Bitcoin and Ethereum could face major bull trap before sharp correction

A widely followed cryptocurrency analyst suggests that Bitcoin (BTC), Ethereum (ETH), and altcoins could be forming the bull trap that would soon lead to a bearish trend. The analyst, known as Capo, posted his analysis on his social media page on X, stating that the cryptocurrency market may soon rise.

According to Capo, Bitcoin could rise to $100,000 while Ethereum may reach $3,000, and a majority of altcoins could gain 10-50% from the current levels until the next pullback happens.

BTCUSD 1-Day price chart. Source:X

A bull trap is a false breakout, which makes it seem like the prices are on an uptrend only to reverse, causing a loss in investments for investors who bought into the fake rally. Capo cautioned that such a scenario could be taking place in the market.

Potential market correction

After the expected jump, Capo predicts that there will be a general drop in the market, with BTC, ETH, and other altcoins possibly having a drop of 30% to 60%. He said that this may be due to a second round of market shakeout or some form of black swan event.

A black swan event refers to an unpredictable event that generates significant consequences in the financial market. The latest such occurrence in the global market was the COVID-19 pandemic, which resulted in a market crash.

Capo’s forecast suggests that the coin may hit $100,000 soon but will face a strong pullback, bringing its value down to around $69,000. However, as the market conditions worsen, he has a bullish outlook, expecting Bitcoin to climb back up to about $116k.

The analyst remains optimistic that an “epic” altcoin season may unfold in the wake of the market’s expected shakeout. Historically, an altcoin rally happens when the Bitcoin market is stable, and investors start returning to it.

According to Crypto Rover, altcoins are currently in an oversold condition, presenting a possible buying opportunity for traders. Although the altseason, is yet to begin, pundits expect the growth in the future. Ethereum is currently trading at $2,010, registering an 8% decline in the last 24 hours.

Altcoins are oversold.

Altcoin season hasn't even started yet. pic.twitter.com/VfuNPGFd1n

— Crypto Rover (@rovercrc) March 8, 2025

Bitcoin’s downhill road

The latest price fluctuations have left Bitcoin investors in the dark due to a reduction of its value to $84,000. Although recently, there have been positive events like the issuance of an executive order for the creation of a strategic Bitcoin reserve, the price has not risen. As of this writing, Bitcoin is trading at $82,659, declining by 4% in the last 24 hours.

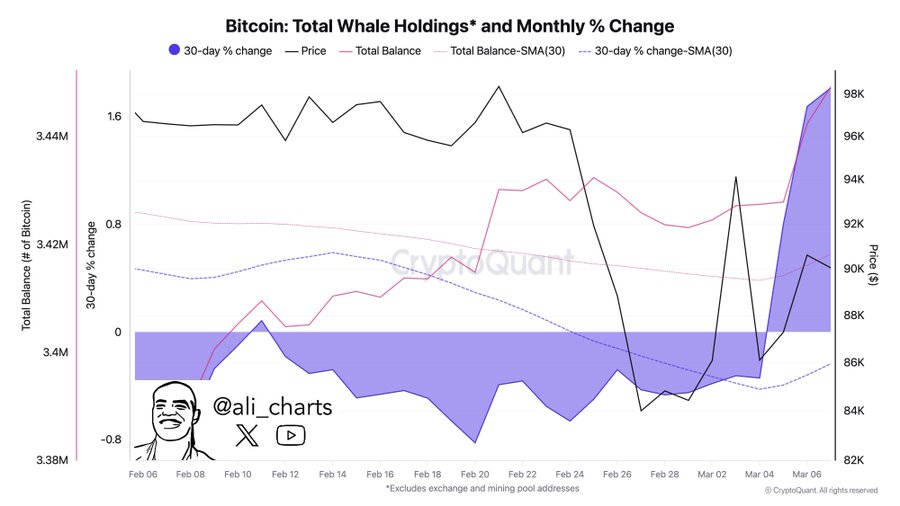

According to on-chain data, Bitcoin’s value has decreased by 11% within the last 7 days, while daily trading volumes dropped by 53%. However, Bitcoin whales have been buying over 22,000 BTC for three consecutive days, which shows that institutional investors are bullish.

Source:X

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now