[IN-DEPTH ANALYSIS] Canada: Why Shorting the CAD Seems Like a Sure Thing?

Executive Summary

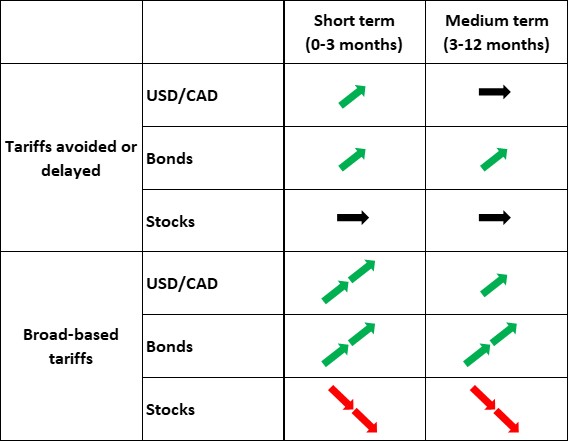

This article analyses the Canadian dollar (CAD) exchange rate under two scenarios: 1) Tariffs avoided or delayed; 2) Broad-based tariffs imposed. In Scenario 1, due to Canada’s dim economic outlook, declining inflation, a more dovish Bank of Canada (BoC) compared to the Federal Reserve (Fed) and a "rise-then-fall" trajectory for the USD Index, we expect CAD to weaken slightly in the short term (0-3 months) before stabilizing in the medium term (3-12 months). In Scenario 2, broad-based tariffs would significantly impact Canada’s economy and policy, leading to a sharp CAD depreciation.

* Investors can directly or indirectly invest in the foreign exchange market, bond market and stock market through passive funds (such as ETFs), active funds, financial derivatives (like futures, options and swaps), CFDs and spread betting.

Note:

1. Macroeconomics

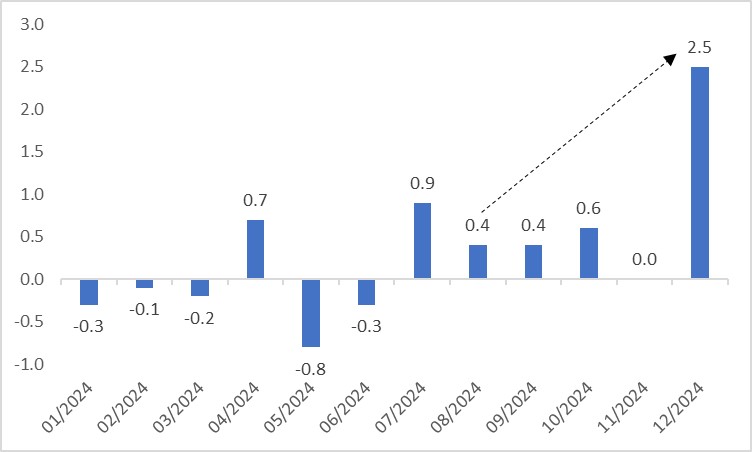

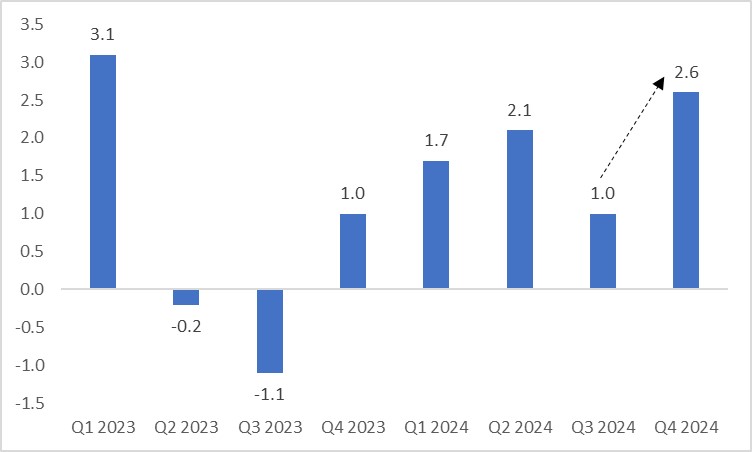

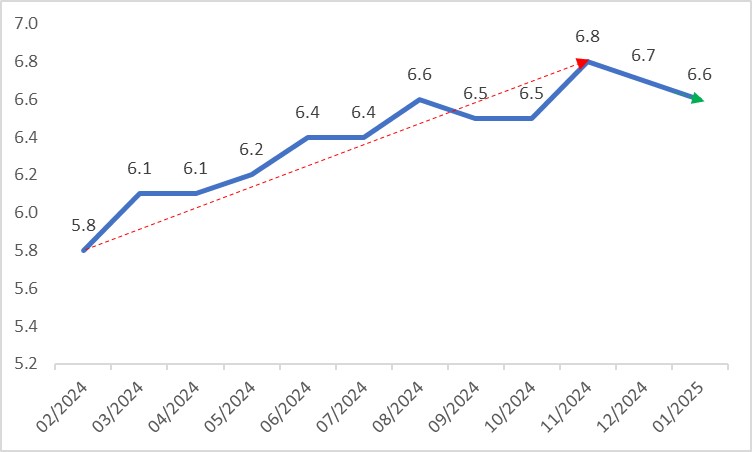

After a sluggish 2023 and a tepid recovery in 2024, Canada’s economy rebounded late in 2024. Strong household spending during the holiday season drove a 2.5% month-on-month surge in December retail sales (Figure 1A), pushing Q4 2024 annualized real GDP growth to 2.6%—the highest since Q2 2023 (Figure 1B). This uptick also bolstered the labour market, with the unemployment rate falling for two consecutive months to 6.6% in January 2025 (Figure 1C).

Looking ahead, Canada’s economic trajectory hinges heavily on U.S. tariff policies. On 4 March 2025, the U.S. imposed a 25% tariff on Canadian imports, citing Canada’s alleged failure to curb illegal immigration and fentanyl inflows. However, on 5 March, the U.S. delayed new tariffs on autos from Canada and Mexico for one month. Given the uncertainty surrounding Trump-era policies, we evaluate two scenarios: 1) Tariffs avoided or delayed; 2) Broad-based tariffs implemented.

Figure 1A: Canada retail sales (m-o-m, %)

Source: Refinitiv, Tradingkey.com

Figure 1B: Canada's real GDP growth (annualized, %)

Source: Refinitiv, Tradingkey.com

Figure 1C: Canada unemployment rate (%)

Source: Refinitiv, Tradingkey.com

1.1 Macroeconomics Under Tariffs Avoided or Delayed

Even if the Trump administration avoids or delays high tariffs, Canada faces two major challenges:

- Tightened Immigration Policy: Slower population growth continues capping aggregate demand.

- U.S. Economic Slowdown: As Canada’s largest export market, a weakening U.S. economy (e.g., Atlanta Fed’s -2.8% Q1 2025 GDP forecast) will dampen demand for Canadian goods, hurting exports.

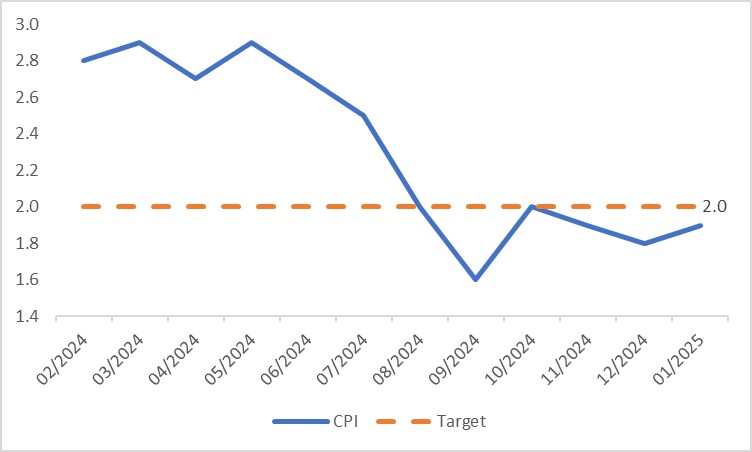

On inflation, Canada’s CPI has fallen below the BoC’s 2% target since September 2024 (Figure 1.1). Amid economic headwinds and low inflation, the BoC is expected to continue cutting rates, further widening the policy gap with the Fed.

Figure 1.1: Canada CPI (%)

Source: Refinitiv, Tradingkey.com

1.2 Macroeconomics Under Broad-Based Tariffs

If the U.S. imposes broad-based tariffs, Canada’s economy will feel the impact primarily through trade channels:

- Oil Sector: Canada, the world’s fourth-largest oil producer, exports 80% of its output, with the U.S. as its top buyer. Tariffs on oil imports would slash Canadian energy exports, slowing GDP growth.

- Other Goods: A 25% tariff on non-energy exports would reduce U.S. demand, but Canada could mitigate some effects via third-country re-exports, softening the blow relative to market fears.

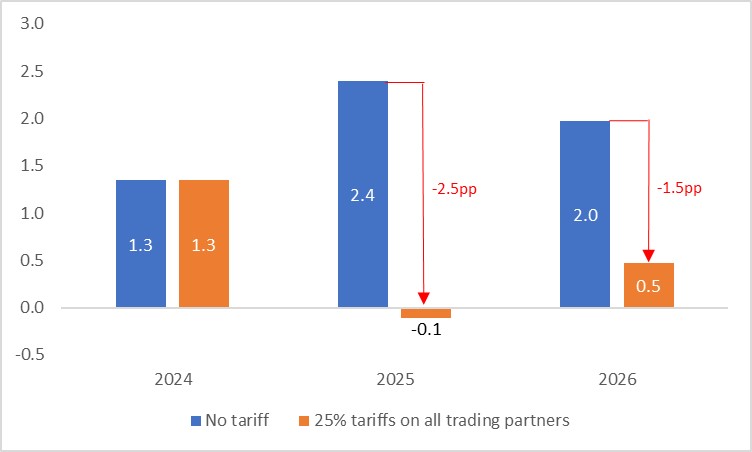

Per BoC estimates, a uniform 25% U.S. tariff on all trading partners would cut Canada’s GDP by 2.5 percentage points in 2025 and 1.5 points in 2026 (Figure 1.2). A stalling or contracting economy would force the BoC into aggressive rate cuts.

Figure 1.2: Canada's GDP declines if the US imposes a 25% tariff on all trading partners (%)

Source: Refinitiv, IMF, Tradingkey.com

2. Exchange Rate (USD/CAD)

2.1 USD/CAD Under Tariffs Avoided or Delayed

Even without high tariffs, CAD faces short-term (0-3 months) downside pressure for three reasons:

- Bleak Economic Outlook: Despite a late 2024 GDP uptick, per capita GDP has slumped to 2016 levels in 2023-2024, signalling structural weakness.

- High Private-Sector Debt: Elevated leverage has driven corporate bankruptcies to multiyear highs, weighing on growth.

- Dovish BoC vs. Fed: Canada’s economic softness and low inflation will keep the BoC more dovish than the Fed, widening the policy rate differential.

We expect the USD Index to rise then fall (see “[IN-DEPTH ANALYSIS] US: Will the USD Index Decline Irreversibly from Today Onward?, published March 3, 2025”). In the medium term (3-12 months), USD/CAD should stabilize in a range.

It’s worth noting that, as a major resource-exporting country, Canada’s economy and currency are closely tied to commodity prices, particularly oil. Rising oil prices improve Canada’s terms of trade, boost export revenues, and tend to strengthen the CAD. Conversely, falling oil prices have the opposite effect. Thus, significant fluctuations in oil prices moving forward could impact our baseline forecast for the USD/CAD exchange rate.

2.2 USD/CAD Under Broad-Based Tariffs

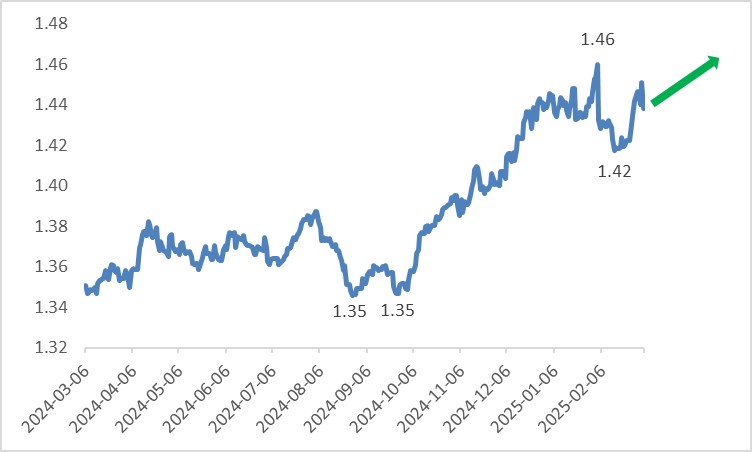

Broad-based tariffs would crater Canadian exports, severely weakening the economy and triggering sharp CAD depreciation. To avert a crisis, the BoC would likely accelerate rate cuts, widening the policy gap with the Fed beyond current expectations and adding further pressure on CAD. Additionally, higher U.S. tariffs could curb imports, shrink the U.S. trade deficit and bolster the U.S. dollar. Thus, under tariffs, CAD would weaken significantly. Even if the USD Index softens midterm, USD/CAD would still climb (Figure 2).

Figure 2: USD/CAD

Source: Refinitiv, Tradingkey.com

3. Bonds

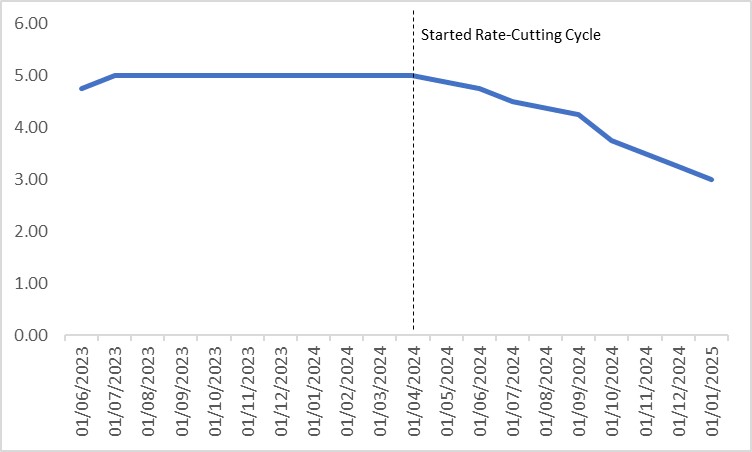

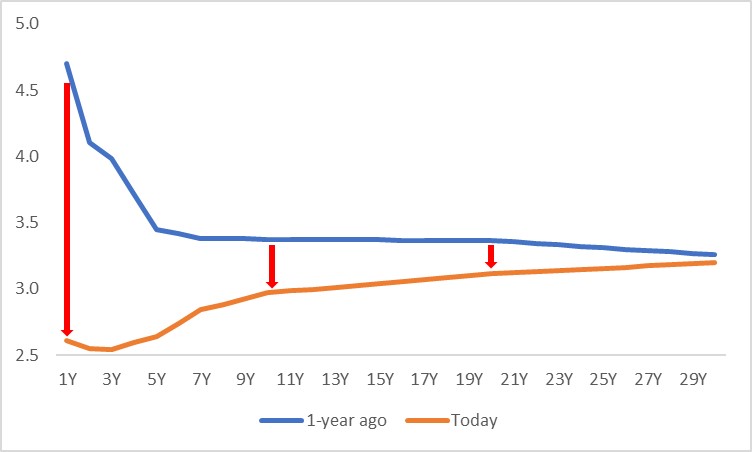

Since June 2024, the BoC has cut its policy rate by 200 basis points to 3.25% (Figure 3.1). If tariffs are delayed, further cuts will be moderate. However, under broad-based tariffs, the BoC would slash rates aggressively. In either case, the Canadian yield curve will shift downward, with short-end yields dropping more than long-end yields (Figure 3.2). Under sustained high tariffs, the curve would decline sharply across all maturities.

Figure 3.1: BoC policy rate (%)

Source: Refinitiv, Tradingkey.com

Figure 3.2: Canadian government bond yield curve (%)

Source: Refinitiv, Tradingkey.com

4. Stocks

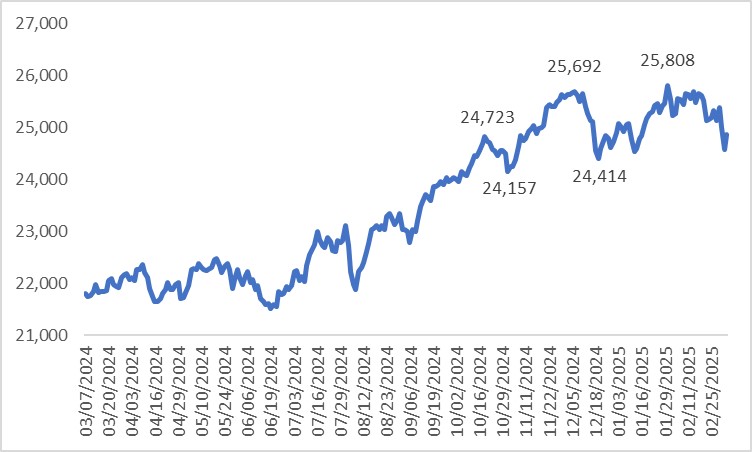

Stock valuations hinge on earnings (numerator) and interest rates (denominator).

- Tariffs Avoided or Delayed: Economic weakness (earnings drag) offsets BoC rate cuts (valuation lift), likely leaving Canadian equities in a volatile range (Figure 4.1).

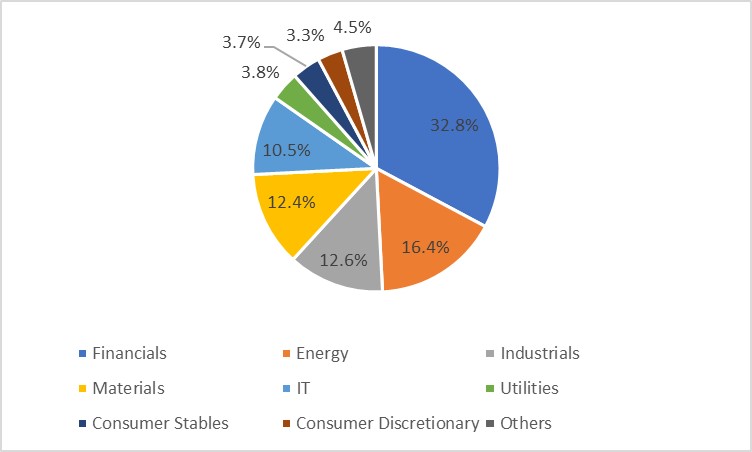

- Broad-Based Tariffs: Stocks would likely fall. In terms of sector breakdown (Figure 4.2), energy firms would lose competitiveness in U.S. markets, hurting revenues and share prices. The integrated North American auto sector would face higher costs, pressuring Canadian automakers’ stocks.

Figure 4.1: S&P/TSX Composite

Source: Refinitiv, Tradingkey.com

Figure 4.2: S&P/TSX Composite breakdown (as of 28 February 2025)

Source: Refinitiv, Tradingkey.com