Here’s Why Nvidia Shares Fell 8% And Other US Tech Stocks Are Getting Hammered

TradingKey - It was an ugly day on Thursday (27 February) for US stocks as the initial optimism surrounding the earnings from tech giant Nvidia Corporation (NASDAQ: NVDA) quickly faded.

While the semiconductor giant had a solid earnings report for its Q4 FY2025, with Nvidia stock actually opening Thursday up over 4%, it retreated with intense selling taking place and ended the day down 8.5%.

That was also the story in broader markets in the US. The S&P 500 Index finished Thursday with a decline of 1.6% while the “tech wreck” continued with the Nasdaq Composite Index falling even more – closing the day down 2.8%.

Big tech stocks in the semiconductor space also suffered, with Broadcom Inc (NASDAQ: AVGO) down 7.1% while MicroStrategy Inc (NASDAQ: MSTR) – a proxy for the price of Bitcoin – plunged 8.8%.

So, why did Nvidia and other tech stocks fall so heavily? And what should investors be aware of as US technology stocks continue to post big declines?

Markets are watching the “Big T” of tariffs

For investors, right now, all eyes are focused on President Trump and his tariff announcements. The reasons for that are manifold. First off, tariffs can potentially increase inflation as the cost of higher goods entering the US get passed on to consumers.

Indeed, President Trump admitted this himself in mid-February when he said “Prices could go up somewhat short-term” and that American consumers could face “some short-term disturbance” when the US imposes tariffs on foreign goods.

That’s a big problem because it also leads to the second issue – higher inflation expectations from consumers themselves. Policymakers at the US Federal Reserve (Fed) fret that higher forward-looking expectations of inflation can actually be a self-fulfilling prophecy that leads to higher prices.

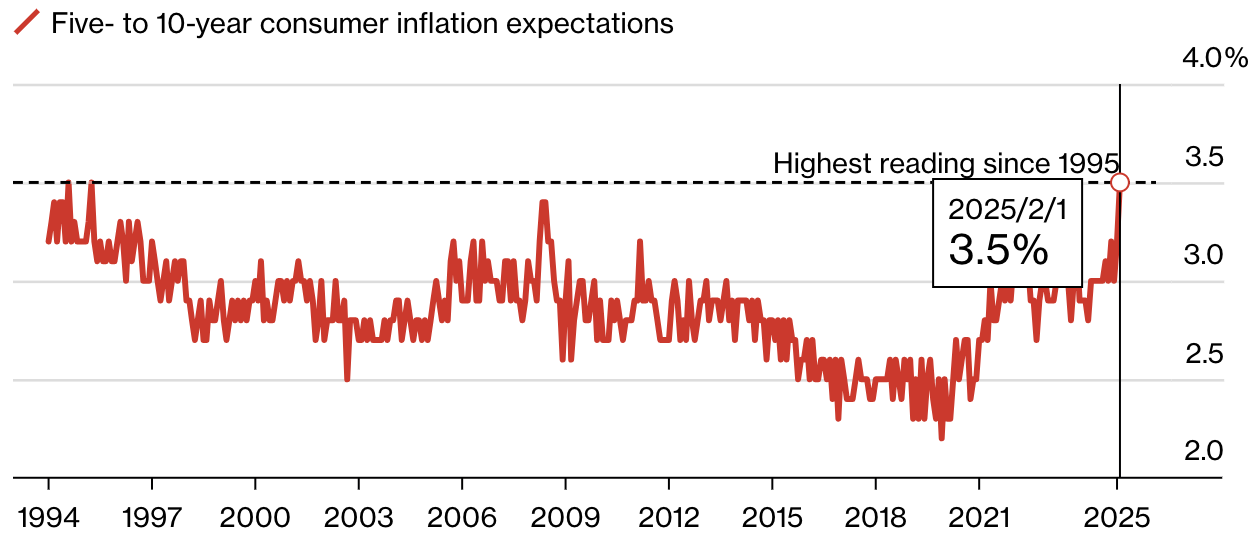

Unfortunately for investors, that’s being borne out in the data and those data points are not looking good to the market. In the latest monthly survey of long-term inflation expectations for February 2025, carried out by the University of Michigan and having been released a few days ago, Americans now expect prices to rise at an annual average of 3.5% over the next five to 10 years.

Americans’ long-term expectations of inflation hit highest level since 1995

Sources: University of Michigan, Bloomberg

The problem with that is that indicator is at its highest point since April 1995, hitting a near-30-year high. With higher expected inflation, the fear from the Fed’s point of view is that higher inflation will then become entrenched – leading to a potentially vicious cycle of higher expectations and, thus, higher inflation.

Read More: Nvidia Stock Drops Post-Earnings, But Analysts Remain Bullish—Here’s Why

The US economy is also slowing

Another big problem facing the market is that the US economy is also slowing. While GDP growth remains relatively robust, the job market is starting to slow significantly – as evidenced by lower non-farm payrolls reports in recent months.

On Thursday (27 February), data also came out that showed that weekly jobless claims in the US hit 242,000 for the week ending 22 February 2025. That was up 22,000 from the prior week’s revised level and was also easily higher than the consensus estimate for 225,000 in jobless claims.

With a weakening job market and higher expected inflation, the Fed is faced with a conundrum on the policy front: having to hold rates higher when the US economy weakens further to ensure inflation doesn’t get out of control or – the worst case scenario – having to actually raise interest rates to kill off inflation.

If the Fed does that then it’s likely to plunge the weakening US economy into a full-on recession. And what happens when recessions occur? Companies’ earnings get hit hard and that’s not what investors want to see.

That’s one big reason why tech stocks have been falling after such a strong run. With higher valuations – but still strong earnings – any slowdown in earnings growth this year could really hit the US tech market hard.

Where next for investors and US tech stocks?

In the immediate short term, the big data point to watch will be the Fed’s preferred gauge of inflation: the Personal Consumption Expenditures (PCE) Index, which is due to be released before the market open in the US today (Friday 28 February).

That will highlight whether the recently higher inflation readings in the US were a blip or if it’s starting to become a worrying trend.

Longer term, investors should be watching exactly what the Fed is looking at – signs that higher inflation is becoming entrenched in the economy while also monitoring signs of weakness in the US economy – particularly on the labour market and consumer fronts.

For investors, the next few weeks are sure to be rocky but if the data turn out to be better than expected and worries recede on the inflation front, then the current sell-off could present an interesting buying opportunity for long-term investors.