[IN-DEPTH ANALYSIS] Trump Policies: Market Overreacted, Remain Bullish on Stocks

Executive Summary

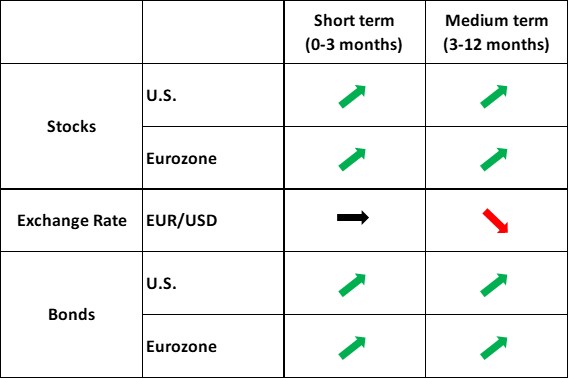

There’s no doubt that Trump’s high tariffs and retaliatory measures from trade partners alone could dampen the upward momentum of U.S. and European stock markets. However, Trump’s potential domestic tax cuts, the Federal Reserve’s renewed rate-cutting cycle, the eurozone’s shift to a low-interest-rate environment, fiscal stimulus and the growing likelihood of a Russia-Ukraine ceasefire all bode well for these markets. We believe the market is currently overemphasizing the impact of tariffs while overlooking other economic and political factors. In summary, we remain bullish on both U.S. and European stocks.

* Investors can directly or indirectly invest in the stock market, foreign exchange market and bond market through passive funds (such as ETFs), active funds, financial derivatives (like futures, options and swaps), CFDs and spread betting.

Note: While we maintain an optimistic outlook on the stock market’s short-term performance (0-3 months), this does not guarantee an upward trend in the ultra-short term (the next 1 week to 1 month). Due to uncertainties surrounding Trump’s policies, stock prices may still face downward risks in the ultra-short term.

1. Introduction

Since Donald Trump’s inauguration in January 2025, his rhetoric, actions and signed agreements have already sparked turbulence in economies, businesses and markets. His “America First” and “Make America Great Again (MAGA)” slogans, erratic policymaking and business-minded governance approach signal an extraordinary period ahead for the U.S. and the world. The only certainty may be “Trump’s uncertainty”. Amid this unpredictability, how should investors position their portfolios? Given global investors’ focus on U.S. and European stock markets, this article begins with a macroeconomic overview, followed by a detailed analysis, evaluation and forecast of these two markets. It will also touch on other asset classes, including foreign exchange and bond markets.

2. Macroeconomics

2.1 U.S. Macroeconomics

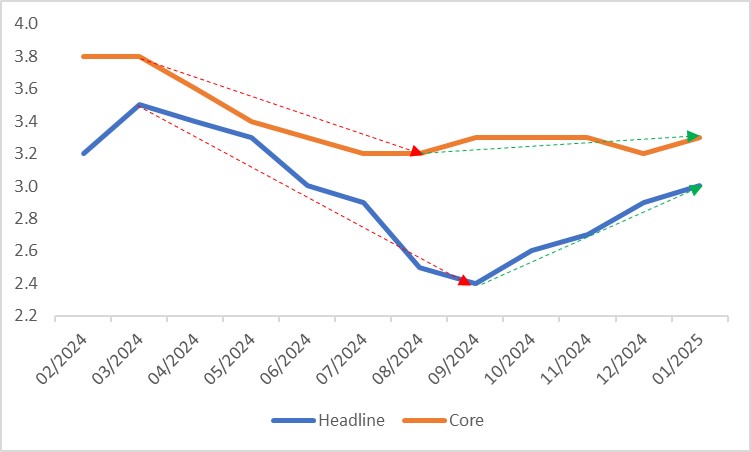

As of today, Trump’s foreign policy centrepiece is his new tariff regime. On 4 March 2025, the U.S. imposed an additional 25% tariff on imports from Canada and Mexico, citing their failure to curb illegal immigration and fentanyl inflows. However, on 5 March the U.S. delayed additional tariffs on Canadian and Mexican automobiles for one month. Earlier this year, Trump had already slapped an additional 10% tariff on Chinese goods. These steep tariffs, combined with the Fed’s slower pace of rate cuts and subsequent pause, have begun driving U.S. inflation higher, with headline and core CPI climbing since September 2024 (Figure 2.1.1). Moreover, high tariffs have raised costs for manufacturing and retail sectors reliant on imported materials, squeezing profits and weighing on economic growth. Q4 2024 GDP grew at an annualized rate of 2.3%, below the 2.6% consensus (Figure 2.1.2). Data also indicates softening U.S. consumer spending and a slowdown in home price growth.

Trump’s tariffs triggered swift retaliation:

- Canada imposed up to 25% additional tariffs on USD 106 billion worth of U.S. imports.

- Mexico adopted a dual strategy of retaliation and negotiation.

- China raised tariffs on U.S. goods to an additional 10% in February 2025, escalating to 20% in March.

These countermeasures have curbed U.S. exports, further weakening the economy. With low growth and rising inflation emerging, many economists warn of a looming stagflation period.

Not all Trump policies are economic headwinds. He is expected to extend his 2017 domestic tax cuts, potentially lowering corporate tax rates or extending personal income tax breaks in 2025. Reduced corporate taxes would boost after-tax profits, spurring investment, while personal tax relief would support household spending—both lifting growth. If Trump delivers on campaign promises to heavily invest in infrastructure and defence, large-scale fiscal spending could stimulate the economy in the short to medium term.

Overall, we expect the U.S. economy to slow but avoid a recession. This moderation of growth could partially temper inflation. Consequently, we anticipate the Fed will resume its rate-cutting cycle, with 4-5 cuts by year-end—exceeding the market’s expectation of 3.

Figure 2.1.1: U.S. CPI (%)

Source: Refinitiv, Tradingkey.com

Figure 2.1.2: U.S. GDP growth (annualized, %)

Source: Refinitiv, Tradingkey.com

2.2 Eurozone Macroeconomics

Beyond Trump’s tariff threats, he has pressured the EU to increase imports of U.S. oil and gas. Greater reliance on American energy would raise costs significantly, threatening the EU’s energy-intensive industries and exacerbating the eurozone’s already sluggish recovery.

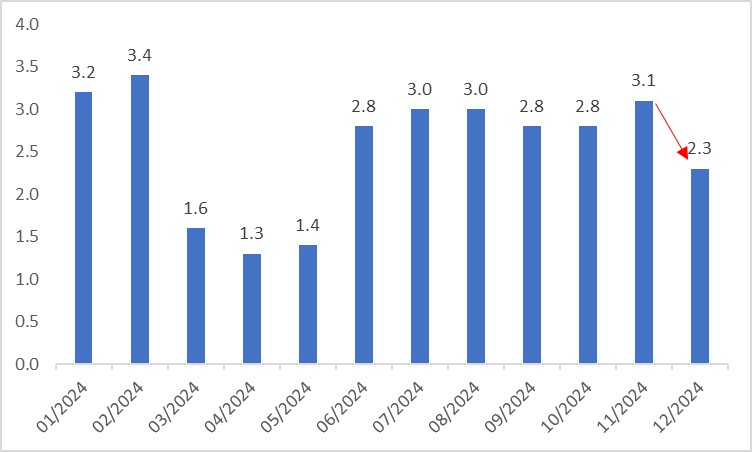

However, Trump’s unexpected shift on the Russia-Ukraine conflict has accelerated Europe’s “re-armament” plans. While higher defence spending may strain EU budgets over the long term (Figure 2.2), it could boost growth in the short to medium term. Additionally, if Trump’s lobbying and threats lead to an early ceasefire in Ukraine, it could lower energy prices, reduce geopolitical risks and restore confidence in Europe’s economy.

In summary, Trump’s policies pose long-term risks to the eurozone, but short- to medium-term effects are mixed. Investors should closely monitor his foreign policy developments.

Figure 2.2: Eurozone government debt (% of GDP)

Source: Refinitiv, Tradingkey.com

3. Stocks

3.1 U.S. Stocks

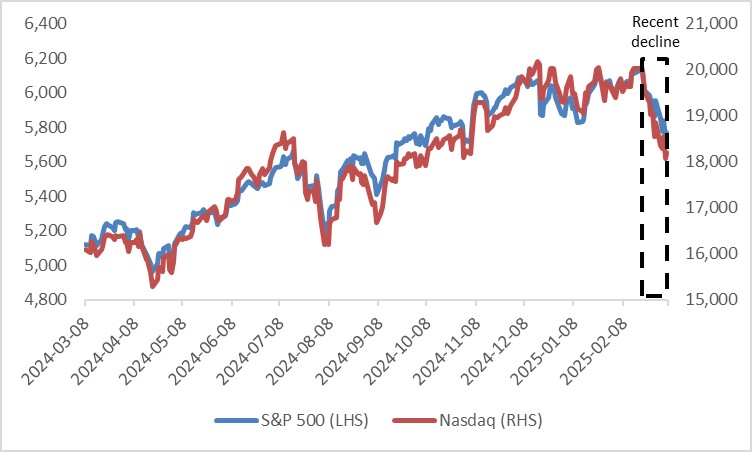

Under the combined pressures of Trump’s tariff policies, retaliatory measures from trade partners and a global economic slowdown, U.S. stock markets have been on a downward trend since late February 2025 (Figure 3.1.1). Looking ahead, we believe that imposing higher tariffs on more countries could become a prevailing trend. Sustained high tariffs would increase corporate costs, squeeze profit margins and exert pressure on stock valuations from the earnings perspective. Even if companies attempt to pass some of these costs onto consumers through price hikes, rising prices could dampen demand, leading to revenue declines. Furthermore, additional retaliatory actions from trade partners may further weigh on U.S. economic growth, adding more pressure on the stock market.

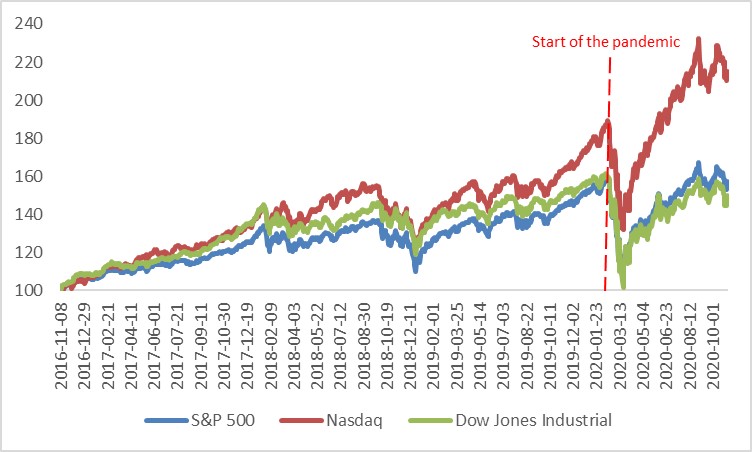

However, reflecting on Trump’s first term (November 8, 2016, to November 3, 2020), despite the disruptions caused by tariff policies, the S&P 500, Nasdaq and Dow Jones indices rose by 57.5%, 114.9%, and 49.9%, respectively—far exceeding historical averages (Figure 3.1.2). This strong performance was largely driven by the Trump administration’s tax cuts and fiscal investments in infrastructure, which effectively boosted domestic demand and fuelled profit growth for listed companies. Based on this precedent, we anticipate that tax reductions and fiscal stimulus measures introduced by Trump in 2025 will partially offset the adverse effects of tariffs and may help halt the current stock market decline.

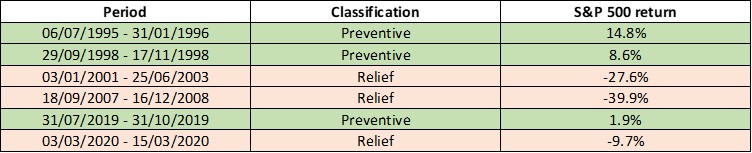

Moreover, as discussed in the U.S. macroeconomic section, the likelihood of a technical recession in the U.S. economy in the near term remains low. The current rate-cutting cycle is characterized as preventive rather than a response to an economic crisis. Since 1995, the U.S. has undergone six rate-cutting cycles, three of which were preventive (July 1995 to January 1996, September to November 1998, and July to October 2019). During each of these preventive cycles, U.S. stock markets recorded gains. Consequently, we expect the current preventive rate-cutting cycle to similarly provide support for the stock market (Figure 3.1.3).

In summary, while tariff policies have intensified market pressures, we remain optimistic about the U.S. stock market, supported by the combined effects of tax cuts, expanded fiscal spending and preventive rate reductions.

Figure 3.1.1: U.S. stocks

Source: Refinitiv, Tradingkey.com

Figure 3.1.2: U.S. stock performance during Trump’s first term

Source: Refinitiv, Tradingkey.com

Note: Re-based 8 November 2016 = 100

Figure 3.1.3: S&P 500 return during rate cut cycles

Source: Refinitiv, Tradingkey.com

3.2 Eurozone Stocks

In February and March 2025, Trump threatened tariffs on EU goods. If implemented, this would dampen eurozone growth and cap stock returns, with export-oriented sectors like autos, machinery and luxury goods facing the heaviest blows.

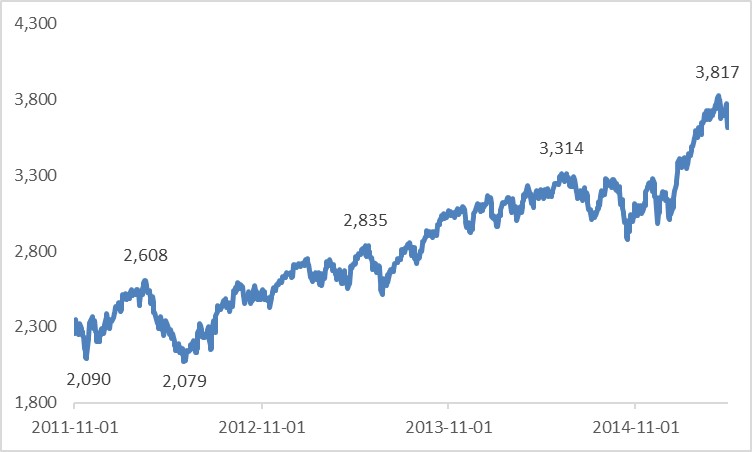

However, weak growth and falling inflation will keep the European Central Bank (ECB) cutting rates. We expect the eurozone to enter a low-rate era in 2025. Historically, the last low-rate period began in November 2011, post-euro debt crisis, ushering in a multi-year stock market boom (Figure 3.2). This stemmed from two factors: significant foreign capital inflows and lower borrowing costs spurring private-sector equity investments.

Unlike 2011, when the debt crisis limited fiscal stimulus, this low-rate cycle will see Europe’s “re-armament” plan and Germany’s “whatever it takes” stimulus bolster growth through fiscal policy.

In summary, despite tariff threats, monetary easing, fiscal support, foreign investment, private-sector growth and a potential Ukraine ceasefire underpin our bullish stance on European stocks.

Figure 3.2: Eurostoxx 50 during the low-interest rate period

Source: Refinitiv, Tradingkey.com

4. Exchange Rate (EUR/USD)

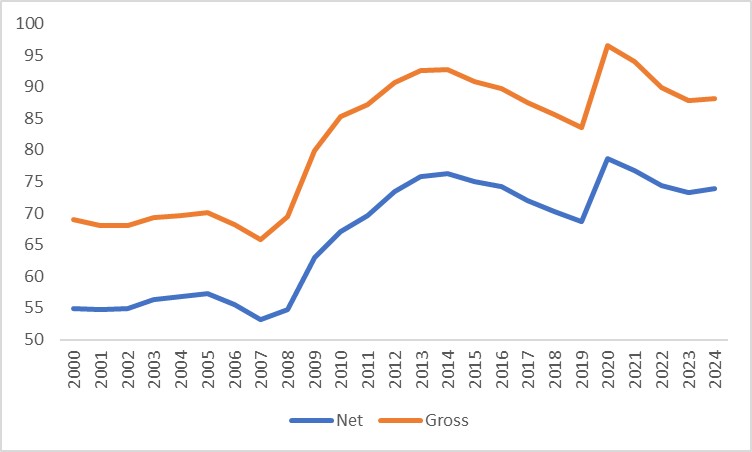

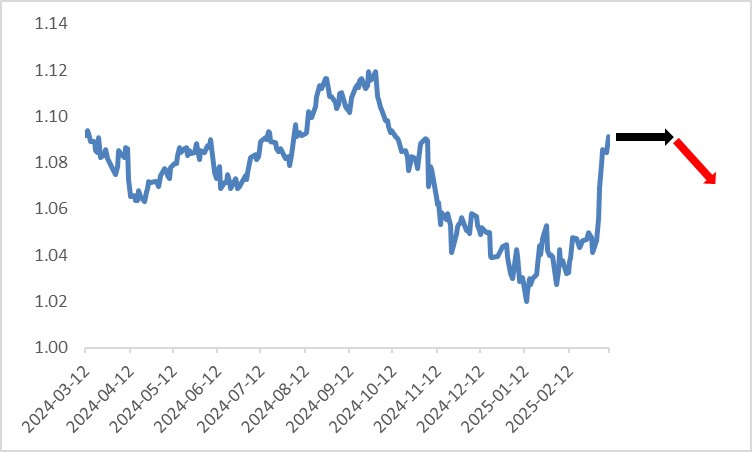

The USD Index has recently plunged, driven by signs of U.S. economic weakness amid Trump’s tariffs and trade retaliation. Investors have shifted from inflation bets to recession trades. Short-term (0-3 months), with economic uncertainty and Fed rate cuts, we expect the USD Index, especially against non-euro currencies, to continue falling. In the medium term (3-12 months), as U.S. weakness spreads globally and Europe’s recovery falters, the dollar’s safe-haven appeal could lift it.

Facing Trump’s tariffs and ECB rate cuts, the euro is likely to weaken against non-U.S. currencies over the next 12 months. Short-term, with both currencies declining against others, we foresee EUR/USD trading in a range without significant moves. Medium-term, this pair will likely enter a downtrend (Figure 4).

Figure 4: EUR/USD

Source: Refinitiv, Tradingkey.com

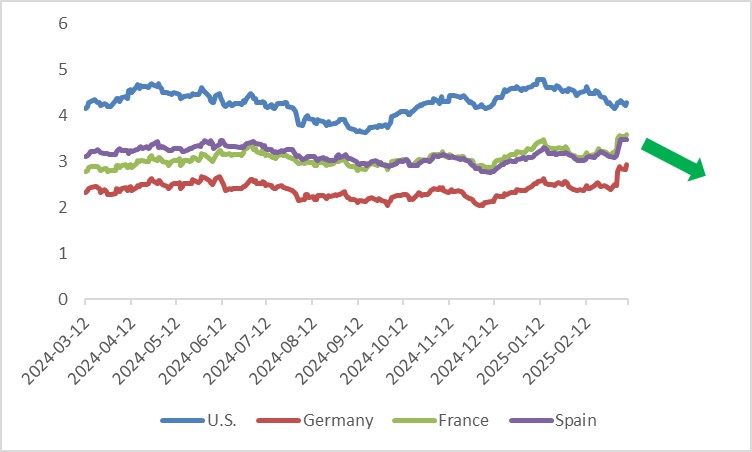

5. Bonds

We project 4-5 Fed rate cuts and 5-6 ECB cuts by year-end 2025. This aggressive easing should push U.S., German, French and Spanish bond yield curves lower (Figure 5). On duration, policy rate declines will primarily drive short-end yields down more than long-end yields.

Figure 5: 10-year government bond yields (%)

Source: Refinitiv, Tradingkey.com