Crypto Today: Litecoin, Binance, and Solana Dominate Headlines as BTC Reclaims $97K

- The global cryptocurrency market halted a rut of 3 consecutive losing days, gaining 1.6% to hit $3.13 trillion on Wednesday,

- Bitcoin price promptly reclaimed the $97,000 territory, rebounding 4% from the 15-day low of $93,388 recorded on Tuesday.

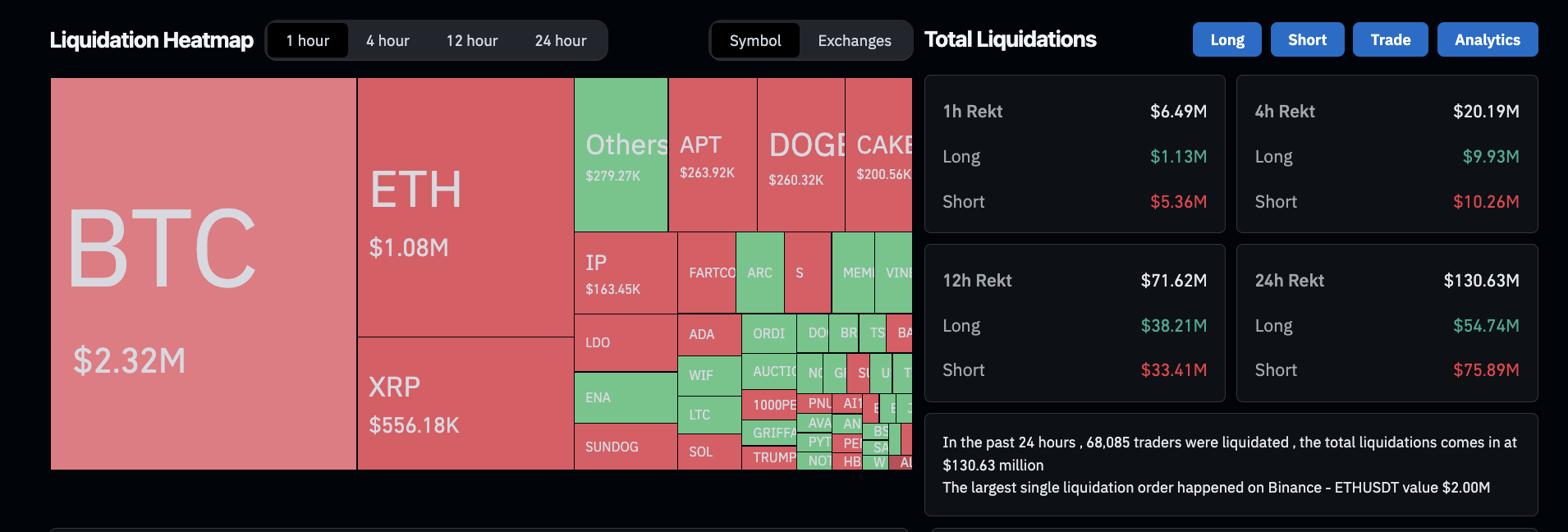

- Market momentum swung bullish as short traders' $75 million in losses accounted for more than 60% of the day's $130 million total liquidations.

Why is Bitcoin Price Up Today?

Bitcoin price rose by 4% in the last 24-hours, briefly reclaiming the $97,000 in the early hours of Thurdday.

Bitcoin (BTC) Price Action

The BTC recovery was fueled by positive market reactions to US President Donald Trump and Vladimir Putin announcing resumption of diplomatic relations between both countries.

- US-based IT firm Strategy also announced another $2 billion fundraise for additional BTC purchases.

Strategy Total Bitcoin Holdings as of Feb 20. 2025 | Source: SaylorTracker.com

According to SaylorTracker.com the firm currently holds 478,740 BTC worth approximately $46 billion having invested over $3 billion within the first 50-days of 2025 alone.

- Bitcoin ETFs resumed trading on Feb 18, booking $60 million outflows. Bitcoin ETFs appear to be struggling for demand as altcoin ETFs gain traction, with the US SEC acknowledging filing for Bitwise’ Litecoin ETF filing on Wednesday, less than a week after Grayscale files received the same fate.

Altcoin Market Updates: LTC, XRP see gains on ETF hype as Solana struggle continues under Milei controversy

It was mixed fortunes for altcoin traders on Wednesday as top cryptocurrencies trended in divergent directions driven by varying catalysts.

Crypto Market Liquidation | Feb 18, 2025 | Source: Coinglass

On the positive note, bullish as short traders' $75 million in losses accounted for more than 60% of the day's $130 million total liquidations.

Binance Coin (BNB) and Ripple (XRP) and Litecoin led the top gainers while Solana (SOL) price underperformed.

- Ripple (XRP) price rose 5% before hitting a major sell-wall at $2.65.

- Litecoin (LTC) price hit a 40-day peak above $136 mark, as market price in 90% of LTC ETF approval.

Bittesor (TAO) price action | Feb 2025 | Source: TradingView

Bittesor (TAO) price stole the show climbing 17% on news of its impending listing on Coinbase slated for Thursday.

Meanwhile on the downside, SOL price plunged as low as $169, as it remained trapped under bearish sentiment surrounding Argentina President Milei and the controversial LIBRA token launched on the Solana network.

Chart of the Day: BNB price tops $650 as Binance eyes return to US market

Binance Coin (BNB) price recorded a sizable 4.3% gain on Wednesday, driven by news of Binance US impending return to the US markets. The Binance exchange US-based affiliates enabled withdrawal and deposits for US residents for the first time in 2-years.

Binance Coin (BNB) Price action | Feb 19, 2025 | Source: TradingView

Notably, BinanceUS suspended USD deposits and withdrawals in 2023 amid an SEC lawsuit. This reversal of the sanction signals potential regulatory easing, fueling investor confidence in Binance’s gradual re-entry into the U.S. market.

While the case remains open, the Judge’s decision to grant a 60-day pause in Binance’s SEC lawsuit has ignited positive sentiment, as it allows negotiations with the regulator’s new crypto task force.

Investors betting on potential upside from Binance’s impending return to the US markets could lift BNB prices in the days ahead.

Institutional investors seeking regulatory clarity may see Binance’s return as a catalyst for increased exposure to BNB. Beyond that, staking incentives and trading fee discounts could also spur BNB demand, if Binance’s US subsidiary restores full trading capabilities in the weeks ahead.

Crypto News Updates:

Strategy Plans $2 Billion Convertible Note Offering for Bitcoin Acquisitions

Strategy, formerly known as MicroStrategy, has announced a $2 billion convertible senior notes offering at 0% interest, with proceeds earmarked for Bitcoin acquisitions and corporate expenses. The notes, set to mature in 2030, provide holders the option to convert into cash or stock. Initial buyers will also have an option to purchase an additional $300 million in notes.

This move comes as Strategy continues expanding its Bitcoin holdings despite market volatility.

The offering follows the company’s recent financial disclosures, including a profitability warning and a reported $1.79 billion impairment loss on its Bitcoin reserves in 2024.

Strategy has maintained its position as one of the largest corporate Bitcoin holders, regularly leveraging debt financing to increase its exposure.

Tether proposes to acquire 51% of Adecoagro to increase majority stake

Tether Investments has submitted a proposal to acquire a 51% controlling stake in Adecoagro S.A., a South American sustainable production company.

The offer, made on February 14, 2025, values Adecoagro’s common shares at $12.41 each. If approved, the acquisition would increase Tether’s ownership from 19.4% to a majority stake, expanding its influence in the agribusiness sector.

Adecoagro’s Board of Directors is currently reviewing the proposal with guidance from financial and legal advisors to assess its impact on shareholder value.

The acquisition aligns with Tether’s broader investment strategy, which has recently expanded beyond digital assets into energy, commodities, and sustainable industries.

Adecoagro, known for its agricultural and renewable energy operations, could offer strategic synergies to Tether’s evolving investment portfolio.

Standard Chartered Bank enters Joint Venture for Hong Kong Dollar-backed (HKD) stablecoin

Standard Chartered Bank (Hong Kong) Limited (SCBHK), Animoca Brands, and HKT have partnered to establish a joint venture focused on issuing a Hong Kong dollar-backed stablecoin. The initiative seeks regulatory approval under Hong Kong’s digital asset framework, leveraging SCBHK’s banking infrastructure, Animoca’s Web3 expertise, and HKT’s mobile wallet technology. The stablecoin aims to enhance digital payments in Hong Kong while exploring cross-border and institutional use cases.

The joint venture aligns with Hong Kong’s strategy to position itself as a global digital asset hub. SCBHK’s involvement underscores growing institutional interest in regulated stablecoins, while Animoca and HKT contribute blockchain and payment system integration. The project will undergo regulatory review as Hong Kong refines its approach to stablecoin oversight, aiming to set industry standards for fiat-backed digital assets.

SEC Begins Formal Review of CoinShares’ Litecoin ETF Application

The U.S. Securities and Exchange Commission (SEC) has initiated a formal review of CoinShares’ Litecoin ETF application following Nasdaq’s submission. Structured as a Delaware Statutory Trust, the ETF would track Litecoin’s performance via the Compass Crypto Reference Index Litecoin – 4pm NY Time, with shares representing fractional undivided beneficial interests.

The proposed fund will exclusively hold Litecoin and cash, ensuring compliance with regulatory custody standards. Nasdaq has a surveillance-sharing agreement with Coinbase Derivatives, a key component of the SEC’s market oversight considerations.

The review period spans 45 days, extendable to 90 days or more, as regulators assess compliance, investor protections, and market surveillance mechanisms. If approved, the ETF would offer investors regulated exposure to Litecoin without direct custody.