Inside PayPal’s Quiet Comeback

- PayPal generated $6.8 billion in free cash flow for 2024, up 60% YoY, fueling a $15B buyback plan.

- Branded checkout declined to 28% of TPV, but remains a high-margin segment amid rising Venmo monetization and SMB adoption.

- Valuation is deeply compressed, with forward P/E at 13.8x and EV/Sales at 2.1x—both over 50% below 5Y averages.

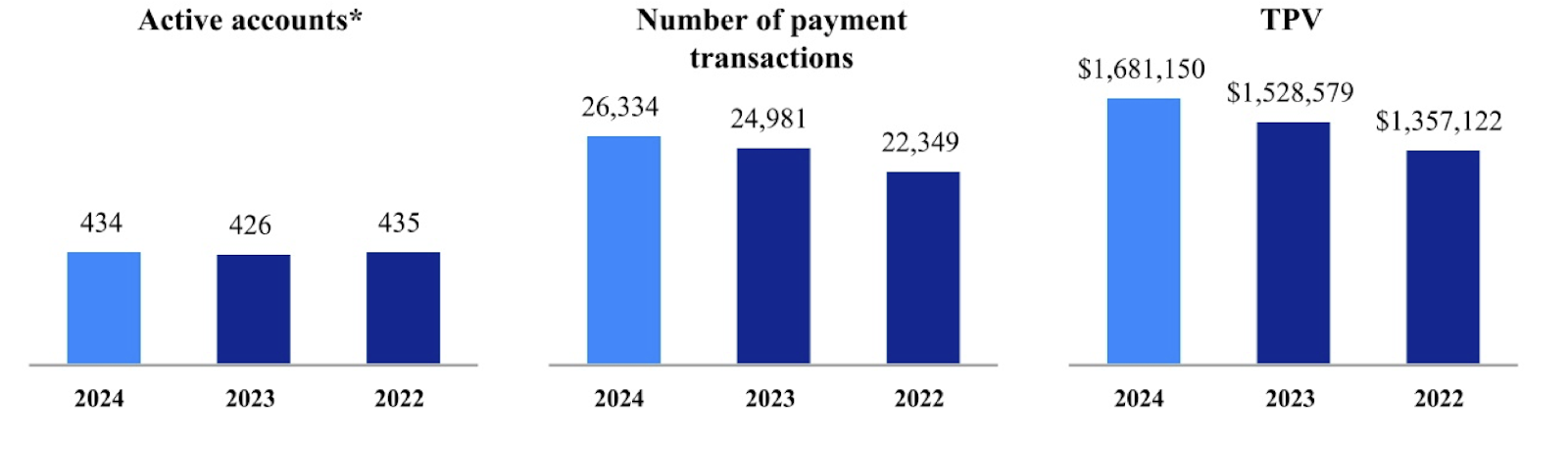

- Active accounts grew to 434 million, while transactions per account rose 3% YoY, signaling engagement amid execution-focused restructuring.

Resetting the Narrative: From Hypergrowth to Strategic Scalability

TradingKey - PayPal Holdings Inc. (PYPL) entered 2025 as a company on a transformation path. From a darling of fintech innovation and dominance of digital payments, the company has matured into a global financial infrastructure company with reach into nearly all corners of digital commerce.

The story, however, is changing. The break-neck growth of the 2010s has given rise to slowing growth, greater competition, and Wall Street's subsequent down-revaluation of shares. PayPal's shares, now at steep discounts to historic multiples, are priced closer to a utility than a growth engine. Below, however, markets' skepticism disguises a business with solid free cash flow, a solid two-sided network, and a renewed focus on execution.

The narrative is now one not of PayPal as disruptor, but as a successful, resilient incumbent. With CEO Alex Chriss at its helm, the company is focused on profitability, cost discipline, and clarity on operations. That's backed with a $15 billion share repurchase plan, with a focus on pouncing on what management sees as a deeply undervalued stock.

With over $15 billion on hand in cash and investment and $6.8 billion in free cash flow generated last year, PayPal is doubling down on shareholder returns. The ultimate test remains out there: can the company grow its core platforms, fend off nimbler rivals, and reaccelerate organic user growth as a world rapidly moves beyond digital wallets.

Understanding the engine: a two-sided ecosystem with a global reach

Its business, at its core, is a two-sided payments network. On one end are 434 million active accounts—those consumers who pay with Venmo, PayPal, and Xoom for everything from peer-to-peer payments to purchases with crypto.

There are millions of merchants at one end that have adopted PayPal-branded checkout, Braintree's unbranded processing, and point-of-sale products such as Zettle for facilitating transactions. Such a setup provides a unique data set for PayPal, allowing for personalized services, reduced fraud, and targeted credit and lending products. It also allows for a payments facilitator role and a financial partner role for PayPal.

Transaction fees, increasing with payment volume, drive most company revenue. Branded checkout, at perhaps the heart of PayPal's consumer experience, accounted for 28% of $1.68 trillion total payment volume for 2024, a 10% year-over-year increase. Down year-over-year, however, the segment is high-margin and strategic.

Braintree, which processes white-label for Uber and DoorDash, grew at a faster pace but at a smaller margin. Venmo, however, is being increasingly monetized through debit cards, “Pay with Venmo” partnerships, and value-add services.

Source: PayPal’s 10K

In addition to transaction processing, PayPal makes money on interest on customers' balances, merchant subscription tools, and credit products secured with partner banks. The company's BNPL products have gained traction globally, and merchant financing products like PayPal Working Capital have helped deepen relationships with small and medium-sized merchants.

On balance, the platform remains expansive and sticky—but complexity has raised worries over focus. Recent initiatives have focused on streamlining offerings, cutting low-performing features, and reallocating resources toward high-impact areas like AI-driven checkout, risk analytics, and platform efficiency.

Faced with a Crowded Market: An Industry That's No Longer Exclusive

The payments ecosystem has expanded dramatically, and with that, competition for each part of PayPal's business has risen. Enterprise players, including Stripe and Adyen, are at the forefront. Their developer-friendly platforms, global reach, and integrated APIs make them the choice for fast-growing digital business. Stripe, particularly, has gained share among startups because of its ease of integration and expanding product set, and Adyen has carved out a niche in Europe with its end-to-end infrastructure. Braintree remains relevant but is not at the innovation forefront anymore.

In consumer payments, PayPal also faces fierce competition from Apple Pay, Google Pay, and Shop Pay from Shopify. Natively embedded into iOS devices and Safari, Apple Pay offers unprecedented convenience and security for offline and online payments. Its mobile checkout share keeps growing, particularly among US millennials and Generation Z consumers. Shop Pay, meanwhile, benefits from seamless integration into Shopify's ecosystem, which powers millions of e-commerce storefronts. These native wallet experiences reduce friction and challenge PayPal's checkout dominance.

Venmo, long seen as PayPal's answer to Square's Cash App, is being slowly reshaped. It has been well-adopted, particularly among young users, but has struggled with monetization. Recent innovation with debit card usage and third-party app integration signal a shift toward not just framing Venmo as a transfer vehicle but as a spending account.

Competition there, however, is fierce as well. Cash App has expanded into investing, Bitcoin, and banking, constructing a broader financial lifestyle platform. Revolut and N26, neobanks, offer comparably aspirational feature sets in international markets, with superior user experience and faster product cycles.

Despite all of this, PayPal also retains some significant strengths. Its brand remains broadly trusted across generations. Its licenses in almost 200 markets represent a hard-to-replicate moat. And its partnerships—from Adobe Commerce, Meta, to BigCommerce—put it in a good position to remain a core enabler of digital commerce. The issue is less survival, but relevance once more in a rapidly evolving world.

.png)

Source: doofinder.com

Financial Narrative: Strength at Operations Along with Margin Discipline

Financially, however, PayPal has stabilized after a rocky stretch. The company posted $31.8 billion in revenue for 2024, a 7% year-over-year increase, and $6.8 billion in free cash flow—a 60% jump. Transaction margin dollars rose alongside revenue, growing 7% to $14.7 billion. Non-GAAP net income came in at $4.8 billion, and GAAP net income at $4.1 billion. These figures indicate underlying health and stronger cost discipline, even as GAAP operating margins remain pressured due to competitive pricing and infrastructure investment.

.png)

Source: PayPal’s 10K

Active accounts rose by 8.8 million, a 2% increase, and engagement metrics rose substantively. Transactions per account hit 60.6, a 3% year-over-year growth, and unbranded transactions fell slightly as a price-to-value strategy gained traction, with a focus on margin. That renewed emphasis on branded experience is already yielding benefits, with checkout conversions and AI-based Fastlane products driving U.S. volumes. SMB adoption also rose, with 45% of qualified SMB volume now handled through PayPal Complete Payments.

Cash operations have also been a highlight. PayPal had $2.2 billion free cash flow alone for Q4 2024, and $7.5 billion for 2024. It repurchased $6 billion worth of shares during last year and has now sanctioned another $15 billion worth of repurchases, a vote for its long-term horizon and inherent value. Its debt remains at a moderate $11.1 billion, with $15.4 billion worth of cash and investments on hand.

.png) Source: PayPal’s Q4 Earnings

Source: PayPal’s Q4 Earnings

PayPal’s Valuation Trap or Treasure? Why the Market May Be Getting It Wrong

PayPal's valuation today is one of a company caught somewhere between skepticism and promise. With a forward P/E multiple of 13.83—around 30% above sector average but well above 53% below its five-year mean of 29.79—PayPal is priced as a slow-growing, mature business, not as a high-growth, free cash flow, brand equity platform. Its forward EV/Sales multiple of 2.12 is a steep 63% discount from its historic average, a reflection of low investor expectations for revenue growth. The divergence is also evident in measures such as the forward EV/EBITDA multiple (9.71), well below its five-year average of 21.2. These figures suggest that investors have sharply discounted PayPal's growth potential, fueled by concerns over competitive threats from Stripe, Apple Pay, and others, as well as its weak branded checkout volume growth.

But this compression in multiples may actually represent a contrarian play. PayPal's 8.68 price-forward cash flow multiple, well over 60% below its five-year average, indicates a cash-generating company with solid growth even if headline growth is decelerating. Its 1.30 (non-GAAP) PEG ratio indicates reasonable pricing on growth expectations, and while its price-to-book multiples look rich due to asset-light business, that is what one expects for digital platforms with minimal physical capital. Effectively, PayPal is priced as if structurally challenged, but its fundamentals—free cash flow margins well above 21% and a solid $15B share repurchase plan—tell a better story. If management can execute on platform monetization and brand refresh, potential for stock re-rating is significant.

Navigating Uncertainty: Where the Fault Lines Lie

Even with improvements made recently, there are threats. Most prominent among these is branded checkout growth slowing down. Previously a growth driver for PayPal, this segment now contributes a decreasing percentage of TPV and is exposed to margin pressure due to merchant discounting and alternative wallets. Unless there is a definitive increase in branded adoption, revenue growth will remain below estimates.

Another aspect of risk is regulatory complexity. PayPal has a footprint in all major international markets and is subject to growing scrutiny on data privacy, BNPL lending, crypto services, and cross-border money movement. New EU proposals and CFPB regulation within the U.S. have the potential to impose compliance costs or limit product launch timetables. That the company depends on banking partners for product delivery and credit underwriting also involves counterparty risk.

Execution looms over all. The transition from a sprawling, growth-driven technology company into a lean, disciplined platform will require cultural and operational shifts. CEO Alex Chriss has outlined a clear plan, but implementing that plan will not occur at a rapid pace. Any missteps—especially on core product performance, developer satisfaction, or retention of partners—might slow down recovery or stoke investor skepticism all over again. In addition, the overall macro environment is not benign. Higher-for-longer interest rates, restraint on consumer spending, and foreign exchange uncertainty may act as a drag on TPV growth or profitability over the near term.

Therefore, PayPal's transformation is afoot but not completed. For investors ready to look beyond short-term noise, the combination of solid cash flows, global scale, and improved execution makes for a solid case. The next chapter will determine whether PayPal gets repriced as a lean fintech winner or remains rooted in its heritage.

Concluding Thoughts

PayPal’s story is no longer about disruption—it’s about disciplined reinvention. As the company pivots from hypergrowth to strategic scalability, it’s leveraging its global reach, free cash flow strength, and brand equity to navigate a crowded, fast-evolving payments landscape.

While the market may view it as yesterday’s fintech star, PayPal is quietly laying the groundwork for a comeback rooted in execution, not hype. The question isn’t whether it can grow like it once did—but whether it can evolve into a lean, durable platform that delivers consistent value in a new era of digital commerce.