Should You Buy Visa While It's Below $320?

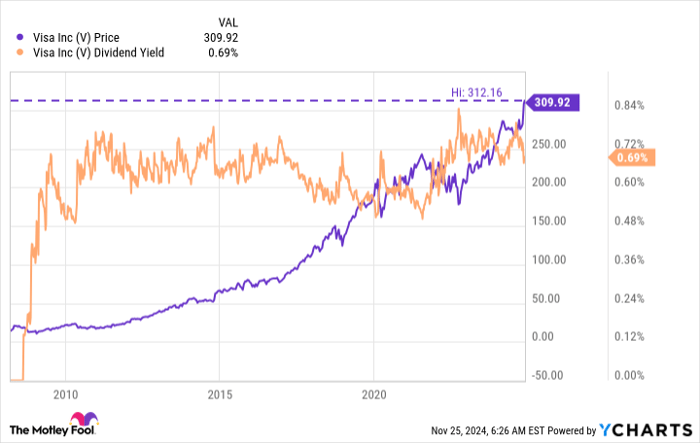

Visa's (NYSE: V) share price is trading near its all-time high of around $312 per share as I write this. Is it worth buying at these levels? If you have a value bias, the answer will probably be no. But if you are willing to buy good companies at fair prices, the answer might be a little different. And if you appreciate dividend growth, well, your convictions about buying might be even stronger. Here's what you need to know to decide whether or not to buy Visa today.

What does Visa do?

In simplistic terms, Visa is a payment processing company that shares an effective duopoly with Mastercard. The logos of these two companies are ubiquitous, fastened upon the plastic cards consumers carry in their wallets, on the windows of stores, and on retail websites across the world wide web to let consumers know they can use those cards. Visa doesn't own the cards or the stores; it simply processes the transactions that take place using cards with its logo on them. It is a toll taker, collecting a small fee for each transaction it handles.

Image source: Getty Images.

In fiscal 2024, Visa handled 233.8 billion transactions, up 10% from the prior year. If that sounds like a big number, well, it is. While the company only collected a small percentage of each transaction as a processing fee, across that many transactions, the fees start to add up. In fiscal 2024, Visa's top line chimed in at $35.9 billion. Adjusted earnings totaled $10.05 per share, up 15% year over year.

Visa is a very big business. And noting the year-over-year growth in fiscal 2024, it continues to expand. That seems likely to continue as card-based payments replace cash. Also helping the growth path is the ongoing expansion of online shopping, where cash isn't even an option. Data safety is another growth support since Visa has the size, financial strength, and research and development prowess to keep up with the illicit efforts of cybercriminals.

Visa has a strong industry position, a growing business, and seemingly a still-bright future. This is why its stock price is near its all-time high. But is it worth buying at these levels?

Visa looks reasonably priced

There are some simple answers to the buy-or-avoid question here, and then some harder ones. Investors who want deep-value stocks won't like Visa. Investors who are looking to maximize the income their portfolio generates won't like Visa. However, there are a few types of investors who might.

For example, despite the stock's dividend yield being a fairly tiny 0.75%, dividend growth investors will probably find Visa interesting. That's because it has increased its dividend annually for 16 consecutive years, and its 10-year annualized dividend growth rate is a whopping 17%! That's a huge dividend growth number and one that will definitely interest dividend growth investors.

That said, the real attraction of the dividend growth comes when you look at Visa's valuation. For starters, the yield is toward the high side of the stock's historical yield range. That suggests that dividend growth investors will be getting a fair price for Visa right now. This fact is backed up by the fact that the price-to-sales ratio and price-to-earnings ratio are both a touch below their five-year averages. So, it's not dirt cheap, but, once again, Visa looks fairly valued despite its lofty share price.

Not a bad deal, but only for the right kind of investor

As noted, Visa is not a screaming value, and it isn't a high-yield stock. However, it doesn't look unreasonably expensive either. It's fairly priced in the "Goldilocks" range. That's not a bad thing for a company that is executing as well as Visa is today. And since there's no particular reason to think that Visa's business is about to fall off a cliff, there is a clear reason for dividend growth investors to consider Visa even as its stock trades up near its 52-week and all-time highs.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $350,915!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,492!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $473,142!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 25, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Mastercard and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.