5 Top Semiconductor Stocks to Watch in 2025

TradingKey - The semiconductor industry is the backbone of modern technology, driving innovations in artificial intelligence (AI), cloud computing, gaming, and more.

As we enter 2025, the demand for advanced chips (which is already red hot) is only set to grow, making certain semiconductor companies prime candidates for investors’ watchlists.

With that in mind, here are five top semiconductor stocks to keep an eye on in 2025, with each poised to benefit from the rise of AI and other cutting-edge technologies, such as quantum computing.

- NVIDIA Corporation

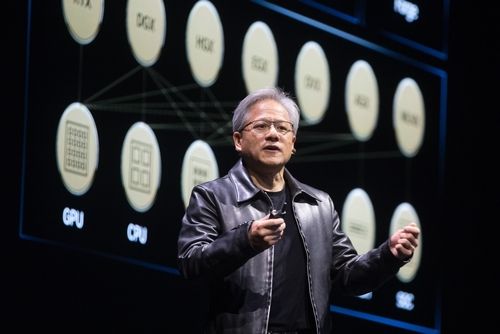

NVIDIA Corporation (NASDAQ: NVDA) is the undisputed leader in AI hardware and software. Its GPUs (graphics processing units) have become the gold standard for AI training and inference workloads, powering everything from autonomous vehicles to generative AI models like ChatGPT.

In 2024, NVIDIA made headlines with its record-breaking growth, driven by surging demand for its data centre products.

Why watch NVIDIA?

NVIDIA’s dominance in the AI chip market is unmatched. Its CUDA software platform is deeply entrenched in the AI development ecosystem, creating a significant moat. The company is also expanding into AI supercomputing and the metaverse, which could open up additional revenue streams.

Growth catalysts for 2025:

- Continued adoption of AI in industries like healthcare, finance, and retail

- Expansion of NVIDIA’s AI software ecosystem, including partnerships with cloud providers

- Growth in AI-powered gaming and virtual reality (VR) technologies

While NVIDIA’s stock saw explosive growth in 2024, its long-term prospects remain strong, making it a must-watch company for investors in 2025.

- AMD

Advanced Micro Devices Inc (NASDAQ: AMD) has consistently proven its ability to compete with both NVIDIA and Intel. Known for its high-performance CPUs and GPUs, AMD has gained a significant share of the gaming, data centre, and enterprise markets.

Its MI300 series AI accelerators, launched in 2024, positioned the company as a credible competitor to NVIDIA in the AI chip space.

Why watch AMD?

AMD’s focus on delivering cost-effective, high-performance chips gives it an edge in a price-sensitive market. Its partnerships with major cloud computing providers, to deliver AI-specific hardware, further solidifies its position as a key player in the AI revolution.

Growth catalysts for 2025:

- Increasing adoption of AI accelerators for cloud and enterprise use

- Expansion into high-performance computing (HPC) for scientific and industrial applications

- Growing market share in gaming and consumer electronics

As AMD continues to innovate and expand its product lineup, it’s well-positioned to ride the AI wave in 2025.

- TSMC

When it comes to manufacturing the world’s most advanced chips, Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) stands unrivalled. As the primary manufacturer for industry giants like NVIDIA, AMD, and Apple, TSMC is the engine that powers the semiconductor industry. That’s unlikely to change in 2025.

Why watch TSMC?

TSMC’s leadership in cutting-edge process nodes – such as 3nm and 2nm technologies – makes it indispensable for companies developing AI and high-performance computing chips. Despite geopolitical risks, TSMC’s dominance in the global semiconductor supply chain is unlikely to wane.

Growth catalysts for 2025:

- Increasing orders for AI and machine learning chips from NVIDIA and AMD

- Expansion into advanced packaging technologies for more efficient chip designs

- Rising demand for chips in electric vehicles and Internet of Things (IoT) devices

TSMC’s unique position as the world’s most advanced chipmaker makes it a cornerstone investment in the AI-driven future.

- ASML

ASML Holdings NV (NASDAQ: ASML) is the unsung hero of the semiconductor industry. The company holds a monopoly on extreme ultraviolet (EUV) lithography machines, which are essential for producing the most advanced chips.

Without ASML, companies like TSMC, Samsung, and Intel couldn’t manufacture the cutting-edge chips that power AI and other technologies.

Why watch ASML?

ASML’s EUV technology is indispensable for the semiconductor industry’s push toward smaller, more efficient chips. As AI drives demand for high-performance semiconductors, ASML is well-positioned to benefit from increased capital expenditures by chipmakers.

Growth catalysts for 2025:

- Higher demand for EUV machines as chipmakers ramp up production of AI-focused chips

- Expansion into high-NA EUV technology, enabling even smaller and faster chips

- Increased investment from governments and companies aiming to secure semiconductor supply chains

With its unique technology and market dominance, ASML is a long-term winner in the semiconductor space.

- Broadcom

While Broadcom Inc (NASDAQ: AVGO) may not have the same brand recognition as NVIDIA or AMD, it plays a critical role in the AI ecosystem. Broadcom designs and manufactures chips for networking, storage, and connectivity – all of which are essential components for AI data centres.

Why watch Broadcom?

Broadcom’s diversified product portfolio ensures it benefits from multiple aspects of the AI revolution. From high-speed data centre networking to custom silicon solutions for hyperscale AI workloads, Broadcom is deeply integrated into the infrastructure that’s at the heart of powering AI.

Growth catalysts for 2025:

- Increasing demand for AI-focused networking solutions in hyperscale data centres

- Growth in custom chip design for leading AI companies

- Expansion into edge computing and IoT devices powered by AI

With its strong cash flow and strategic positioning, Broadcom offers a less volatile way to invest in the AI-driven semiconductor boom.

Where are chip stocks headed in 2025?

The rise of AI is transforming the semiconductor industry, creating immense opportunities for investors that can identify the companies supplying the hardware and infrastructure behind this technological revolution.

NVIDIA and AMD lead the charge with their AI-focused processors, while TSMC and ASML enable the production of these advanced chips. Broadcom’s role in AI infrastructure provides a diversified way to tap into this growth.

Investors looking to capitalise on the AI revolution in 2025 should consider these five market-leading semiconductor stocks, each uniquely positioned to benefit from the growing demand for AI and advanced computing technologies.