oil hit six-month lows, while bitcoin BTC= found its feet around $87,800 following a volatile week.

"Fears about weaker U.S. and global economic activity are manifesting in the markets, with cyclicals driving the sell-off," said Kyle Rodda, senior financial markets analyst at Capital.com.

In China, the offshore yuan CNH=EBS was roughly steady at 7.2593, having staged its biggest daily rally the previous day since Trump's inauguration as investors ditched the dollar.

Along with its unchanged economic growth target, Beijing committed more fiscal resources than last year to mitigate the impact of rising U.S. tariffs.

China aims for a budget deficit of about 4% of gross domestic product in 2025, up from 3% in 2024.

"It doesn't look like China wants to go overboard with spending right away, given the tariff threats, as they potentially want to save ammunition for external threats later in the year," Saxo chief investment strategist Charu Chanana said.

Hong Kong's Hang Seng .HSI rallied 2.1%, and an index of mainland blue chips .CSI300 rose 0.3%.

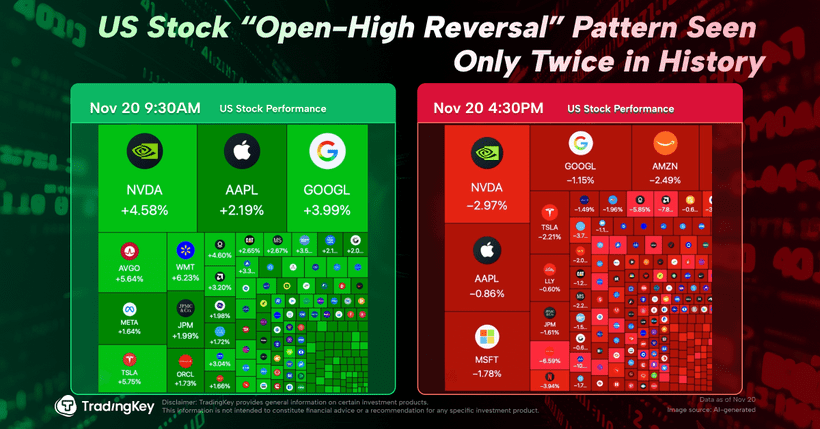

Overnight, the U.S. S&P 500 .SPX slid 1.2%, but futures ESCv1 rose 0.7% on Wednesday.

The U.S. dollar index =USD tumbled 0.4% to 105.11, bringing its losses over the last three days to 2.23%, the most in this timeframe since late 2022.

In the ascendant was the euro, which rose 0.5% to $1.0677, the most since mid-November, prompting a flurry of bullish forecasts from major investment banks.

Sterling GBP=D3 rose 0.4% to $1.284, its highest since early December, while the Japanese yen JPY=EBS strengthened, leaving the dollar down 0.25% at 149.44.

Oil fell for a third day on Wednesday, under pressure from concern over energy demand as tit-for-tat tariffs ramp up and from OPEC+ plans to raise output in April.

Brent LCOc1 futures fell 0.3% to $70.80 a barrel, having hit $69.75 the previous day, the lowest since September.

($1 = 0.9350 euros)