Is Amazon a Buy, Sell, or Hold in 2025?

It took a while, but e-commerce giant Amazon (NASDAQ: AMZN) finally topped its all-time high, last seen in 2021. You might be nervous since the broader market has continued to rip higher, a reminder of 2021, which, in hindsight, was primarily due to a market bubble caused by 0% interest rates.

But Amazon is a different company now than just three years ago. Everyone knows about the e-commerce business, which owns about 40% of America's online shopping market, but the company's Q3 earnings hammered home some encouraging truths about Amazon's future.

I'll outline what excites me for 2025 and beyond and whether the stock, up 37% over the past year, is a buy, sell, or hold.

Amazon's growing the most in the right places

Most people know Amazon started selling books online in the late 1990s and has evolved into a juggernaut that offers a seemingly unbeatable combination of product selection, low prices, and fast delivery that has fueled the company's rise to control about 40% of America's e-commerce sales. However, Amazon is an exceptional company because it has successfully leveraged its e-commerce business to create additional businesses.

Amazon sells products online at thin margins to keep competition at bay. So it's great news that Amazon is growing the fastest in segments that can contribute more to the company's bottom line.

Specifically, I'm looking at:

- The cloud computing segment, Amazon Web Services (AWS), grew 19% year over year in Q3.

- Subscription services, which include Prime memberships, grew 11% year over year.

- Advertising, ads shown to online shoppers, and streamed video grew 19% year over year.

Amazon doesn't break out its operating income for each specific segment; instead, it divides it into three categories: North America, International, and AWS. However, AWS alone accounted for $10.4 billion of Amazon's total operating profit of $17.4 billion (60%) in Q3, despite AWS only representing 17% of sales.

In other words, you want Amazon's fastest-growing segments to be these higher-margin areas because that will move the needle on the bottom line faster.

Cash flow is piling up as a result

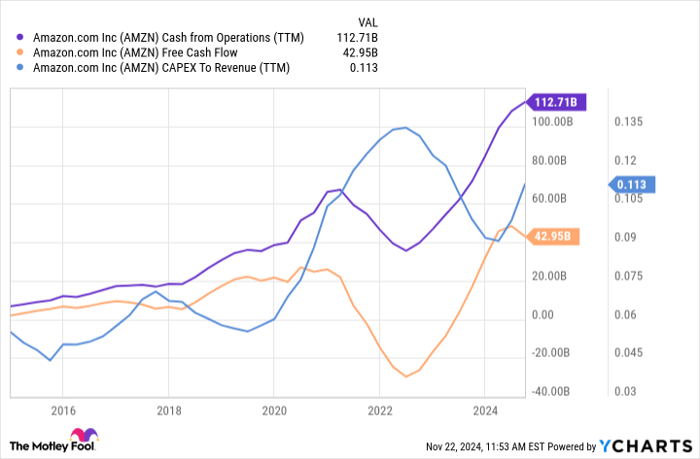

That's exactly what's happening. You can see a few things in the chart below.

AMZN Cash from Operations (TTM) data by YCharts

First, notice how Amazon's cash flow from operations (day-to-day business activities) has exploded higher over the past few years. It has pushed Amazon's free cash flow higher, despite the company continually investing more of its sales back into the business. Amazon has invested in logistics to support its e-commerce business and in AWS to expand its computing capacity to support growth and new opportunities in artificial intelligence (AI).

If these high-margin segments weren't growing, increasing Amazon's capital expenditures from 4% to 6% of sales to 11% to 13% would dramatically slow earnings growth. Yet Amazon's earnings have soared over the past couple years, and analysts estimate they will grow by an average of 28% annually over the next three to five years.

Is Amazon stock a buy, sell, or hold?

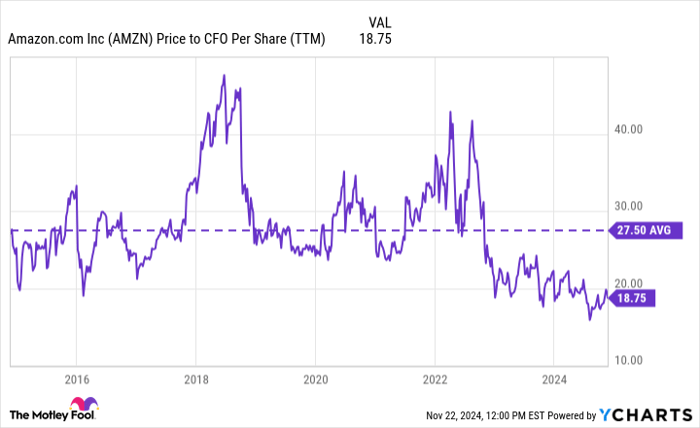

Amazon invests so much money in the business that valuing the stock based on a snapshot of earnings can be misleading. Instead, I would like to compare the stock to the company's cash flow from operations because it's a more steady measure of its performance.

The chart suggests that Wall Street doesn't yet appreciate how much cash Amazon generates compared to three years ago. The company's surging cash flow has pushed Amazon's valuation to roughly 30% below its decade average and its lowest levels since about 2016:

AMZN Price to CFO Per Share (TTM) data by YCharts

Looking ahead, it seems likely that Amazon's ad business and AWS continue growing for the foreseeable future. AWS is poised to benefit from AI, which still appears to be in its early innings, while Amazon continues investing in bringing eyeballs to Prime Video. The company will start broadcasting more live sports in 2025, including the NBA and Nascar.

Consider Amazon stock a compelling buy for long-term investors.