Here's Why Snowflake Stock Soared 52% Last Month

Shares of data company Snowflake (NYSE: SNOW) soared 52.2% during November, according to data provided by S&P Global Market Intelligence. The stock was already up about 15% in the first half of the month. But it skyrocketed after reporting financial results for its fiscal third quarter of 2025 on Nov. 20.

For context, Snowflake stock is still down year to date even though the S&P 500 is having an above-average year. At the end of October, it was down 42% for 2024 as investors worried about its slowing growth rate and rising expenses. But the Q3 report provided fresh reason for optimism.

The biggest development for Snowflake is that it had some big customer wins in Q3. It added 400 new customers during the quarter, of which about 20 are members of the Forbes Global 2000. Moreover, customers spending $1 million or more annually had an impressive 25% jump.

It's just a hunch but I believe the real catalyst in the stock price was that Snowflake's management said the words that investors wanted to hear. The company is seen as a top player in the artificial intelligence (AI) space, but AI hadn't catalyzed its growth yet. But in Q3, management attributed growth to AI, which finally signals a shift in the right direction.

Are Snowflake's long-term goals back on track?

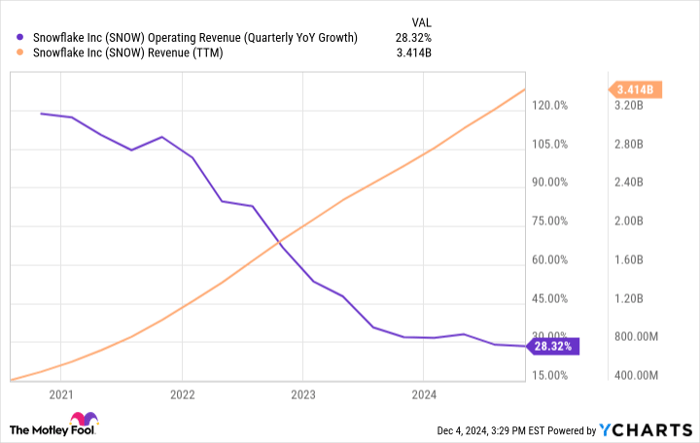

Since its celebrated initial public offering (IPO) in 2020, Snowflake's growth has been spectacular, but its growth rate has steadily dropped at an alarming rate.

SNOW Operating Revenue (Quarterly YoY Growth) data by YCharts.

Snowflake's management has long been targeting $10 billion in annual product revenue in fiscal 2029 (mostly overlapping with calendar 2028). But at the rate that its growth was dropping, it was in danger of not hitting this lofty goal. And that was a problem because investors were largely investing with those long-term targets in mind.

Snowflake's AI is starting to turn the tide, as its customers start increasing their spending commitments to use its products and tools. Perhaps the biggest encouraging metric is the company's remaining performance obligations. These jumped an impressive 55% year over year in Q3, and it means that its customers are looking to spend some money.

A big recent shift in customer spend?

Through the first three quarters of its fiscal 2025, Snowflake's product revenue (which accounts for 95% of total revenue) is up nearly 31% from the comparable period of fiscal 2024. Management expects Q4 revenue to jump 23% year over year, leading to 29% growth for the whole year.

On one hand, Q4's growth rate is slower than what Snowflake's investors are used to. But the 29% guidance for the year is up from previous guidance of 26% growth. My point is this: Snowflake's management must have been anticipating a very slow Q4 to have put guidance at 26%. So while the Q4 forecast is slower than growth in Q3, it's a big step up from where trends were just a few months ago.

That's an important development, and it explains why Snowflake investors are riding high right now.