Dogecoin Warning: One Level Could Trigger A Surge, Says Analyst

In his latest livestream, crypto chartist Kevin drilled down on Dogecoin’s price action, stressing both caution and optimism for the popular meme coin. Speaking to his YouTube audience, Kevin acknowledged Dogecoin’s history of dramatic price swings yet underlined that critical technical levels could spark the next substantial move.

When Will Dogecoin’s Next Big Move Be?

Kevin noted Dogecoin’s pattern of large retracements followed by new highs in previous bull markets. “Look at these moves, right? Every single pullback that Dogecoin got in the previous bull market—56%, 57%, 53%—all led to new highs,” he said, emphasizing the coin’s cyclical nature.

He also compared Dogecoin’s pullbacks from 2022 onward to what happened in its earlier cycles: “In this bull market so far, Dogecoin had a 65% correction, now it’s had a 58% correction. We’re doing the same thing that we’ve always done.”

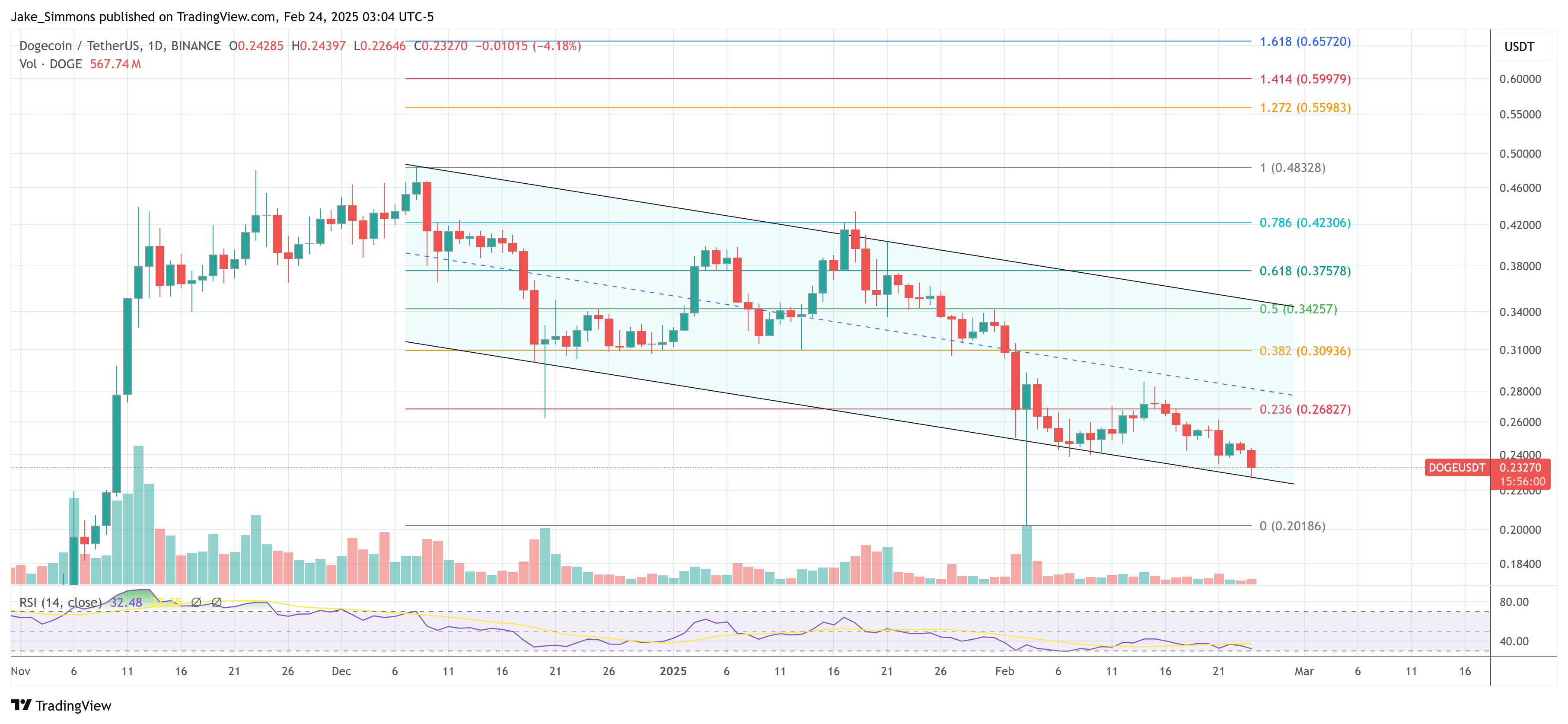

Despite Dogecoin’s tendency to rebound, Kevin underscored specific threshold levels that need to be recaptured. “Doge has a mission to accomplish, and that is to get back above the macro golden pocket and the weekly bull market support band, which is now at $0.30,” he explained. From his perspective, “If Dogecoin starts closing weekly candles above $0.30, I have no doubt in my mind that we will come back up to the macro 0.786 [Fibonacci level] … that $0.48-level, and then probably head higher from there.”

When asked about Dogecoin’s current outlook, Kevin cautioned that market conditions—and particularly Bitcoin’s performance—would have the final say. “Dogecoin is not going to drive the market; it’s going to go where Bitcoin’s going.” If Bitcoin remains sideways or dips further, Dogecoin could stall below that $0.30 barrier.

His broader thesis is that the crypto market at large, including Dogecoin, is paused in a state of anticipation. Kevin believes key policy changes—such as an end to quantitative tightening (QT), improved inflation data, or interest-rate cuts—could serve as the catalyst for another altcoin rally. Because Dogecoin often closely tracks the general sentiment around Bitcoin and total market cap, broader macro shifts would likely dictate its trajectory.

“Nothing’s changed on Doge […] at any time, it can come down and take this wick down at the $0.20 level. For now, the path of least resistance is down,” Kevin added. Nonetheless, he stressed this could change abruptly if overall market sentiment improves and Bitcoin begins to rally.

Overall, Kevin stressed that broader market factors—such as changes in US monetary policy or an overall jump in crypto market confidence—could “flip the switch” for Dogecoin. A strong macro tailwind, he believes, would likely pull DOGE decisively above $0.30, setting the stage for a run back toward $0.48.

At press time, DOGE traded at $0.232.