Meet the Little-Known Company That's Betting That Nvidia's Jensen Huang Is "Dead Wrong"

Jensen Huang, co-founder and CEO of Nvidia (NASDAQ: NVDA), has been right about a lot of things. After all, you don't lead a business to generate revenue of more than $100 billion annually unless you've made some prescient decisions. But when it comes to assessing the quantum computing development timeline, the CEO of D-Wave Quantum (NYSE: QBTS), Dr. Alan Baratz, says Huang is "dead wrong."

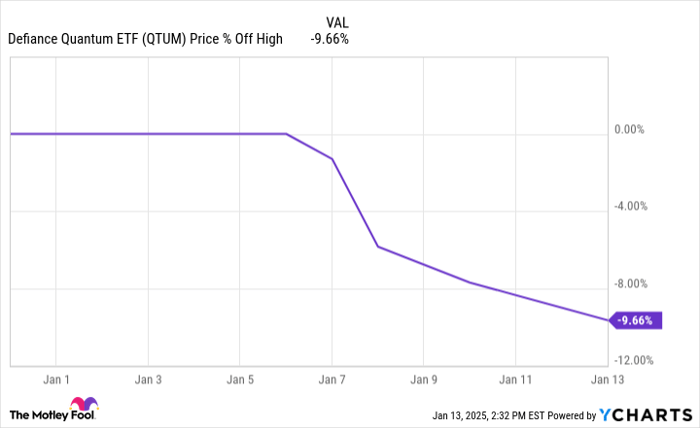

When Huang was asked about quantum computers on Jan. 7 at the CES expo in Las Vegas, he said it could be 15 to 30 years before there are "very useful" quantum computers. Since that statement, quantum computing stock prices have nosedived. Just consider how quantum computing exchange-traded fund (ETF) Defiance Quantum ETF (NASDAQ: QTUM) is dropping like a rock.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Data by YCharts.

Shares of D-Wave Quantum have fared far worse than the Defiance Quantum ETF. As of this writing, D-Wave stock is down more than 60% from its highs in 2025 and the year isn't even two weeks old yet.

That's why Baratz is speaking out against Huang's timeline. As the CEO of D-Wave, he believes there's a lot of misunderstanding regarding the quantum computing space. And he wants to set the record straight.

Quantum computing is a complex conversation topic

It's important to note here that Huang and Baratz are both intellectual heavyweights. Huang has a Master of Science in Electrical Engineering from Stanford University. For his part, Baratz has a PhD from MIT in computer science. In short, both individuals are brilliant and have informed opinions on this subject -- opinions that are higher quality than those of most investors.

It's also important to remember that quantum computing isn't a pedestrian subject matter. Whereas many people can wrap their minds around classical computers that run on a binary code of zeros and ones, quantum computers go beyond the binary options, which complicates things. With a superposition, quantum bits -- qubits -- can be zero and one at the same time.

The short explanation is that this makes quantum computers far more powerful than classical computers. Many have explained it using a maze example. Imagine a maze with 1,000 possible paths. A classical computer can exit the maze by trying every option, one by one. By contrast, a quantum computer attempts all possibilities simultaneously, reaching the solution in a fraction of the time.

I'm not an electrical engineer or a computer scientist. But I don't need a degree to see that quantum computers could be one of the greatest technological advancements ever.

The problem is that D-Wave isn't the only publicly traded quantum computing stock -- there are many companies and they're all very different in how they manage the development of their quantum computers. Rigetti Computing (NASDAQ: RGTI) uses a superconducting approach whereas IonQ (NYSE: IONQ) uses trapped ions. Then there are companies that use gate-model architecture and others, such as D-Wave, that use a quantum-annealing process.

If none of this makes sense, that's the point I'm making: The space is complex because quantum computing companies aren't all the same. There are different approaches and there are very bright people working on all sides. In short, investors need to cautiously avoid quickly drawing overconfident conclusions.

Could Baratz and Huang both be right?

Jensen Huang said, "If you kind of said 15 years for very useful quantum computers, that would probably be on the early side." For his part, Huang indicated that he believes very useful quantum computers are closer to 20 years away. But Dr. Baratz strongly disagrees.

Baratz went on CNBC to explain. He said that Huang is "dead wrong" because D-Wave is "commercial today." But remember, this is a complex subject. And with complexity, there's an acute need for nuance. And that could be true here as well.

Indeed, D-Wave has commercialized its quantum computers. The company generated revenue of $1.9 million in the third quarter of 2024, had bookings of $2.3 million, and had 132 customers. Therefore, Baratz's statement is true: D-Wave is indeed commercial today, as is Rigetti, IonQ, and others.

Does this mean that quantum computers are "very useful"? Not necessarily. Therefore, Huang could still be right as well.

To me, there are two options here. Either Huang overstates the timeline because he doesn't understand the quantum-annealing process or Baratz overstates the usefulness of D-Wave's computers today.

With due respect to Huang, I'm inclined to believe Baratz. According to Dr. Baratz, gate-model architecture could be 15 years away because it's inferior to quantum annealing. But in fairness, gate-based companies such as IonQ are also commercial today by Baratz's definition. Moreover, with bookings of nearly $64 million in its third quarter, IonQ is actually further along in the commercialization process.

Whether you agree with me or not, I think the investor takeaway is that the quantum computing space is extremely promising but the complexity makes it very hard for the average person to invest.

For this reason, the Defiance Quantum ETF might be the better investment option for those who are interested in this tech subsector. It allows investors to participate in the upside in the space without trying to pick individual winners.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $345,467!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,391!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $453,161!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 13, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.