[Reuters Analysis] Exposure to Treasury futures plunges at risky moment: McGeever

By Jamie McGeever

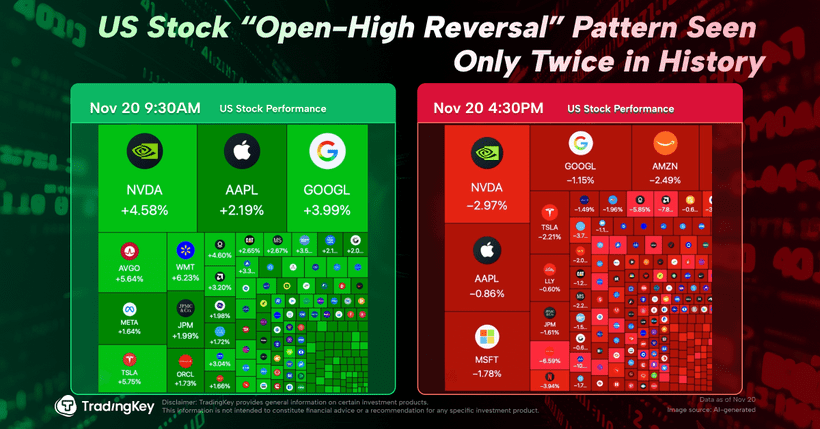

ORLANDO, Florida, March 11 (Reuters) - Levels of open interest in the U.S. Treasuries futures market rarely garner much attention, but this might be one of those occasions, as President Donald Trump's tariff agenda threatens to slam the brakes on the U.S. economy, perhaps even putting it into reverse gear.

Commodity Futures Trading Commission figures show that open interest, the broadest measure of investors' exposure to U.S. bond futures, is sliding at a historic pace. In some cases, such as two-year contracts, the fall is the sharpest on record.

In the week through March 4, open interest in two-year futures fell by a record 396,525 contracts, or nearly $80 billion. That's around 10% of investors' total exposure, and it means overall open interest is down 17% from its peak around the U.S. presidential election in November.

Open interest in the 10-year space fell by 503,744 contracts, or $50 billion, the third biggest weekly fall on record and again around 10% of total exposure.

The value of open interest across two-, five- and 10-year contracts fell by $179 billion in the week to $1.858 trillion, the lowest since June last year. More significantly, this marked a notable 9% decline in a single week.

Why does this matter? As a paper by Federal Reserve staffers Andrew Meldrum and Oleg Sokolinskiy found last month, cash market depth "significantly affects liquidity fragility in all maturity sectors" of the Treasury market. In other words, the slump in open interest could mean that one of the world's most important markets has become easier to disrupt.

'POINT OF CONCERN'

Some of this activity is seasonal, as funds are rolling their positions into new benchmark contracts. And some is related to the so-called basis trade, the arbitrage play used by hedge funds to exploit the tiny price difference between cash bonds and futures.

So far, so normal, in which case open interest should pick up again in the coming weeks as investors of all stripes - particularly asset managers on the 'long' side and hedge funds on the 'short' side - rebuild their exposures.

But the sharp moves are coming at a time of heightened volatility and uncertainty across all markets. Wall Street and U.S. Big Tech have borne much of the brunt, with around $5 trillion wiped off the value of U.S. stocks in the last three weeks. But volatility is on the rise everywhere.

Treasury yields have tumbled around 60 basis points in the last month, and implied volatility as measured by the MOVE index this week rose to its highest in four months.

True, there has been no sign of market dysfunction despite the big price moves, but room for complacency is shrinking.

"Uncertainty could keep some investors away," said Gennadiy Goldberg, head of U.S. rates strategy at TD Securities. "If open interest doesn't come back it could be a sign that risk managers are deleveraging. Right now it's something to watch closely rather than a point of concern."

RECORD FALLS

Much of the decline in recent months is down to leveraged funds reducing their 'short' positions more aggressively than asset managers scaling back their corresponding 'long' positions, suggesting speculators are deleveraging.

The value of leveraged funds' aggregate short position across two-, five- and 10-year contracts is now $970 billion. That's down by almost a fifth from the record high of $1.186 trillion in November last year.

This is probably not a bad thing and will likely please regulators who had warned that a disorderly unwind of funds' basis trades could pose major financial stability risks. That hasn't played out.

But further reduced open interest from here at a time of rising volatility might put liquidity, prices and investors' ability to trade under greater strain.

As Meldrum and Sokolinskiy note, "Times of low market depth are associated with an increased probability of low liquidity states in the future."

And at this delicate juncture, anything that impacts liquidity in the world's most important market is certainly worth monitoring.

(The opinions expressed here are those of the author, a columnist for Reuters.)

CFTC 2-year Treasury futures open interest plunges

CFTC Treasury futures total open interest

U.S. 10-year Treasury yield