Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

- Solana price remained pinned below $130 on Tuesday, despite BTC, XRP, and ADA scoring excess of 3% gains in the last 24 hours.

- After multiple transactions shifting assets into exchange-wallets in March, FTX estate is set to begin major repayments on May 30.

- According to Arkham data, 61% of FTX’s $800 million on-chain holdings are held on Solana, while 39% are Ethereum.

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Solana (SOL) price remains subdued as BTC leads market recovery

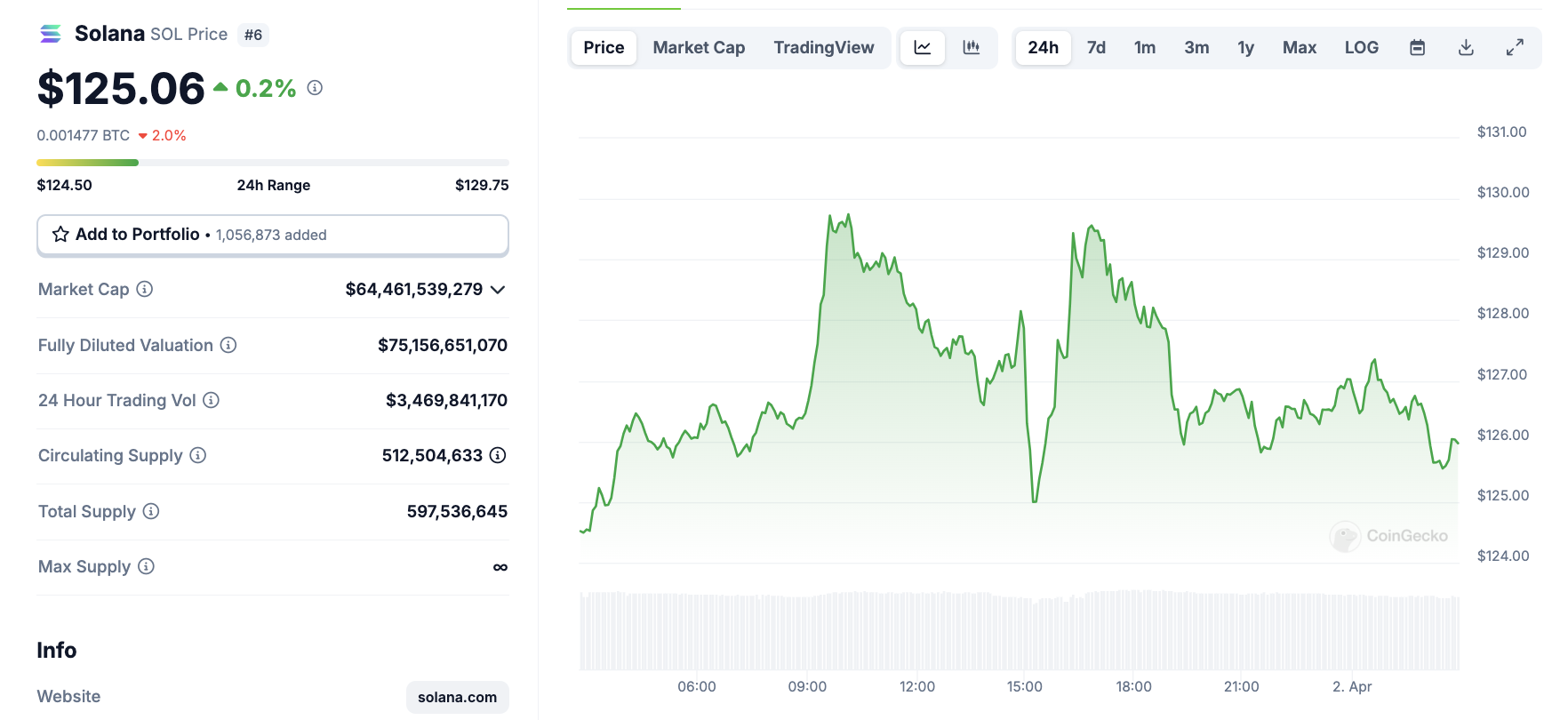

Solana’s price remained pinned below $130 on Tuesday, despite a broader market recovery. While Bitcoin (BTC), Ripple (XRP), and Cardano (ADA) posted gains exceeding 3% over the past 24 hours, SOL lagged behind.

Solana price analysis | SOLUSD

Solana price analysis | SOLUSD

According to TradingView data, SOL stagnated below the $130 mark, trading at $126 at press time.

When a systemically important asset like Solana lags behind a market-wide rally, it suggests the presence of active internal bearish catalysts dampening investor sentiment.

Solana faces April volatility risks with FTX set to begin major repayments on May 30

Media reports indicate that Solana’s lackluster performance on Tuesday can be attributed to recent developments surrounding the defunct FTX exchange’s ongoing repayments.

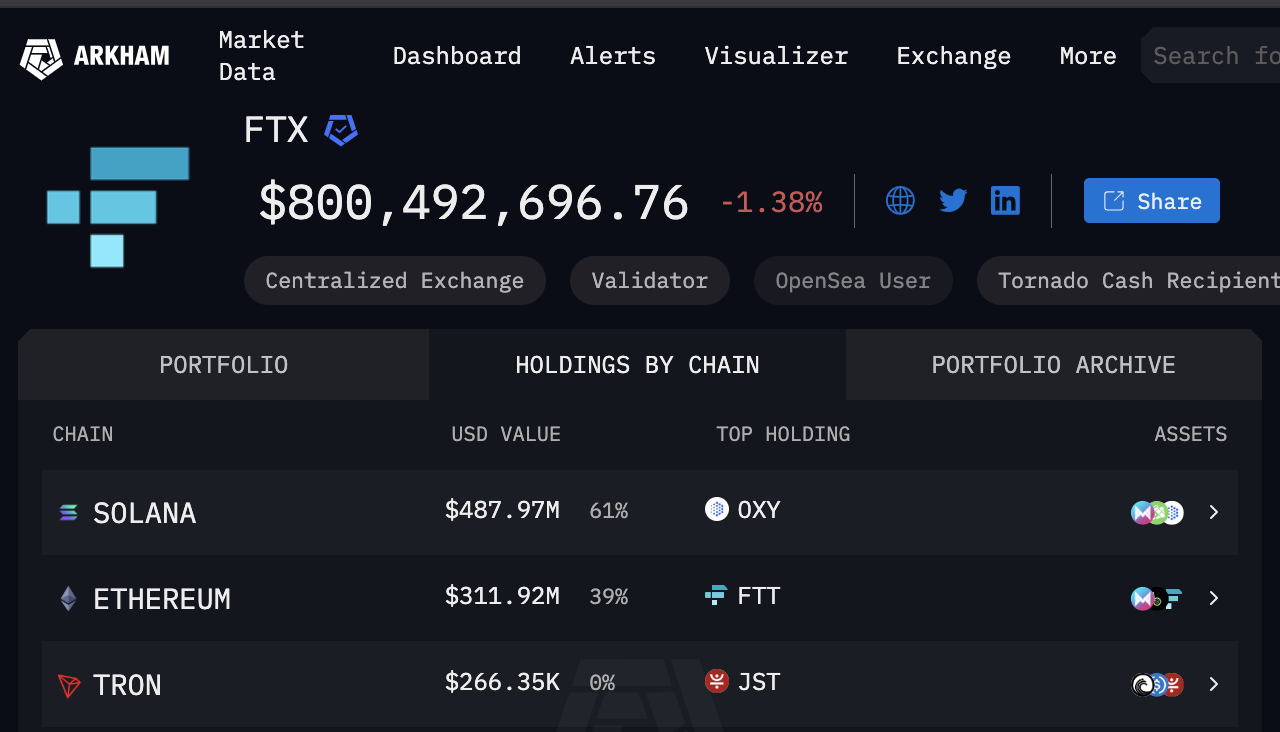

After multiple transactions shifting assets into exchange wallets throughout March, the FTX estate is set to initiate major creditor repayments on May 30.

The latest data from Arkham Intelligence shows that 61% of FTX’s $800 million in on-chain holdings are in Solana, while 39% are in Ethereum.

FTX On-chain Holdings as of April 1, 2025 | Source: Arkham

FTX On-chain Holdings as of April 1, 2025 | Source: Arkham

Crucially, the court has stipulated that repayments must be made in USD rather than crypto assets.

As a result, on-chain holdings are expected to be liquidated before distributions begin.

This impending sell-off could drain over $800 million in liquidity from both the Solana and Ethereum ecosystems, creating significant selling pressure.

The looming liquidation event casts a bearish overhang on Solana’s price action for the coming weeks.

The prospect of large-scale forced selling could weigh on SOL and ETH, causing them to underperform relative to other top-ranked altcoins in April.

Investors will be watching closely to see how Solana navigates this period of heightened volatility, particularly as the market anticipates whether support levels around $120 can hold when the current market rebound phase subsides.

Solana price outlook: Bears eye $120 reversal in April as FTX overhang mounts

Solana price remains on a fragile footing, struggling to reclaim lost ground amid broader market uncertainty.

TradingView data shows SOL trading at $125.55, failing to reclaim key moving averages. The 5-day and 8-day simple moving averages (SMA) have crossed below the 13-day SMA, confirming bearish momentum.

A downward crossover of these short-term SMAs historically signals sustained sell pressure, making it difficult for bulls to reclaim the $130 level.

Solana Price Forecast | SOLUSD

Solana Price Forecast | SOLUSD

The MACD indicator further underscores the bearish outlook. As seen above, the MACD line remains below the signal line at -5.16 and -5.69, respectively, reinforcing downward momentum.

A weak histogram suggests diminishing buying activity, preventing a sustained rebound. Unless momentum shifts, Solana price forecast tilts bearish, with $120 as the next critical support level.

For bulls, reclaiming $128.93—the nearest resistance marked by the short-term moving averages—would be necessary to alter sentiment.

However, failure to hold above $125.23 could expose Solana to steeper declines, especially with FTX-linked liquidity risks looming in May.