The Best Stocks to Invest $1,000 in Right Now

A $1,000 investment might not seem like much in the stock market today. But with commission-free and fractional trades, it's now easier than ever to build up positions in stocks that are trading at a few hundred or thousand dollars per share.

For conservative investors, it might be smarter to simply invest $1,000 in an S&P 500 index fund or exchange-traded ETF to keep pace with the market. But if you're looking for a bit more growth or income, you should consider investing that $1,000 into the chipmaker Nvidia (NASDAQ: NVDA) or the telecom giant Verizon Communications (NYSE: VZ). Here's why.

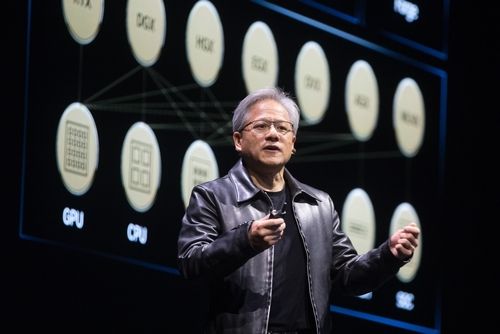

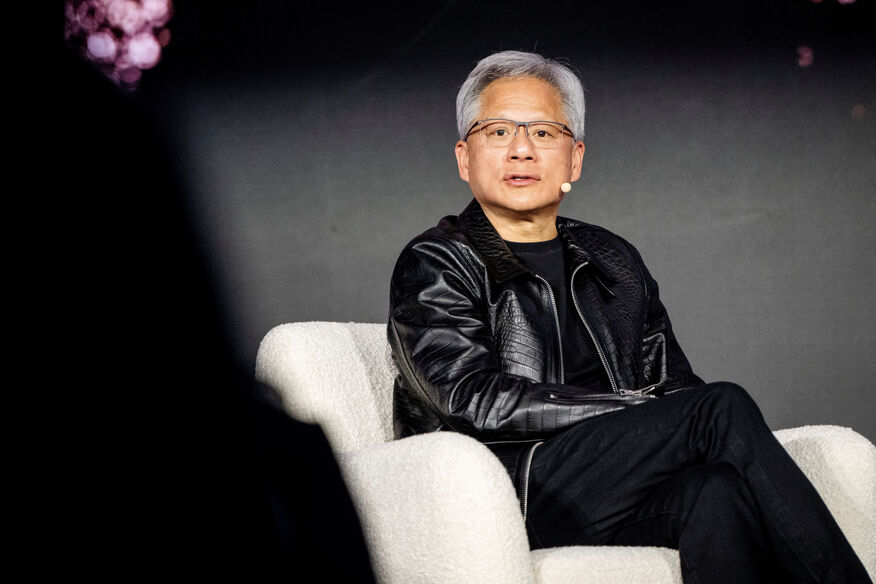

The growth stock: Nvidia

Nvidia's stock has soared nearly 2,040% over the past five years. Most of that rally -- which would have turned a modest $1,000 investment into more than $21,300 -- was driven by its surging sales of data center GPUs for processing artificial intelligence (AI) tasks. Unlike CPUs, which process single pieces of data individually, GPUs can process a wide range of integers and floating point numbers simultaneously through scalar processing.

That makes them well-suited for rendering demanding graphics, mining smaller cryptocurrencies, and processing large amounts of data for AI applications. Nvidia now supplies more than 98% of the world's data center GPUs, and that market should continue to grow as generative AI applications continue to evolve and expand.

From fiscal 2024 (which ended in January 2024) to fiscal 2027, analysts expect Nvidia's revenue and EPS to grow at a compound annual growth rate (CAGR) of 57% and 65%, respectively. Those growth rates are explosive, yet Nvidia's stock still looks reasonably valued at 31 times forward earnings.

Its valuations might be compressed by some near-term concerns regarding tighter export curbs, higher tariffs, and potential antitrust probes, but it will keep selling the best picks and shovels for the AI gold rush. So even if you missed out on Nvidia's historic rally over the past few years, it's still a good idea to park some cash in this bellwether of the booming AI industry.

The dividend stock: Verizon

Verizon was once considered a stable blue chip dividend stock, but it lost about a third of its value over the past five years as it struggled to expand its core wireless business. But after that steep decline, the telecom giant's stock trades at just nine times forward earnings and pays a high forward dividend yield of 6.9%. By comparison, AT&T trades at 12 times forward earnings and pays a lower forward yield of 4.9%.

Verizon traded at a discount to AT&T over the past few years because it was gaining wireless customers at a slower clip and relying more heavily on discounts to stay competitive. But in 2024, Verizon more than doubled its postpaid phone net additions compared to 2023. It achieved that acceleration by localizing its incentives and marketing campaigns, expanding its customizable "myPlans", and growing its distribution business with Walmart. It also expanded its prepaid business by acquiring TracFone. It expects its wireless revenue to rise another 2%-2.8% in 2025.

As Verizon gained more customers again, its wireless retail churn rate declined from 1.67% in 2023 to 1.62% in 2024. The operating margins of its consumer and business segments expanded for the full year, while its free cash flow (FCF) rose 6% to $19.8 billion and easily covered its $11.2 billion in dividend payments. In short, Verizon is a good way to earn some income as interest rates gradually decline. A simple $1,000 investment in Verizon would net an extra $69 in extra dividends every year.