Target Shares Plunge on Its Holiday Outlook. Should Investors Buy the Dip in the Stock?

Target (NYSE: TGT) is getting labeled as the Grinch heading into the holiday season, after the retailer saw its shares plunge following poor third-quarter results and subdued guidance for the upcoming quarter. This most recent earnings summary was in contrast to rival Walmart (NYSE: WMT), which reported strong quarterly sales and was upbeat approaching the all-important holidays for retailers.

The slump in Target's share price now has the stock trading down about 14% on the year, as of this writing. Let's take a closer look at its most recent report and guidance to see if this dip in price could be a nice holiday gift for investors interested in the stock.

Disappointing Q3 results and guidance

After turning in solid results last quarter and looking like a turnaround was at hand, Target laid an egg when it announced its third-quarter results. Revenue edged up just 0.3% to $25.7 billion, below the $25.9 billion analyst consensus. Adjusted earnings per share (EPS), meanwhile, fell 12% to $1.85, badly missing analysts' expectations of $2.30.

Same-store sales (comps) also rose by 0.3%, helped by a 2.4% increase in traffic. However, its average ticket declined by 2%. E-commerce sales jumped by 10.8%, but in-store comparable sales fell 1.9%. Beauty was once again a standout category for Target, with the segment seeing 6% comps growth. However, the company said that overall, consumer budgets remain stretched due to years of high inflation. It said this is leading to customers waiting for deals and then stocking up.

The retailer continued to see strong growth in loyalty members, adding 3 million in the quarter. Target management said this is helping with the company's ad business, which grew by the mid-teens in the quarter. Meanwhile, after increasing gross margins last quarter, Target saw them slip 20 basis points year over year to 27.2% and by 170 basis points sequentially from 28.9% in the second quarter. Management blamed higher digital fulfillment and supply chain costs for the decline.

Looking ahead, Target slashed its full-year earnings guidance, taking it to a range of $8.30 to $8.90 per share from a prior outlook of $9 to $9.70. That comes a quarter after the company raised its guidance.

| Metric | Original Guidance | Prior Guidance | New Guidance |

|---|---|---|---|

| Adjusted EPS |

$8.60 to $9.60 |

$9 to $9.70 |

$8.30 to $8.90 |

Source: Target.

For the fourth quarter, it forecast comps to be flat, with adjusted EPS between $1.85 and $2.45. It said it continues to expect to see softness in spending on discretionary items. It also noted there will be five fewer shopping days between Thanksgiving and Christmas compared to last year.

Should investors buy the dip?

Target is clearly being outperformed by its rival Walmart at this point. The latter has shifted much more of its business toward groceries and other nondiscretionary items over the years, which helps isolate it more from consumer pressures.

Image source: Getty Images

And Walmart appears to be making inroads into higher-income households making over $100,000 a year. This demographic has been the bread and butter of Target over the years. However, lower prices and the convenience of Walmart memberships that offer free same-day delivery have helped attract these customers.

Target also offers same-day delivery, but with lower prices and more grocery offerings, Walmart appears to be winning the battle with consumers feeling the effects of the inflation of the past few years.

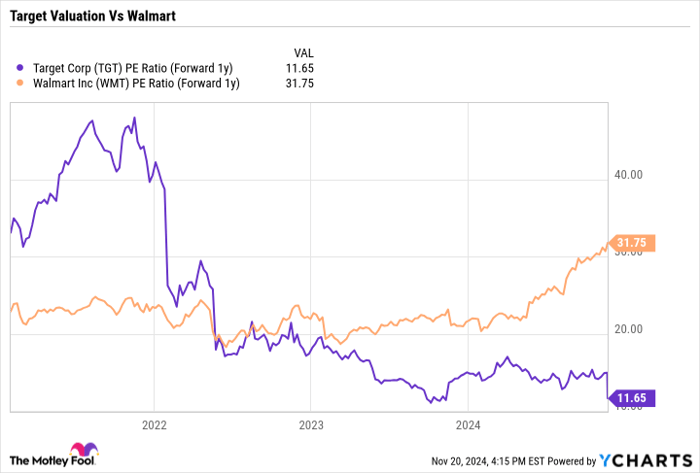

From a valuation standpoint, Target stock now trades at a forward price-to-earnings ratio (P/E) of less than 12 times next year's analyst estimates, versus nearly 32 for Walmart.

TGT PE ratio (forward 1y); data by YCharts.

While Walmart stock warrants trading at a premium -- perhaps even a large premium given its more defensive nature and recent growth -- the gap between the two retailers has become extremely wide. Currently, it looks like Target shares are in the bargain bin compared both to Walmart and to historical levels.

While Target is more dependent on the consumer and the economy, I think it looks like a solid rebound candidate that investors can consider buying after this recent price dip.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $380,291!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,278!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,003!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 18, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Target and Walmart. The Motley Fool has a disclosure policy.