[IN-DEPTH ANALYSIS] UK: GBP Will Weaken Against USD While Strengthening Against EUR

Executive Summary

On the GBP side of the GBP/USD pair, the UK’s economic recovery, rising inflation and our expectation of smaller-than-anticipated interest rate cuts by the Bank of England (BoE) provide support for the pound against non-USD currencies. On the USD side, we expect the USD Index to rise initially before declining. After assessing the relative strength of the driving factors on both sides of this currency pair, we anticipate a slight decline in GBP/USD in the short term (0-3 months). Over the medium term (3-12 months), we expect the pair to stabilize. Additionally, due to differences in economic strength, monetary policy and political risks, we believe the pound will strengthen against the euro in the short term.

1. Macroeconomics

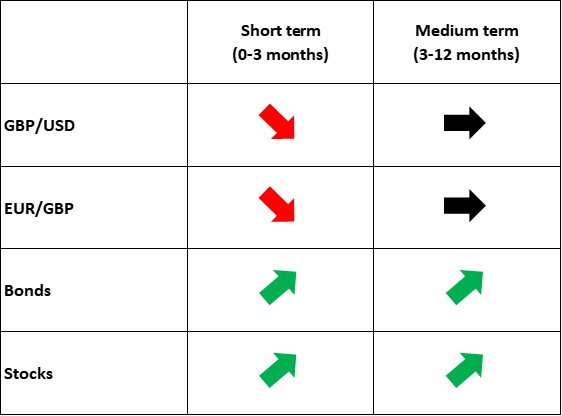

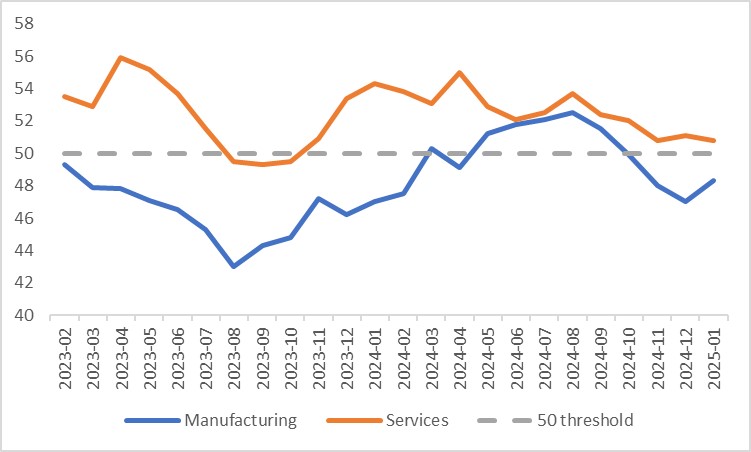

Last year, the UK economy experienced significant volatility. After a strong start in 2024, growth showed signs of softening but rebounded toward year-end. A 1.4% year-on-year GDP increase in Q4 locked in annual growth of 0.9% for 2024. Breaking down GDP components, both manufacturing and services showed notable improvement, corroborated by UK PMI data. Although the S&P Global/CIPS Manufacturing PMI remains below the 50 threshold, it has risen for two consecutive months. The Services PMI, despite fluctuations, has consistently stayed above 50, signalling sustained growth in the UK services sector (Figure 1.1).

In the labour market, increases in National Insurance Taxes and the National Living Wage, alongside the potential introduction of the Employee Bill of Rights, may dampen corporate hiring intentions. Nevertheless, the UK labour market remains broadly healthy. The unemployment rate has hovered slightly above 4%, below its historical average. Average earnings growth over the three months ending December 2024 reached 6% year-on-year, marking four consecutive months of rising growth rates. Looking ahead, with economic stabilization taking hold and a robust labour market, we project UK GDP growth of 1.1% in 2025—well above the BoE’s latest forecast of 0.75% (Figure 1.2).

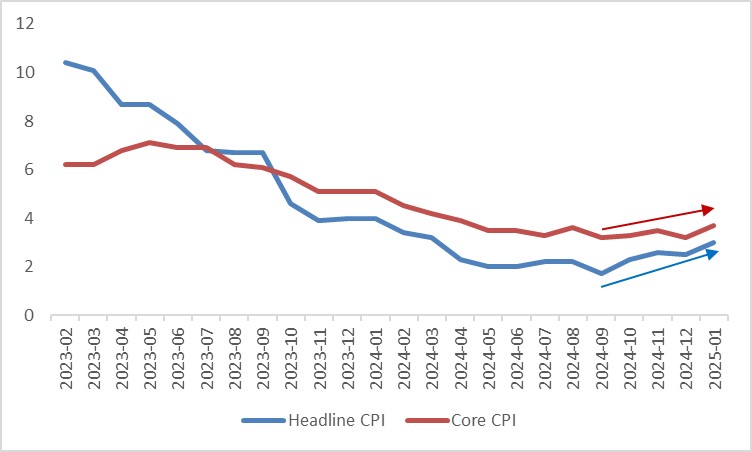

Inflation in the UK faces an upside risk. Driven by strong wage growth, supply constraints and a depreciating pound, both headline CPI and core CPI bottomed out in September 2024 and climbed to 3% and 3.7%, respectively, by January 2025—far exceeding the BoE’s 2% target (Figure 1.3). On 6 February, the BoE cut rates by 25 basis points, lowering the policy rate to 4.5%. Looking forward, given the stronger-than-expected economic recovery and rising inflation expectations, we anticipate an additional 50 basis points reduction by year-end 2025, bringing the rate to 4%—well above the 3% predicted by dovish economists.

Figure 1.1: UK PMI

Source: Refinitiv, Tradingkey.com

Figure 1.2: UK GDP forecasts (%), Tradingkey vs. BoE

Source: BoE, Tradingkey.com

Figure 1.3: UK inflation (%)

Source: Refinitiv, Tradingkey.com

2. Exchange Rate (GBP/USD)

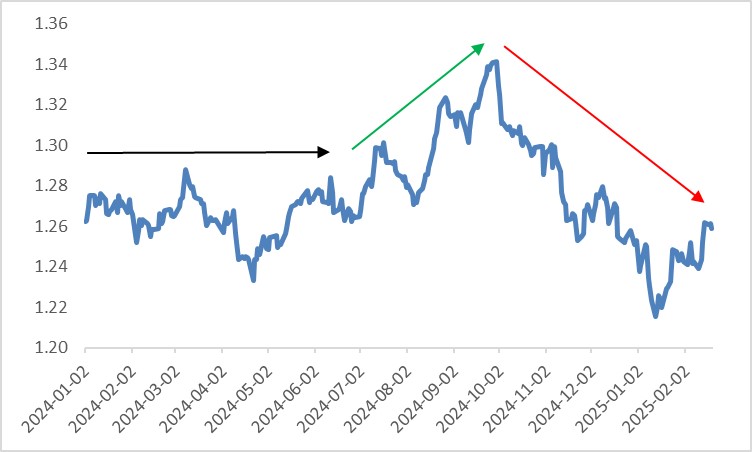

Similar to the macroeconomy, in 2024, GBP/USD saw significant volatility. In the first half of the year, declining UK inflation led investors to expect the BoE’s monetary policy to align closely with the Fed’s, resulting in a range-bound pound. However, in Q3, while BoE rate cut expectations held steady, rising expectations of Fed cuts drove the pound sharply higher. By Q4, the narrative flipped: diverging economic data between the US and the UK led investors to anticipate larger BoE cuts relative to the Fed, causing the pound to weaken (Figure 2).

Looking ahead, we expect the BoE’s rate cuts to be smaller than currently anticipated, limiting the widening of the US-UK policy rate differential. This, combined with the UK’s ongoing economic recovery and rising inflation, provides upward support for the pound. On the USD side, factors such as the “Trump Trade” and weaker-than-expected Fed rate cuts will likely bolster the USD Index in the short term (0-3 months). With supportive factors on both ends of the pair, the dollar’s strength is expected to dominate, leading to a slight GBP/USD decline in the short term. Over the medium term (3-12 months), as the Trump Trade fades and the Fed resumes rate cuts, dollar strength will wane, stabilizing GBP/USD.

Against the euro, the UK’s stronger economy, lower political risk and less aggressive BoE rate cuts compared to the ECB suggest EUR/GBP will weaken in the short term.

Figure 2: GBP/USD

Source: Refinitiv, Tradingkey.com

3. Bonds

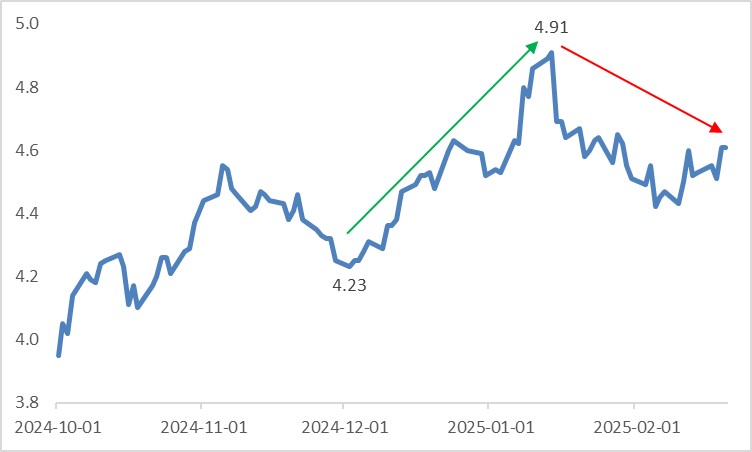

Concerns over fiscal challenges drove UK 10-year gilt yields from a low of 4.23% on 2 December 2024 to a high of 4.91% on 13 January 2025. Subsequently, as fiscal consolidation eased concerns, yields began to retreat (Figure 3.1).

Looking forward, the BoE remains in a rate-cutting cycle and lower policy rates may pull gilt yields down. However, our projected 50 basis point cut—smaller than the consensus of 75 basis points and far below the 150 basis points forecast by dovish economists—suggests limited downside for yields. On duration, the modest decline in the gilt yield curve implies it is unlikely to steepen or flatten significantly.

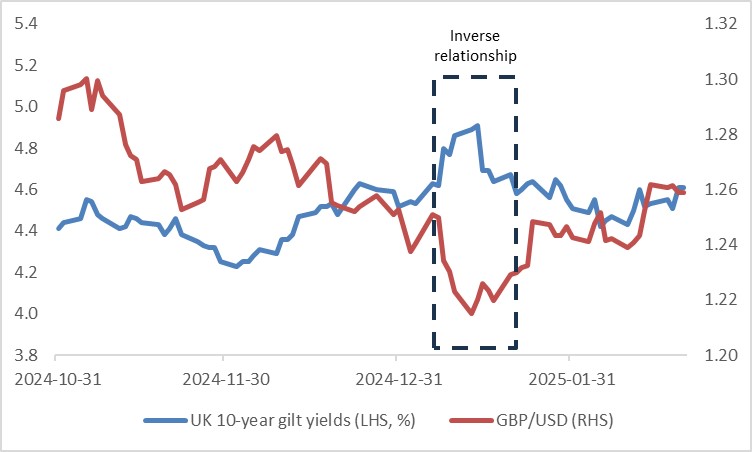

In January, fiscal concerns triggered an inverse relationship between gilt yields and the pound (i.e., rising yields vs. a falling GBP/USD) (Figure 3.2). We see a low likelihood of this dynamic repeating in 2025. Thus, a slight decline in gilt yields may contribute to a modest GBP/USD drop.

Figure 3.1: UK 10-year gilt yields (%)

Source: Refinitiv, Tradingkey.com

Figure 3.2: UK 10-year gilt yields vs. GBP/USD

Source: Refinitiv, Tradingkey.com

4. Stocks

The UK stock market broke out of its range-bound pattern starting from May last year, surging since the start of 2025 (Figure 4). The economic recovery has boosted corporate revenues and profits, lifting stock prices from the numerator of the valuation equation. Going forward, a more certain recovery should continue to support UK equities.

Moreover, UK stock valuations remain low, particularly for the FTSE 350, which trades well below its historical average. A surge in M&A activity in 2024 underscores this, reflecting corporate investors’ recognition of a valuation discount. High dividend yields further enhance the appeal of UK stocks. Amid rising trade protectionism, investors should monitor Trump’s tariff policies. However, the UK—as a steadfast US ally—faces fewer tariff risks.

Compared to Europe (including the UK), the US economy exhibits greater resilience. Among indices, we favour the FTSE 100—where USD revenue exposure is higher—over the FTSE 250.

Figure 4: FTSE 100

Source: Refinitiv, Tradingkey.com