Buffett Stands by Equities as Berkshire’s Top Choice Despite Net Selling

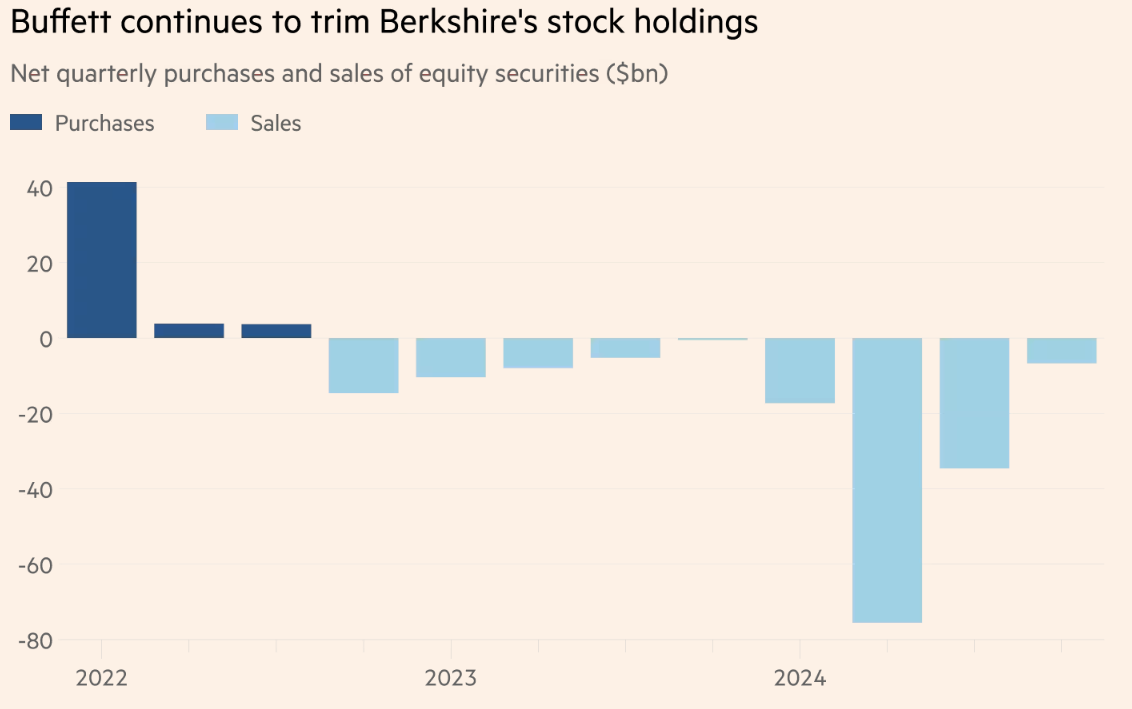

TradingKey - Berkshire Hathaway reported strong fourth-quarter operating earnings, primarily driven by its insurance business. Notably, despite the US stock market rally and soaring corporate valuations over the past two years, Buffett has continued to be a net seller of stocks.

Ongoing Equity Reductions in Q4

In Q4 2024, Berkshire further reduced its holdings in banking stocks. The company offloaded nearly 75% of its stake in Citigroup, selling 40.6 million shares worth more than$2.4 billion. It also continued to unwind itsBank of America position, cutting 95 million shares since mid-October, bringing its ownership down to approximately 8.9%.

While Buffett was exiting banking stocks, investor sentiment toward the sector reached its most optimistic level in years, partly due to President Donald Trump’s pledge to ease industry regulations. TheKBW Bank Index, which tracks major U.S. banks, rose approximately 40% last year.

Berkshire made justone new stock purchase in Q4, investing$1.2 billion in Constellation Brands, the maker of Modelo beer.

Source: FT

Equities Are Still Berkshire's Top Choice

Berkshire spent less than $3 billion on share repurchases in the first three quarters of 2024, and halts buybacks entirely in Q4 and early 2025. This marks a shift from previous years, in which Berkshire aggressively repurchased nearly$70 billion in shares over four years.

Stock sales and reduced buybacks drove Berkshire’s cash reserves to nearly double, rising from 168 billion to over 334 billion. Buffett has repeatedly noted that high market valuations have made it more challenging to find attractive deals. Therefore, he has become more inclined to moving capital out of equities and allocating large amounts of cash into the U.S. Treasury.

In his annual letter to shareholders, Buffett reaffirmed Berkshire’s continued commitment to equities even with these cautious moves: "Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities — mostly American equities, although many of these will have significant international operations. That preference won’t change."

He also noted that although the company's ownership in publicly traded stocks declined last year, the value of its private equity holdings increased and remains significantly greater than its publicly traded portfolio.

The value of Berkshire Hathaway's nearly 200 privately held subsidiaries, including ice cream chain Dairy Queen and lingerie manufacturer Fruit of the Loom, has increased. This underscores that the vast majority of Berkshire’s investments remain in the form of privately owned businesses and a stock portfolio.

Higher Short-Term Treasury Yields Boost Insurance Income

Berkshire Insurance division had yet another strong year in 2024. The insurance division reported $11.6 billion in investment income, primarily earned fromTreasury security holdings, significantly outpacing dividend income from equity investments.

Buffett stated, "We benefited from a predictable rise in investment income as Treasury bill yields improved and we significantly increased our holdings of these highly liquid short-term securities."

Despite hurricanes Helen and Milton causing approximately $1.2 billion in losses to Berkshire’s reinsurance and insurance operations, underwriting results still improved.

Additionally, Berkshire's Q1 2025 results will reflect losses related to the January Los Angeles wildfire. The company disclosed that its insurance group currently estimates a pre-tax loss of around $1.3 billion from the event.

Japanese Trading Houses Remain a Key Long-Term Bet

Buffett continues to express confidence in the five major trading houses, noting that the five companies tend to raise dividends at appropriate times, buy back shares when reasonable, and take a much less aggressive approach to executive compensation compared to their U.S. counterparts.

Mitsubishi, Mitsui, Itochu, Sumitomo, and Marubeni have agreed to allow Berkshire to surpass the previously agreed 10% ownership threshold. Buffett indicated that Berkshire’s stake in these companies may increase over time and emphasized that the company’s future leaders would maintain positions in Japanese firms for decades to come.

The "Oracle of Omaha" further highlighted Berkshire’s expected 812 million in dividend income from Japan investments in 2025,compared to approximately 135 million in interest expenses on its Debt issued in yen.

However, it is worth noting that Japan’s five major trading companies have struggled over the past year. Itochu and Marubeni have each declined more than 8%, while Mitsubishi has dropped 26%. Meanwhile, Mitsui and Sumitomo have fallen 16% and 10%, respectively, over the same period.