Bitcoin Holds Critical Support At $83,444 As Bulls Target Key Resistance

Crypto analyst Ali Martinez has shared some important insights into the current Bitcoin (BTC) market based on UTXO Realized Price Distribution (URPD). Using this metric, the renowned market expert has highlighted key support and resistance levels with a potentially strong impact on BTC’s immediate price movement. Following another week of widespread market uncertainty, Bitcoin prices remain in consolidation, failing to make an effective breakout above $84,380.

Bitcoin Bull Run: $97,532 Holds Key To Renewed Bullish Momentum

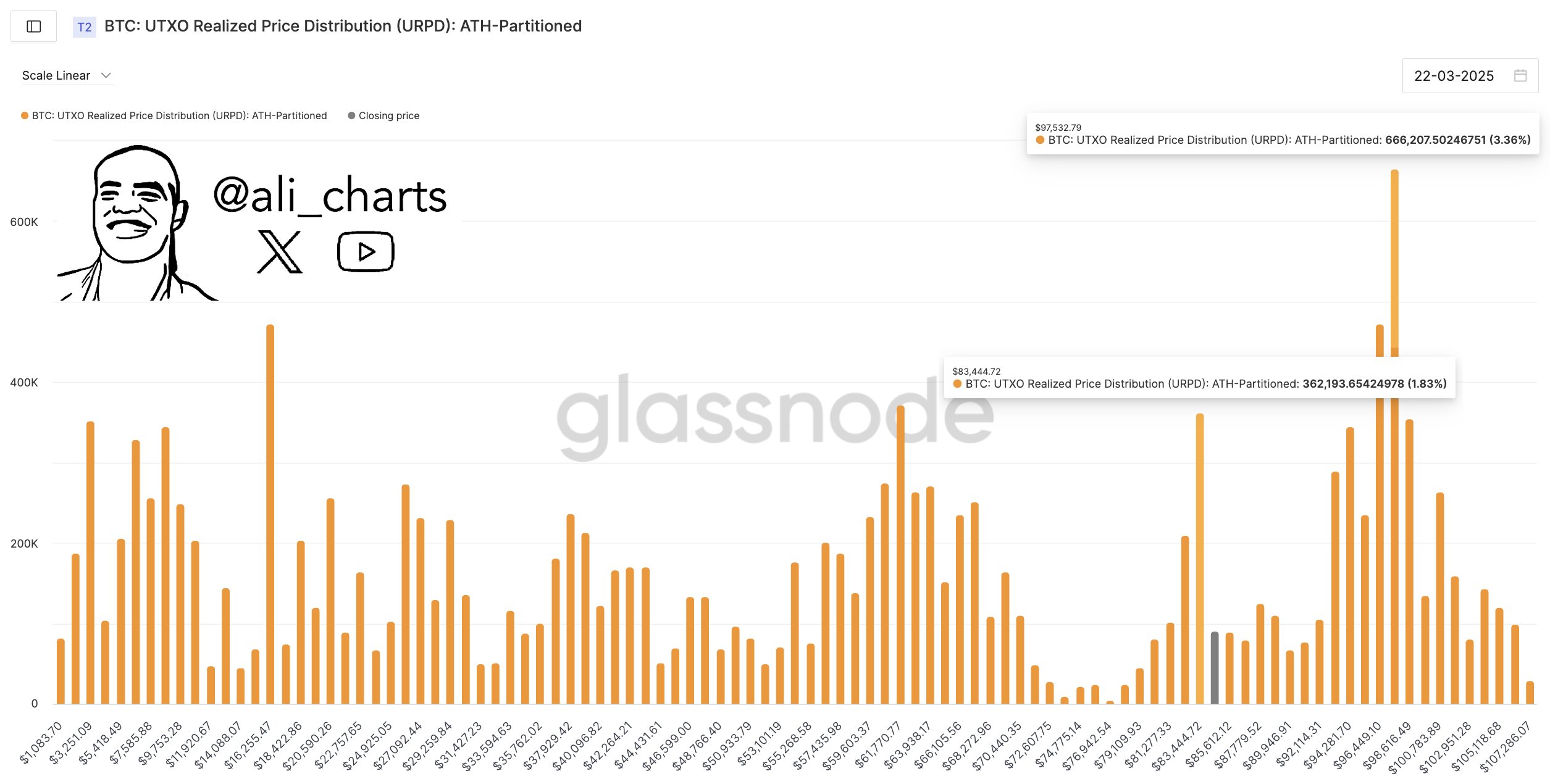

In on-chain analysis, the Unspent Transaction Output (UTXO) represents the remainder of Bitcoin after every transaction which can be used as input in a new transaction. Therefore, the UTXO Realized Price Distribution allows analysts to identify price levels at which Bitcoin’s current supply was last moved. By highlighting price levels with high concentrations of UTXOs, the URPD is an important metric in discovering resistance and support levels. In an X post on March 22 by Martinez, data from Glassnode shows a strong cluster of UTXOs around $83,444 indicating that many investors have their cost basis around this level. Currently, BTC’s price is well above this support level showing intent of a potential upswing. However, Martinez notes that a stiff resistance awaits market bulls at the $97,532 price level which also hosts a vast amount of UTXOs.

The analyst explains that a successful clearance of this resistance price level would signal a renewed bullish momentum in a BTC market that has undergone significant correction in the past few months. In a highly positive scenario, Bitcoin is likely to surge towards new all-time highs. However, failure to move past $97,532 may force BTC to remain in consolidation or even retrace to lower support levels.

Bitcoin Rearing To Resume Uptrend?

In other developments, Martinez has suggested Bitcoin’s current correction is likely still ongoing based on the Bitcoin Sharpe Ratio. For context, the Sharpe Ratio determines whether BTC’s returns are currently worth the level of risk involved at the moment.

The analyst explains that best market entries have occurred when the Bitcoin Sharpe ratio is at low risk, presenting a favorable buying opportunity. However, the current Sharpe ratio indicates high risk suggesting that prospective BTC investors might need to exercise patience.

Martinez said:

We’re not there yet, but getting close might signal a prime buying window!

At the time of writing, BTC continues to trade at $84,075 following a 0.27% price increase in the last 24 hours. However, the asset’s daily trading volume has crashed by 46.41% as market engagement falls.