Why C3.ai Stock Soared 51% in November

Shares of C3.ai (NYSE: AI) were surging last month as investors cheered a new partnership with Microsoft, a sign that the AI software company may finally be turning the corner after years of wide losses. Additionally, the company benefited from a strong report from Palantir, the software company that has best proven the market for AI services thus far.

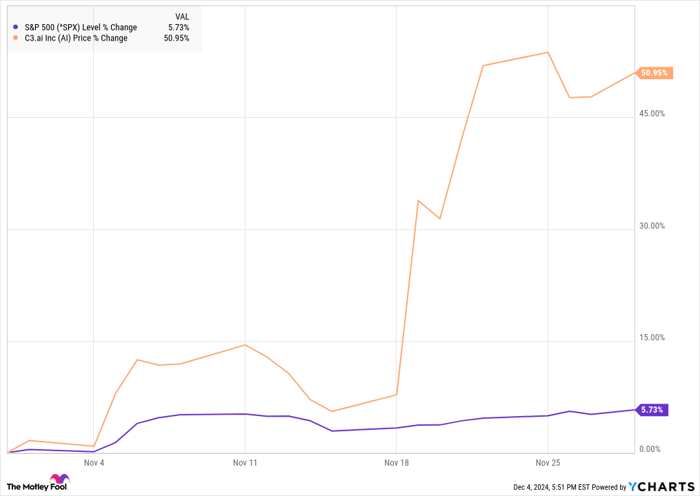

According to data from S&P Global Market Intelligence, the stock finished the month up 51%. As you can see from the chart below, the stock popped after the Microsoft news came out on Nov. 19.

^SPX data by YCharts

C3.ai is having a moment

C3.ai first scored gains on Nov. 5, tracking with Palantir, which posted strong results in its third quarter. C3.ai is much smaller than Palantir, but the two companies do have some things in common, including a focus on AI software and the fact that they derive a significant percentage of their business from the federal government.

C3.ai stock rose 7% on Nov. 5 and jumped another 5% on Nov. 6 in response to the U.S. election results.

However, the real surge in the stock came on Nov. 19 when the expanded Microsoft partnership was announced. The stock jumped 24.2% on the news and continued to gain from there. At the Microsoft Ignite conference, the two companies announced a strategic alliance to accelerate the adoption of C3.ai's Enterprise AI platform on Microsoft's Azure cloud infrastructure service.

The alliance includes technical integration that will make C3's software like C3 Generative AI available on the Microsoft Commercial Cloud Portal, and include joint sales and marketing for C3's Enterprise AI applications.

The two companies already had a partnership, but they called it a "significant milestone" in their relationship.

What's next for C3.ai

The AI for the enterprise company is bringing a lot of momentum into its second-quarter earnings report, a sign that expectations are high after strong reports from Palantir and other software titans like Salesforce, and thanks to the expanded partnership with Microsoft.

C3.ai's revenue growth has been improving, but the company is still significantly unprofitable. For its second-quarter report, which is due out on Monday, analysts expect revenue to increase 24.3% to $91 million and for its adjusted loss per share to widen from $0.13 to $0.16.

Given the recent surge, the stock is likely to have a big move one way or the other. Keep an eye out for commentary about the Microsoft partnership as well.