What Is Ethereum? Why Has the "Surpass Bitcoin" Slogan Disappeared? Is ETH Still Worth Investing In?

TradingKey - Ethereum, as the world's largest smart contract platform, has attracted a vast number of developers and consistently ranks first in total value locked (TVL) among all public blockchains. This dominance once led many to believe that Ethereum's market cap would eventually Bitcoins in.

However, in recent years, this perspective has faded, and discussions on the topic have largely disappeared. Why has this shift occurred? What has happened to Ethereum? What does its future hold? Is ETH still a worthwhile investment?

What Is Ethereum (ETH)?

Ethereum is an open-source blockchain platform launched in 2015 by Vitalik Buterin and his team. Designed to support smart contracts and decentralized applications (DApps), Ethereum aims to promote automation and transparency without the need for third-party intervention.

Similar to the relationship between BTC and Bitcoin, Ether (ETH) is Ethereum's native token and serves as the "fuel" for the Ethereum ecosystem. It is primarily used to pay for transaction fees and computational services on the network. In other words, if Ethereum is compared to a country, ETH would be its legal currency, facilitating various transactional activities.

Ethereum | Bitcoin | |

Blockchain | Ethereum | Bitcoin |

Token | ETH | BTC |

Token Supply | 121 million | 21 million |

Launch Year | 2015 | 2009 |

Founder | Vitalik Buterin | Satoshi Nakamoto |

Differences Between Ethereum and Bitcoin, Source: TradingKey.

What Are Ethereum's Core Technologies?

If Bitcoin pioneered blockchain technology, Ethereum can be credited with bringing it out of the ivory tower and driving its adoption across various industries. Ethereum's core technologies comprise several key components that support its operations, enable smart contract execution, and DApp development.

Technology Component | Description | Features/Functionality |

Blockchain Technology | Ethereum's foundational architecture for storing all transaction information | Transparency, decentralization, and security |

Smart Contracts | Self-executing code that automatically executes transactions based on conditions | Automation without intermediaries, enhancing efficiency |

Ethereum Virtual Machine (EVM) | Environment for executing smart contracts | Ensures consistent code execution across all nodes |

Consensus Mechanism | Proof of Stake (PoS) | Improves block generation efficiency and reduces energy consumption |

DApps | Applications running on Ethereum | Provides services such as finance, gaming, and social platforms |

Layer 2 Solutions | Second-layer architecture to enhance Ethereum's scalability | Increases processing speed, reduces transaction fees, and improves user experience |

What Are Ethereum's Use Cases?

Ethereum's smart contract functionality and strong developer community have established it as a leading platform for blockchain technology, enabling applications across finance, art, gaming, and beyond.

Application Area | Specific Scenarios | Representative Projects |

| Lending platforms | Aave、Compound |

Decentralized exchanges | Uniswap、SushiSwap | |

Stablecoins | DAI | |

Derivatives | Synthetix | |

| Collectibles | CryptoPunks、Bored Ape Yacht Club |

Gaming | Axie Infinity、Decentraland、The Sandbox | |

Supply Chain Management | Product tracking | VeChain |

Food safety | IBM Food Trust | |

Social | Decentralized social networks | Minds |

Decentralized identity | uPort | |

Content distribution | Livepeer | |

| donations | Giveth |

Disaster relief | AidCoin |

How Has Ethereum Performed in the Market?

Unlike Bitcoin, which primarily serves as a store of value, Ethereum focuses on smart contracts and decentralized applications, attracting a large number of developers and ranking first in TVL among all public blockchains.

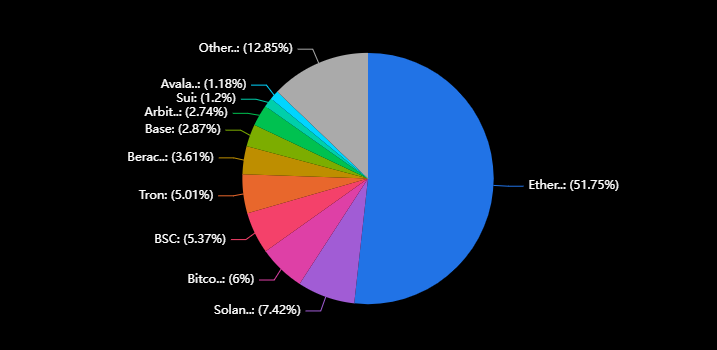

According to data, Ethereum hosts 1,306 DApps, while the Bitcoin network has only 58. Additionally, Ethereum's TVL stands at $44 billion, accounting for over 50% of the total, far surpassing Bitcoin's 6% (approximately $5 billion).

TVL Share Across All Public Blockchains (as of March 11, 2025), Source: DefiLlama.

From an application perspective, Ethereum undeniably ranks first among all public blockchains, far surpassing Bitcoin. However, its market cap remains smaller than Bitcoin's. As of now, Ethereum's market cap is $230 billion, compared to Bitcoin’s $1.6 trillion. Moreover, since 2021, Ethereum's market share has steadily decline, dropping from a peak of 20% to 8%, while Bitcoin's has increased from 40% to 60%.

ETH and BTC Market Cap Share, Source: CoinMarketCap.

In 2017 and 2020, the ICO and DeFi booms, significantly boosted Ethereum's market cap, leading its community to believe it could surpass Bitcoin. However, in recent years, Ethereum has not achieved significant breakthroughs in technology or applications. Meanwhile, many countries and large institutions have prioritized Bitcoin,diminishing investor confidence in Ethereum and weakening the narrative that it could surpass Bitcoin

ETH's Historical Price Trends

In 2015, ETH launched at an initial price of approximately $0.31. In 2017, driven by the ICO boom, ETH surged from around $8 at the beginning of the year to approximately $800 by year-end. However, in 2018, as the crypto market entered a bear phase, and ETH dropped to around $80.

ETH Price Chart, Source: CoinMarketCap.

In 2020, ETH rose from around $130 at the start of the year to around $750 by year-end, fueled by the DeFi boom. In 2021, the NFT explosion pushed ETH from around $700 at the start of the year to an all-time high of around $4,800 in November. In 2022, global economic conditions and turmoil in the crypto market caused ETH to plummet to around $880.

In 2023, ETH gradually recovered, driven by expectations for Ethereum 2.0 upgrades and Layer 2 solutions. In 2024, the approval of Ethereum spot ETFs by the U.S. SEC and Trump's election as President boosted ETH, though it failed to surpass its all-time high. Currently, ETH is trading around $1,800, returning to its 2023 lows.

Is ETH Still Worth Investing In?

In recent years, the Ethereum Foundation's inaction has allowed competitors like Solana, Cardano, and Avalanche to capture market share. Additionally, the Foundation's continuous selling of ETH has severely damaged community confidence and frustrated investors. However, with recent personnel changes on the Foundation's board, ETH selling has been effectively halted.

Ethereum missed the MEME trend, the biggest opportunity of this bull market. However, this does not negate its technological advantages or future application potential. In fact, each bull market or phase in the crypto space brings different trends. Ethereum's focus should be on strengthening its core advantages—particularly addressing network congestion and high transaction fees—while waiting for the right opportunity.

Moreover, ETH remains the second-largest cryptocurrency by market cap, with spot ETFs approved in multiple countries and regions Its inclusion in the U.S. cryptocurrency strategic reserve further underscores its strong market recognition. In short, despite market volatility and competitive pressures, Ethereum's technological innovation and institutional investor participation provide solid support for ETH.

Conclusion

As the world's largest smart contract platform, Ethereum's technological and application advantages serve as the foundation for ETH's position as the second-largest cryptocurrency. However, if Ethereum fails to fully capitalize on its potential, these advantages could turn into liabilities, limiting ETH's price growth.