Is This Outstanding Index ETF a Millionaire-Maker?

There's nothing wrong with keeping things simple. Consider, for example, how a recipe can be ruined by straying too far from its original list of ingredients -- nobody wants a milkshake made with a heaping helping of brussels sprouts, right?

Similarly, investing doesn't have to be complicated. Indeed, by allocating large portions of a portfolio to funds that track major indexes, investors can feel secure knowing that their portfolio will largely capture the stock market's growth.

Let's have a closer look at one excellent index-linked exchange-traded fund (ETF) and see if it could be a millionaire-maker.

Image source: Getty Images.

What is the Invesco QQQ Trust Series I ETF?

In the simplest terms, the Invesco QQQ Trust Series I ETF (NASDAQ: QQQ) is an index-linked ETF that tracks the Nasdaq 100 index. That index, in turn, is made up of the 100 largest non-financial stocks that are listed on the Nasdaq stock exchange.

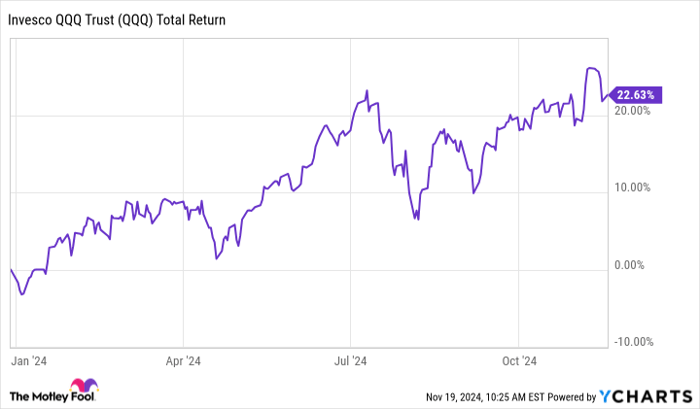

QQQ Total Return Level data by YCharts.

Many of the stocks in the index are the mega-cap tech stocks you might expect to find: Nvidia, Microsoft, Apple, and Amazon. However, there are also much smaller, less well-known names like Ansys, MongoDB, and The Trade Desk. Finally, there are also companies from outside the tech sector, such as Starbucks, Kraft Heinz, and AstraZeneca.

All in all, this fund offers investors the opportunity to own a broad array of stocks representing many sectors (except for financials). Granted, the index is heavily skewed toward the tech industry, with roughly 59% of holdings falling within that sector.

Yet, given tech's outperformance over the last few decades, investors should ask themselves: Is it a bad thing to be relatively overweight in the tech sector over the long term? I would suggest -- particularly for younger investors -- that it is not. In fact, staying slightly overweight in the tech sector could prove to be a millionaire-making move. Here's why.

Large investments in the tech sector have paid off

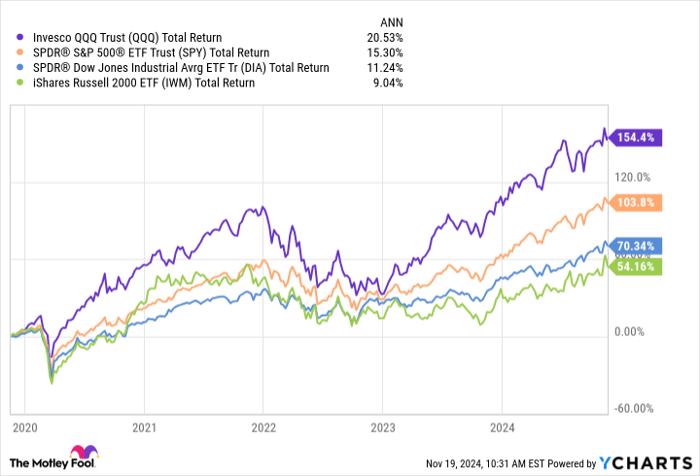

Let's compare the relative performance across four index-linked ETFs: The Invesco QQQ Trust Series I, the SPDR S&P 500 ETF Trust, the SPDR Dow Jones Industrial Average ETF, and the iShares Russell 2000 ETF.

QQQ Total Return Level data by YCharts.

As you can see, over the last five years, the Invesco fund has significantly outperformed the other funds with a compound annual growth rate (CAGR) of 20.5%.

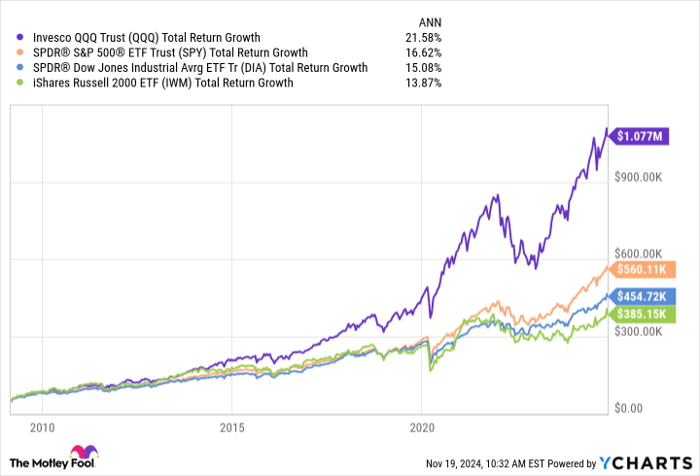

What's more, the difference is even more pronounced if we examine the last 15 years -- starting with the end of the Great Recession bear market, which occurred in March 2009.

QQQ Total Return Level data by YCharts.

Indeed, $50,000 invested in the Invesco fund in March 2009 would have grown to over $1 million today. In comparison, the same amount, invested on the same day, would have grown to only $560,000 in the S&P 500 fund, $454,000 in the Dow fund, and less than $386,000 in the Russell fund.

The lesson? Even with near-perfect timing and very similar index-linked ETF funds, there is an enormous amount of difference in performance among these funds -- and the tech-heavy Invesco fund has proven to be the best.

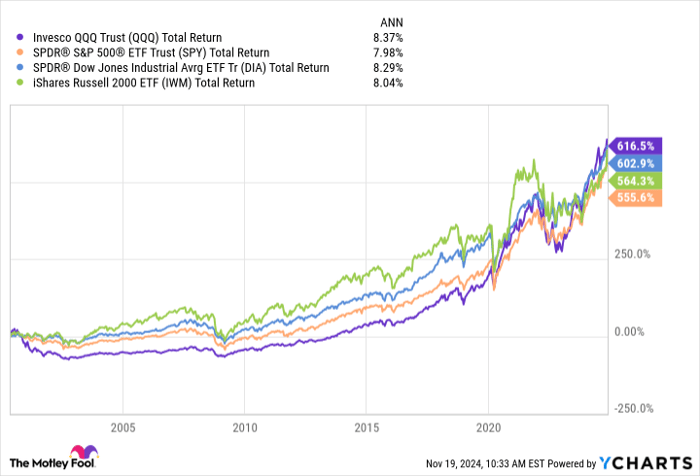

All that said, there is no guarantee that the Invesco fund will continue its outperformance. After all, there were periods, such as the dot-com bubble of 2001-2003, where tech stocks severely underperformed the broader market. However, even with that turbulent period included, the Invesco fund has ever-so-slightly exceeded the performance of its major index rivals since the start of this century.

QQQ Total Return Level data by YCharts.

No investment is a sure thing, but index-linked ETFs are about as close as you can find. They offer investors a broad range of stocks and have a proven track record of delivering real returns over decades. Moreover, the tech-heavy nature of the Invesco fund offers investors a realistic chance to outperform the market, given the high growth and solid profitability of many of its major components. Investors looking for a smart and simple way to grow their portfolio to over $1 million should consider the Invesco fund.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $380,291!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,278!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,003!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Amazon, Invesco QQQ Trust, The Trade Desk, and iShares Trust-iShares Russell 2000 ETF and has the following options: long December 2024 $615 calls on SPDR S&P 500 ETF Trust, short December 2024 $220 calls on iShares Trust-iShares Russell 2000 ETF, and short December 2024 $605 calls on SPDR S&P 500 ETF Trust. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, MongoDB, Starbucks, and The Trade Desk. The Motley Fool recommends Ansys, AstraZeneca Plc, and Kraft Heinz and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.