How Trump's Potential Copper Tariffs Could Shift the US Stock Market?

TradingKey - The White House Last week highlighted growing concerns over U.S. reliance on imported copper to meet domestic consumption, announcing plans to evaluate national security risks posed by dependence on foreign copper supplies.

The review will assess vulnerabilities across imported raw copper ore, concentrate, alloys, scrap copper, and derivative products.While the U.S. holds significant copper reserves, constraints in smelting and refining capacity have kept it reliant on imports.The administration underscored the strategic need to strengthen domestic supply chains for manufacturing, infrastructure, and national security.

President Donald Trump remarked,"Like our Steel and Aluminum Industries, our Great American Copper Industry has been decimated by global actors attacking our domestic production. Tariffs will help build back our American Copper Industry and strengthen our National Defense. American industries depend on copper, and it should be MADE IN AMERICA—No exemptions, no exceptions!"

The market widely projects that Trump will impose tariffs on copper after the review concludes. According to TradingKey analyst Nick Li, U.S. copper import tariffs, currently ranging from 10% to 15%, could be raised to 20% or even higher.

CME Copper Prices Surge

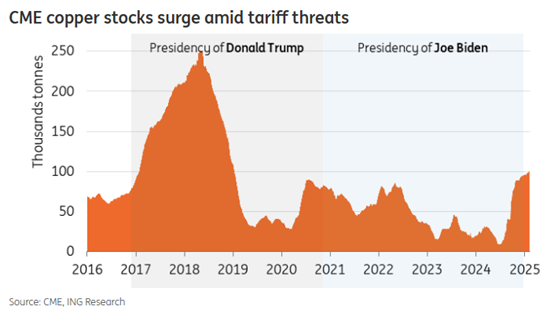

Concerns over potential tariffs have driven speculation that the U.S. copper market could experience temporary supply constraints. Traders have been shifting metal from global warehouses operated by the London Metal Exchange (LME) to the U.S. to capitalize on arbitrage opportunities. Copper imports into the U.S. have nearly doubled from the early 2024 average as market participants adjust to the anticipated policy shift.

A similar situation occurred during Trump’s first term when uncertainty surrounding tariffs led to a surge in Chicago Mercantile Exchange (CME) copper inventories, followed by a subsequent drawdown. Since Trump secured victory in the U.S. presidential election, copper inventories at CME have been steadily increasing, now exceeding 100,000 metric tons.

According to ING, U.S. copper prices have surged over 20% this year, marking their highest level since early 2024, while LME benchmark prices have risen approximately 10% yeartodate. If tariffs are imposed, New York copper prices could face further upside pressure.

Source: ING Research

Citi: Copper Tariffs May Take Effect by Q4 2025

In a report last Wednesday, Citi said the U.S. could introduce a 25% copper tariff in Q4 2025 after completing the official review ordered by Trump’s executive action.

The bank also warned that"effective duties on U.S. copper imports could come sooner via other channels, namely reciprocal tariffs, but also country specific duties like those announced on Canada and Mexico."

Additionally, as part of broader trade measures, reciprocal tariffs on copper imports could be imposed as early as Q2 2025. While the official review process could take up to 270 days—extending into late November 2025—Citi noted that previous cases, such as steel and aluminum tariffs, were expedited.

SupplySide Impact: Chile and Canada the Hardest Hit

According to a White House report, 45% of U.S. copper supply comes from imports. While the U.S. produced approximately 850,000 metric tons of mined copper in 2024, it remains dependent on imports from key trade allies to meet domestic demand.

Chile is the largest supplier, accounting for 38% of total U.S. copper imports, followed by Canada (28%) and Mexico (8%). Chile and Canada will likely take the biggest hit If the tariffs go into effect.

Meanwhile, Major global miners, such as Rio Tinto and BHP, have faced delays in the Resolution Copper project in Arizona due to resistance from Indigenous groups. However, the renewed focus on copper tariffs could potentially ease opposition to domestic mining expansion.

Source: Reuters

DemandSide Impact: Cost Pressures for Data Centers and EVs

Copper’s superior conductivity makes it vital for manufacturing. Tariffs on imports would raise costs for U.S. firms, cutting profits and global competitiveness. U.S. equities, driven by earnings growth, face risks as higher costs and lower market share threaten profits, pressuring valuations.

The Conference Board’s widely followed consumer confidence index fell7 points to 98.3 in February, marking the sharpest decline since August 2021 and significantly below Wall Street’s forecast of 102.5. Stephanie Guichard, Senior Economist of Conference Board, attributed the weakness partially to inflation concerns and the anticipated effects of tariffs."There was a sharp increase in mentions of trade and tariffs… Most notably, comments on the current administration and its policies dominated the responses," she said.

Nick Li noted that in the medium term, the increase in copper price costs, as well as the rise in copper tariffs and trade frictions, will have a negative impact on industries such as electric vehicle batteries, semiconductor chips etc. In response to the issue of supply chain complexity, the costs of chip manufacturing and electric vehicles may increase, and investment in infrastructure projects may slow down, ultimately leading to higher consumer prices.

The“digital demand” for copper is primarily driven by data centers, which require substantial amounts of copper for networking, cooling, and power infrastructure. AIdriven computing demands are expected to accelerate copper consumption. Projections indicate that data center electricity consumption could rise from 2% of global demand today to 9% by 2050, withdata center copper demand increasing sixfold over the same period.

NVIDIA’s data center business could be significantly impacted, particularly for AI servers and network infrastructure. Tech giants Microsoft and Amazon, which heavily rely on data centers, may also face substantial cost increases.

Copper is essential for low emission energy technologies such as wind, solar, and hydroelectric power, as well as for EVs and batteries. EVs require three times more copper than conventional internal combustion engine vehicles, meaning Tesla and Rivian would face notable cost increases.

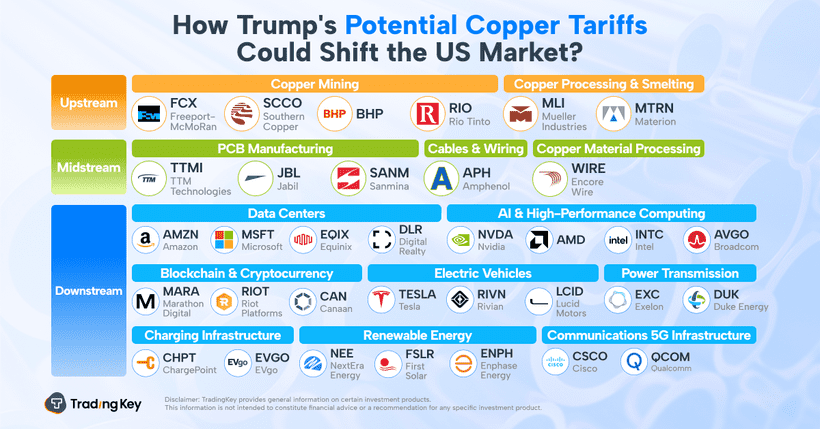

Here Are Stocks to Watch

Copper Mining:

FreeportMcMoRan (FCX): One of the world’s largest copper mining companies.

Southern Copper (SCCO): Major copper producer in Latin America.

Copper Processing & Smelting

Mueller Industries (MLI): Largest U.S. manufacturer of copper pipes and components.

Copper Material Processing

Encore Wire (WIRE): Manufacturer of copper wires for the construction & industrial sector.

Cables & Wiring

Amphenol (APH): Major global provider of cable connectors.

PCB (Printed Circuit Boards)

Jabil (JBL): Electronics manufacturing services.

Data Centers

Equinix (EQIX): World’s largest data center operator.

Digital Realty (DLR): Data center construction and cloud hosting services.

AI & HighPerformance Computing

NVIDIA (NVDA): Manufactures AI GPUs and data center accelerator chips.

AMD (AMD): AI accelerator chips, server CPUs, and GPUs.

Blockchain & Cryptocurrency

Marathon Digital (MARA): Bitcoin mining company.

Electric Vehicles

Tesla (TSLA): Electric vehicle manufacturer.

Rivian (RIVN): Focuses on electric pickup trucks.

Communications & 5G Infrastructure

Qualcomm (QCOM): Designs 5g Related chips and modules.

Charging Infrastructure

ChargePoint (CHPT): EV charging network operator.

Renewable Energy

NextEra Energy (NEE): World’s largest renewable energy company.

First Solar (FSLR): Manufacturer of solar photovoltaic modules.

Power Transmission

Duke Energy (DUK): Public utility company.