Starbucks (SBUX): Q2 Numbers Look Worse than the Reality Actually Is, but Need to See More Drop in Price to become Attractive

Summary

Disappointing results but a change in the strategy towards ramping up hiring may pay off with higher growth and winning back market share (of course, at the expense of profitability). The current valuation of 25x 2026 expected earnings not enticing, better stay on the sideline with this.

Estimates Miss

TradingKey - Starbucks released its 2025Q2 results after the latest trading session and the stock went down 6.5% post-market. Obviously, the investors did not like the miss on both revenue and EPS and even on the earnings call, the management described the numbers as “disappointing”:

· Revenue: $8.76 billion vs. $8.82 billion expected (+2.3% year-over-year)

· Earnings per share: 41 cents adjusted vs. 49 cents expected (-39.7% year-over-year)

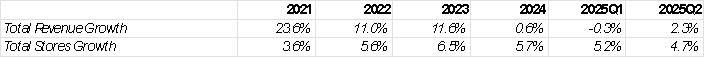

Revenue was positive mostly due to the stores expansion of 4.7% from last year, however the same store sales growth remained negative. On the earnings side there was a significant drop, and it is mostly due to a shrinking in the margins driven by the ongoing business revamp started by the new CEO Brian Niccol with the so-called “Back to Starbucks strategy”. The global operating margin for 2025Q2 was just 8.2%, far below 12.7% one year ago.

Source: SEC Filings, TradingKey

Change of Strategy

However, the main takeaway for investors is not in the financial reports but on the earnings call.

The company is planning to scale back on investments in automatized technology (cold press, cold brew equipment) and ramp up the investment in labor by hiring more baristas. This can have significant implications for the future of the company.

With more baristas in stores, Niccol aims to improve the customer experience by providing more personal interaction with customers. With better customer experience, the stores will see improved footfall and therefore a higher revenue growth. This shows the management is planning to focus on getting back market share from the competition, which has been more intense recently. However, this will come at the expense of the profitability.

By switching the investment focus from equipment and technology to extensive hiring, we would observe less capital expenditure in the cash flow statement but more operating expenses in the income statement, which will lead to lower margins.

We can already see this in the Store Operating Costs being up 12% from the same period last year, and reaching almost 50% of the revenue for the quarter.

Source: SEC Filings, TradingKey

Also, when it comes to margins, there will be headwinds from keeping the prices at the same level and the increase in coffee bean costs due to tariffs (though the effect will be limited).

Overall, the plan to focus on hiring goes in the exact opposite direction of what we see with the other restaurant chains where they invest in technology and cut staff in order to optimize operations. Thus, the move of Niccol can be seen as somehow risky. However, investors should not dismiss the high level of expertise and strong track record of the Starbucks CEO.

On the positive note, the earnings call mentioned the average spending per person improved a bit, showing that the company so far is avoiding the negative effects from the suppressed consumption. This can be explained by scaling back on discounts and focusing the marketing budget on promotion on the media.

Valuation

With 2026 PE of 25x, SBUX still has room to go down before it becomes truly attractive. This level of PE ratio is in line with what we have seen historically (excluding the COVID period), and it does not look like a bargain. Also, it will take a quarter or two to see the positive effect from Niccol’s actions.

Source: macrotrends.net