Is 2025 Poised to Become the Federal Reserve’s “Tightening Year"?

TradingKey - The FOMC’s top concerns remain inflation and employment. The January CPI report shows inflation diverging from the Fed’s 2% target, while Thursday’s PPI also climbed steadily, reinforcing the upward trend in prices. Recent job data suggests the labor market does not appear to need further monetary support and remains generally strong, leaving little incentive for a rate cut in the current environment.

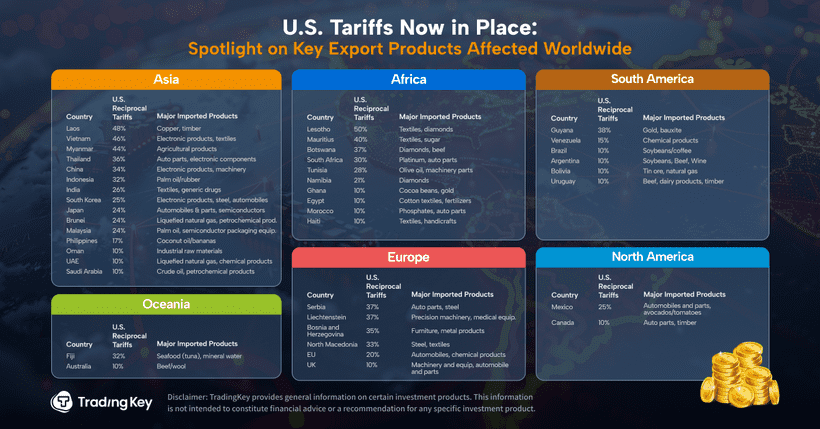

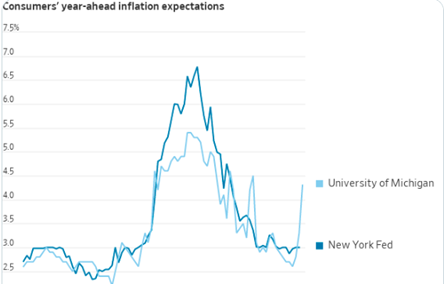

In fact, an even bigger concern than recent January figures is how U.S. inflation will evolve after additional Trump-era tariffs. A University of Michigan survey shows that tariff worries have sent short-term inflation expectations soaring—one-year expectations jumped from 3.3% to 4.3%.

Source: WSJ

Some investors remain optimistic. Based on recent CPI and PPI data, economists project that January’s core PCE price index will increase by about 0.2% to 0.3%, which is lower than the 0.4% gain many had expected following the CPI release. The upcoming PCE data is under heightened market focus.

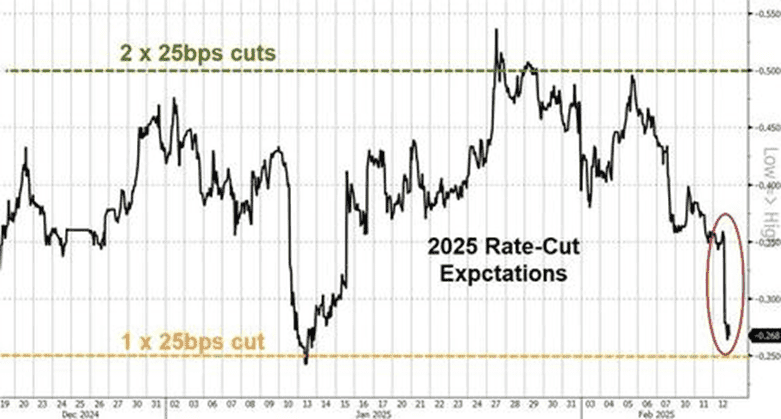

This week’s data will likely force analysts to scrap any plans for a policy shift in the first half of 2025.

Last week, Macquarie revised its baseline scenario to show no change in the federal funds rate in 2025, having previously forecast a possible 25-basis-point cut in March or May.

Likewise, Bank of America analysts stated in a note that “the cutting cycle is over,” adding that “markets are now pricing only about 25 bp of cuts this year. Hikes remain unlikely, but they seem less inconceivable now. We still think the threshold for hikes is 3% core PCE inflation and unanchored long-term inflation expectations.”

Meanwhile, interest rate futures indicate that traders expect the first (and only) rate cut this year to be delayed until December.

Source: Interest Rate Futures Market

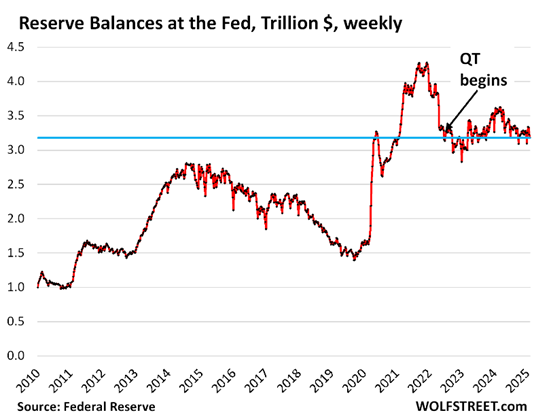

Furthermore, the Fed’s balance-sheet reduction plan may also be extended. Since the Federal Reserve began quantitative easing in June 2022, it has aimed to reduce overall market liquidity—reflected most clearly in bank reserve levels—and to keep money market rates from becoming volatile. So far, quantitative tightening (QT) has trimmed $2.15 trillion from the Fed’s balance sheet. The daily balance of the Fed’s Overnight Reverse Repurchase (ON RRP) facility has fallen below $80 billion—its lowest since April 2021—down from a $2.4 trillion peak in December 2022.

The Fed’s guideline for shrinking its balance sheet is to shift reserves from an “ample” level to a “sufficient” level, meaning it plans to halt QT before reserves become “scarce.” However, reserve balances have not actually declined since QT began. Reserves represent the excess liquidity banks hold at the Fed.

Source: WOLFSTREET

This week, Federal Reserve Chair Jerome Powell testified before Congress over two days, stating that the central bank’s balance sheet reduction process will not conclude in the near term. Meanwhile, several Wall Street banks have pushed back the date they expect QT to end. Powell told the House panel on Wednesday that the Fed still has a way to go in trimming its holdings, noting that there are no clear signs of liquidity tightening to a degree that would affect the plan to reduce Treasuries and mortgage-backed securities.

Goldman Sachs economists indicated in a report last Friday that recent communications imply the Federal Reserve continues to favor allowing quantitative tightening to proceed, despite limited visibility for reserve demand in the coming months—partly due to debt-ceiling dynamics.