Weekly wrap: XRP, Solana and Dogecoin lead altcoin gains on Friday

- XRP, Solana and Dogecoin rallied on Friday, posting gains of 3% to 6%.

- Bitcoin’s six-day volatility decline paves the way for altcoin gains in the market cycle.

- ETF hype acts as a catalyst in XRP, Solana and Dogecoin this week, pushing prices higher.

XRP, Solana (SOL) and Dogecoin (DOGE) gained 5.91%, 2.88% and 3.36% respectively on Friday. While Bitcoin (BTC) hovers around the $97,000 level, the three altcoins pave the way for recovery and rally in altcoins ranking within the top 50 cryptocurrencies by market capitalization on CoinGecko.

The decline in Bitcoin’s dominance and the hype surrounding the odds of approval of Exchange Traded Funds (ETFs) for altcoins like XRP, Solana, Dogecoin, Litecoin (LTC) and Cardano (ADA) are the two key market movers for these three tokens this week.

XRP, Solana and Dogecoin pave way for altcoin price rally

Bitcoin’s rising dominance acted as a hurdle for an altcoin season, a period in which 75% of the altcoins in the top 50 cryptocurrencies ranked by market capitalization outperform Bitcoin in a 90-day timeframe.

BTC dominance has declined since February 7, down from a high of 62.27% to 60.48% as of Friday. The waning dominance of the top cryptocurrency allows for gains in altcoins, supporting price rallies in most tokens in the top 50.

Bitcoin market cap dominance chart | Source: TradingView

XRP, Solana and Dogecoin’s gains on Friday mark an extension of the seven-day rally in the three altcoins. Data from TradingView shows that XRP traders gained 17%, Solana gained 6% and Dogecoin traders gained 12% in the past seven days.

Bitcoin volatility declines, is altcoin season possible?

Analysts at K33 Research observed in a recent report published on Friday that the six-day volatility for Bitcoin declined over the past week. The decline in volatility is accompanied by shallow flows to Exchange Traded Products (ETPs).

The slowdown of activity in Bitcoin derivatives contributed to the dwindling volatility and options traders are seeking downside protection, according to analysts.

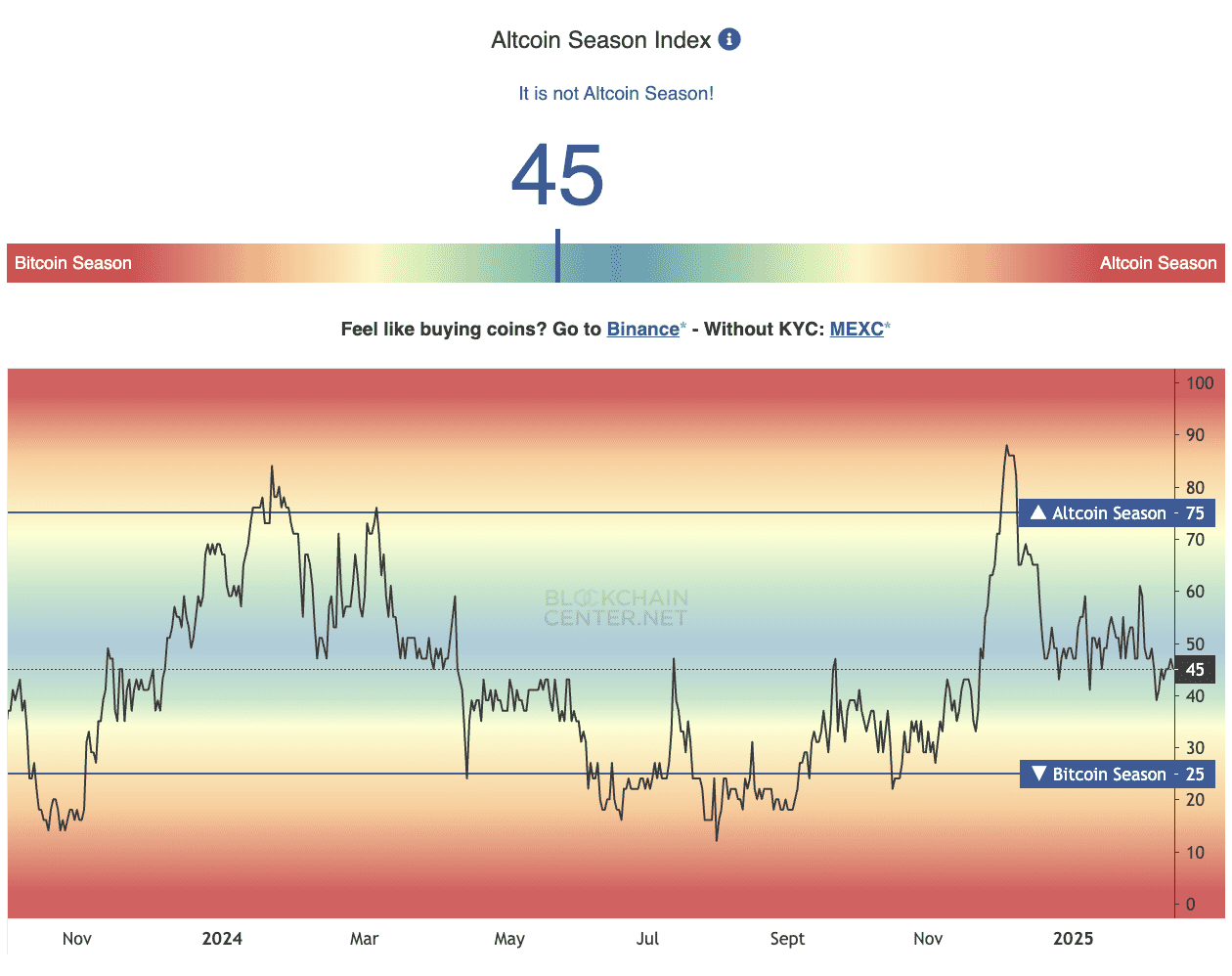

The altcoin season index at Blockchaincenter reads 45 on a scale of 0 to 100, meaning it is not “altcoin season” yet. The metric climbed from a low of 39, the lowest level observed in three months, up to 45 at the time of writing.

If the metric crosses 75, it marks the beginning of an altcoin season where cryptocurrencies other than Bitcoin yield relatively higher gains than BTC for holders in a 90-day timeframe.

Altcoin season index | Source: Blockchaincenter

ETF hype catalyzes altcoin gains

Bloomberg ETF analysts James Seyffart and Eric Balchunas recently calculated odds for approval of different altcoin ETFs in the US. Seyffart published the details in a recent tweet on X, with Litecoin (LTC) ranking the highest at 90%, followed by Dogecoin (DOGE) at 75%, Solana (SOL) at 70% and XRP at 65%.

NEW: @EricBalchunas and I took a look at the filings for spot crypto ETFs. We're putting out relatively high odds of approval across the board. Mainly focused on Litecoin, Solana, XRP, and Dogecoin for now.

— James Seyffart (@JSeyff) February 10, 2025

Here's the table with the odds and some other details: pic.twitter.com/xaXaNXLb0M

ETF hype has fueled anticipation of price rallies in the altcoins, supporting a positive sentiment and price gains in the three tokens this week.