Why Walgreens Stock Tumbled 64% in 2024

Shares of Walgreens Boots Alliance (NASDAQ: WBA) fell sharply last year as a combination of declining vaccine demand, headwinds on consumer discretionary spending, and misguided acquisitions led to a series of dismal earnings reports from the company.

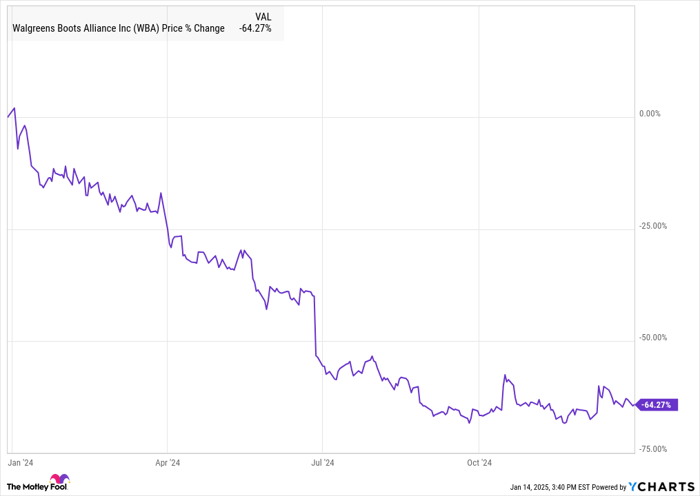

As a result, Walgreens was forced to cut its dividend, took a multibillion-dollar impairment charge, and lost its place in the Dow Jones Industrial Average (DJINDICES: ^DJI). According to data from S&P Global Market Intelligence, the stock fell 64% over the course of 2024. As you can see from the chart, the stock fell steadily over most of the year as its prospects continued to decline.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Why Walgreens collapsed

Walgreens fell steadily through the first three quarters of the year as the company missed estimates and cut guidance, and Wall Street's view of the stock soured. By the fourth quarter, the stock seemed to stabilize, but it had yet to show signs of recovery.

The lowlights started early for Walgreens, as it said it was cutting its dividend early in January when it reported first-quarter earnings. The company slashed its dividend by 48% to $0.25 a quarter, which it said was part of a focus on right-sizing costs and increasing cash flow. It also maintained its adjusted earnings per share guidance at the time at $3.20-$3.50.

In the second-quarter report, out at the end of March, Walgreens dropped another bomb on investors, taking a $5.8 billion goodwill impairment on VillageMD. It acquired the primary care and urgent care business as a way to diversify and vertically integrate, but it's become clear that it greatly overpaid the business. Walgreens paid $5.2 billion in 2021 to increase its stake in VillageMD from 30% to 63%, though its growth strategy in the business did not pan out. It also narrowed its adjusted EPS guidance to $3.20-$3.35 in the quarter.

Walgreens' worst day of the year came on June 27, when the stock fell 22% on another disappointing earnings report. This time, it slashed its full-year EPS guidance to $2.80-$2.95 due to challenging pharmacy industry trends and a weak consumer environment.

Image source: Getty Images.

What's next for Walgreens?

Almost everything that could go wrong for Walgreens last year did, but it showed signs of recovery in its first-quarter earnings report earlier this month. While management expects adjusted earnings per share of just $1.40-$1.80 this year, the business has seemed to stabilize, and the top line is growing.

For dividend investors, Walgreens is appealing right now, offering a dividend yield of 10.9%, which should be safe if the business has stabilized.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $345,467!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,391!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $453,161!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 13, 2025

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.